SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of February 2015

FRESENIUS MEDICAL CARE AG & Co. KGaA

(Translation of registrant’s name into English)

Else-Kröner Strasse 1

61346 Bad Homburg

Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82

On February 25, 2015 Fresenius Medical Care AG & Co. KGaA (the “Company”) issued an Investor News announcing its fourth quarter and twelve months earnings results for 2014. A copy of the Investor News is furnished as Exhibit 99.1.

The attached Investor News contains non-GAAP financial measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles. To supplement our fourth quarter and fiscal year 2014 consolidated financial results presented in accordance with Generally Accepted Accounting Principles in the United States, or GAAP, we have used non-GAAP financial measure of (a) EBITDA, or operating income excluding interest, taxes, depreciation and amortization, and (b) free cash flow. These non-GAAP measures are provided to enhance the user’s overall understanding of our current financial performance and our prospects for the future. In addition, because we have historically reported certain non-GAAP financial measures in our financial results, we believe the inclusion of these non-GAAP financial measures provides consistency and comparability in our financial reporting to prior periods for which these non-GAAP financial measures were previously reported. These non-GAAP financial measures should not be used as a substitute for or be considered superior to GAAP financial measures. Reconciliation of the non-GAAP financial measures to the most comparable GAAP financial measures are included in the attached Investor News in a separate statement setting forth the reconciliation and in the Cash Flow Statement.

The Exhibit attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

DATE: February 25, 2015

|

|

FRESENIUS MEDICAL CARE AG & Co. KGaA, |

|

|

a partnership limited by shares, represented by: |

|

|

|

|

|

FRESENIUS MEDICAL CARE MANAGEMENT AG, its |

|

|

general partner |

|

|

|

|

|

|

|

|

By: |

/s/ RICE POWELL |

|

|

|

Name: |

Rice Powell |

|

|

|

Title: |

Chief Executive Officer and |

|

|

|

|

Chairman of the Management Board |

|

|

|

|

of the General Partner |

|

|

|

|

|

|

|

|

|

By: |

/s/ MICHAEL BROSNAN |

|

|

|

Name: |

Michael Brosnan |

|

|

|

Title: |

Chief Financial Officer and member |

|

|

|

|

of the Management Board of the |

|

|

|

|

General Partner |

|

|

|

|

|

|

|

|

3

Exhibit 99.1

February 25, 2015

INVESTOR

NEWS

Fresenius Medical Care reports

fourth quarter and full year 2014 results

· Targets achieved for fiscal year 2014

· Further expansion of our operations and new record level of revenue

· Increased dividend to be proposed at the Annual General Meeting

· Accelerated earnings growth expected

Fourth quarter 2014 key figures:

|

Net revenue |

|

$ |

4,320 million |

|

+12 |

% |

|

Operating income (EBIT) |

|

$ |

663 million |

|

0 |

% |

|

Net income1 |

|

$ |

335 million |

|

-4 |

% |

|

Basic earnings per share |

|

$ |

1.11 |

|

-5 |

% |

Full year 2014 key figures:

|

Net revenue |

|

$ |

15,832 million |

|

+8 |

% |

|

Operating income (EBIT) |

|

$ |

2,255 million |

|

0 |

% |

|

Net income1 |

|

$ |

1,045 million |

|

-6 |

% |

|

Basic earnings per share |

|

$ |

3.46 |

|

-5 |

% |

Dividend proposal:

Rice Powell, chief executive officer of Fresenius Medical Care stated: “During fiscal year 2014, we continuously improved our results and delivered on revenue and net income guidance. We have strengthened our core business and also expanded our portfolio with acquisitions in the field of Care Coordination. After revenue of approximately 500 million US$ in 2013 we now expect our Care Coordination business to generate around 1.7 billion of revenue in 2015. We expect accelerated earnings growth for 2015 and beyond supported mainly by a strong organic business, our acquisitions and the Global Efficiency Program”.

1 attributable to shareholders of Fresenius Medical Care AG & Co. KGaA

2

Fourth quarter 2014

Revenue

Net revenue for the fourth quarter of 2014 increased by 12% to $4,320 million (+15% at constant currency) as compared to the fourth quarter of 2013. Organic revenue growth worldwide was 7%. Health Care revenue grew by 15% to $3,322 million (+18% at constant currency) and dialysis product revenue increased by 3% to $998 million (+8% at constant currency) as compared to the fourth quarter of 2013.

North America revenue for the fourth quarter of 2014 increased by 15% to $2,876 million. Organic revenue growth was 6%. Health Care revenue grew by 15% to $2,640 million with a same market treatment growth of 4%. Net Dialysis Care revenue increased by 5% to $2,245 million. Care Coordination revenue increased by 151% to $395 million. Dialysis product revenue increased by 8% to 236 million compared to the fourth quarter of 2013.

