As filed with the Securities and Exchange Commission on October 9, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

| Minnesota |

|

41-0919654 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

4400 West 78th Street, Suite 520

Minneapolis, Minnesota 55435

(Address of principal executive offices, including zip code)

APOGEE ENTERPRISES, INC. EMPLOYEE STOCK PURCHASE PLAN

(Full title of the plan)

Patricia A. Beithon, Esq.

General Counsel and Secretary

Apogee Enterprises, Inc.

4400 West 78th Street, Suite 520

Minneapolis, Minnesota 55435

(952) 835-1874

(Name, address and telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

x |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of securities

to be registered |

|

Amount

to be

registered(1)(2) |

|

Proposed

maximum offering

price per share(3) |

|

Proposed

maximum aggregate

offering price(3) |

|

Amount of

registration fee |

| Common Stock, par value $0.33 1/3 per share |

|

250,000 shares |

|

$48.79 |

|

$12,197,500 |

|

$1,228.29 |

| |

| |

| (1) |

Represents shares of common stock of Apogee Enterprises, Inc. that may be offered or sold pursuant to the Apogee Enterprises, Inc. Employee Stock Purchase Plan. |

| (2) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended, this registration statement also covers any additional shares of common stock that may be offered or issued under the Apogee Enterprises, Inc.

Employee Stock Purchase Plan to prevent dilution resulting from stock splits, stock dividends or similar transactions. |

| (3) |

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(h)(1) and (c) under the Securities Act of 1933, as amended. The proposed maximum offering price is based on the

average of the high and low prices of Apogee Enterprises, Inc. common stock as reported on the Nasdaq Global Select Market on October 8, 2015. |

EXPLANATORY NOTE

This Registration Statement on Form S-8 of Apogee Enterprises, Inc. (the “Company”) is being filed pursuant to General Instruction E

to Form S-8 under the Securities Act of 1933, as amended, to register an additional 250,000 shares of the Company’s common stock (“Common Stock”), par value $0.33 1/3 per share, issuable pursuant to the Apogee Enterprises, Inc.

Employee Stock Purchase Plan, as amended (the “Plan”). The issuance of the additional shares was approved by the Board of Directors (the “Board”) of the Company at a meeting of the Board on October 7, 2015. The remaining

shares of Common Stock issuable under the Plan have been previously registered pursuant to a Registration Statement on Form S-8 (Registration No. 333-107403), which is hereby incorporated by reference.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| Item 3. |

Incorporation of Documents by Reference. |

The following documents, which have been filed with the

Securities and Exchange Commission (the “SEC”) by Apogee Enterprises, Inc. (“we,” “us” or “Apogee”) and the Apogee Enterprises, Inc. Employee Stock Purchase Plan (as amended to date, the “Plan”), are

incorporated by reference in this registration statement:

| |

(a) |

Our Annual Report on Form 10-K for the fiscal year ended February 28, 2015; |

| |

(b) |

Our Quarterly Reports on Form 10-Q for the fiscal quarters ended May 30, 2015 and August 29, 2015; |

| |

(c) |

Our Current Reports on Form 8-K filed on May 6, 2015 and June 30, 2015; and |

| |

(d) |

The description of our common stock contained in any registration statement or report filed by us under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including any amendment or report

filed for the purpose of updating such description. |

All documents filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the

Exchange Act subsequent to the date hereof and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities remaining unsold, shall be deemed to be

incorporated by reference herein and to be a part hereof from the respective dates of filing of such documents.

|

|

|

| 4.1 |

|

Restated Articles of Incorporation of Apogee Enterprises, Inc. (incorporated by reference to Exhibit 3.1 to Apogee’s Annual Report on Form 10-K for the year ended February 28, 2004). |

|

|

| 4.2 |

|

Amended and Restated Bylaws of Apogee Enterprises, Inc., as amended through January 24, 2006 (incorporated by reference to Exhibit 3.1 to Apogee’s Current Report on Form 8-K filed January 30, 2006). |

|

|

| 4.3 |

|

Specimen certificate for shares of common stock of Apogee Enterprises, Inc. (incorporated by reference to Exhibit 4A to Apogee’s Annual Report on Form 10-K for the year ended March 2, 2002). |

