Secured Property Developments Plc Notification of Registration for Electronic Settlement

June 22 2015 - 12:00PM

UK Regulatory

TIDMSPD

SECURED PROPERTY DEVELOPMENTS PLC

Unit 6 ,Orchard Mews ,42 Orchard Road

Highgate,London N6 5TR

NOTIFICATION OF REGISTRATION FOR ELECTRONIC

SETTLEMENT JUNE 2015

To: All members of the Company

Notification of directors' resolution relating to the CREST system SECURED

PROPERTY DEVELOPMENTS PLC ordinary shares of GBP0.20 each - ICAP ISDX Growth

Market

This is to give you notice, in accordance with the Uncertificated Securities

Regulations 2001 (the Regulations), that on 22 June 2015, the Company resolved

by a resolution of its directors that title to the ordinary shares of GBP0.20

each in the capital of the Company, in issue or to be issued, may be

transferred by means of a relevant system. The resolution of the directors will

become effective immediately.

Explanatory note

The above notice is the notice that the Company is obliged to give to its

members, under the Regulations, of the passing of a "directors' resolution" (as

defined in the Regulations) in relation to its ordinary shares. The directors'

resolution will enable the Company's ordinary shares to join CREST in due

course. The shares have not become transferable by means of the CREST system

merely by virtue of the passing of the directors' resolution; the permission of

the Operator of the system, Euroclear UK & Ireland, must also be given before

the shares can become so transferable. The effect of the directors' resolution

is to disapply, in relation to the ordinary shares, those provisions of the

Company's articles of association that are inconsistent with the holding and

transfer of those shares in CREST and any provision of the Regulations, as and

when the shares concerned enter the CREST system The Company passed the above

resolution because it has been notified by ICAP that with effect from January

2015, the Central Securities Depositories Regulation (CSDR) will come into

force, which mandated that all transferable securities are required to be

eligible for settlement in dematerialised form within CREST. The Company

currently trades its shares on the ISDX market and has been advised further

that to continue to be able to do so, it needs to have the capability to

dematerialise its ordinary shares. The Company's shares have not previously

been eligible for settlement in dematerialised form. The Company has considered

the implications and options available and the Directors have concluded that it

is in the best interests of the Company and its stakeholders to provide

liquidity to its shares through continuing to trade them on the ISDX market and

accordingly to dematerialise the ordinary shares so that they are eligible for

settlement within CREST.

The necessary paperwork will now be completed and the Company will apply to

Euroclear UK & Ireland to have the ordinary shares admitted to CREST so that

moving forward they can be settled in either dematerialised form or in

certificated form.

Registrars:

The Company has appointed Avenir Registrars Ltd to maintain the register of

Ordinary Shares in CREST.

Avenir Registrars Ltd

Suite A, 6 Honduras Street,

London

EC1Y 0TH

ylva.baeckstrom@avenir-registrars.co.uk

www.avenir-registrars.co.uk

Telephone 020 7692 5500

Process for dematerialisation by holders of eligible securities:

The information provided to shareholders principally refers to the obligations

of the Issuers of a Security. For Holders, paper certificates may continue to

exist in parallel with Securities enabled in CREST. There is little direct

impact other than the change to T+2 settlement cycle and impact on ex-dividend

dates (that moved from 2 days to 1 day before record date). However, this may

give rise to practical barriers for transactions in paper Securities. Holders

should consult their financial adviser or stockbroker for details.

Holders who wish to dematerialise their holdings may contact their stockbroker

to lodge their holdings in an appropriate nominee or directly into a CREST

personal member account. The process will typically involve providing their

share certificate along with an appropriately completed J30 stock transfer to

their stockbroker. The stockbroker will arrange dematerialisation of the

holding via CREST counters and Avenir Registrars Ltd.

Future communications:

Nominees - holders of dematerialised securities held in an appropriate

stockbroker Nominee should communicate directly with their stockbroker for

holdings and other details. The stockbroker will be able to provide all

necessary support as the legal holder.

CREST Personal Member accounts - those who transfer their holdings into a CREST

personal member account should also contact their stockbroker in the first

instance as these are sponsored accounts and the stockbroker will have all

appropriate details. However, they may also contact the Registrars for

details.

Physical Holdings - Those who continue to hold securities in certificated form

may contact the Registrars who will arrange to provide electronic access to

view their individual entry on the Register of Holders.

Yours faithfully

I H Cobden

Company Secretary

22 June 2015

END

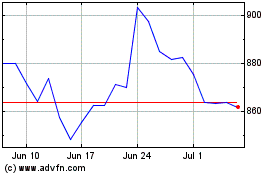

Frasers (LSE:FRAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Frasers (LSE:FRAS)

Historical Stock Chart

From Apr 2023 to Apr 2024