International revenue increased by 5% to $1,422 million (+15% at constant currency). Organic revenue growth was 7%. Health Care revenue increased by 12% to $682 million (+26% at constant currency). Dialysis product revenue decreased by 1% to $740 million (+6% at constant currency).

Earnings

Operating income (EBIT) increased from $661 million in the fourth quarter of 2013 to $663 million in the fourth quarter of 2014. Operating income for North America for the fourth quarter of 2014 was $493 million, an increase of 9% as compared to the fourth quarter of 2013. In the International segment, operating income for the fourth quarter of 2014 increased by 2% to $278 million as compared to $274 million in the fourth quarter of 2013.

Net interest expense for the fourth quarter of 2014 was $117 million, compared to $98 million in the fourth quarter of 2013.

Income tax expense was $143 million for the fourth quarter of 2014, which translates into an effective tax rate of 26.2%. This compares to income tax expense of $171 million and a tax rate of 30.4% for the fourth quarter of 2013. The tax rate was affected favorably by the resolution of challenged deductions for civil settlement payments taken in prior years.

3

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA for the fourth quarter of 2014 was $335 million, a decrease of 4% compared to $349 million for the fourth quarter of 2013.

Basic earnings per share (EPS) for the fourth quarter of 2014 was $1.11, a decrease of 5% compared to the corresponding number for the fourth quarter of 2013. The weighted average number of shares outstanding for the fourth quarter of 2014 was approximately 303.3 million shares, compared to approximately 301.0 million shares for the fourth quarter of 2013. The increase in shares outstanding resulted from stock option exercises during 2014.

Cash flow

In the fourth quarter of 2014, the company generated $588 million in net cash provided by operating activities, representing 14% of revenue, almost unchanged compared to the corresponding figure of last year ($ 589 million).

A total of $282 million was spent for capital expenditures, net of disposals. Free cash flow was $306 million compared to $355 million in the fourth quarter of 2013.

A total of $725 million in cash was spent for acquisitions and investments, net of divestitures. Free cash flow after investing activities was a negative $419 million as compared to $157 million in the fourth quarter of 2013.

Full year 2014

Revenue and earnings

Net revenue for the full year 2014 increased by 8% to $15,832 million (+10% at constant currency) as compared to the full year 2013. Organic revenue growth worldwide was 5%.

Operating income (EBIT) for the full year 2014 was $2,255 million as compared to $2,256 million in the full year 2013.

4

Net interest expense for the full year 2014 was $411 million as compared to $409 million in the full year 2013.

Income tax expense for the full year 2014 was $584 million, which translates into an effective tax rate of 31.7%. This compares to income tax expense of $592 million and a tax rate of 32.0% for the full year 2013. In 2014, the tax rate was influenced by different tax effects partially offsetting each other. In the second quarter the tax rate increased by a reversal of an original tax benefit following a financial court ruling issued against another company, while in the fourth quarter the tax rate was favorably influenced by the resolution of challenged deductions for civil settlement payments taken in prior years.

For the full year 2014, net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA was $1,045 million, down by 6% from the corresponding number of $1,110 million for the full year 2013.

In the full year 2014, basic earnings per share (EPS) was $3.46, a decrease of 5% compared to the corresponding number for the full year 2013. The weighted average number of shares outstanding during the full year 2014 was approximately 302.3 million shares.

Cash flow

In the full year 2014, the company generated $1,861 million in net cash provided by operating activities, representing 12% of revenue, as compared to $2,035 million for the same period in 2013.

A total of $920 million was spent for capital expenditures, net of disposals. Free cash flow for the full year 2014 was $941 million as compared to $1,307 million in the full year 2013.

A total of $1,770 million in cash was spent for acquisitions and investments, net of divestitures. Free cash flow after investing activities was a negative $829 million as compared to a positive $829 million in the full year 2013.

Employees

As of December 31, 2014, Fresenius Medical Care had 99,895 employees (full-time equivalents) worldwide, compared to 90,690 employees at the end of December 2013. This increase of more than 9,200 employees was mainly attributable to acquisitions as well as to our continued organic growth.

5

Balance sheet structure

The company´s total assets were $25,447 million (Dec. 31, 2013: $23,120 million), an increase of 10%. Current assets increased by 7% to $6,725 million (Dec. 31, 2013: $6,287 million). Non-current assets were $18,722 million (Dec. 31, 2013: $16,833 million), an increase of 11%. Total equity increased by 6% to $10,028 million (Dec. 31, 2013: $9,485 million). The equity ratio was 39% as compared to 41% at the end of 2013. Total debt was $9,532 million (Dec. 31, 2013: $8,417 million). As of December 31, 2014, the debt/EBITDA ratio was 3.1 (Dec. 31, 2013: 2.8).