|

|

| 4.4 |

|

Apogee Enterprises, Inc. 2000 Employee Stock Purchase Plan.* |

|

|

| 4.5 |

|

First Amendment of Apogee Enterprises, Inc. 2000 Employee Stock Purchase Plan, dated February 27, 2009* |

|

|

| 5.1 |

|

Opinion of Dorsey & Whitney LLP.* |

|

|

| 23.1 |

|

Consent of Dorsey & Whitney LLP (included in Exhibit 5.1).* |

|

|

| 23.2 |

|

Consent of Independent Registered Public Accounting Firm.* |

|

|

| 24.1 |

|

Power of Attorney.* |

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Minneapolis, State of Minnesota, on October 9, 2015.

|

|

|

| APOGEE ENTERPRISES, INC. |

|

|

| By: |

|

/s/ Joseph F. Puishys |

|

|

Joseph F. Puishys |

|

|

President and Chief Executive Officer |

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons

in the capacities indicated on October 9, 2015.

|

|

|

| Signature |

|

Title |

|

|

| /s/ Joseph F. Puishys |

|

President, Chief Executive Officer and Director |

| Joseph F. Puishys |

|

(principal executive officer) |

|

|

| /s/ James S. Porter |

|

Chief Financial Officer |

| James S. Porter |

|

(principal financial and accounting officer) |

|

|

| * |

|

Chairman |

| Bernard P. Aldrich |

|

|

|

|

| * |

|

Director |

| Jerome L. Davis |

|

|

|

|

| * |

|

Director |

| Sara L. Hays |

|

|

|

|

| * |

|

Director |

| John T. Manning |

|

|

|

|

| * |

|

Director |

| Robert J. Marzec |

|

|

|

|

| |

|

Director |

| Donald A. Nolan |

|

|

|

|

| * |

|

Director |

| Richard V. Reynolds |

|

|

|

|

| * |

|

Director |

| David E. Weiss |

|

|

|

|

|

| *By: |

|

/s/ Patricia A. Beithon |

|

|

Patricia A. Beithon |

|

|

Attorney-in-Fact |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Restated Articles of Incorporation of Apogee Enterprises, Inc. (incorporated by reference to Exhibit 3.1 to Apogee’s Annual Report on Form 10-K for the year ended February 28, 2004). |

|

|

| 4.2 |

|

Amended and Restated Bylaws of Apogee Enterprises, Inc., as amended through January 24, 2006 (incorporated by reference to Exhibit 3.1 to Apogee’s Current Report on Form 8-K filed January 30, 2006). |

|

|

| 4.3 |

|

Specimen certificate for shares of common stock of Apogee Enterprises, Inc. (incorporated by reference to Exhibit 4A to Apogee’s Annual Report on Form 10-K for the year ended March 2, 2002). |

|

|

| 4.4 |

|

Apogee Enterprises, Inc. 2000 Employee Stock Purchase Plan.* |

|

|

| 4.5 |

|

First Amendment of Apogee Enterprises, Inc. 2000 Employee Stock Purchase Plan, dated February 27, 2009.* |

|

|

| 5.1 |

|

Opinion of Dorsey & Whitney LLP.* |

|

|

| 23.1 |

|

Consent of Dorsey & Whitney LLP (included in Exhibit 5.1).* |

|

|

| 23.2 |

|

Consent of Independent Registered Public Accounting Firm.* |

|

|

| 24.1 |

|

Power of Attorney.* |

Exhibit 4.4

APOGEE ENTERPRISES, INC.

2000 EMPLOYEE STOCK PURCHASE PLAN

(Amended and Restated Effective as of May 1, 2003)

ARTICLE I. INTRODUCTION

Section 1.01 Purpose. The purpose of the Plan is to encourage and assist employees and directors of the Company and certain

related corporations in acquiring an ownership interest in the Company through the systematic purchase of the Common Stock of the Company under convenient and advantageous terms. It is believed that the Plan will encourage participants to put forth

their best efforts toward the profitability of the Company.

