Reynolds American CEO to Leave Role at Year's End -- 2nd Update

October 19 2016 - 5:45PM

Dow Jones News

By Tripp Mickle

Reynolds American Inc. tapped Debra Crew, a former U.S. Army

captain and PepsiCo Inc. executive who has helped boost the tobacco

company's revenue since 2014, to become its new chief executive

officer when Susan Cameron retires next year.

Ms. Cameron, 57, who was lured out of retirement by Reynolds in

May 2014 to complete its $25 billion takeover of Lorillard Inc.,

said the move fulfills one of two mandates she was given by

Reynolds's board after rejoining the company.

In addition to finding and grooming a replacement, Ms. Cameron

was pressed to successfully integrate Lorillard after the takeover.

That project was completed last month, about three months ahead of

schedule.

Ms. Crew, who has served as president of the R.J. Reynolds

Tobacco Co. subsidiary since 2014, played a critical role in the

integration process, helping ignite growth of Lorillard's Newport

brand, Ms. Cameron said.

"As part of this succession plan, [Ms. Crew] had to demonstrate

she could do it in our industry and that she could lead this

organization," Ms. Cameron said. "She has done that

brilliantly."

Newport has increased its market share to 13.9% from 13.4% since

June 2015, adding an estimated $200 million in quarterly

incremental revenue for Reynolds, according to estimates by Wells

Fargo.

Ms. Crew, 45, joined Reynolds after more than a decade's work

across consumer packaged goods companies like Mars, Inc., Nestle SA

and Kraft Foods Inc. She spent four years at PepsiCo rising from

president of the soft drink and snack food company's Western Europe

region to president of North America nutrition.

Ms. Cameron said the mix of Ms. Crew's expertise from the

consumer packaged goods industry along with the tobacco expertise

of longtime Reynolds executives like Chief Financial Officer Andrew

Gilchrist would create a balanced leadership team that could

effectively steer the company forward.

Ms. Crew takes over Reynolds at a time when the tobacco industry

continues to struggle with declining cigarette volumes and slowing

sales of e-cigarettes. The company said Wednesday it now expects

U.S. cigarette volumes to decline 2.5% this year, down from an

earlier estimate of a 2% downturn and more in line with historic

declines of 3% to 4% annually.

In the most recent quarter, Reynolds said its cigarette volumes

declined 1.5% to 22 billion from 22.3 billion a year ago as a 0.9%

increase in Newport volumes failed to offset a 3.8% decline in

volumes of Camel and Pall Mall.

The company reported a 47% decline in sales to $54 million from

its "all other" division, which includes Vuse e-cigarettes.

Reynolds posted earnings of $861 million compared with $657

million a year ago, falling short of analysts' expectations. The

company's stock fell 2.1% to $46.29 on Wednesday.

Ms. Crew said she plans to continue Ms. Cameron's efforts to

expand Reynolds's tobacco portfolio, so it can compete for tobacco

consumers who increasingly shift between cigarettes, smokeless

tobacco and e-cigarette products. She said the company would

provide an update soon on its strategy for "heat-not-burn" tobacco

products, which are more similar to conventional cigarettes than

e-cigs.

"Consumers continue to say they're interested in other choices

outside cigarettes," Ms. Crew said. "We have options for those

consumers and that's what makes us an exciting company."

--Mike Esterl and Joshua Jamerson contributed to this

article.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

October 19, 2016 17:30 ET (21:30 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

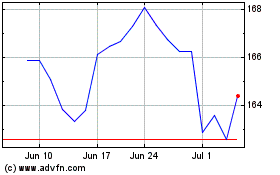

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

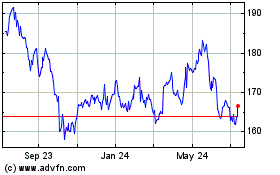

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024