Please refer to the attachments for a complete overview of the results for the fourth quarter and full year 2014 and the reconciliation of non-GAAP financial measures included in this release to the most comparable GAAP financial measures.

Dividend

At the annual general meeting to be held on May 19, 2015, shareholders will be asked to approve a dividend of €0.78 per share, an increase of 1% from 2013 (€0.77). For the 18th consecutive year, shareholders can expect to receive an increased annual dividend.

Outlook

The information provided is based on exchange rates prevailing at the beginning of 2015. Savings from the global efficiency program are included, while potential acquisitions are not. In addition the outlook reflects further operating cost investments within the Care Coordination segment for future growth in line with our 2020 strategy.

For 2015 the company expects revenue to grow at 5—7% which at constant currency is a growth rate of 10-12%.

Net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA is expected to increase 0—5% in 2015.

6

The company expects to spend around $1.0 billion on capital expenditures and around $400 million on acquisitions in 2015. The debt/EBITDA ratio is expected to be around 3.0 by the end of 2015.

For the year 2016 we expect an acceleration of growth with a revenue increase of 9—12% and net income attributable to shareholders of Fresenius Medical Care AG & Co. KGaA growing by 15—20%.

As disclosed in the company’s long-term target for 2020 the company expects revenue to grow at an average annual growth rate of approx. 10% and net income attributable to shareholders in the high single digits.

Conference call

Fresenius Medical Care will hold a conference call to discuss the results of the fourth quarter 2014 on Wednesday, February 25, 2015 at 3.30 p.m. CET/ 9.30 a.m. EST. The company invites investors to follow the live webcast of the call at the company’s website www.freseniusmedicalcare.com in the “Investor Relations” section. A replay will be available shortly after the call.

Fresenius Medical Care is the world’s largest integrated provider of products and services for individuals undergoing dialysis because of chronic kidney failure, a condition that affects more than 2.7 million individuals worldwide. Through its network of 3,361 dialysis clinics in North America, Europe, Latin America, Asia-Pacific and Africa, Fresenius Medical Care provides dialysis treatments for 286,312 patients around the globe. Fresenius Medical Care is also the world’s leading provider of dialysis products such as hemodialysis machines, dialyzers and related disposable products.

For more information about Fresenius Medical Care, visit the company’s website at www.freseniusmedicalcare.com.

Disclaimer

This release contains forward-looking statements that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking statements due to certain factors, including changes in business, economic and competitive conditions, regulatory reforms, foreign exchange rate fluctuations, uncertainties in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in Fresenius Medical Care AG & Co. KGaA’s reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care AG & Co. KGaA does not undertake any responsibility to update the forward-looking statements in this release.

