Riverview Bancorp, Inc. (Nasdaq:RVSB) (“Riverview” or the

“Company”) today reported a net loss of $12.8 million, or $0.57 per

share, in its fourth fiscal quarter ended March 31, 2012, compared

to a net loss of $16.6 million, or $0.74 per share in the preceding

quarter and net income of $854,000, or $0.04 per share, in its

fourth fiscal quarter a year ago. The Company’s financial results

were impacted by the previously announced increase in the provision

for loan losses of $14.3 million during the fourth fiscal quarter

of 2012.

For the fiscal year, Riverview reported a net loss of $28.5

million, or $1.28 per share, compared to net income of $4.3

million, or $0.24 per share, for fiscal year 2011. Riverview’s

fiscal year 2012 results include a deferred tax asset valuation

allowance of $15.7 million. The valuation allowance represents a

non-cash accounting entry that may be reversed in future periods

if, among other considerations, the Company returns to sustained

profitability. Reversals of this allowance would increase

Riverview’s net income in these future periods.

“For the second consecutive quarter we have significantly

increased our loan loss provision in an effort to position

Riverview for recovery in an economy that remains sluggish,” said

Pat Sheaffer, Chairman and CEO. “We continue to focus on

strengthening the Bank and working diligently, side by side with

our clients on problem assets. Riverview remains an important

economic participant as one of the few community banks in the

region and the only community bank headquartered in Clark

County.”

Credit Quality

Riverview recorded a $14.3 million provision for loan losses in

the fourth quarter of fiscal year 2012, compared to $8.1 million in

the preceding quarter and $500,000 in the fourth quarter of fiscal

year 2011. The increase in the provision for loan losses was the

result of recently updated appraisals received on several

properties as well as the Company’s ongoing internal loan reviews.

The allowance for loan losses was $18.6 million at March 31, 2012,

representing 2.71% of total loans and 41.27% of non-performing

loans (NPLs). NPLs increased to $45.0 million, or 6.56% of total

loans at March 31, 2012, compared to $32.0 million, or 4.61% of

total loans at December 31, 2011 and $12.3 million, or 1.79% of

total loans, a year ago.

“Maintaining our capital levels for safety and growth as well as

identifying problem credits remain our top priorities,” said Ron

Wysaske, President and COO. “We continue to aggressively make

progress in these areas and our REO balances are steadily being

reduced.”

Riverview’s real estate owned (REO) decreased $1.9 million

during the quarter to $18.7 million at March 31, 2012 compared to

$20.7 million three months earlier and $27.6 million a year ago.

REO sales during the quarter totaled $4.9 million, with write-downs

of $934,000 and additions of $3.9 million. Riverview currently has

several additional properties under sales contracts, including a

$2.2 million land development property that was sold in April 2012

after the close of the fiscal year for a $144,000 loss.

The Company has seen an increase in sales activity for building

lots in recent months. Since the end of the last quarter, the

Company has sold a total of $5.0 million in building lots,

including the recent sale in April 2012. The Company also has an

additional $5.5 million in building lots under contract with

expected sales dates in the first fiscal quarter ended June 30,

2012.

Home builders in the area have also noted this increased demand

for single-family homes. Data through April 2012 showed that the

number of building permits for single-family homes in Vancouver has

tripled compared to the same four month period in the prior year.

In March 2012, the number of closed home sales also increased 25

percent compared to February 2012 and 5.6 percent compared to March

2011. “We are encouraged by this increase in sales activity,” said

Wysaske. “This increased activity has allowed us to continue to

reduce our land development and speculative construction

portfolios.”

The Company currently has identified 37% of the land development

portfolio as impaired and has charged down these loans to their

estimated fair value, less selling costs, based on updated

appraisals. Additionally, the Company currently has a $3.8 million

allowance on its outstanding land development portfolio. The

Company has identified 71% of the speculative construction

portfolio as impaired and has charged down these loans to their

estimated fair value, less selling costs, based on updated

appraisals.

