TIDMSGZ

RNS Number : 1126V

Scotgold Resources Ltd

04 August 2015

SCOTGOLD RESOURCES LIMITED

CONONISH GOLD AND SILVER PROJECT BANKABLE FEASIBILITY STUDY

RESULTS AND FINANCE UPDATE

Scotgold Resources Limited ('Scotgold' or 'the Company') is

pleased to announce the results of the Bankable Feasibility Study

('BFS') for its wholly owned Cononish Gold and Silver Project

conducted by Bara Consulting Ltd of the UK. This study is based

upon the Mineral Resource Statement announced in January 2015 and

confirms the Ore Reserve Estimate announced in May 2015, both of

which were compiled using guidelines recommended in the JORC Code

(2012). The Cononish Gold and Silver Project is part of the

Company's gold portfolio located in Scotland.

SUMMARY OF BFS HIGHLIGHTS

PRODUCTION

----------------------------------------------------

Average Production 72,000 tonne per

annum

Average LoM Grade (Au 11.8 gram/tonne

Eq)

Average Metal Produced 23,370 ounce equivalent

gold* per annum

Life of Mine 8 years

-------------------------- ------------------------

FINANCIAL (at Gold US$1,100/oz & Silver

US$15/oz)

----------------------------------------------------

Peak Funding Requirement GBP18.5M

Unit Operating Costs GBP327/ ounce

equivalent gold

(US$523/ ounce

equivalent gold)

Net pre-tax cashflow GBP43M

NPV (10%) pre-tax GBP23M

IRR pre-tax 45%

Payback Period 19 months

-------------------------- ------------------------

* Ounces equivalent gold = ounces gold + ounces silver*15/1100 -

ratio calculated at base case prices of $1,100/ ounce gold and

$15.00/ ounce silver

PRE-TAX CASHFLOW SENSITIVITY TO

GOLD PRICE

----------- -------- ---------------------------------------------------------------------

Gold US$700/ US$900/ US$1,000/ US$1,100/ US$1,200/ US$1,300/ US$1,500/

Price ounce ounce ounce ounce ounce ounce ounce

----------- -------- --------- ---------- ---------- ---------- ---------- ----------

Pre Tax GBP1.5M GBP22.5M GBP32.9 GBP43.4M GBP53.9 GBP64.3M GBP85.3M

Cashflow

NPV (10%) (GBP4M) GBP9M 16.1 GBP23M 29.8 GBP37M GBP50M

IRR 0% 25% 35% 45% 54% 64% 82%

----------- -------- --------- ---------- ---------- ---------- ---------- ----------

-- Robust Project economics using a base case gold price of

US$1,100/ounce (GBP688/ ounce) with a EBITDA of GBP67.4M, a pre-tax

free cashflow of GBP43.4M, pre-tax NPV(10%) of GBP22.5M and a

pre-tax IRR of 45%.

-- Low operating cost with Life of Mine ('LoM') average of

GBP327/ ounce equivalent gold (US$523/ ounce equivalent gold)

(including Royalties) and Project breakeven (0% IRR) at US$689/

ounce equivalent gold

-- Peak Funding Requirement of GBP18.5M and all in LoM Capital

including contingencies, replacements etc. of GBP24.0M

-- Average annual gold production of 23,370 ounce equivalent

gold with peak production in Year 2 of 28,540 ounce equivalent

gold.

-- Average LoM grade of 11.8 grams equivalent gold /tonne and

peak grade of 15.4 grams equivalent gold / tonne in year 2.

-- Rapid Implementation schedule of 16 months post contract and

finance completion and short payback period of 19 months from full

production.

-- Based on the earlier PFS, the company has been offered

indicative terms by leading banks to provide debt finance for the

majority of the project's funding requirement.

-- Completion of this BFS facilitates the selection of the

preferred finance route and the signing of a mandate with the

selected institutions in near future

Richard Gray, Chief Executive of Scotgold, commented:

"The BFS illustrates the robustness of the Cononish Project with

the mine profitable down to US$700 per ounce and provides a very

solid base for our ongoing discussions with potential project

finance providers. Once concluded, we look forward to putting this

fully permitted project into development and pursuing its strong

upside potential, which includes a possible Mineral Resource

extension and the likely price premium for gold with proven

Scottish provenance."

Details of the material assumptions considered in the derivation

of the production target and forecast financial information above

are provided in Appendix 1.

The BFS Study Executive Summary is published on Scotgold's

website at www.scotgold.com. The criteria used in this release

under JORC Code, 2012 Edition can be found on the website under ASX

announcements together with a commentary.

Key Attributes of Cononish Gold and Silver Project

In summary, the key attributes of the project are:

ü Mineralization occurs in a narrow (average width of about 2 m)

near vertical quartz vein.

ü The project has a resource estimate in Measured, Indicated and

Inferred categories (see ASX release "Resource Estimate Update"

dated 22/01/2015) prepared by Mr M.Titley of CSA Global ( see

below) of 541,000 tonnes at a gold grade of 14.3 g/t and a silver

grade of 59.7 g/t. The average Bulk Density is 2.72 tonne/m(3)

.

ü After taking into account various modifying factors, the

proven and probable ore reserves (see ASX release "Cononish Gold

Project Study Update and Reserve Estimate" dated 26/05/2015),

prepared by Mr P Willis of Bara Consulting (see below) comprises

555,000 tonnes at a gold grade of 11.1 g/t and a silver grade of

47.7 g/t.

ü Proven and probable ore reserves represent 12% and 88% of the

reported production target respectively. No inferred resources are

considered in the BFS.