7

Statement of earnings

|

|

|

Three months ended

December 31 |

|

Twelve months ended

December 31 |

|

|

in US$ million, except share data, audited |

|

2014 |

|

2013 |

|

Change |

|

2014 |

|

2013 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care revenue |

|

3,417 |

|

2,975 |

|

14.9 |

% |

12,553 |

|

11,415 |

|

10.0 |

% |

|

Less: patient service bad debt provision |

|

95 |

|

80 |

|

19.3 |

% |

303 |

|

285 |

|

6.3 |

% |

|

Net Health Care revenue |

|

3,322 |

|

2,895 |

|

14.7 |

% |

12,250 |

|

11,130 |

|

10.1 |

% |

|

Dialysis products revenue |

|

998 |

|

972 |

|

2.7 |

% |

3,582 |

|

3,480 |

|

2.9 |

% |

|

Total net revenue |

|

4,320 |

|

3,867 |

|

11.7 |

% |

15,832 |

|

14,610 |

|

8.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of revenue |

|

2,906 |

|

2,566 |

|

13.3 |

% |

10,836 |

|

9,872 |

|

9.8 |

% |

|

Gross profit |

|

1,414 |

|

1,301 |

|

8.7 |

% |

4,996 |

|

4,738 |

|

5.4 |

% |

|

Selling, general and administrative |

|

724 |

|

621 |

|

16.7 |

% |

2,645 |

|

2,391 |

|

10.6 |

% |

|

(Gain) loss on sale of dialysis clinics |

|

(1 |

) |

(0 |

) |

4593.6 |

% |

(1 |

) |

(9 |

) |

-93.4 |

% |

|

Research and development |

|

31 |

|

31 |

|

-0.5 |

% |

122 |

|

126 |

|

-2.9 |

% |

|

Income from equity method investees |

|

(3 |

) |

(12 |

) |

-75.0 |

% |

(25 |

) |

(26 |

) |

-4.9 |

% |

|

Operating income (EBIT) |

|

663 |

|

661 |

|

0.3 |

% |

2,255 |

|

2,256 |

|

-0.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

(45 |

) |

(13 |

) |

241.9 |

% |

(84 |

) |

(39 |

) |

116.3 |

% |

|

Interest expense |

|

162 |

|

111 |

|

45.6 |

% |

495 |

|

448 |

|

10.7 |

% |

|

Interest expense, net |

|

117 |

|

98 |

|

19.6 |

% |

411 |

|

409 |

|

0.6 |

% |

|

Income before taxes |

|

546 |

|

563 |

|

-3.1 |

% |

1,844 |

|

1,847 |

|

-0.2 |

% |

|

Income tax expense |

|

143 |

|

171 |

|

-16.3 |

% |

584 |

|

592 |

|

-1.4 |

% |

|

Net income |

|

403 |

|

392 |

|

2.7 |

% |

1,260 |

|

1,255 |

|

0.3 |

% |

|

Less: Net income attributable to noncontrolling interests |

|

68 |

|

43 |

|

56.0 |

% |

215 |

|

145 |

|

47.2 |

% |

|

Net income attributable to shareholders of FMC AG & Co. KGaA |

|

335 |

|

349 |

|

-3.9 |

% |

1,045 |

|

1,110 |

|

-5.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (EBIT) |

|

663 |

|

661 |

|

0.3 |

% |

2,255 |

|

2,256 |

|

-0.1 |

% |

|

Depreciation and amortization |

|

186 |

|

169 |

|

10.1 |

% |

699 |

|

648 |

|

7.9 |

% |

|

EBITDA |

|

849 |

|

830 |

|

2.3 |

% |

2,954 |

|

2,904 |

|

1.7 |

% |

|

EBITDA margin |

|

19.7 |

% |

21.5 |

% |

|

|

18.7 |

% |

19.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares |

|

303,347,550 |

|

301,041,739 |

|

|

|

302,339,124 |

|

301,877,303 |

|

|

|

|

Preference shares |

|

— |

|

— |

|

|

|

— |

|

1,937,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

1.11 |

|

$ |

1.16 |

|

-4.6 |

% |

$ |

3.46 |

|

$ |

3.65 |

|

-5.4 |

% |

|

Basic earnings per ADS |

|

$ |

0.55 |

|

$ |

0.58 |

|

-4.6 |

% |

$ |

1.73 |

|

$ |

1.83 |

|

-5.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In percent of revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