Section 1.02 Effect on Prior Plans. From and after the

Commencement Date (as defined in Section 9.02 below) the Apogee Enterprises, Inc. Employee Stock Purchase Plan (the “Prior Plan”) shall terminate. All outstanding accounts administered under the Prior Plan shall, as of the

Commencement Date, automatically become Stock Purchase Accounts under this Plan and be administered according to the provisions of this Plan.

Section 1.03 Definitions. For purposes of the Plan, the following terms will have the meanings set forth below:

(a) “Acceleration Date” means the earlier of the date of shareholder approval or approval by the Company’s Board of

Directors of (i) any consolidation or merger of the Company in which the Company is not the continuing or surviving corporation or pursuant to which shares of Company Common Stock would be converted into cash, securities or other property,

other than a merger of the Company in which shareholders of the Company immediately prior to the merger have substantially the same proportionate ownership of stock in the surviving corporation immediately after the merger; (ii) any sale,

exchange or other transfer (in one transaction or a series of related transactions) of all or substantially all of the assets of the Company; or (iii) any plan of liquidation or dissolution of the Company.

(b) “Affiliate” means any subsidiary corporation of the Company, as defined in Section 424(f) of the Code, whether now

or hereafter acquired or established.

(c) “Code” means the Internal Revenue Code of 1986, as amended.

(d) “Committee” means the committee described in Section 10.01 of the Plan.

(e) “Common Stock” means the Company’s Common Stock, par value $.33-1/3 per share, as such stock may be adjusted

for changes in the stock or the Company as contemplated by Article XI of the Plan.

(f) “Company” means Apogee

Enterprises, Inc., a Minnesota corporation, and its successors by merger or consolidation as contemplated by Section 11.02 of the Plan.

(g) “Current Compensation” means all regular wage, salary,

commission payments and retainer fees paid by the Company or a Participating Affiliate to a Participant in accordance with the terms of his or her employment or service as a director, but

excluding annual bonus payments and all other forms of special compensation.

(h) “Fair Market Value” as of a given date

means the fair market value of the Common Stock determined by such methods or procedures as shall be established from time to time by the Committee, but shall not be less than, if the Common Stock is then quoted on the NASDAQ National Market System,

the average of the high and low sales price as reported on the NASDAQ National Market System on such date or, if the NASDAQ National Market System is not open for trading on such date, on the most recent preceding date when it is open for trading.

If on a given date the Common Stock is not traded on an established securities market, the Committee shall make a good faith attempt to satisfy the requirements of this Section 1.03(h) and in connection therewith shall take such action as it

deems necessary or advisable.

(i) “Participant” means a Regular Employee who is eligible to participate in the Plan

under Section 2.01 of the Plan and who has elected to participate in the Plan.

(j) “Participating Affiliate” means

an Affiliate whose eligible Regular Employees may participate in the Plan that was (i) an Affiliate on the date that this Plan was adopted or (ii) an Affiliate that was acquired after the Plan was adopted and which has been designated by

the Committee in advance of the Purchase Period in question as a corporation whose eligible Regular Employees may participate in the Plan.

(k) “Plan” means the Apogee Enterprises, Inc. 2000 Employee Stock Purchase Plan, as it may be amended, the provisions of

which are set forth herein.

(k) “Plan Custodian” means the entity appointed by the Committee to receive and take custody

of the funds contributed by the Participants and the Company and any Participating Affiliates and to carry out any additional duties of the Plan Custodian as set forth in the Plan.

(l) “Purchase Period” means the period beginning on the first business day of each calendar month and ending on the last

business day of the same calendar month; provided, however, that the then-current Purchase Period will end upon the occurrence of an Acceleration Date.

(m) “Regular Employee” means (i) an employee of the Company or a Participating Affiliate as of the first day of a

Purchase Period, including a union employee, but excluding an employee whose customary employment is less than 30 hours per week or (ii) a non-employee director of the Company.

(n) “Stock Purchase Account” means the account maintained by the Plan Custodian recording the number of full and fractional

shares allocated to a Participant based on the amount received from each Participant through payroll deductions made under the Plan and the Company’s or the Participating Affiliate’s contribution made under the Plan.