Net charge-offs in the fourth quarter of fiscal 2012 totaled

$11.6 million, compared to $6.8 million in the third quarter of

fiscal 2012 and $3.0 million in the fourth quarter a year ago. The

increase was due partially to the charge-off of specific valuation

allowances established by the Company in prior quarters. During the

fourth quarter of fiscal 2012, the Company charged-off an

additional $5.0 million of loans that the Company had reserved for

at December 31, 2011. For the year, net charge-offs were $22.5

million compared to $11.7 million for fiscal 2011.

During the fourth quarter of fiscal 2012, the Company received

updated appraisals on over 40% of its impaired loans (41% of its

nonaccrual loans). The Company has received appraisals on all of

its nonaccrual loans that are supported by real estate in the last

twelve months.

Non-performing assets were $63.8 million at March 31, 2012

compared to $52.7 million in the preceding quarter and $39.9

million a year ago. At March 31, 2012, Riverview’s non-performing

assets were 7.42% of total assets, compared to 6.11% at the end of

the preceding quarter and 4.65% a year ago.

Balance Sheet Review

“As expected, loan balances declined further in the fourth

fiscal quarter as we continued planned reduction in land loans, as

well as other nonperforming loans,” said Wysaske. “In addition,

demand for new loans continued to be modest in this challenging

lending environment.” Net loans totaled $668.1 million at March 31,

2012 compared to $678.6 million at December 31, 2011 and $672.6

million a year ago. New loan production during the past year was

concentrated primarily in single-family residential mortgages and

small-business commercial loans.

As with the preceding quarter, Riverview continued reducing its

exposure to land development and speculative construction loans.

The balance of these portfolios was $49.6 million at March 31, 2012

compared to $58.5 million at December 31, 2011 and $75.1 million a

year ago. Speculative construction loans totaled $10.8 million, and

land development loans $38.9 million, representing a combined total

of 7.2% of the total loan portfolio at

March 31, 2012.

The commercial real estate (“CRE”) loan portfolio totaled $354.9

million as of March 31, 2012, of which 29.2% was owner-occupied and

70.8% was investor-owned. At March 31, 2012, the CRE portfolio

contained nine loans totaling $14.8 million that were

nonperforming, representing 4.2% of the total CRE portfolio and

32.9% of total nonperforming loans.

“We are encouraged by the success we are having in adding

interest bearing and non-interest bearing checking accounts, which

is allowing us to reduce our percentage of higher cost certificates

of deposit,” said Wysaske. “As a result, interest bearing checking

deposits and non-interest bearing checking deposits increased 38%

and 14%, respectively, compared to a year ago, and 100% of this

organic growth was generated from our existing seventeen branch

network.”

Total deposits increased $9.4 million during the quarter and

$27.9 million during the year to $744.5 million at

March 31, 2012. Total deposits were $735.0 million at

December 31, 2011 and $716.5 million a year ago. Core deposits,

which include checking accounts, savings accounts, money market

deposit accounts and retail CDs, increased $36.1 million to $688.6

million at March 31, 2012 compared to $652.5 million a year ago,

and comprised 92.5% of total deposits.

Net Interest Margin

Riverview’s net interest margin was 4.12% for the fourth fiscal

quarter compared to 4.21% for the preceding quarter and 4.71% for

the fourth fiscal quarter a year ago. The decrease was primarily

due to the reversal of interest income on loans that were placed on

non-accrual status during the quarter. The reversal of interest on

non-accrual loans decreased the net interest margin by 18 basis

points during the fourth quarter. The cost of interest bearing

deposits was 0.59% during the current quarter, a decrease of eight

basis points from the preceding quarter and a decrease of 29 basis

points from the fourth quarter a year ago. For the year, the net

interest margin was 4.33% compared to 4.64% for fiscal 2011.

Income Statement

Net interest income was $8.0 million in the fourth fiscal

quarter, compared to $8.4 million in the preceding quarter and $8.7

million in the fourth quarter a year ago. The decline in net

interest income was due to the reversal of approximately $334,000

of interest income on non-accrual loans and the continued pressure

on loan yields as a result of the low interest rate environment.