67.3 |

% |

66.3 |

% |

|

|

68.4 |

% |

67.6 |

% |

|

|

|

Gross profit |

|

32.7 |

% |

33.7 |

% |

|

|

31.6 |

% |

32.4 |

% |

|

|

|

Operating income (EBIT) |

|

15.4 |

% |

17.1 |

% |

|

|

14.2 |

% |

15.4 |

% |

|

|

|

Net income attributable to shareholders of FMC AG & Co. KGaA |

|

7.8 |

% |

9.0 |

% |

|

|

6.6 |

% |

7.6 |

% |

|

|

8

Segment and other information

|

|

|

Three months ended

December 31 |

|

Twelve months ended

December 31 |

|

|

audited |

|

2014 |

|

2013 |

|

Change |

|

2014 |

|

2013 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

4,320 |

|

3,867 |

|

11.7 |

% |

15,832 |

|

14,610 |

|

8.4 |

% |

|

Operating income (EBIT) in US$ million |

|

663 |

|

661 |

|

0.3 |

% |

2,255 |

|

2,256 |

|

-0.1 |

% |

|

Operating income margin in % |

|

15.4 |

% |

17.1 |

% |

|

|

14.2 |

% |

15.4 |

% |

|

|

|

Days sales outstanding (DSO) |

|

|

|

|

|

|

|

72 |

|

73 |

|

|

|

|

Employees (full-time equivalents) |

|

|

|

|

|

|

|

99,895 |

|

90,690 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

2,876 |

|

2,507 |

|

14.7 |

% |

10,500 |

|

9,606 |

|

9.3 |

% |

|

Operating income (EBIT) in US$ million 1) |

|

493 |

|

453 |

|

9.0 |

% |

1,643 |

|

1,623 |

|

1.2 |

% |

|

Operating income margin in % 1) |

|

17.2 |

% |

18.1 |

% |

|

|

15.6 |

% |

16.9 |

% |

|

|

|

Revenue per treatment in US$ |

|

367 |

|

357 |

|

2.8 |

% |

360 |

|

352 |

|

2.5 |

% |

|

Cost per treatment in US$ |

|

297 |

|

288 |

|

3.1 |

% |

297 |

|

287 |

|

3.5 |

% |

|

Days sales outstanding (DSO) |

|

|

|

|

|

|

|

50 |

|

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue per treatment in US$ |

|

375 |

|

365 |

|

2.8 |

% |

368 |

|

359 |

|

2.5 |

% |

|

Cost per treatment in US$ |

|

303 |

|

294 |

|

3.1 |

% |

303 |

|

293 |

|

3.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

1,422 |

|

1,351 |

|

5.2 |

% |

5,265 |

|

4,970 |

|

5.9 |

% |

|

Operating income (EBIT) in US$ million 1) |

|

278 |

|

274 |

|

1.8 |

% |

970 |

|

897 |

|

8.2 |

% |

|

Operating income margin in % 1) |

|

19.6 |

% |

20.2 |

% |

|

|

18.4 |

% |

18.1 |

% |

|

|

|

Revenue per treatment in US$ |

|

157 |

|

160 |

|

-1.5 |

% |

161 |

|

159 |

|

1.0 |

% |

|

Growth at constant currency |

|

11.0 |

% |

3.2 |

% |

|

|

8.4 |

% |

2.5 |

% |

|

|

|

Days sales outstanding (DSO) |

|

|

|

|

|

|

|

114 |

|

110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue in US$ million |

|

22 |

|

9 |

|

163.9 |

% |

67 |

|

34 |

|

99.7 |

% |

|

Operating income (EBIT) in US$ million 1) |

|

(108 |

) |

(66 |

) |

66.7 |

% |

(358 |

) |

(264 |

) |

35.9 |

% |

1) Certain items, in the net aggregate amount of $20 million and $38 million for the three- and twelve-month periods ending December 31, 2013, respectively, relating to research and development, compensation expense and income from equity method investees have been reclassified between the North America Segment, the International Segment and Corporate, as applicable, to conform to the current year’s presentation.

9

Reconciliation of non U.S. GAAP financial measures

to the most directly comparable U.S. GAAP financial measures

|

|

|

Three months ended

December 31 |

|

Twelve months ended

December 31 |

|

|

in US$ million, audited |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Segment information North America (1) |

|

|

|

|

|

|

|

|

|

|

Net revenue |

|

2,876 |

|

2,507 |

|

|

|

|

|

|

Costs of revenue and research and development |

|

1,973 |

|

1,707 |

|

|

|

|

|

|

Selling, general and administrative |

|

413 |

|

354 |

|

|

|

|

|

|

Gain on sale of dialysis clinics |

|

(1 |

) |

(0 |

) |

|

|

|

|

|

Income from equity method investees |

|

(2 |

) |

(7 |

) |

|

|

|

|

|

Costs of revenue and operating expenses |

|

2,383 |

|

2,054 |

|

|

|

|

|

|

Operating income (EBIT) |

|

493 |

|

453 |

|

|

|

|

|

|

Operating income margin |

|

17.2 |

% |

18.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of net cash provided by operating activities to EBITDA (2) |

|

|

|

|

|

|

|

|

|

|

Total EBITDA |

|

|

|

|

|

2,954 |

|

2,904 |

|

|

Interest expense, net |

|

|

|

|

|

(411 |

) |

(409 |

) |

|

Income tax expense |

|

|

|

|

|

(584 |

) |

(592 |

) |

|

Change in working capital and other non-cash items |

|

|

|

|

|

(98 |

) |

132 |

|

|

Net cash provided by operating activities |

|

|

|

|

|

1,861 |

|

2,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized EBITDA (3) |

|

|

|

|

|

|

|

|

|

|

Operating income (EBIT) |

|

|

|

|

|

2,347 |

|

2,256 |

|

|

Depreciation and amortization |

|

|

|

|

|

716 |

|

648 |

|

|

Non-cash charges |

|

|

|

|

|

57 |

|

68 |

|

|

Annualized EBITDA |

|

|

|

|

|

3,120 |

|

2,972 |

|

(1) In 2013, certain items relating to research and development, compensation expense and income from equity method investees have been reclassified between the North America Segment, the International Segment and Corporate, as applicable, to conform to the current year’s presentation.

2) EBITDA is the basis for determining compliance with certain covenants in Fresenius Medical Care’s long-term debt instruments.