2

ARTICLE II. ELIGIBILITY AND PARTICIPATION

Section 2.01 Eligible Employees. All Regular Employees who have reached the age of 18 years shall be eligible to participate in

the Plan beginning on the first day of the first Purchase Period to commence after such person becomes a Regular Employee. Subject to the provisions of Article VI of the Plan, each such employee will continue to be eligible to participate in the

Plan so long as he or she remains a Regular Employee.

Section 2.02 Election to Participate. An eligible Regular Employee may

elect to participate in the Plan for a given Purchase Period by filing with the Company, in advance of that Purchase Period and in accordance with such terms and conditions as the Committee in its sole discretion may impose, a form provided by the

Company for such purpose (which authorizes regular payroll deductions from Current Compensation in that Purchase Period and continuing until the employee withdraws from the Plan or ceases to be eligible to participate in the Plan).

Section 2.03 Voluntary Participation. Participation in the Plan on the part of a Participant is voluntary and such participation

is not a condition of employment nor does participation in the Plan entitle a Participant to be retained as an employee of the Company or any Participating Affiliate.

ARTICLE III. PAYROLL DEDUCTIONS AND STOCK PURCHASE ACCOUNT

Section 3.01 Deductions from Pay. The form described in Section 2.02 of the Plan will permit a Participant to elect payroll

deductions of any multiple of $1 per week but not more than $500 per week of such Participant’s Current Compensation, subject to such other limitations as the Committee in its sole discretion may impose. A Participant may increase, decrease or

cease making payroll deductions at any time, subject to such limitations as the Committee in its sole discretion may impose.

Section 3.02 Credit to Account. Payroll deductions will be remitted at the end of each Purchase Period to the Plan Custodian and

credited to the Participant’s Stock Purchase Account. At such time, the Company or the Participating Affiliate will contribute, and remit to the Plan Custodian, an amount equal to 15% of the contribution amount of each Participant for the

Purchase Period and such amount will be credited to each Participant’s Stock Purchase Account at the end of the Purchase Period.

Section 3.03 Interest. No interest will be paid on payroll deductions or on any other amount credited to, or on deposit in, a

Participant’s Stock Purchase Account.

Section 3.04 No Additional Contributions. A Participant may not make any payment

into the Stock Purchase Account other than the payroll deductions made pursuant to the Plan.

Section 3.05 Nature of Account.

The Stock Purchase Account is established solely for accounting purposes, and all dollar amounts credited to the Stock Purchase Account will remain part of the general assets of the Company or the Participating Affiliate (as the case may be).

3

ARTICLE IV. RIGHT TO PURCHASE SHARES

Section 4.01 Number of Shares. Each Participant will have the right to purchase on the last business day of the Purchase Period

all, but not less than all, of the number of whole and fractional shares of Common Stock that can be purchased at the price specified in Section 4.02 of the Plan with the entire credit balance in the Participant’s Stock Purchase Account.

Section 4.02 Purchase Price. The purchase price for any Common Stock purchased under the Plan shall be the price paid in the

open market by the Plan Custodian for the relevant Purchase Period on behalf of all Participants in the Plan.

ARTICLE V. EXERCISE OF

RIGHT

Section 5.01 Purchase of Stock. Following the last business day of a Purchase Period, the entire credit balance in

each Participant’s Stock Purchase Account will be used to purchase the number of whole shares and fractional shares of Common Stock purchasable with such amount, unless the Participant has notified the Company, in advance of that date and

subject to such terms and conditions as the Committee in its sole discretion may impose, of the Participant’s election to receive the distribution of the entire credit balance in cash.

Section 5.02 Reports to Participants. The Plan Custodian will issue quarterly statements to each Participant showing the number of

shares purchased for his or her Stock Purchase Account in the preceding quarter and the total number of shares in the Participant’s Stock Purchase Account.

Section 5.03 Notice of Acceleration Date. The Company shall use reasonable commercial efforts to notify each Participant in

writing at least ten days prior to any Acceleration Date that the then-current Purchase Period will end on such Acceleration Date.