Total net interest income plus non-interest income was $9.6 million

in the fourth fiscal quarter compared to $9.9 million in the

preceding quarter and $10.4 million in the fourth quarter a year

ago. Non-interest income was $1.6 million in the fourth fiscal

quarter compared to $1.5 million in the preceding quarter and $1.7

million in the fourth fiscal quarter a year ago.

Fee income for Riverview Asset Management Corp. (“RAMCorp”), a

trust company subsidiary of the Bank, increased to $604,000 during

the fourth quarter compared to $568,000 in the preceding quarter

and $546,000 in the fourth quarter a year ago. For fiscal year

2012, RAMCorp’s fee income increased 13.9% to $2.4 million compared

to $2.1 million a year ago, while assets under management increased

9.6% to $359.6 million at March 31, 2012 compared to $328.1 million

a year earlier.

Non-interest expense decreased to $8.2 million in the fourth

fiscal quarter compared to $10.2 million in the preceding quarter.

The improvement was due to a reduction in write-downs of REO

properties compared to the December quarter. Non-interest expense

was $8.6 million in the fourth quarter a year ago. In fiscal 2012,

non-interest expense was $34.4 million compared to $31.5 million in

fiscal 2011.

During the third quarter of fiscal 2012 the Company established

a valuation allowance against its deferred tax asset. During the

quarter ended March 31, 2012, the Company increased its valuation

allowance $4.7 million to $15.7 million as a result of the

Company’s quarterly net loss. Management will review the deferred

tax asset on a quarterly basis to determine the appropriate

valuation allowance, if needed. Any future reversals of the

deferred tax asset valuation allowance would decrease the Company’s

income tax expense and increase its after tax net income in the

period of reversal.

Capital and Liquidity

The Bank continues to maintain capital levels in excess of the

regulatory requirements to be categorized as “well capitalized”

with a total risk-based capital ratio of 12.53% and a Tier 1

leverage ratio of 9.11% at March 31, 2012. To be considered “well

capitalized” a bank has to have a total risk-based capital ratio of

10%.

The Company recently completed a capital plan that outlined the

Company’s various strategies for maintaining and increasing the

Bank’s capital.

At March 31, 2012, the Bank had available total and contingent

liquidity of over $500 million, including over $300 million of

borrowing capacity from the Federal Home Loan Bank of Seattle and

the Federal Reserve Bank of San Francisco, and more than $80

million from cash and short-term investments. At March 31, 2012,

the Bank had no outstanding borrowings.

Non-GAAP Financial

Measures

In addition to results presented in accordance with generally

accepted accounting principles in the United States of America

(GAAP), this press release contains certain non-GAAP financial

measures. Riverview believes that certain non-GAAP financial

measures provide investors with information useful in understanding

the company’s financial performance; however, readers of this

report are urged to review these non-GAAP financial measures in

conjunction with GAAP results as reported.

Financial measures that exclude intangible assets are non-GAAP

measures. To provide investors with a broader understanding of

capital adequacy, Riverview provides non-GAAP financial measures

for tangible common equity, along with the GAAP measure. Tangible

common equity is calculated as shareholders’ equity less goodwill

and other intangible assets. In addition, tangible assets are total

assets less goodwill and other intangible assets.

The following table provides a reconciliation of ending

shareholders’ equity (GAAP) to ending tangible shareholders’ equity

(non-GAAP), and ending assets (GAAP) to ending tangible assets

(non-GAAP).

March 31, December 31, March

31, (Dollars in thousands)

2012

2011 2011 Shareholders’ equity $ 78,807 $

91,567 $ 106,944 Goodwill 25,572 25,572 25,572 Other intangible

assets, net 415 456 615 Tangible shareholders’ equity $

52,820 $ 65,539 $ 80,757 Total assets $ 859,198 $ 862,330 $

859,263 Goodwill 25,572 25,572 25,572 Other intangible assets, net

415 456 615 Tangible assets $ 833,211 $ 836,302 $ 833,076

About Riverview

Riverview Bancorp, Inc. (www.riverviewbank.com) is headquartered

in Vancouver, Washington – just north of Portland, Oregon on the

I-5 corridor. With assets of $859 million, it is the parent company

of the 88 year-old Riverview Community Bank, as well as Riverview

Asset Management Corp. The Bank offers true community banking

services, focusing on providing the highest quality service and

financial products to commercial and retail customers. There are 17

branches, including twelve in the Portland-Vancouver area and three

lending centers, with a new branch scheduled to open in the rapidly

growing metropolitan area of Gresham, Oregon in the summer of

2012.

