FORM 6-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of January 2016

Commission File Number: 1-07952

KYOCERA CORPORATION

6 Takeda Tobadono-cho, Fushimi-ku,

Kyoto 612-8501, Japan

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Registration S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Registration S-T Rule 101(b)(7): o

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

| | |

| | KYOCERA CORPORATION |

|

|

|

|

| /s/ SHOICHI AOKI |

|

| Shoichi Aoki |

|

| Director, |

|

| Managing Executive Officer and |

|

| General Manager of |

|

| Corporate Financial and Accounting Group |

Date: January 29, 2016

Information furnished on this form:

EXHIBITS

| | | |

| Exhibit Number |

|

|

| 1. |

| English translation of the announcement of the reorganization of Kyocera Corporation (“Rinji-houkokusho”) |

English translation of the announcement of reorganization of Kyocera Corporation (“Rinji-houkokusho”)

1. Reason for Filing

To report, in accordance with Paragraph 4 of Article 24-5 of the Financial Instruments and Exchange Law and Sub-Paragraph 7 and 7-3 of Paragraph 2 of Article 19 of Ordinance of Cabinet Office relating to Disclosure of Corporation, following a resolution of its Meeting of Board of Directors adopted on January 29, 2016, Kyocera Corporation (the Company) will reorganize the Company’s business as described below, effective as from April 1, 2016.

(1) Kyocera Circuit Solutions, Inc. (“KCS”) and Kyocera Chemical Corporation (“KCC”), both of which are wholly owned consolidated subsidiaries of the Company, will be merged into the Company; and

(2) The business unit engaged in the sale of photovoltaic power generation equipment will be separated by means of a corporate split from Kyocera Solar Corporation, a wholly owned consolidated subsidiary of the Company engaged in the sale of photovoltaic power generation equipment and contracting relating to photovoltaic power generation systems for the Japanese market, and such business unit shall be succeeded to by the Company.

2. Matters Reported

[1] Merger

(1) Outline of the company which will be taken over as merger

1) Kyocera Circuit Solutions, Inc.

(A) Status of Kyocera Circuit Solutions, Inc.

| | |

| Trade Name | Kyocera Circuit Solutions, Inc. |

| Location of Headquarter | Fushimi-ku, Kyoto |

| Name and Title of Representative | Kazuyuki Nada, President and Director |

| Capital Amount | 4,000 million yen (as of March 31, 2015) |

| Total Shareholders’ Equity | 25,960 million yen (as of March 31, 2015) |

| Total Assets | 52,840 million yen (as of March 31, 2015) |

| Principal Businesses | Development, manufacture and sale of organic packages and multilayer printed wiring boards for semiconductor devices |

(B) Performances for the most recent three fiscal years ended March 31

| | | | | | | |

|

|

| (Millions of Yen) |

|

|

| Fiscal Years Ended March 31, |

| Kyocera Circuit Solutions, Inc. |

| 2013 |

| 2014 |

| 2015 |

| Net Sales |

| 50,702 |

| 51,505 |

| 53,083 |

| Profit (Loss) from Operations |

| 1,473 |

| 2,925 |

| (2,490) |

| Recurring Income (Loss) |

| 1,962 |

| 3,226 |

| (1,767) |

| Net Income (Loss) |

| 1,633 |

| 1,508 |

| (1,412) |

* On October 1, 2014, Kyocera SLC Technologies Corporation absorbed former Kyocera Circuit Solutions, Inc., and changed the name to Kyocera Circuit Solutions, Inc. as the succeeding company. The above table represents performances after its merger.

(C) The name of principal shareholder and its shareholding ratio

Kyocera Corporation: 100%

1

(D) Relationship with the Company

| | |

| Capital Relationship: | KCS is a wholly owned consolidated subsidiary of the Company. |

| Personal Relationship: | Two Directors and a member of Audit and Supervisory Board of KCS are delegated from the Company. Certain employees of the Company are dispatched to KCS. |

| Trade Relationship: | The Company finances as lending for KCS’s capital for investment and operating capital, and KCS rents manufacturing properties, land and buildings from the Company. The Company purchases the products from KCS. |

2) Kyocera Chemical Corporation

(A) Status of Kyocera Chemical Corporation

| | |

| Trade Name | Kyocera Chemical Corporation |

| Location of Headquarter | Shinagawa-ku, Tokyo |

| Name and Title of Representative | Kazuhiro Sawai, President and Director |

| Capital Amount | 10,172 million yen (as of March 31, 2015) |

| Total Shareholders’ Equity | 15,557 million yen (as of March 31, 2015) |

| Total Assets | 19,818 million yen (as of March 31, 2015) |

| Principal Businesses | Development, manufacture and sale of materials for semiconductors and chemical materials |