3) EBITDA 2014: including largest acquisitions

10

Balance sheet

|

|

|

December 31 |

|

December 31 |

|

|

in US$ million, except debt/EBITDA ratio |

|

2014 |

|

2013 |

|

|

|

|

(audited) |

|

(audited) |

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

6,725 |

|

6,287 |

|

|

Goodwill and Intangible assets |

|

13,951 |

|

12,416 |

|

|

Other non-current assets |

|

4,771 |

|

4,417 |

|

|

Total assets |

|

25,447 |

|

23,120 |

|

|

|

|

|

|

|

|

|

Liabilities and equity |

|

|

|

|

|

|

Current liabilities |

|

3,477 |

|

3,554 |

|

|

Long-term liabilities |

|

11,117 |

|

9,433 |

|

|

Noncontrolling interests subject to put provisions |

|

825 |

|

648 |

|

|

Total equity |

|

10,028 |

|

9,485 |

|

|

Total liabilities and equity |

|

25,447 |

|

23,120 |

|

|

|

|

|

|

|

|

|

Equity/assets ratio |

|

39 |

% |

41 |

% |

|

|

|

|

|

|

|

|

Debt |

|

|

|

|

|

|

Short-term borrowings |

|

133 |

|

97 |

|

|

Short-term borrowings from related parties |

|

5 |

|

62 |

|

|

Current portion of long-term debt and capital lease obligations |

|

314 |

|

511 |

|

|

Long-term debt and capital lease obligations, less current portion |

|

9,080 |

|

7,747 |

|

|

Total debt |

|

9,532 |

|

8,417 |

|

|

|

|

|

|

|

|

|

Debt/EBITDA ratio |

|

3.1 |

|

2.8 |

|

11

Cash flow statement

|

|

|

Three months ended

December 31 |

|

Twelve months ended

December 31 |

|

|

in US$ million, audited |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

Operating activities |

|

|

|

|

|

|

|

|

|

|

Net income |

|

403 |

|

392 |

|

1,260 |

|

1,255 |

|

|

Depreciation / amortization |

|

186 |

|

169 |

|

699 |

|

648 |

|

|

Change in working capital and other non-cash items |

|

(1 |

) |

28 |

|

(98 |

) |

132 |

|

|

Net cash provided by operating activities |

|

588 |

|

589 |

|

1,861 |

|

2,035 |

|

|

In percent of revenue |

|

13.6 |

% |

15.2 |

% |

11.8 |

% |

13.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

(285 |

) |

(235 |

) |

(932 |

) |

(748 |

) |

|

Proceeds from sale of property, plant and equipment |

|

3 |

|

1 |

|

12 |

|

20 |

|

|

Capital expenditures, net |

|

(282 |

) |

(234 |

) |

(920 |

) |

(728 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow |

|

306 |

|

355 |

|

941 |

|

1,307 |

|

|

In percent of revenue |

|

7.1 |

% |

9.2 |

% |

5.9 |

% |

8.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Acquisitions, net of cash acquired, and purchases of intangible assets |

|

(730 |

) |

(198 |

) |

(1,779 |

) |

(496 |

) |

|

Proceeds from divestitures |

|

5 |

|

— |

|

9 |

|

18 |

|

|

Acquisitions, net of divestitures |

|

(725 |

) |

(198 |

) |

(1,770 |

) |

(478 |

) |

|

Free cash flow after investing activities |

|

(419 |

) |

157 |

|

(829 |

) |

829 |

|

12

Revenue development

|

in US$ million, audited |

|

2014 |

|

2013 |

|

Change |

|

Change

at cc |

|

Organic

growth |

|

Same

market

treatment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

4,320 |

|

3,867 |

|

11.7 |

% |

15.3 |

% |

6.9 |

% |

|

|

|

Dialysis products |

|

998 |

|

972 |

|

2.7 |

% |

7.9 |

% |

8.1 |

% |

|

|

|

Net Health Care |

|

3,322 |

|

2,895 |

|

14.7 |

% |

17.7 |

% |

6.5 |

% |

3.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

2,876 |

|

2,507 |

|

14.7 |

% |

14.7 |

% |

6.3 |

% |

|

|

|

Dialysis products |

|

236 |

|

219 |

|

7.6 |

% |

7.6 |

% |

7.5 |

% |

|

|

|

Net Health Care |

|

2,640 |

|

2,288 |

|

15.4 |

% |

15.4 |

% |

6.2 |

% |

3.8 |

% |

|

Thereof Net Care Coordination revenue |

|

395 |

|

157 |

|

151.0 |

% |

151.0 |

% |

|

|

|

|

|

Thereof Net Dialysis Care revenue |

|

2,245 |

|

2,131 |

|

5.4 |

% |

5.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

1,422 |

|

1,351 |

|

5.2 |

% |

15.3 |

% |

7.1 |

% |

|

|

|

Dialysis products |

|

740 |

|

744 |

|

-0.5 |

% |

6.2 |

% |

6.4 |

% |

|

|

|

Net Health Care |

|

682 |

|

607 |

|

12.3 |

% |

26.5 |

% |

8.0 |

% |

4.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regional development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