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: This press release contains forward-looking

statements that are subject to risks and uncertainties, including,

but not limited to: the Company’s ability to raise common capital,

the amount of capital it intends to raise and its intended use of

that capital. The credit risks of lending activities, including

changes in the level and trend of loan delinquencies and write-offs

and changes in the Company’s allowance for loan losses and

provision for loan losses that may be impacted by deterioration in

the housing and commercial real estate markets; changes in general

economic conditions, either nationally or in the Company’s market

areas; changes in the levels of general interest rates, and the

relative differences between short and long term interest rates,

deposit interest rates, the Company’s net interest margin and

funding sources; fluctuations in the demand for loans, the number

of unsold homes, land and other properties and fluctuations in real

estate values in the Company’s market areas; secondary market

conditions for loans and the Company’s ability to sell loans in the

secondary market; results of examinations of us by the Office of

Comptroller of the Currency or other regulatory authorities,

including the possibility that any such regulatory authority may,

among other things, require us to increase the Company’s reserve

for loan losses, write-down assets, change Riverview Community

Bank’s regulatory capital position or affect the Company’s ability

to borrow funds or maintain or increase deposits, which could

adversely affect its liquidity and earnings; the Company’s

compliance with regulatory enforcement actions we have entered into

with the OCC as successor to the OTS and the possibility that our

noncompliance could result in the imposition of additional

enforcement actions and additional requirements or restrictions on

our operations; legislative or regulatory changes that adversely

affect the Company’s business including changes in regulatory

policies and principles, or the interpretation of regulatory

capital or other rules; the Company’s ability to attract and retain

deposits; further increases in premiums for deposit insurance; the

Company’s ability to control operating costs and expenses; the use

of estimates in determining fair value of certain of the Company’s

assets, which estimates may prove to be incorrect and result in

significant declines in valuation; difficulties in reducing risks

associated with the loans on the Company’s balance sheet; staffing

fluctuations in response to product demand or the implementation of

corporate strategies that affect the Company’s workforce and

potential associated charges; computer systems on which the Company

depends could fail or experience a security breach; the Company’s

ability to retain key members of its senior management team; costs

and effects of litigation, including settlements and judgments; the

Company’s ability to successfully integrate any assets,

liabilities, customers, systems, and management personnel it may in

the future acquire into its operations and the Company’s ability to

realize related revenue synergies and cost savings within expected

time frames and any goodwill charges related thereto; increased

competitive pressures among financial services companies; changes

in consumer spending, borrowing and savings habits; the

availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; the Company’s

ability to pay dividends on its common stock; and interest or

principal payments on its junior subordinated debentures; adverse

changes in the securities markets; inability of key third-party

providers to perform their obligations to us; changes in accounting

policies and practices, as may be adopted by the financial

institution regulatory agencies or the Financial Accounting

Standards Board, including additional guidance and interpretation

on accounting issues and details of the implementation of new

accounting methods; other economic, competitive, governmental,

regulatory, and technological factors affecting the Company’s

operations, pricing, products and services and the other risks

described from time to time in our filings with the Securities and

Exchange Commission.

Such forward-looking statements may include projections. Any

such projections were not prepared in accordance with published

guidelines of the American Institute of Certified Public

Accountants or the Securities Exchange Commission regarding

projections and forecasts nor have such projections been audited,

examined or otherwise reviewed by independent auditors of the

Company. In addition, such projections are based upon many

estimates and inherently subject to significant economic and

competitive uncertainties and contingencies, many of which are

beyond the control of management of the Company. Accordingly,

actual results may be materially higher or lower than those

projected. The inclusion of such projections herein should not be

regarded as a representation by the Company that the projections

will prove to be correct.