(B) Performances for the most recent three fiscal years ended March 31

| | | | | | | |

|

|

| (Millions of Yen) |

|

|

| Fiscal Years Ended March 31, |

| Kyocera Chemical Corporation |

| 2013 |

| 2014 |

| 2015 |

| Net Sales |

| 13,595 |

| 13,274 |

| 13,426 |

| Profit from Operations |

| 413 |

| 493 |

| 594 |

| Recurring Income |

| 725 |

| 671 |

| 1,617 |

| Net Income |

| 1,895 |

| 434 |

| 1,114 |

(C) The name of principal shareholder and its shareholding ratio

Kyocera Corporation: 100%

(D) Relationship with the Company

| | |

| Capital Relationship: | KCC is a wholly owned consolidated subsidiary of the Company. |

| Personal Relationship: | Two Directors and two members of Audit and Supervisory Board of KCC are delegated from the Company. Certain employees of the Company are dispatched to KCC. |

| Trade Relationship: | The Company purchases the products from KCC. The Company acts for KCC to manage certain portion of KCC’s funds. |

(2) Purpose of Mergers

KCS develops, manufactures and sells organic packages and multilayer printed wiring boards for semiconductor devices. KCC develops, manufactures and sells materials for semiconductors and chemical materials. The purpose of the restructuring is to improve efficiency by integrating these businesses of the two companies with the Company, and to enhance the development of new products and markets, and to further expand these businesses through pursuit of synergistic effects.

2

(3) Method of mergers, allocation of shares and other contents of the agreement

(A) Method of mergers

In the mergers, the Company will be a surviving company, and KCS and KCC will be dissolved.

(B) Allocation of shares related to mergers

The Company will not allocate shares and other properties for these mergers due to that KCS and KCC are wholly owned consolidated subsidiaries of the Company.

(C) Other contents of the merger agreement

a) Schedule of mergers

| | |

| Meeting of Board of Directors of KCC to approve merger agreement | January 21, 2016 |

| Meeting of Board of Directors of KCS to approve merger agreement | January 23, 2016 |

| Meeting of Board of Directors of the Company to approve merger agreements | January 29, 2016 |

| Execution of merger agreements | January 29, 2016 |

* Each of the Company, KCS and KCC will undertake these mergers without approval of a general shareholders’ meeting pursuant to Article 796, paragraph 2 of the Companies Act of Japan (simplified merger) (in the case of the Company) and Article 784, paragraph 1 of the Companies Act (short form merger) (in the case of KCS and KCC).

| | |

| Effective date of mergers | April 1, 2016 (scheduled) |

| Application for registration of mergers in the commercial register | April 1, 2016 (scheduled) |

b) Treatment of warrants and bonds with warrants in mergers

Not applicable

(4) Basis of calculation of allocation ratio related to mergers

Not applicable

(5) Status of the succeeding company after these mergers

| | |

| Trade Name | Kyocera Corporation |

| Location of Headquarter | Fushimi-ku, Kyoto |

| Name and Title of Representative | Goro Yamaguchi, President and Director |

| Capital Amount | 115,703 million yen |

| Total Shareholders’ Equity | Not yet determined |

| Total Assets | Not yet determined |

| Principal Businesses | Fine Ceramic Parts Group Semiconductor Parts Group Applied Ceramic Products Group Electronic Device Group Telecommunications Equipment Group |

[2] Absorption –type corporate split

(1) Outline of the company which will be taken over as absorption-type corporate split

(A) Status of the company undertaking corporate split

| | |

| Trade Name | Kyocera Solar Corporation |

| Location of Headquarter | Fushimi-ku, Kyoto |

| Name and Title of Representative | Masaharu Goto, President and Director |

| Capital Amount | 310 million yen (as of March 31, 2015) |

| Total Shareholders’ Equity | 14,209 million yen (as of March 31, 2015) |

| Total Assets | 86,186 million yen (as of March 31, 2015) |

| Principal Businesses | Sales of photovoltaic power generation equipment and contracting relating to photovoltaic power generation systems |

3

(B) Performances for the most recent three fiscal years ended March 31

| | | | | | | |

|

|

| (Millions of Yen) |

|

|

| Fiscal Years Ended March 31, |

| Kyocera Solar Corporation |

| 2013 |

| 2014 |

| 2015 |

| Net Sales |

| 105,926 |

| 167,828 |

| 161,662 |

| Profit from Operations |

| 4,002 |

| 9,829 |

| 4,213 |

| Recurring Income |

| 4,174 |

| 9,941 |

| 4,303 |

| Net Income |

| 2,569 |

| 6,119 |

| 2,745 |

(C) The name of principal shareholder and its shareholding ratio

Kyocera Corporation: 100%

(D) Relationship with the Company

| | |

| Capital Relationship: | KSC is a wholly owned consolidated subsidiary of the Company. |

| Personal Relationship: | Two Directors and two members of Audit and Supervisory Board of KSC are delegated from the Company. Certain employees of the Company are dispatched to KSC. |

| Trade Relationship: | The Company finances as lending for KSC’s operating capital, and KSC rents offices from the Company. KSC purchases the products from the Company. |

(2) Purpose of absorption-type corporate split

KSC engages in the sale of photovoltaic power generation equipment and contracting relating to photovoltaic power generation systems. The purpose of the restructuring is to improve efficiency by integrating the business unit engaged in the sale of photovoltaic power generation systems of KSC with the Company, and to enhance the development of new markets, and to further expand these businesses through pursuit of synergistic effects.