2,876 |

|

2,507 |

|

14.7 |

% |

14.7 |

% |

6.3 |

% |

|

|

|

Europe/Middle East/Africa |

|

766 |

|

810 |

|

-5.5 |

% |

4.1 |

% |

4.5 |

% |

|

|

|

Latin America |

|

237 |

|

225 |

|

5.4 |

% |

23.1 |

% |

15.7 |

% |

|

|

|

Asia-Pacific |

|

419 |

|

316 |

|

32.6 |

% |

38.7 |

% |

7.7 |

% |

|

|

|

Corporate |

|

22 |

|

9 |

|

163.9 |

% |

172.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended December 31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

15,832 |

|

14,610 |

|

8.4 |

% |

10.0 |

% |

5.3 |

% |

|

|

|

Dialysis products |

|

3,582 |

|

3,480 |

|

2.9 |

% |

4.4 |

% |

4.4 |

% |

|

|

|

Net Health Care |

|

12,250 |

|

11,130 |

|

10.1 |

% |

11.8 |

% |

5.6 |

% |

3.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

10,500 |

|

9,606 |

|

9.3 |

% |

9.3 |

% |

4.8 |

% |

|

|

|

Dialysis products |

|

845 |

|

834 |

|

1.3 |

% |

1.3 |

% |

1.4 |

% |

|

|

|

Net Health Care |

|

9,655 |

|

8,772 |

|

10.1 |

% |

10.1 |

% |

5.1 |

% |

3.5 |

% |

|

Thereof Net Care Coordination revenue |

|

1,039 |

|

528 |

|

96.8 |

% |

96.8 |

% |

|

|

|

|

|

Thereof Net Dialysis Care revenue |

|

8,616 |

|

8,244 |

|

4.5 |

% |

4.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

5,265 |

|

4,970 |

|

5.9 |

% |

10.8 |

% |

5.8 |

% |

|

|

|

Dialysis products |

|

2,670 |

|

2,612 |

|

2.2 |

% |

4.2 |

% |

4.1 |

% |

|

|

|

Net Health Care |

|

2,595 |

|

2,358 |

|

10.1 |

% |

18.1 |

% |

7.7 |

% |

4.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regional development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

10,500 |

|

9,606 |

|

9.3 |

% |

9.3 |

% |

4.8 |

% |

|

|

|

Europe/Middle East/Africa |

|

3,072 |

|

3,023 |

|

1.6 |

% |

3.6 |

% |

3.6 |

% |

|

|

|

Latin America |

|

836 |

|

843 |

|

-0.8 |

% |

16.3 |

% |

12.7 |

% |

|

|

|

Asia-Pacific |

|

1,357 |

|

1,104 |

|

22.9 |

% |

26.4 |

% |

6.4 |

% |

|

|

|

Corporate |

|

67 |

|

34 |

|

99.7 |

% |

99.7 |

% |

|

|

|

|

1 same market treatment growth = organic growth less price effects

cc = Constant Currency

Changes in revenue include the impact of changes in foreign currency exchange rates. We use the non-GAAP financial measure at Constant Exchange Rates or Constant Currency to show changes in our revenue without giving effect to period-to-period currency fluctuations. Under U.S. GAAP, revenues received in local (non-U.S. dollar) currency are translated into U.S. dollars at the average exchange rate for the period presented. Once we translate the current period local currency revenues for the Constant Currency, we then calculate the change, as a percentage, of the current period revenues using the prior period exchange rates versus the prior period revenues. This resulting percentage is a non-GAAP measure referring to a percentage change at Constant Currency.