The Company cautions readers not to place undue reliance on any

forward-looking statements. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to the Company. The Company

does not undertake and specifically disclaims any obligation to

revise any forward-looking statements to reflect the occurrence of

anticipated or unanticipated events or circumstances after the date

of such statements. These risks could cause our actual results for

fiscal 2012 and beyond to differ materially from those expressed in

any forward-looking statements by, or on behalf of, us, and could

negatively affect the Company’s operating and stock price

performance.

RIVERVIEW BANCORP, INC. AND SUBSIDIARY

Consolidated Balance Sheets (In thousands, except share

data) (Unaudited)

March 31, 2012

Dec. 31, 2011

March 31, 2011

ASSETS

Cash (including interest-earning accounts

of $33,437, $23,146 and $37,349)

$ 46,393 $ 36,313 $ 51,752 Certificate of deposits 41,473 42,718

14,900 Loans held for sale 480 659 173 Investment securities held

to maturity, at amortized cost 493 493 506 Investment securities

available for sale, at fair value 6,314 6,337 6,320 Mortgage-backed

securities held to maturity, at amortized 171 177 190

Mortgage-backed securities available for sale, at fair value 974

1,146 1,777 Loans receivable (net of allowance for loan losses of

$18,584, $15,926 and $14,968) 668,088 678,626 672,609 Real estate

owned 18,731 20,667 27,590 Prepaid expenses and other assets 6,362

6,087 5,887 Accrued interest receivable 2,158 2,378 2,523 Federal

Home Loan Bank stock, at cost 7,350 7,350 7,350 Premises and

equipment, net 17,068 16,351 16,100 Deferred income taxes, net 603

594 9,447 Mortgage servicing rights, net 278 299 396 Goodwill

25,572 25,572 25,572 Core deposit intangible, net 137 157 219 Bank

owned life insurance 16,553 16,406

15,952 TOTAL ASSETS $ 859,198 $ 862,330

$ 859,263

LIABILITIES AND EQUITY

LIABILITIES: Deposit accounts $ 744,455 $ 735,046 $ 716,530 Accrued

expenses and other liabilities 9,398 9,574 9,396 Advance payments

by borrowers for taxes and insurance 800 409 680 Junior

subordinated debentures 22,681 22,681 22,681 Capital lease

obligation 2,513 2,531 2,567

Total liabilities 779,847 770,241 751,854 EQUITY:

Shareholders' equity Serial preferred stock, $.01 par value;

250,000 authorized, issued and outstanding, none - - - Common

stock, $.01 par value; 50,000,000 authorized, March 31, 2012 –

22,471,890 issued and outstanding; 225 225 225 December 31, 2011 -

22,471,890 issued and outstanding; March 31, 2011 – 22,471,890

issued and outstanding; Additional paid-in capital 65,610 65,621

65,639 Retained earnings 14,736 27,493 43,193 Unearned shares

issued to employee stock ownership trust (593 ) (619 ) (696 )

Accumulated other comprehensive loss (1,171 ) (1,153

) (1,417 ) Total shareholders’ equity 78,807 91,567 106,944

Noncontrolling interest 544 522

465 Total equity 79,351 92,089

107,409 TOTAL LIABILITIES AND EQUITY $

859,198 $ 862,330 $ 859,263

RIVERVIEW

BANCORP, INC. AND SUBSIDIARY Consolidated Statements of

Operations Three Months Ended Twelve

Months Ended (In thousands, except share data)

(Unaudited)