ARTICLE

VI. WITHDRAWAL FROM PLAN; SALE OF STOCK

Section 6.01 Voluntary Withdrawal. A Participant may, in accordance with such

terms and conditions as the Committee in its sole discretion may impose, withdraw from the Plan and cease making payroll deductions by filing with the Company a form provided for this purpose. A Participant who withdraws from the Plan will not be

eligible to reenter the Plan for a period of at least six months after the date of such withdrawal.

Section 6.02 Death.

Subject to such terms and conditions as the Committee in its sole discretion may impose, upon the death of a Participant, no further amounts shall be credited to the Participant’s Stock Purchase Account. Thereafter, on the last business day of

the Purchase Period during which such Participant’s death occurred and in accordance with Section 5.01 of the Plan, the entire credit balance in such Participant’s Stock Purchase Account will be used to purchase shares of Common

Stock, unless such Participant’s estate has notified the Company, in advance of that day and subject to such terms and conditions as the Committee in its sole discretion may impose, of its election to have the entire credit balance in such

Participant’s Stock Purchase Account distributed in cash within 30 days after the end of that Purchase Period or at such earlier time as the Committee in its sole discretion may decide. Each Participant, however, may designate one or more

beneficiaries who, upon death, are to receive the Common Stock or

4

the amount that otherwise would have been distributed or paid to the Participant’s estate and may change or revoke any such designation from time to time. No such designation, change or

revocation will be effective unless made by the Participant in writing and filed with the Company during the Participant’s lifetime. Unless the Participant has otherwise specified the beneficiary designation, the beneficiary or beneficiaries so

designated will become fixed as of the date of the Participant’s death so that, if a beneficiary survives the Participant but dies before the receipt of the payment due such beneficiary, the payment will be made to such beneficiary’s

estate.

Section 6.03 Termination of Employment. Subject to such terms and conditions as the Committee in its sole discretion

may impose, upon a Participant’s termination of employment with the Company or a Participating Affiliate, no further amounts shall be credited to the Participant’s Stock Purchase Account. Thereafter, on the last business day of the

Purchase Period during which such Participant’s termination of employment occurred and in accordance with the Plan, the entire credit balance in such Participant’s Stock Purchase Account will be used to purchase shares of Common Stock,

unless such Participant has notified the Company, in advance of that day and subject to such terms and conditions as the Committee in its sole discretion may impose, of the Participant’s election to receive the entire credit balance in such

Participant’s Stock Purchase Account in cash within 30 days after the end of that Purchase Period. For purposes of this Section 6.03, a transfer of employment to any Participating Affiliate, or a leave of absence which has been approved by

the Committee, will not be deemed a termination of employment as a Regular Employee.

Section 6.04 Sale of Stock. A

Participant may direct the Plan Custodian to sell a portion or all of the full shares held in his or her Stock Purchase Account. Upon receipt of the direction, the Plan Custodian will sell the designated shares at the prevailing market price.

Following the second sale in any calendar year by a Participant of shares held in his or her Stock Purchase Account, all payroll deductions and contributions by the Company or the Participating Affiliate will cease for a period of six months, after

which time the Participant may resume participation in the Plan. If a Participant makes a third request for the sale of shares in any calendar year, the Participant’s participation in the Plan shall cease, the Participant’s Stock Purchase

Account shall be closed, and the Participant shall not be eligible to participate in the Plan for a period of at least six months after the date of the Participant’s third request for such sale of shares.

ARTICLE VII. NONTRANSFERABILITY

Section 7.01 Nontransferable Right to Purchase. The right to purchase Common Stock hereunder may not be assigned, transferred,

pledged or hypothecated (whether by operation of law or otherwise), except as provided in Section 6.02 of the Plan, and will not be subject to execution, attachment or similar process. Any attempted assignment, transfer, pledge, hypothecation

or other disposition or levy of attachment or similar process upon the right to purchase will be null and void and without effect.

Section 7.02 Nontransferable Account. Except as provided in Section 6.02 of the Plan, the amounts credited to a Stock

Purchase Account may not be assigned, transferred,

5

pledged or hypothecated in any way, and any attempted assignment, transfer, pledge, hypothecation or other disposition of such amounts will be null and void and without effect.

