TIDMSVT

RNS Number : 3141D

Severn Trent PLC

28 January 2015

28 January 2015

Severn Trent Plc - acceptance of final determination for Severn

Trent Water and new dividend policy

Severn Trent Plc today announces that Severn Trent Water has

accepted the Final Determination for the period 2015-2020 published

by Ofwat on 12 December 2014.

This means that our customers will continue to have the lowest

combined average bills in the land until at least 2020. Severn

Trent Water bills will fall in real terms over the next five years,

by which time they will be around GBP60 below the industry average.

Next year average bills will fall to GBP329, from GBP333. We are

proud that Severn Trent customers have already had six consecutive

years of the lowest average combined bills and best value in

Britain. We are also making provision to help four times as many

customers who struggle to pay their bill over the next five

years.

We are committed to our largest five year investment programme

ever, totaling GBP6.2 billion* in real terms, the majority of which

will help to support the economy in the Midlands. This includes a

capital investment programme of GBP3.3 billion* to improve service

and quality for customers, which will help grow our RCV(1)

(Regulatory Capital Value) to c. GBP10 billion by 2020. Although c.

GBP30 million of investment on improving water quality was not

included in the Final Determination, we have nevertheless decided

to keep it in our plan. We will fund this additional investment

using savings achieved by operating our business more efficiently.

We are also committed to significantly improving customer service

performance through our suite of ODIs (Outcome Delivery

Incentives). These include fixing 100% of visible leaks within 24

hours and reducing interruptions to supply by more than 50%.

The next five years will also see a greater focus on reducing

flooding, employing innovative solutions to improve river quality

such as catchment management and a wide ranging community

educational programme to promote water conservation and reduce

sewer blockages. We will also undertake one of our largest ever

capital investment projects to improve the resilience of water

supplies to our one million customers in Birmingham.

The price review has been a challenging process and the Final

Determination contains stretching objectives and requires

significant improvements in operating efficiencies. However, the

Board believes it can meet the required operational and capital

expenditure levels whilst delivering on its performance

commitments. This belief is based on the process improvements made

over the current regulatory period and plans already in place to

deliver the efficiencies contained in the business plan for

2015-2020.

In order to deliver our plan and reflecting the lower cost of

capital allowed by Ofwat, Severn Trent has reviewed its financing

plan and dividend policy.

Going forward, the Company intends to manage its existing debt

portfolio and future debt issuance to increase the proportion of

debt which is at floating rates. In addition, the Board has decided

to move towards a net debt/RCV gearing ratio of around 62.5% which

is in line with Ofwat's notional assumption. As part of this move

Severn Trent will commence a GBP100 million share buy back

programme.

Severn Trent is also announcing today its dividend policy for

the period 2015-2020. The Board has decided to set the 2015/16

dividend at 80.66p, a reduction of 5% compared to the current year

total dividend of 84.90p. Our policy will then be to grow the

dividend annually at no less than RPI until March 2020. This

replaces the current dividend policy of RPI+3% which runs until

March 2015.

The Board believes that this financing plan and new dividend

policy are commensurate with a sustainable investment grade credit

rating.

* 2012/13 prices

1. Nominal, assumes year end 2.0% RPI for 14/15 and an average

of 3.3% year end RPI for 2015-2020

Liv Garfield, Chief Executive Severn Trent Plc, said:

"At Severn Trent we always seek to strike the right balance

between the service customers receive, the bills they pay, and

returns to investors and we believe our plan for the next five

years achieves that balance, delivering better services, better

value and a healthier environment. The price review has been a

challenging process but has led to a great outcome for customers.

We were pleased that our business plan achieved a high approval

rating of 88% from customers.

We know there is more we need to do to improve our processes and

raise our standards, and I'm looking forward to working with the

great people in Severn Trent and building on improvements made over

the current regulatory period, as we continue to deliver for our

customers and communities, shareholders and the environment."

There will be a conference call to discuss this announcement at

10:00 GMT today, Wednesday 28 January 2015. This can be accessed

via the Severn Trent website (www.severntrent.com) or by

dialling:

UK: freephone 0800 279 4977

USA: national freephone: 1877 280 2342

Conference Code: 5603989

Severn Trent Plc will publish its usual trading update for the

period 1October 2014 to 12 February 2015 on 13 February. The

company will also be holding a capital markets day on 17 March to

provide more detail on its business plan for the period

2015-2020.

Enquiries:

0207 353 4200 (on the

Liv Garfield Severn Trent Plc day)

Chief Executive 02477 715000

0207 353 4200 (on the

Mike McKeon Severn Trent Plc day)

Finance Director 02477 715000

0207 353 4200 (on the

Rob Salmon Severn Trent Plc day)

Head of Communications 02477 715000

0207 353 4200 (on the

John Crosse Severn Trent Plc day)

Head of Investor Relations 02477 715000

Katharine Wynne /

Martha Walsh Tulchan Communications 0207 353 4200

Cautionary statement regarding Forward Looking Statements

This document contains statements that are, or may be deemed to

be, 'forward-looking statements' with respect to Severn Trent's

financial condition, results of operations and business and certain

of Severn Trent's plans and objectives with respect to these

items.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'will', 'would',

'should', 'expects', 'believes', 'intends', 'plans', 'projects',

'potential', 'reasonably possible', 'targets', 'goal' or

'estimates' and, in each case, their negative or other variations

or comparable terminology. Any forward-looking statements in this

document are based on Severn Trent's current expectations and, by

their very nature, forward-looking statements are inherently

unpredictable, speculative and involve risk and uncertainty because

they relate to events and depend on circumstances that may or may

not occur in the future.

Forward-looking statements are not guarantees of future

performance and no assurances can be given that the forward-looking

statements in this document will be realised. There are a number of

factors, many of which are beyond Severn Trent's control, that

could cause actual results, performance and developments to differ

materially from those expressed or implied by these forward-looking

statements. These factors include, but are not limited to: the

Principal Risks disclosed in our Annual Report as at May 2013

(which have not been updated since); changes in the economies and

markets in which the group operates; changes in the regulatory and

competition frameworks in which the group operates; the impact of

legal or other proceedings against or which affect the group; and

changes in interest and exchange rates.

All written or verbal forward-looking statements, made in this

document or made subsequently, which are attributable to Severn

Trent or any other member of the group or persons acting on their

behalf are expressly qualified in their entirety by the factors

referred to above. Subject to compliance with applicable laws and

regulations, Severn Trent does not intend to update these

forward-looking statements and does not undertake any obligation to

do so,

Nothing in this document should be regarded as a profits

forecast.

This document is not an offer to sell, exchange or transfer any

securities of Severn Trent Plc or any of its subsidiaries and is

not soliciting an offer to purchase, exchange or transfer such

securities in any jurisdiction. Securities may not be offered, sold

or transferred in the United States absent registration or an

applicable exemption from the registration requirements of the US

Securities Act of 1933 (as amended).

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDBGDBGBDBGUR

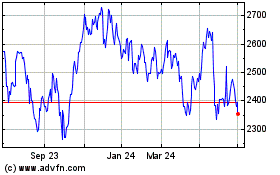

Severn Trent (LSE:SVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

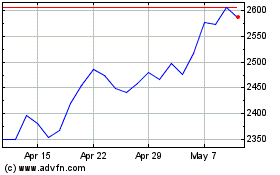

Severn Trent (LSE:SVT)

Historical Stock Chart

From Apr 2023 to Apr 2024