March 31, 2012

Dec. 31, 2011

March 31, 2011

March 31, 2012 March 31,

2011 INTEREST INCOME: Interest and fees on loans receivable $

9,130 $ 9,669 $ 10,239 $ 38,894 $ 42,697 Interest on investment

securities-taxable 36 28 49 145 164 Interest on investment

securities-non taxable 7 11 12 42 55 Interest on mortgage-backed

securities 10 12 18 51 88 Other interest and dividends 127

109 70

400 210 Total interest income

9,310 9,829 10,388 39,532 43,214 INTEREST EXPENSE: Interest

on deposits 908 1,061 1,337 4,357 6,569 Interest on borrowings

387 381

364 1,508 1,483 Total

interest expense 1,295 1,442

1,701 5,865

8,052 Net interest income 8,015 8,387 8,687 33,667 35,162

Less provision for loan losses 14,300

8,100 500 26,150

5,075 Net interest income (loss) after

provision for loan losses (6,285 ) 287 8,187 7,517 30,087

NON-INTEREST INCOME: Fees and service charges 914 962 916 3,996

4,047 Asset management fees 604 568 546 2,367 2,079 Gain on sale of

loans held for sale 87 29 54 160 393 Bank owned life insurance

income 146 151 150 601 601 Other (190 )

(180 ) 73 (297 )

769 Total non-interest income 1,561 1,530 1,739 6,827 7,889

NON-INTEREST EXPENSE: Salaries and employee benefits 3,850 4,014

4,601 15,889 16,716 Occupancy and depreciation 1,253 1,211 1,180

4,793 4,677 Data processing 285 306 293 1,421 1,067 Amortization of

core deposit intangible 20 20 24 82 96 Advertising and marketing

expense 184 286 172 998 749 FDIC insurance premium 288 289 400

1,136 1,640 State and local taxes 139 150 136 549 638

Telecommunications 110 109 111 434 428 Professional fees 283 334

352 1,254 1,310 Real estate owned expenses 1,130 2,781 634 5,097

1,817 Other 687 692

663 2,770

2,358 Total non-interest expense 8,229

10,192 8,566 34,423

31,496 INCOME (LOSS) BEFORE

INCOME TAXES (12,953 ) (8,375 ) 1,360 (20,079 ) 6,480 PROVISION

(BENEFIT) FOR INCOME TAXES (196 ) 8,220

506 8,378

2,165 NET INCOME (LOSS) $ (12,757 ) $ (16,595

) $ 854 $ (28,457 ) $ 4,315

Earnings (loss) per common share: Basic $ (0.57 ) $ (0.74 ) $ 0.04

$ (1.28 ) $ 0.24 Diluted $ (0.57 ) $ (0.74 ) $ 0.04 $ (1.28 ) $

0.24 Weighted average number of shares outstanding: Basic

22,327,171 22,321,011 22,302,538 22,317,933 18,341,191 Diluted

22,327,171 22,321,011 22,302,538 22,317,933 18,341,308

(Dollars in thousands)