(3) Method of absorption-type corporate split, allocation of shares and other contents of agreement

(A) Method of absorption-type corporate split

This will be a “split-type corporate split”, in which the Company will be the succeeding company, and KSC, an existing wholly-owned subsidiary of the Company, will be the splitting company.

(B) Allocation of shares related to corporate split

Because KSC is a wholly-owned subsidiary of the Company and the method of corporate split will be a “split-type corporate split”, no allocation of new shares will be made in the corporate split.

(C) Other contents of corporate split agreement

(a) Schedule of corporate split

| | |

| Meeting of Board of Directors of KSC to approve agreement for corporate split | January 27, 2016 |

| Meeting of Board of Directors of the Company to approve agreement for corporate split | January 29, 2016 |

| Execution of agreement for corporate split | January 29, 2016 |

* Each of the Company and KSC will undertake the corporate split without approval of a general shareholders’ meeting pursuant to Article 796, paragraph 2 of the Companies Act (simplified corporate split) (in the case of the Company) and Article 784, paragraph 1 of the Companies Act (short form corporate split) (in the case of KSC).

| | |

| Effective Date of corporate split | April 1, 2016 (scheduled) |

| Application for register of corporate split in the commercial register | April 1, 2016 (scheduled) |

(b) Treatment of warrants and bonds with warrants in corporate split

Not applicable.

4

(c) Rights and Obligations to be succeeded to by succeeding company (i.e., the Company)

As of the effective date of the absorption-type corporate split, the Company will succeed to all assets and liabilities, and all rights and obligations under agreements and contracts, which belong to the divisions for sales of photovoltaic power generation equipment and management business, and technical center of KSC.

(d) Expectation of performance of obligations

a) Splitting company (i.e., KSC)

Taking into consideration the amounts of assets, liabilities and net assets of KSC, the Company judges that there is no doubt with respect to certainty of performance of obligations by KSC.

b) Succeeding company (i.e., the Company)

Taking into consideration the amounts of assets, liabilities and net assets of the Company, and also the amount of assets, liabilities and net assets to which it will succeed from KSC, the Company judges that there is no doubt with respect to certainty of performance of obligations by the Company.

(e) New directors and statutory auditors of the Company from the splitting company (i.e., KSC)

There will be no new director or statutory auditor of the Company from KSC.

(f) Outline of business to be succeeded as a result of corporate split

a) Substance of business of divisions for sales of photovoltaic power generation equipment, management business, and technical center of KSC.

Sales of photovoltaic power generation equipment and ancillary equipment, and management and after sales maintenance business incidental thereto.

b) Business results of the business unit engaged in the sale of photovoltaic power generation equipment of KSC for the fiscal year ended March 31, 2015

Sales of the business unit engaged in the sale of photovoltaic power generation equipment of KSC for the fiscal year ended March 31, 2015 were 140,781 million yen, which is equivalent to 22.2% of the Company's sales of 634,984 million yen for the same period.

(g) Assets and liabilities to be transferred and amounts thereof (as of September 30, 2015)

| | | | | | | |

|

|

|

|

|

|

| (Millions of Yen) |

| Asset |

| Liabilities |

| Item |

| Book Value |

| Item |

| Book Value |

| Current Asset |

| 27,499 |

| Current Liabilities |

| 25,095 |

| Non-Current Asset |

| 636 |

| Non-Current Liabilities |

| 23 |

| Total |

| 28,135 |

| Total |

| 25,118 |

* The amount of the succeeded assets (28,135 million yen) as of September 30, 2015 is equivalent to 1.2% of the Company's assets (2,272,957 million yen) as of the same day.

(4) Allocation of shares related to absorption-type corporate split

Not applicable

(5) Status of the succeeding company after this corporate split

| | |

| Trade Name | Kyocera Corporation |

| Location of Headquarter | Fushimi-ku, Kyoto |

| Name and Title of Representative | Goro Yamaguchi, President and Director |

| Capital Amount | 115,703 million yen (as of March 31, 2015) |

| Total Shareholders’ Equity | Not yet determined |

| Total Assets | Not yet determined |

| Principal Businesses | Fine Ceramic Parts Group Semiconductor Parts Group Applied Ceramic Products Group Electronic Device Group Telecommunications Equipment Group |

5

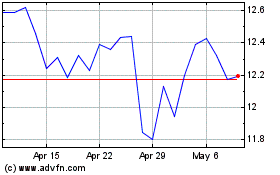

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

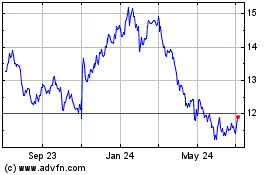

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Apr 2023 to Apr 2024