UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2015

Commission File Number: 001-34238

THE9 LIMITED

Building No. 3, 690 Bibo Road

Zhangjiang Hi-tech Park, Pudong New Area

Shanghai 201203, People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7): ¨

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

| THE9 LIMITED |

|

|

| By: |

|

/s/ Jun Zhu |

| Name: |

|

Jun Zhu |

| Title: |

|

Chairman and Chief Executive Officer |

Date: March 26, 2015

Exhibit Index

Exhibit 99.1 — Press Release

Exhibit 99.1

The9 Limited Announces Unaudited Financial Information as of and for the Six Months Ended

December 31, 2014

Shanghai, China – March 26, 2015. The9 Limited (NASDAQ: NCTY) (“The9”), an online game developer

and operator, announced its unaudited financial results for the six months ended December 31, 2014 today.

Financial Highlights:

| • |

|

Net revenues in the second half of 2014 amounted to RMB36.9 million (US$5.9 million), representing an increase of 34.4% from RMB27.4 million (US$4.4 million) in the first half of 2014 and a decrease of 37.2% from

RMB58.7 million (US$9.5 million) in the second half of 2013. |

| • |

|

In the second half of 2014, net profit attributable to holders of ordinary shares was RMB34.2 million (US$5.5 million). In the first half of 2014 and the second half of 2013, net loss attributable to holders of ordinary

shares was RMB141.9 million (US$22.9 million) and RMB244.4 million (US$39.4 million), respectively. |

Management Comments:

Jun Zhu, Chairman and Chief Executive Officer of The9, said, “Red 5 launched Firefall in July 2014 in North America and Europe. We have high expectations

for Firefall in the China market. In August 2014, Shanghai Oriental Pearl Culture Development Co. Ltd., a wholly-owned subsidiary of Shanghai Oriental Pearl (Group) Co., Ltd. (SH: 600832), closed its investment in Red 5 and became a minority

shareholder of Red 5. Also in August 2014, Qihoo 360 Technology Co., Ltd. (NASDAQ: QIHU) and we established a 50-50 joint venture System Link Corporation Limited to publish and operate Firefall in China for a five-year term. Under this license

agreement, System Link is expected to pay to us no less than an aggregate of US$160 million including license fee and royalties during the term of the agreement. All these show the great potential of Firefall in China. We are dedicating our best

resources to prepare for the launch of Firefall in China and we target to launch Firefall in China in the second half of 2015. In addition, we are also planning to launch several mobile games in 2015. In August 2014, we sold Huopu Cloud, a

subsidiary which developed and held a proprietary web game, for a total consideration of RMB200 million. This sale has proven our in-house game development capability has been recognized by the market.”

Page 1

Discussion of The9’s Unaudited 2014 Second Half Results

Net Revenues

Our net revenues in the second half of 2014

amounted to RMB36.9 million (US$5.9 million), representing an increase of 34.4% from RMB27.4 million (US$4.4 million) in the first half of 2014 and a decrease of 37.2% from RMB58.7 million (US$9.5 million) in the second half of 2013. The increase

over the first half of 2014 was mainly due to increase of revenue from Firefall in North America and Europe, and partly offset by decrease of revenue from various MMO, web and social games in China. The decrease from the second half of 2013 was

mainly due to the decrease of revenue from Planetside 2.

Gross Loss

Our gross loss in the second half of 2014 amounted to RMB7.2 million (US$1.2 million), compared with RMB14.3 million (US$2.3 million) and RMB5.2 million

(US$0.8 million) in the first half of 2014 and in the second half of 2013, respectively. The gross loss in the second half of 2014 reflected lower level of revenue generated coupled with the continued incurrence of a relatively fixed portion of our

costs, such as overhead, depreciation and rental charges.