At or

for the three months ended At or for the twelve months

ended March 31, 2012 Dec. 31, 2011 March 31,

2011 March 31, 2012 March 31, 2011

AVERAGE

BALANCES

Average interest–earning assets $ 788,509 $ 790,922 $ 748,907 $

777,869 $ 758,847 Average interest-bearing liabilities 652,607

651,368 639,503 645,369 649,342 Net average earning assets 135,902

139,554 109,404 132,500 109,505 Average loans 695,994 694,205

685,507 694,387 703,861 Average deposits 741,320 742,899 705,456

731,089 708,169 Average equity 91,207 109,301 108,114 104,878

100,643 Average tangible equity 65,192 83,238 81,896 78,788 74,337

ASSET

QUALITY

March 31, 2012 Dec. 31, 2011 March 31, 2011

Non-performing loans 45,033 32,037 12,323 Non-performing

loans to total loans 6.56 % 4.61 % 1.79 % Real estate/repossessed

assets owned 18,731 20,667 27,590 Non-performing assets 63,764

52,704 39,913 Non-performing assets to total assets 7.42 % 6.11 %

4.65 % Net loan charge-offs in the quarter 11,642 6,846 2,995 Net

charge-offs in the quarter/average net loans 6.73 % 3.91 % 1.77 %

Allowance for loan losses 18,584 15,926 14,968 Average

interest-earning assets to average interest-bearing liabilities

120.82 % 121.42 % 117.11 % Allowance for loan losses to

non-performing loans 41.27 % 49.71 % 121.46 % Allowance for loan

losses to total loans 2.71 % 2.29 % 2.18 % Shareholders’ equity to

assets 9.17 % 10.62 % 12.45 %

CAPITAL

RATIOS

Total capital (to risk weighted assets) 12.53 % 13.14 % 14.61 %

Tier 1 capital (to risk weighted assets) 11.26 % 11.89 % 13.35 %

Tier 1 capital (to leverage assets) 9.11 % 9.74 % 11.24 % Tangible

common equity (to tangible assets) 6.34 % 7.84 % 9.69 %

DEPOSIT

MIX

March 31, 2012 Dec. 31, 2011 March 31, 2011

Interest checking $ 106,904 $ 96,757 $ 77,399 Regular

savings 45,741 42,453 37,231 Money market deposit accounts 244,919

235,902 236,321 Non-interest checking 116,882 116,854 102,429

Certificates of deposit 230,009 243,080

263,150 Total deposits $ 744,455 $ 735,046

$ 716,530

COMPOSITION OF

COMMERCIAL AND CONSTRUCTION LOANS

Commercial Commercial Real Estate Real Estate &

Construction Commercial Mortgage Construction Total

March 31,

2012

(Dollars in thousands) Commercial $ 87,238 $ - $ - $ 87,238

Commercial construction - - 13,496 13,496 Office buildings - 96,404

- 96,404 Warehouse/industrial - 48,605 - 48,605 Retail/shopping

centers/strip malls - 80,595 - 80,595 Assisted living facilities -

35,866 - 35,866 Single purpose facilities - 93,473 - 93,473 Land -

38,888 - 38,888 Multi-family - 42,795 - 42,795 One-to-four family

- - 12,295 12,295 Total $ 87,238 $

436,626 $ 25,791 $ 549,655

March 31,

2011

(Dollars in thousands) Commercial $ 85,511 $ - $ - $ 85,511

Commercial construction - - 8,608 8,608 Office buildings - 95,529 -

95,529 Warehouse/industrial - 49,627 - 49,627 Retail/shopping

centers/strip malls - 85,719 - 85,719 Assisted living facilities -

35,162 - 35,162 Single purpose facilities - 98,651 - 98,651 Land -

55,258 - 55,258 Multi-family - 42,009 - 42,009 One-to-four family

- - 18,777 18,777 Total $ 85,511 $

461,955 $ 27,385 $ 574,851

LOAN

MIX

March 31, 2012 Dec. 31, 2011 March 31, 2011

Commercial and construction Commercial $ 87,238 $ 86,759 $ 85,511

Other real estate mortgage 436,626 448,288 461,955 Real estate

construction 25,791 27,544 27,385 Total

commercial and construction 549,655 562,591 574,851 Consumer Real

estate one-to-four family 134,975 129,780 110,437 Other installment

2,042 2,181 2,289 Total consumer 137,017

131,961 112,726 Total loans 686,672 694,552

687,577 Less: Allowance for loan losses 18,584

