Rio Tinto Annual Iron Ore Shipments Rise

January 16 2017 - 5:27PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Rio Tinto PLC (RIO.AU) exported more cargoes of iron ore

in 2016 as it continued to ratchet up production from a recently

expanded network of mines in a remote part of Australia.

The Anglo-Australian company on Tuesday reported iron-ore

shipments of 327.6 million metric tons from its Western Australia

mining operations during the year, up 3% on 2015. That was in line

with a company projection in October that it would ship between 325

million and 330 million tons from Australia in 2016.

Miners including Rio Tinto and Anglo-Australian rival BHP

Billiton Ltd. (BHP.AU) poured billions of dollars into massive

expansions of their Australian mining operations over the past

decade as China's economy grew rapidly, demanding greater volumes

of the steelmaking ingredient for skyscrapers, bridges and other

infrastructure.

Now, three in every five tons of iron ore traded by sea come

from Australia's vast Pilbara region. Rio Tinto and BHP are the

world's No. 2 and No. 3 exporters of iron ore, respectively.

Brazil's Vale SA is the largest global supplier.

Rio Tinto stuck to an earlier forecast that shipments from

Australia should increase to between 330 million and 340 million

tons this year, higher than 2016 but lower than once anticipated

because of delays to an autonomous railway project.

The company said it will continue in the year ahead to advance

its AutoHaul project that will see driverless trains snake from

mine to port through the Pilbara, but with a driver remaining on

board until it is satisfied the system is safe and reliable.

Rio Tinto also has a majority stake in an iron-ore operation in

Canada, Iron Ore Company of Canada, where its share of output in

2016 increased 3% on-year to 10.7 million tons.

Iron ore prices have steadied around US$80 a ton, down from a

peak around US$190 a ton in 2011, in the heady days of the mining

boom, but up from as low as US$37 a little over a year ago. At the

same time, Rio Tinto has been doubling down on its push to cut

costs in the business that has included increasing utilization of

trucks and plant and reworking deals with suppliers.

Chief Executive Jean-Sébastien Jacques said Rio Tinto's focus in

2017 will remain on productivity and cost reduction. "This will

ensure that we continue to deliver value for our shareholders," he

said.

The miner said on Tuesday that full-year production of other

commodities including copper and coal, two other important

commodities for company earnings, were mostly higher.

Annual production of copper was up 4% at 523,300 tons, although

this missed prior guidance partly due to lower-than-expected

volumes from its Kennecott mine in the U.S. state of Utah. Hard

coking coal output was up 4% on-year, at 8.1 million tons.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

January 16, 2017 17:12 ET (22:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

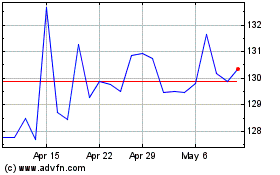

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

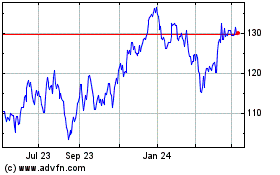

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024