Operating Expenses

In the second half of 2014, our operating expenses, excluding gain from disposal of subsidiaries, were RMB151.8 million (US$24.5 million), which decrease by

0.8% from RMB153.0 million (US$24.7 million) in the first half of 2014 and decrease by 39.9% from RMB252.6 million (US$40.7 million) in the second half of 2013. The decrease compared to the first half of 2014 was primarily due to the net effect of

the increase in marketing expenses in the second half relating to the launch of Firefall in the North America and Europe, and reversal of an allowance provided on a long-term receivable from a supplier recognized in the second half of 2013. The

decrease compared to the second half of 2013 was primarily due to the cost cutting on product development, marketing expenses and general and administrative expenses, and the reversal of an allowance provided on a long-term receivable from a

supplier recognized in the second half of 2013. In addition, in the first half of 2014, we also recorded a gain on disposal of subsidiaries of RMB165.4 million (US$26.7 million) in the second half of 2014 in connection with the disposal of Huopu

Cloud Computing Terminal Technology Co., Ltd., a wholly-owned subsidiary, as well as certain other subsidiary, which was recorded as a deduction to operating expense.

Page 2

Interest Income

Interest income in the second half of 2014 was RMB1.9 million (US$0.3 million), compared to RMB1.5 million (US$0.2 million) in the first half of 2014 and

RMB2.6 million (US$0.4 million) in the second half of 2013. The fluctuation of interest income was typically in line with our cash balances.

Other

Income (Expenses), Net

Other expenses in the second half of 2014 was RMB5.4 million (US$0.9 million), compared to other income of RMB3.3 million

(US$0.5 million) in the first half of 2014 and other income of RMB7.0 million (US$1.1 million) in the second half of 2013. Other expenses in the second half of 2014 mainly represented foreign exchange losses. Other income in the first half of 2014

mainly represented foreign exchange gains. Other income in the second half of 2013 mainly represented a refund of game license fee.

Net Profit (Loss)

attributable to holders of ordinary shares

In the second half of 2014, net profit attributable to holders of ordinary shares was RMB34.2 million

(US$5.5 million). In the first half of 2014 and the second half of 2013, net loss attributable to holders of ordinary shares was RMB141.9 million (US$22.9 million) and RMB244.4 million (US$39.4 million), respectively.

Basic net profit per share and per ADS in the second half of 2014 was RMB1.48 (US$0.25), compared to basic net loss per share of RMB6.13 (US$0.99) in the

first half of 2014 and basic net loss per share of RMB10.64 (US$1.71) in the second half of 2013.

Currency Convenience Translation

The translation of Renminbi (RMB) into US dollars (US$) in this press release are presented solely for the convenience of the readers at the noon buying rate

in the City of New York for cable transfers in Renminbi per U.S. dollar as certified for customs purposes by the H.10 weekly statistical release of the Federal Reserve Board as of December 31, 2014, which was RMB 6.2046 to US$1.00. Such

translations should not be construed as representations that the RMB amounts represents, or have been or could be converted into, US$ at that or any other rate. The percentages stated in this press release are calculated based on the RMB amounts.

About The9 Limited

The9 Limited is an online game

developer and operator in China. The9 develops and operates, directly or through its affiliates, its proprietary MMO, web and mobile games including Firefall, TianTianWanDiaoChan and Dao Feng. In 2010, The9 established its wireless business unit to

focus on mobile internet business. In 2013, The9 formed a joint venture with Shanghai ZTE to develop and operate home entertainment set top box business.

Page 3

Safe Harbor Statement

This announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates” and similar statements. Among other things, the business outlook and quotations from management in this press release contain forward-looking statements. The9 may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and Exchange Commission on Forms 20-F and 6-K, etc., in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors

or employees to third parties. Statements that are not historical facts, including statements about The9’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number

of important factors could cause actual results to differ materially from those contained in any forward-looking statement. Potential risks and uncertainties include, but are not limited to, political and economic policies of the Chinese government,

the laws and regulations governing the online game industry, information disseminated over the Internet and Internet content providers in China, intensified government regulation of Internet cafes, The9’s ability to retain existing players and

attract new players, license, develop or acquire additional online games that are appealing to users, anticipate and adapt to changing consumer preferences and respond to competitive market conditions, and other risks and uncertainties outlined in