15,926 14,968 Loans receivable, net $ 668,088 $ 678,626 $

672,609

DETAIL OF

NON-PERFORMING ASSETS

Northwest Other Southwest Other Oregon Oregon Washington

Washington Other Total

March 31,

2012

(Dollars in thousands) Non-performing assets Commercial $

194 $ 746 $ 2,990 $ - $ - $ 3,930 Commercial real estate 2,737 -

9,735 - 2,348 14,820 Land - 1,902 6,383 - 4,700 12,985 Multi-family

627 1,000 - - - 1,627 Commercial construction - - - - - -

One-to-four family construction 1,246 6,117 393 - - 7,756 Real

estate one-to-four family 678 189 3,048 - - 3,915 Consumer -

- - - - - Total non-performing

loans 5,482 9,954 22,549 - 7,048 45,033 REO 2,477

5,863 6,825 3,566 - 18,731

Total non-performing assets $ 7,959 $ 15,817 $ 29,374 $

3,566 $ 7,048 $ 63,764

DETAIL OF SPEC

CONSTRUCTION AND LAND DEVELOPMENT LOANS

Northwest Other Southwest Other Oregon Oregon Washington

Washington Other Total

March 31,

2012

(Dollars in thousands) Land and spec construction loans Land

development loans $ 6,044 $ 3,672 $ 24,472 $ - $ 4,700 $ 38,888

Spec construction loans 1,246 6,117 3,006

392 - 10,761 Total land and spec

construction $ 7,290 $ 9,789 $ 27,478 $ 392 $ 4,700 $ 49,649

At or for the three months

ended At or for the twelve months ended

SELECTED OPERATING

DATA

March 31, 2012

Dec. 31, 2011

March 31, 2011

March 31, 2012

March 31, 2011

Efficiency ratio (4) 85.93 % 102.77 % 82.16 % 85.01 % 73.16

% Coverage ratio (6) 97.40 % 82.29 % 101.41 % 97.80 % 111.64 %

Return on average assets (1) -5.92 % -7.42 % 0.41 % -3.27 % 0.51 %

Return on average equity (1) -56.25 % -60.24 % 3.20 % -27.13 % 4.29

%

NET INTEREST

SPREAD

Yield on loans 5.32 % 5.53 % 6.06 % 5.60 % 6.07 % Yield on

investment securities 2.36 % 2.66 % 3.12 % 2.63 % 2.96 % Total

yield on interest earning assets 4.79 % 4.93 % 5.63 % 5.08 % 5.70 %

Cost of interest bearing deposits 0.59 % 0.67 % 0.88 % 0.70

% 1.06 % Cost of FHLB advances and other borrowings 6.23 % 5.99 %

5.83 % 5.97 % 4.59 % Total cost of interest bearing liabilities

0.80 % 0.88 % 1.08 % 0.91 % 1.24 % Spread (7) 3.99 % 4.05 %

4.55 % 4.17 % 4.46 % Net interest margin 4.12 % 4.21 % 4.71 % 4.33

% 4.64 %

PER SHARE

DATA

Basic earnings per share (2) $ (0.57 ) $ (0.74 ) $ 0.04 $ (1.28 ) $

0.24 Diluted earnings per share (3) (0.57 ) (0.74 ) 0.04 (1.28 )

0.24 Book value per share (5) 3.51 4.07 4.76 3.51 4.76 Tangible

book value per share (5) 2.35 2.92 3.59 2.35 3.59 Market price per

share: High for the period $ 2.46 $ 2.50 $ 3.21 $ 3.18 $ 3.81 Low

for the period 2.03 2.11 2.69 2.03 1.73 Close for period end 2.26

2.37 3.04 2.26 3.04 Cash dividends declared per share - - - - -

Average number of shares outstanding: Basic (2) 22,327,171

22,321,011 22,302,538 22,317,933 18,341,191 Diluted (3) 22,327,171

22,321,011 22,302,538 22,317,933 18,341,308

(1) Amounts for the quarterly periods are annualized.(2) Amounts

exclude ESOP shares not committed to be released.(3) Amounts

exclude ESOP shares not committed to be released and include common

stock equivalents.(4) Non-interest expense divided by net interest

income and non-interest income.(5) Amounts calculated based on

shareholders’ equity and include ESOP shares not committed to be

released.(6) Net interest income divided by non-interest

expense.(7) Yield on interest-earning assets less cost of funds on

interest bearing liabilities.

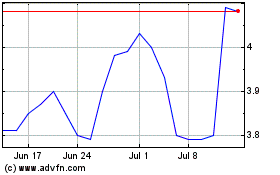

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Mar 2024 to Apr 2024

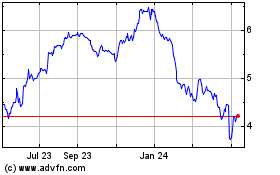

Riverview Bancorp (NASDAQ:RVSB)

Historical Stock Chart

From Apr 2023 to Apr 2024