Report of Foreign Issuer (6-k)

June 30 2016 - 9:34AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

June 30, 2016

|

Commission File Number 001-16125

|

|

|

|

|

|

|

|

Advanced Semiconductor Engineering, Inc.

|

|

( Exact name of Registrant as specified in its charter)

|

|

|

|

|

26 Chin Third Road

Nantze Export Processing Zone

Kaoshiung, Taiwan

Republic of China

|

|

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note

: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission

in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish

and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are

traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If "Yes" is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

Signatures

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

ADVANCED SEMICONDUCTOR

ENGINEERING, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 30, 2016

|

By:

|

/s/ Joseph Tung

|

|

|

|

Name:

|

Joseph Tung

|

|

|

|

Title:

|

Chief Financial Officer

|

|

Investor Relations Contact:

|

Advanced Semiconductor Engineering,

Inc.

Iris Wu, Manager

irissh_wu@aseglobal.com

Tel: +886.2.6636.5678

|

Siliconware Precision Industries

Co., Ltd.

Mike Ma, Spokesperson

mikema@spil.com.tw

Tel: +886.4.2554.5527

|

June 30, 2016

Joint Announcement by ASE and SPIL

June 30, 2016 –

Advanced Semiconductor Engineering, Inc. (TWSE code: 2311, NYSE code: ASX, hereafter “

ASE

”) and Siliconware

Precision Industry Co., Ltd. (TWSE code: 2325, NASDAQ code: SPIL, hereafter “

SPIL

”) jointly announced today

that each party’s respective board of directors has adopted resolution to approve the entering into and execution of a joint

share exchange agreement between ASE and SPIL (the “

Agreement

”) and agreement to establish a new holding company

(the “

Holdco

”). Major terms of the Agreement are set forth below:

1. ASE and SPIL jointly

agree to establish Holdco, which will be listed in the Taiwan Stock Exchange and whose American depositary shares will be listed

in the New York Stock Exchange. Upon the establishment of the Holdco, ASE and SPIL will become wholly-owned subsidiaries of the

HoldCo and become sibling companies. Through this parallel operation model which incentivizes healthy internal competition and

promotes cooperation, ASE and SPIL will strive to improve each company’s operating efficiency, economies of scale as well

as research and development and innovation results, thereby creating an environment of mutual assistance and win-win mentality,

strengthening competitiveness and improving the performance of Holdco, with the main goals of improving the quality of customer

service, creating shareholders value and benefiting the employees.

2. Upon the establishment

of the Holdco, ASE and SPIL will each maintain its legal status as separate entities, retain its respective legal entity name as

well as independent business and operation model. ASE and SPIL will each retain its respective management team and employees and

maintain its current organizational structure, compensation and relevant benefits and personnel policies.

3. The share exchange

will be conducted (1) at an exchange ratio of one ASE common share for 0.5 HoldCo common share, and (2) at NT$55 in cash for each

of SPIL’s common shares, with ASE and SPIL becoming wholly-owned subsidiaries of HoldCo. The cash consideration of NT$55

has been adjusted to NT$51.2 after excluding the NT$2.8 per share cash dividend distribution approved by resolution at SPIL’s

annual shareholders’ meeting in 2016 as well as a NT$1.0 per share payment from capital reserve. The NT$51.2 cash consideration

aforementioned will not be subject to further adjustment if the cash dividends distribution by SPIL in 2017 is less than 85% of

SPIL’s after-tax net profit for the year 2016.

4. The long stop date

of the Agreement (the “

Long Stop Date

”), which means the expiration of the Agreement, is set at 18 months after

the execution date of the Agreement (i.e., December 31, 2017) or a later date otherwise agreed upon in writing by both parties.

If the closing of this transaction cannot be consummated due to failure of the conditions precedent to be satisfied on or before

the Long Stop Date, the Agreement shall be terminated automatically at 0:00 on the day immediately following the Long Stop Date,

unless otherwise agreed in writing.