The9’s filings with the U.S. Securities and Exchange Commission, including its annual reports on Form 20-F. The9 does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For further information, please contact:

Ms. Phyllis Sai

Manager, Investor Relations

The9 Limited

Tel: +86 (21) 5172-9990

Email: IR@corp.the9.com

Website: http://www.corp.the9.com/

– Tables follow –

Page 4

THE9 LIMITED

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME INFORMATION

(Expressed in Renminbi - RMB and US Dollars - US$, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six month

ended Jun 30 |

|

|

Six month

ended December 31 |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

| |

|

RMB

(unaudited) |

|

|

RMB

(unaudited) |

|

|

RMB

(unaudited) |

|

|

US$

(Note) |

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Online game services |

|

|

22,199,785 |

|

|

|

52,415,966 |

|

|

|

33,217,915 |

|

|

|

5,353,756 |

|

| Other revenues |

|

|

5,547,325 |

|

|

|

7,069,176 |

|

|

|

3,874,540 |

|

|

|

624,462 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27,747,110 |

|

|

|

59,485,142 |

|

|

|

37,092,455 |

|

|

|

5,978,218 |

|

|

|

|

|

|

| Sales Taxes |

|

|

(326,865 |

) |

|

|

(774,716 |

) |

|

|

(235,809 |

) |

|

|

(38,005 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Revenues |

|

|

27,420,245 |

|

|

|

58,710,426 |

|

|

|

36,856,646 |

|

|

|

5,940,213 |

|

|

|

|

|

|

| Cost of revenue |

|

|

(41,706,220 |

) |

|

|

(63,913,645 |

) |

|

|

(44,076,349 |

) |

|

|

(7,103,818 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross loss |

|

|

(14,285,975 |

) |

|

|

(5,203,219 |

) |

|

|

(7,219,703 |

) |

|

|

(1,163,605 |

) |

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product development |

|

|

(79,550,315 |

) |

|

|

(100,558,324 |

) |

|

|

(76,702,721 |

) |

|

|

(12,362,235 |

) |

| Sales and marketing |

|

|

(18,270,728 |

) |

|

|

(49,663,417 |

) |

|

|

(33,487,372 |

) |

|

|

(5,397,185 |

) |

| General and administrative |

|

|

(51,629,447 |

) |

|

|

(66,923,309 |

) |

|

|

(59,527,803 |

) |

|

|

(9,594,139 |

) |

| Impairment on equipment, intangible assets, other assets and allowance(reversal of allowance) of long-term receivable |

|

|

(3,555,845 |

) |

|

|

(35,466,122 |

) |

|

|

17,927,763 |

|

|

|

2,889,431 |

|

| Gain on disposal of subsidiaries |

|

|

0 |

|

|

|

0 |

|

|

|

165,392,382 |

|

|

|

26,656,413 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

(153,006,335 |

) |

|

|

(252,611,172 |

) |

|

|

13,602,249 |

|

|

|

2,192,285 |

|

| Other operating Income |

|

|

50,000 |

|

|

|

55,372 |

|

|

|

25,000 |

|

|

|

4,029 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from operations |

|

|

(167,242,310 |

) |

|

|

(257,759,019 |

) |

|

|

6,407,546 |

|

|

|

1,032,709 |

|

| Investment income from cost method investment |

|

|

0 |

|

|

|

0 |

|

|

|

1,142,353 |

|

|

|

184,114 |

|

| Interest income, net |

|

|

1,482,111 |

|

|

|

2,605,392 |

|

|

|

1,932,448 |

|

|

|

311,454 |

|

| Other income(expense), net |

|

|

3,276,714 |

|

|

|

6,985,096 |

|

|

|

(5,382,192 |

) |

|

|

(867,452 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (Loss) before income tax expense, gain on investment disposal, impairment loss on investments and share of loss in equity

investments |

|

|

(162,483,485 |

) |

|

|

(248,168,531 |

) |

|

|

4,100,155 |

|

|

|

660,825 |

|

| Income tax expense |

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (Loss) before gain on investment disposal, impairment loss on investments and share of loss in equity investments |