ARTICLE VIII. COMMON STOCK ISSUANCE AND DIVIDEND REINVESTMENT

Section 8.01 Issuance of Purchased Shares. Promptly after the last day of each Purchase Period and subject to such terms and

conditions as the Committee in its sole discretion may impose, the Company will cause the Common Stock then purchased pursuant to Section 5.01 of the Plan to be issued for the benefit of the Participant and held in the Participant’s Stock

Purchase Account pursuant to Section 8.03 of the Plan.

Section 8.02 Completion of Issuance. A Participant shall have no

interest in the Common Stock purchased pursuant to Section 5.01 of the Plan until such Common Stock is issued for the benefit of the Participant pursuant to Section 8.03 of the Plan.

Section 8.03 Form of Ownership. The Common Stock issued under Section 8.01 of the Plan will be held in the name of the

Participant or jointly in the name of the Participant and another person, as the Participant may direct on a form provided by the Company, until such time as certificates for such shares of Common Stock are delivered to or for the benefit of the

Participant pursuant to Section 8.05 of the Plan.

Section 8.04 Automatic Dividend Reinvestment. Any and all cash

dividends paid on full and fractional shares of Common Stock held in a Participant’s Stock Purchase Account shall be credited to the Participant’s Stock Purchase Account on the basis of the number of shares in the Participant’s Stock

Purchase Account on the date of record of the dividend and shall be reinvested to acquire shares of Common Stock purchased in the open market by the Plan Custodian. Purchases of Common Stock under this Section 8.04 will be normally purchased

within ten business days of the dividend payment date, depending upon market conditions. The price per share of the Common Stock purchased pursuant to this Section 8.04 shall be the price per share at which the Common Stock is actually

purchased in the open market for the relevant period on behalf of all participants in the Plan. All shares of Common Stock acquired under this Section 8.04 will be held in the Plan in the same name as the Common Stock upon which the cash

dividends were paid.

Section 8.05 Delivery. At any time and subject to such terms and conditions as the Committee in its sole

discretion may impose, the Participant may elect to have the Plan Custodian deliver to or for the benefit of the Participant a certificate for the number of whole shares and cash for the number of fractional shares representing the Common Stock

purchased pursuant to Section 5.01 of the Plan together with any additional shares of Common Stock acquired pursuant to Section 8.04 of the Plan upon the reinvestment of dividends. The election notice will be processed as soon as

practicable after receipt.

ARTICLE IX. EFFECTIVE DATE, AMENDMENT AND TERMINATION OF PLAN

Section 9.01 Effective Date. The Plan was approved by the Board of Directors on July 25, 2000. The Plan was amended and

restated effective as of May 1, 2003.

6

Section 9.02 Plan Commencement. The Plan commenced September 1, 2000 (the

“Commencement Date”).

Section 9.03 Powers of Board. The Board of Directors may amend or discontinue the Plan at any

time; provided, however, that any termination of the Plan shall not adversely affect the rights relating to the Participant’s Common Stock issued pursuant to the Plan.

ARTICLE X. ADMINISTRATION

Section 10.01 The Committee. The Plan shall be administered by a committee (the “Committee”) of directors of the Company

designated by the Board of Directors to administer the Plan.

Section 10.02 Powers of Committee. Subject to the provisions of

the Plan, the Committee shall have full authority to administer the Plan, including authority to interpret and construe any provision of the Plan, to establish deadlines by which the various administrative forms must be received in order to be

effective, and to adopt such other rules and regulations for administering the Plan as it may deem appropriate. The Committee shall have full and complete authority to determine whether all or any part of the Common Stock acquired pursuant to the

Plan shall be subject to restrictions on the transferability thereof or any other restrictions affecting in any manner a Participant’s rights with respect thereto. Decisions of the Committee will be final and binding on all parties who have an

interest in the Plan.

Section 10.03 Power and Authority of the Board of Directors. Notwithstanding anything to the contrary

contained herein, the Board of Directors may, at any time and from time to time, without any further action of the Committee, exercise the powers and duties of the Committee under the Plan.

Section 10.04 Stock to be Sold. The Common Stock to be sold under the Plan shall be shares acquired in the open market by the Plan

Custodian.

