Report of Foreign Issuer (6-k)

July 17 2015 - 6:02AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For July 16, 2015

Commission File Number: 001-12033

Nymox Pharmaceutical Corporation

9900 Cavendish Blvd., St. Laurent, QC, Canada, H4M 2V2

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l): [ ]

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [ X ]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______________

Changes in Registrant’s Certifying Accountant.

(a) Dismissal of Independent Registered Public Accounting Firm

On July 15, 2015, the Board of Directors (the “Board”) of Nymox Pharmaceutical Corporation (the “Company”) approved the dismissal of KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm.

The audit reports of KPMG on the Company’s financial statements as of and for the years ended December 31, 2014 and 2013 did not contain any adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principle, except as follows:

KPMG’s report on the consolidated financial statements of the Company as of and for the years ended December 31, 2014 and 2013 contained an explanatory paragraph that states that the failure of two Phase 3 studies of NX-1207 materially affects Nymox Pharmaceutical Corporation’s current ability to fund its operations, meet its cash flow requirements, realize its assets and discharge its obligations, and casts substantial doubt about its ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of that uncertainty.

The audit reports of KPMG on the effectiveness of internal control over financial reporting as of December 31, 2014 and 2013 did not contain any adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principle, except as follows:

KPMG’s report indicates that the Company did not maintain effective internal control over financial reporting as of December 31, 2014 because of the effect of a material weakness on the achievement of the objectives of the control criteria and contains an explanatory paragraph that states that the Company did not employ a sufficient complement of finance and accounting personnel to ensure that there was a proper segregation of incompatible duties relating to certain processes, primarily impacting the expenditures/disbursements processes and information technology controls, and sufficient compensating controls did not exist in these areas.

During the years ended December 31, 2014 and 2013 and through the subsequent interim period to July 15, 2015, the date of KPMG’s dismissal, there were no: (i) disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the their satisfaction, would have caused them to make reference in connection with their opinion to the subject matter of the disagreements, or (2) reportable events, except that KPMG advised the Company of the following material weakness: the Company did not employ a sufficient complement of finance and accounting personnel to ensure that there was a proper segregation of incompatible duties relating to certain processes, primarily impacting the expenditures/disbursements processes and information technology controls, and sufficient compensating controls did not exist in these areas.

The Company has provided KPMG with a copy of the above disclosures and has requested that KPMG furnish it with a letter addressed to the Securities and Exchange Commission stating whether or not KPMG agrees with the above statements. A letter from KPMG is attached as Exhibit 99.1 to this Form 6-K.

(b) New Independent Registered Public Accounting Firm

On July 15, 2015, the Board approved the engagement of Cutler & Co., LLC (“Cutler”) to serve as the Company’s new independent registered public accounting firm. Prior to the date of Cutler’s engagement, the Company has not consulted with Cutler regarding (i) the application of accounting principles to a specific completed or contemplated transaction, (ii) the type of audit opinion that might be rendered on the Company’s financial statements and neither a written report was provided to the registrant nor oral advice was provided that the new accountant concluded was an important factor considered by the registrant in reaching a decision as to the accounting, auditing or financial reporting issue; or (iii) any matter that was either the subject of a disagreement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

NYMOX PHARMACEUTICAL CORPORATION |

|

(Registrant) |

|

|

|

|

|

By: /s/ Paul Averback, MD |

|

Paul Averback, MD |

|

President and Chief Executive Officer |

Date: July 16, 2015

Exhibit 99.1

|

|

|

|

|

|

KPMG LLP |

Telephone |

(514) 840-2100 |

|

|

600 de Maisonneuve Blvd. West |

Fax |

(514) 840-2187 |

|

|

Suite 1500 |

Internet |

www.kpmg.ca |

|

|

Tour KPMG |

|

|

|

|

Montréal, Québec H3A 0A3 |

|

|

|

July 16, 2015

Securities and Exchange Commission

Washington, D.C. 20549

Ladies and Gentlemen:

We were previously principal accountants for Nymox Pharmaceutical Corporation and, under the date of March 26, 2015, we reported on the consolidated financial statements of Nymox Pharmaceutical Corporation as of December 31, 2014 and December 31, 2013 and for the three-year period ended December 31, 2014, and the effectiveness of internal control over financial reporting as of December 31, 2014. On July 15, 2015 we were dismissed. We have read Nymox Pharmaceutical Corporation's statements included on its Form 6-K dated July 16, 2015, and we agree with such statements, except that we are not in a position to agree or disagree with Nymox Pharmaceutical Corporation’s statement that the dismissal was approved by the Board of Directors and statements in item (b).

(signed) KPMG LLP*

___

*CPA auditor, CA, public accountancy permit No. A110592

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

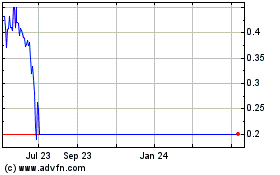

Nymox Pharmaceutical (NASDAQ:NYMX)

Historical Stock Chart

From Apr 2023 to Apr 2024