|

|

(162,483,485 |

) |

|

|

(248,168,531 |

) |

|

|

4,100,155 |

|

|

|

660,825 |

|

| Gain on disposal of equity investee and available-for-sale investment |

|

|

9,403,451 |

|

|

|

0 |

|

|

|

23,750,001 |

|

|

|

3,827,805 |

|

| Impairment loss on investments |

|

|

0 |

|

|

|

(15,181,566 |

) |

|

|

0 |

|

|

|

0 |

|

| Share of loss in equity investments |

|

|

(879,476 |

) |

|

|

(411,547 |

) |

|

|

(2,833,054 |

) |

|

|

(456,606 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit (loss) |

|

|

(153,959,510 |

) |

|

|

(263,761,644 |

) |

|

|

25,017,102 |

|

|

|

4,032,024 |

|

|

|

|

|

|

| Net loss attributable to noncontrolling interest |

|

|

(12,046,743 |

) |

|

|

(19,401,046 |

) |

|

|

(9,396,578 |

) |

|

|

(1,514,454 |

) |

| Net loss attributable to redeemable noncontrolling interest |

|

|

0 |

|

|

|

0 |

|

|

|

(20,876,617 |

) |

|

|

(3,364,700 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit (loss) attributable to The9 Limited |

|

|

(141,912,767 |

) |

|

|

(244,360,598 |

) |

|

|

55,290,297 |

|

|

|

8,911,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accretion on redeemable noncontrollling interest |

|

|

0 |

|

|

|

0 |

|

|

|

21,076,744 |

|

|

|

3,396,955 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit (loss) attributable to holders of ordinary shares |

|

|

(141,912,767 |

) |

|

|

(244,360,598 |

) |

|

|

34,213,553 |

|

|

|

5,514,223 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit (loss) attributable to holders of ordinary shares per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Basic |

|

|

(6.13 |

) |

|

|

(10.64 |

) |

|

|

1.48 |

|

|

|

0.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Basic |

|

|

23,146,859 |

|

|

|

22,968,487 |

|

|

|

23,182,241 |

|

|

|

23,182,241 |

|

Page 5

THE9 LIMITED

CONSOLIDATED BALANCE SHEETS INFORMATION

(Expressed in

Renminbi - RMB and US Dollars - US$)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