Section 10.05 Notices. Notices to the Committee should be addressed as follows:

Apogee Enterprises, Inc.

7900

Xerxes Avenue South, Suite 1800

Minneapolis, MN 55431

Attn: ESPP

ARTICLE XI.

ADJUSTMENT FOR CHANGES IN STOCK OR COMPANY

Section 11.01 Stock Dividend or Reclassification. If the outstanding shares

of Common Stock are increased, decreased, changed into or exchanged for a different number or kind of securities of the Company, or shares of a different par value or without par value, through reorganization, recapitalization, reclassification,

stock dividend, stock split, amendment to the Company’s Articles of Incorporation, reverse stock split or otherwise, an appropriate

7

adjustment shall be made in the maximum number and kind of securities to be purchased under the Plan with a corresponding adjustment in the purchase price to be paid therefor.

Section 11.02 Merger or Consolidation. If the Company is merged into or consolidated with one or more corporations during the term

of the Plan, appropriate adjustments will be made to give effect thereto on an equitable basis in terms of issuance of shares of the corporation surviving the merger or of the consolidated corporation, as the case may be.

ARTICLE XII. APPLICABLE LAW

The internal law, and not the law of conflicts, of the State of Minnesota shall govern all questions concerning the validity, construction and

effect of the Plan, any rules or regulations relating to the Plan and the rights to purchase Common Stock granted under the Plan.

8

Exhibit 4.5

FIRST AMENDMENT

OF

APOGEE ENTERPRISES, INC.

2000 EMPLOYEE STOCK PURCHASE PLAN

(Amended and Restated Effective as of May 1, 2003)

The “2000 EMPLOYEE STOCK PURCHASE PLAN,” as adopted by APOGEE ENTERPRISES, INC., a Minnesota corporation, and as amended and restated in a document

entitled “Apogee Enterprises, Inc. 2000 Employee Stock Purchase Plan (Amended and Restated Effective as of May 1, 2003),” is hereby amended in the following respects:

1. PURPOSE. Effective February 28, 2009, Section 1.01 of the Plan Statement is amended to read in full as follows:

Section 1.01 Purpose. The purpose of the Plan is to encourage and assist employees of the Company and certain related corporations

in acquiring an ownership interest in the Company through the systematic purchase of the Common Stock of the Company under convenient and advantageous terms. It is believed that the Plan will encourage participants to put forth their best efforts

toward the profitability of the Company.

2. DEFINITIONS. Effective February 28, 2009, Section 1.03(g) of the Plan Statement is amended to

read in full as follows:

(g) “Current Compensation” means all regular wage, salary and commission

payments paid by the Company or a Participating Affiliate to a Participant in accordance with the terms of his or her employment, but excluding annual bonus payments and all other forms of special compensation.

3. DEFINITIONS. Effective February 28, 2009, Section 1.03(m) of the Plan Statement is amended to read in full as follows:

(m) “Regular Employee” means an employee of the Company or a Participating Affiliate as of the first day of a

Purchase Period, including a union employee, but excluding an employee whose customary employment is less than 30 hours per week.

4. SAVINGS CLAUSE.

Save and except as herein expressly amended, the Plan Statement shall continue in full force and effect.

|

|

|

|

|

|

|

|

|

| February 27, 2009 |

|

|

|

APOGEE ENTERPRISES, INC. |

|

|

|

|

|

|

|

|

By |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Its |

|

Chairman and Chief Executive Officer |

Page 1

Exhibit 5.1

[Dorsey & Whitney LLP Letterhead]

October 9, 2015

Apogee Enterprises, Inc.

4400 West 78th Street - Suite 520

Minneapolis, Minnesota

55435

| |

Re: |

Registration Statement on Form S-8 |

Ladies and Gentlemen:

We have acted as counsel to Apogee Enterprises, Inc., a Minnesota corporation (the “Company”), in connection with a Registration Statement on Form

S-8 (the “Registration Statement”) relating to the registration of the offer and sale by the Company of up to 250,000 shares (the “Shares”) of common stock, $0.33 1/3 par value per share, of the Company pursuant to the

Apogee Enterprises, Inc. Employee Stock Purchase Plan, as amended (the “Plan”).

