Rolls-Royce Reports Loss on Bribery Charges, Weak Pound -- 2nd Update

February 14 2017 - 4:46AM

Dow Jones News

By Robert Wall

LONDON-- Rolls-Royce Holdings PLC on Tuesday said it swung to a

full-year GBP4.03 billion ($5.05 billion) net loss, stung by a

settlement over corruption charges, the fall in the British pound

and setbacks on high-profile aircraft engine programs.

Rolls-Royce, best known for making aircraft engines for Boeing

Co. and Airbus SE's long-range planes, reported a GBP83 million

profit the year before. The loss in the latest year reflected a

large, noncash accounting hit from the revaluation of U.S. currency

hedges after the British pound slumped in the wake of the country's

vote to leave the European Union. It included a GBP671 million

one-time charge for bribery settlements with U.S., British and

Brazilian authorities after the company admitted to illegal

business practices spanning decades.

The company's closely watched underlying pretax profit, that

strips out one-time items and currency fluctuations, fell for a

third year to GBP813 million from GBP1.43 billion a year earlier,

ahead of expectations. Underlying sales fell 2% to GBP13.4

billion.

Shares slumped 2.57% to GBP7.21.

Chief Executive Warren East said 2017 "remains a challenging

year."

Earnings this year will only be modestly better, Rolls-Royce

said. Underlying free cash flow, which was GBP100 million last

year, should be similarly weak in 2017, the company said. The

figure doesn't include a GBP293 million payment on its bribery

fine. Mr. East said cash-flow should top GBP1 billion by the end of

the decade.

Rolls-Royce, no longer affiliated with the luxury car maker,

began the year warning that earnings would sag. Profit on its

engines for Airbus A330 planes would retreat amid weaker demand and

with the plane maker introducing an upgraded model with newer

Rolls-Royce engines. Costs on its Trent 1000 engines used to power

Boeing Dreamliners have also risen with turbine components

degrading too quickly. Other problems include weakness in its

business to provide engine for regional and business jets where

Rolls-Royce has lost ground to rivals.

Chief Financial Officer David Smith said many of the earnings

difficulties, including weakness in demand for business jet engines

and services, would remain this year.

Rolls-Royce has embarked on companywide restructuring and

overhauled management to boost returns. About 600 manager positions

are being eliminated along with around 2,600 job losses in the

aerospace unit that generates most Rolls-Royce sales. About 1,800

jobs are being eliminated in the ship-engine unit. Mr. East has

promised annual savings starting at the end of this year of around

GBP200 million.

He said the company would also work to define a long-term

vision. The broad portfolio would remain unchanged, though some

businesses could be repositioned or be sold. He promised an update

this year.

The company also is bracing for the introduction of new

accounting standards that will depress near-term profit.

Rolls-Royce typically sells aircraft engines at a loss and makes up

the money later on servicing them. Rolls-Royce masks the early

losses by booking some of the assured services revenue early. Under

new accounting rules those losses will need to be reflected

immediately and services revenue can't be booked until the work

takes place. Under the new accounting standard Rolls-Royce wouldn't

have made an operating profit, Mr. Smith said.

Rolls-Royce a year ago announced its first dividend cut since

1992 to maintain balance sheet health amid falling profit. The

company said it would pay a 7.1 pence final dividend or 11.7 pence

for the full-year compared with 16.4 pence for 2015.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 14, 2017 04:31 ET (09:31 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

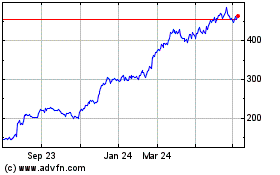

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

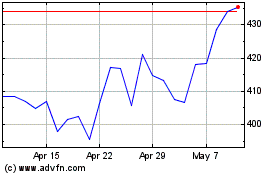

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024