ü Access will be from the existing exploration adit and footwall

ramps will provide access to ore drives at a 15 m vertical

interval. A rock pass system has been included to improve ore

handling and the transfer of waste.

ü The mining method will be a retreat top down Long Hole Open

Stoping (LHOS) method using conventional trackless equipment.

Shrinkage stoping was investigated but was only economically viable

in the very narrowest (<1.4 m) areas of the mine and was

therefore not considered further.

ü Full production will be at 72,000 tonnes per annum. The life

of mine at full production based on the current reserves in the

Proven and Probable categories is approximately 8 years. The mining

production schedule adequately takes into account the constraints

mentioned below. Average gold and silver production will be

approximately 22,208 ounces gold and 85,081 ounces silver per annum

respectively or 23,370 ounce equivalent gold.

A graph showing the expected mine annual mine production can be

found on Scogold's website at www.scotgold.com

ü Mining permission has been granted but with certain conditions

which have been accommodated within the mine plan. Approximately

129,000 tonnes of tailings (after taking into account the mass

pull) is scheduled to be stored in old stopes towards the end of

the mine's life, enabling the full capacity of the Tailings

Management Facility ('TMF') to be restricted to 400,000 tonnes and

minimising surface impact.

ü Waste is only trucked to surface when required for the

building of the TMF and various screening berms (73,000 tonnes).

All other waste will be stored in old stopes (163,000 tonnes).

ü Based on extensive testwork by Lakefield, Gekko and AMMTEC,

the plant is designed as a conventional gravity and flotation

plant. 25% of the gold is estimated to be recovered on site into a

doré bar with the balance being produced as concentrate to be

treated off site. Overall estimated recovery is 93% for gold and

90% for silver The doré and concentrate will be sold "at the gate"

to third party processors.

ü The process plant will be housed in a single multi-use

building which will also contain a workshop and office area. This

is designed to have minimal visual and noise impact on the

surrounding area.

Cononish Gold and Silver Project Study Results

ü The following costs have been estimated at an accuracy of

between -5% and +15% and include appropriate contingencies:

o Peak funding requirement (pre production expenditure): GBP18.5

million.

o Total LoM Capital Expenditure: GBP24 million.

o Average operating cost: GBP110 per tonne treated (including

marketing, interest and royalty charges). It should be noted that

transport, smelting and refining charges where reflected as cost of

sales in the PFS. These costs have been included as part of

operating costs in the BFS.

o Average operating cost: GBP 327 (US$ 523) per ounce equivalent

gold (on the same basis as above

o All in cost including capital GBP455 (US$ 729) per ounce

equivalent gold

ü The following financial results were estimated using a gold

price of US$ 1,100/ounce, a silver price of US$ 15/ounce and a

US$/GBP exchange rate of 1.6:

o Pre-tax NPV@10% GBP22.9 million

o Pre-tax IRR 45%

o Post-tax NPV@10% GBP18.5 million*

o Post-tax IRR 41%*

o Average profit margin 53%

o Payback 19 months

* Note post-tax calculations are based on a hypothetical all

equity funding scenario and as such are illustrative only.

Scotgold Resources Limited Westhouse Securities Limited

Richard Gray Martin Davison

Chief Executive Officer

Tel: +44 (0)7905 884 021 Tel: +44 (0)20 7601 6100

Capital Markets Consultants Vicarage Capital Limited

Simon Rothschild Rupert Williams

Tel +44 (0)7703 167 065 Tel: +44 (0)20 3651 2911

Forward Looking Statements

This announcement contains certain statements that may

constitute "forward looking statements". Such statements are only

predictions and are subject to inherent risks and uncertainties,

which could cause actual values, results, performance achievements

to differ materially from those expressed, implied or projected in

any forward looking statements.

Competent Persons Statement

The information in this report that relates to the 2015 Ore

Reserves for Cononish Gold Project (refer ASX announcement dated

25/05/2015) is based on information compiled by Pat Willis, a

Competent Person who is registered as a Professional Engineer

(Pr.Eng.) with the Engineering Council for South Africa (ECSA) and

a Fellow in good standing and Past President of the Southern Africa

Institute of Mining and Metallurgy (FSAIMM).. Mr Willis is employed

by Bara Consulting Limited, an independent consulting company. Mr

Willis has sufficient experience which is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Mr Willis consents to the inclusion in the report of the

matters based on his information in the form and context in which

it appears.

The information in this report that relates to the 2015 Mineral

Resources Estimate for Cononish Gold Project (refer ASX

announcement dated 22/01/2015) is based on information compiled by

Malcolm Titley, a Competent Person who is a Member of The

Australasian Institute of Mining and Metallurgy. Mr Titley is

employed by CSA Global (UK) Limited, an independent consulting

company. Mr Titley has sufficient experience which is relevant to

the style of mineralisation and type of deposit under consideration

and to the activity which he is undertaking to qualify as a

Competent Person as defined in the 2012 Edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves'. Mr Titley consents to the inclusion in

the report of the matters based on his information in the form and

context in which it appears.

Further, the Company confirms it is not aware of any new

information or data that materially affects the information

contained in the original announcements and that all material

assumptions and technical parameters underpinning the estimate of

Resources and Reserves continue to apply and have not materially

changed.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUGURURUPAPUC

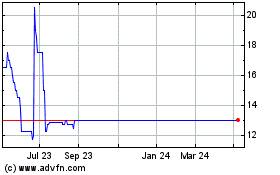

Scotgold Resources (LSE:SGZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Scotgold Resources (LSE:SGZ)

Historical Stock Chart

From Apr 2023 to Apr 2024