We have examined such documents and have reviewed such

questions of law as we have considered necessary or appropriate for the purposes of our opinions set forth below. In rendering our opinions set forth below, we have assumed the authenticity of all documents submitted to us as originals, the

genuineness of all signatures and the conformity to authentic originals of all documents submitted to us as copies. We have also assumed the legal capacity for all purposes relevant hereto of all natural persons. As to questions of fact material to

our opinions, we have relied upon certificates or comparable documents of officers and other representatives of the Company and of public officials.

Based on the foregoing, we are of the opinion that the Shares, when issued and delivered in accordance with the terms of the Plan, will be validly issued,

fully paid and non-assessable.

Our opinions expressed above are limited to the laws of the State of Minnesota.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving this consent, we do not admit that we are within the

category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

|

| Very truly yours, |

|

| /s/ Dorsey & Whitney LLP |

RAR

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated April 29, 2015, relating to the consolidated

financial statements and financial statement schedule of Apogee Enterprises, Inc. and subsidiaries (the “Company”), and the effectiveness of the Company’s internal control over financial reporting, appearing in the Annual Report on

Form 10-K of Apogee Enterprises, Inc. for the year ended February 28, 2015.

|

| /s/ Deloitte & Touche LLP |

| Minneapolis, Minnesota |

| October 9, 2015 |

Exhibit 24.1

POWER OF ATTORNEY

KNOW ALL PERSONS BY

THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Joseph F. Puishys, James S. Porter and Patricia A. Beithon, and each of them, the undersigned’s true and lawful attorneys-in-fact and agents, each

acting alone, with the powers of substitution and revocation, for the undersigned and in the undersigned’s name, place and stead, in any and all capacities, to sign one or more Registration Statements on Form S-8, and any and all amendments

(including post-effective amendments) thereto, relating to the registration of the offer and sale by the Company of up to 250,000 shares of common stock, $0.33 1/3 par value per share, of the Company pursuant to the Apogee Enterprises, Inc.

Employee Stock Purchase Plan, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, and with such state commissions and other agencies as necessary, granting unto

such attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as the undersigned might

or could do in person, hereby ratifying and confirming all that such attorneys-in-fact and agents, or any of them, or their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

IN WITNESS WHEREOF, this Power of Attorney has been signed by the following persons as of the dates set forth below:

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Joseph F. Puishys |

|

President, Chief Executive Officer and Director |

|

October 7, 2015 |

| Joseph F. Puishys |

|

(principal executive officer) |

|

|

|

|

|

| /s/ James S. Porter |

|

Chief Financial Officer |

|

October 7, 2015 |

| James S. Porter |

|

(principal financial and accounting officer) |

|

|

|

|

|

| /s/ Bernard P. Aldrich |

|

Chairman |

|

October 7, 2015 |

| Bernard P. Aldrich |

|

|

|

|

|

|

|

| /s/ Jerome L. Davis |

|

Director |

|

October 7, 2015 |

| Jerome L. Davis |

|

|

|

|

|

|

|

| /s/ Sara L. Hays |

|

Director |

|

October 7, 2015 |

| Sara L. Hays |

|

|

|

|

|

|

|

| /s/ John T. Manning |

|

Director |

|

October 7, 2015 |

| John T. Manning |

|

|

|

|

|

|

|

| /s/ Robert J. Marzec |

|

Director |

|

October 7, 2015 |

| Robert J. Marzec |

|

|

|

|

|

|

|

| |

|

Director |

|

|

| Donald A. Nolan |

|

|

|

|

|

|

|

| /s/ Richard V. Reynolds |

|

Director |

|

October 7, 2015 |

| Richard V. Reynolds |

|

|

|

|

|

|

|

| /s/ David E. Weiss |

|

Director |

|

October 7, 2015 |

| David E. Weiss |

|

|

|

|

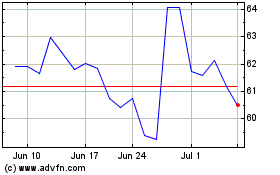

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Apr 2023 to Apr 2024