5. The closing of the

transaction will be subject to the execution of the Agreement, the necessary approvals by relevant domestic and foreign competent

authorities, the approvals by ASE and SPIL’s respective shareholders’ meeting as well as the satisfaction of other

conditions precedent.

The management teams

of ASE and SPIL have agreed to jointly plan, with the utmost sincerity and determination and on the basis of equality, reciprocity

and mutual benefit, the establishment of the HoldCo to consolidate the current operations and excellent talents of ASE and SPIL.

The collaboration between the parties will result in synergies that can create competitive advantages and opportunities for the

future development and sustained growth of the semiconductor industry by enhancing efficiency and economies of scale as well deeply

strengthening research and development and innovation capabilities, thereby providing customers with higher quality, more efficient,

and well-rounded packaging and testing services. ASE and SPIL have always strived for research and development innovation and improving

economies of scale and operating efficiency to maximize shareholder value and improve the semiconductor packaging and testing industry's

advantage. Both parties also believe that one of their main tasks and social responsibilities is to continue to cultivate and nurture

excellent talents for years to come.

Safe Harbor Notice:

This press release contains

“forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended,

and Section 21E of the United States Securities Exchange Act of 1934, as amended, including statements regarding ASE’s or

HoldCo’s future results of operations and business prospects. Although these forward-looking statements, which may include

statements regarding ASE’s or HoldCo’s (if established) future results of operations, financial condition or business

prospects, are based on ASE’s or HoldCo’s (if established) own information and information from other sources we believe

to be reliable, you should not place undue reliance on these forward-looking statements, which apply only as of the date of this

press release. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“plan” and similar expressions, as they relate to ASE or HoldCo (if established), are intended to identify these forward-looking

statements in this press release. These statements discuss future expectations, identify strategies, contain projections of results

of operations of ASE’s or HoldCo’s (if established) financial condition, or state other forward-looking information.

Known and unknown risks, uncertainties and other factors could cause the actual results to differ materially from those contained

in any forward-looking statement. ASE cannot promise that its expectations expressed in these forward-looking statements will turn

out to be correct. ASE’s or HoldCo’s (if established)actual results could be materially different from and worse than

those expectations. For a discussion of important risks and factors that could cause ASE’s or HoldCo’s (if established)

actual results to be materially different from its expectations, please see the documents we file from time to time with the U.S.

Securities and Exchange Commission (“U.S. SEC”), including ASE’s 2015 Annual Report on Form 20-F filed on April

29, 2016.

This press release

is not an offering of securities for sale in any jurisdiction:

ASE may file a registration

statement on Form F-4 with the U.S. SEC in connection with the proposed Joint Share Exchange. The Form F-4 (if filed) will contain

a prospectus and other documents. The Form F-4 (if filed) and prospectus, as they may be amended from time to time, will contain

important information about ASE, SPIL, the Joint Share Exchange and related matters. U.S. shareholders of ASE are urged to read

the Form F-4 (if filed), the prospectus and the other documents, as they may be amended from time to time, that may be filed with

the U.S. SEC in connection with the Joint Share Exchange carefully before they make any decision at any shareholders’ meeting

of ASE with respect to the Joint Share Exchange. The Form F-4 (if filed), the prospectus and all other documents filed with the

U.S. SEC in connection with the Joint Share Exchange will be available when filed, free of charge, on the U.S. SEC’s website

at www.sec.gov. In addition, the Form F-4 (if filed), the prospectus and all other documents filed with the U.S. SEC in connection

with the Joint Share Exchange will be made available, free of charge, to U.S. shareholders of ASE who make a written request to

ir@aseglobal.com

.

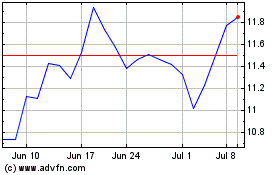

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

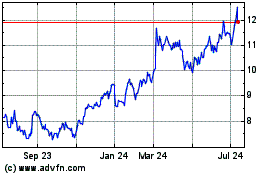

ASE Technology (NYSE:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024