As of December 31, 2013 |

|

|

As of December 31, 2014 |

|

| |

|

RMB |

|

|

RMB |

|

|

US$ |

|

| |

|

(audited) |

|

|

(unaudited) |

|

|

(unaudited) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

156,987,201 |

|

|

|

181,482,300 |

|

|

|

29,249,638 |

|

| Accounts receivable |

|

|

19,138,096 |

|

|

|

11,804,750 |

|

|

|

1,902,581 |

|

| Advances to suppliers, net |

|

|

4,525,549 |

|

|

|

733,339 |

|

|

|

118,193 |

|

| Prepayments and other current assets, net |

|

|

32,464,598 |

|

|

|

56,573,321 |

|

|

|

9,117,964 |

|

| Prepaid royalties |

|

|

4,878,579 |

|

|

|

0 |

|

|

|

0 |

|

| Deferred costs |

|

|

68,217 |

|

|

|

9,745 |

|

|

|

1,571 |

|

| Amounts due from a related party |

|

|

0 |

|

|

|

5,250,000 |

|

|

|

846,146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

218,062,240 |

|

|

|

255,853,455 |

|

|

|

41,236,093 |

|

| Restricted cash |

|

|

700,000 |

|

|

|

0 |

|

|

|

0 |

|

| Investments in equity investees |

|

|

50,848,141 |

|

|

|

39,223,925 |

|

|

|

6,321,749 |

|

| Property, equipment and software, net |

|

|

50,439,400 |

|

|

|

36,346,230 |

|

|

|

5,857,949 |

|

| Goodwill |

|

|

9,710,854 |

|

|

|

9,746,054 |

|

|

|

1,570,779 |

|

| Intangible assets, net |

|

|

128,643,824 |

|

|

|

97,539,341 |

|

|

|

15,720,488 |

|

| Land use right, net |

|

|

72,194,206 |

|

|

|

70,273,296 |

|

|

|

11,325,999 |

|

| Other long-term assets, net |

|

|

16,080,483 |

|

|

|

8,348,409 |

|

|

|

1,345,519 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

|

546,679,148 |

|

|

|

517,330,710 |

|

|

|

83,378,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

69,376,348 |

|

|

|

40,213,660 |

|

|

|

6,481,266 |

|

| Other taxes payable |

|

|

1,238,852 |

|

|

|

932,431 |

|

|

|

150,281 |

|

| Advances from customers |

|

|

18,896,049 |

|

|

|

16,833,165 |

|

|

|

2,713,014 |

|

| Amounts due to related parties |

|

|

4,799,753 |

|

|

|

6,304,956 |

|

|

|

1,016,174 |

|

| Deferred revenue |

|

|

20,113,256 |

|

|

|

20,434,962 |

|

|

|

3,293,518 |

|

| Refund of game points |

|

|

169,998,682 |

|

|

|

169,998,682 |

|

|

|

27,398,814 |

|

| Other payables and accruals |

|

|

45,669,488 |

|

|

|

41,872,851 |

|

|

|

6,748,679 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

330,092,428 |

|

|

|

296,590,707 |

|

|

|

47,801,746 |

|

| Long-term accounts payable |

|

|

21,110,517 |

|

|

|

18,992,201 |

|

|

|

3,060,987 |

|

| Deferred tax liabilities, non-current |

|

|

5,343,060 |

|

|

|

5,362,427 |

|

|

|

864,266 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

356,546,005 |

|

|

|

320,945,335 |

|

|

|

51,726,999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Redeemable Noncontrolling Interest |

|

|

0 |

|

|

|

131,497,104 |

|

|

|

21,193,486 |

|

| Ordinary shares (US$0.01 par value; 23,146,859 and 23,201,601 shares issued and outstanding as of December 31, 2013 and

December 31, 2014, respectively) |

|

|

1,881,784 |

|

|

|

1,885,153 |

|

|

|

303,832 |

|

| Additional paid-in capital |

|

|

2,152,320,786 |

|

|

|

2,075,900,461 |

|

|

|

334,574,422 |

|

| Statutory reserves |

|

|

28,071,982 |

|

|

|

28,071,982 |

|

|

|

4,524,382 |

|

| Accumulated other comprehensive loss |

|

|

(8,987,041 |

) |

|

|

(8,638,604 |

) |

|

|

(1,392,290 |

) |

| Accumulated deficit |

|

|

(1,912,569,874 |

) |

|

|

(1,999,192,344 |

) |

|

|

(322,211,318 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| The9 Limited shareholders’ equity |

|

|

260,717,637 |

|

|

|

98,026,648 |

|

|

|

15,799,028 |

|

| Noncontrolling interests |

|

|

(70,584,494 |

) |

|

|

(33,138,377 |

) |

|

|

(5,340,937 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

190,133,143 |

|

|

|

64,888,271 |

|

|

|

10,458,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities, redeemable noncontrolling interest and equity |

|

|

546,679,148 |

|

|

|

517,330,710 |

|

|

|

83,378,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 6

Note: The United States dollar (“US dollar” or “US$”) amounts disclosed in the accompanying

financial statements are presented solely for the convenience of the readers at the rate of US$1.00 =RMB6.2046, representing the noon buying rate in the City of New York for cable transfers of RMB, as certified for customs purposes by the Federal

Reserve Bank of New York, on December 31, 2014.

Page 7

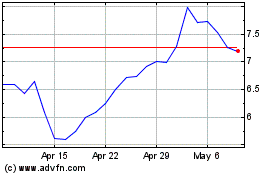

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

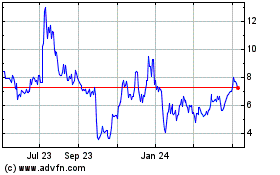

The9 (NASDAQ:NCTY)

Historical Stock Chart

From Apr 2023 to Apr 2024