We believe that revenue growth is a key indication of how a company is progressing from period to period and that the non-GAAP financial measure Constant Currency is useful to investors, lenders, and other creditors because such information enables them to gauge the impact of currency fluctuations on a company’s revenue from period to period. However, we also believe that the usefulness of data on Constant Currency period-over-period changes is subject to limitations, particularly if the currency effects that are eliminated constitute a significant element of our revenue and significantly impact our performance. We therefore limit our use of Constant Currency period-over-period changes to a measure for the impact of currency fluctuations on the translation of local currency revenue into U.S. dollars. We do not evaluate our results and performance without considering both Constant Currency period-over-period changes in non-U.S. GAAP revenue on the one hand and changes in revenue prepared in accordance with U.S. GAAP on the other. We caution the readers of this report to follow a similar approach by considering data on Constant Currency period-over-period changes only in addition to, and not as a substitute for or superior to, changes in revenue prepared in accordance with U.S. GAAP. We present the fluctuation derived from U.S. GAAP revenue next to the fluctuation derived from non-GAAP revenue. Because the reconciliation of non-GAAP to U.S. GAAP measures is inherent in the disclosure, we believe that a separate reconciliation would not provide any additional benefit.

13

Key figures product business

|

in US$ million, audited |

|

2014 |

|

2013 |

|

Change |

|

Change at cc |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31 |

|

|

|

|

|

|

|

|

|

|

Total product revenue |

|

1,349 |

|

1,324 |

|

1.9 |

% |

7.2 |

% |

|

Less internal revenue |

|

(351 |

) |

(352 |

) |

-0.5 |

% |

5.0 |

% |

|

Total external revenue |

|

998 |

|

972 |

|

2.7 |

% |

7.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

460 |

|

435 |

|

5.6 |

% |

5.6 |

% |

|

Less internal revenue |

|

(224 |

) |

(216 |

) |

3.7 |

% |

3.7 |

% |

|

Total North America external revenue |

|

236 |

|

219 |

|

7.6 |

% |

7.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

866 |

|

880 |

|

-1.6 |

% |

6.3 |

% |

|

Less internal revenue |

|

(126 |

) |

(136 |

) |

-7.2 |

% |

7.1 |

% |

|

Total International external revenue |

|

740 |

|

744 |

|

-0.5 |

% |

6.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended December 31 |

|

|

|

|

|

|

|

|

|

|

Total product revenue |

|

4,927 |

|

4,785 |

|

3.0 |

% |

4.9 |

% |

|

Less internal revenue |

|

(1,345 |

) |

(1,305 |

) |

3.1 |

% |

6.0 |

% |

|

Total external revenue |

|

3,582 |

|

3,480 |

|

2.9 |

% |

4.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

1,698 |

|

1,650 |

|

2.9 |

% |

2.9 |

% |

|

Less internal revenue |

|

(853 |

) |

(816 |

) |

4.5 |

% |

4.5 |

% |

|

Total North America external revenue |

|

845 |

|

834 |

|

1.3 |

% |

1.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

3,162 |

|

3,101 |

|

1.9 |

% |

4.9 |

% |

|

Less internal revenue |

|

(492 |

) |

(489 |

) |

0.6 |

% |

8.5 |

% |

|

Total International external revenue |

|

2,670 |

|

2,612 |

|

2.2 |

% |

4.2 |

% |

cc = Constant Currency

Changes in revenue include the impact of changes in foreign currency exchange rates. We use the non-GAAP financial measure at Constant Exchange Rates or Constant Currency to show changes in our revenue without giving effect to period-to-period currency fluctuations. Under U.S. GAAP, revenues received in local (non-U.S. dollar) currency are translated into U.S. dollars at the average exchange rate for the period presented. Once we translate the current period local currency revenues for the Constant Currency, we then calculate the change, as a percentage, of the current period revenues using the prior period exchange rates versus the prior period revenues. This resulting percentage is a non-GAAP measure referring to a percentage change at Constant Currency.

We believe that revenue growth is a key indication of how a company is progressing from period to period and that the non-GAAP financial measure Constant Currency is useful to investors, lenders, and other creditors because such information enables them to gauge the impact of currency fluctuations on a company’s revenue from period to period. However, we also believe that the usefulness of data on Constant Currency period-over-period changes is subject to limitations, particularly if the currency effects that are eliminated constitute a significant element of our revenue and significantly impact our performance. We therefore limit our use of Constant Currency period-over-period changes to a measure for the impact of currency fluctuations on the translation of local currency revenue into U.S. dollars. We do not evaluate our results and performance without considering both Constant Currency period-over-period changes in non-U.S. GAAP revenue on the one hand and changes in revenue prepared in accordance with U.S. GAAP on the other. We caution the readers of this report to follow a similar approach by considering data on Constant Currency period-over-period changes only in addition to, and not as a substitute for or superior to, changes in revenue prepared in accordance with U.S. GAAP. We present the fluctuation derived from U.S. GAAP revenue next to the fluctuation derived from non-GAAP revenue. Because the reconciliation of non-GAAP to U.S. GAAP measures is inherent in the disclosure, we believe that a separate reconciliation would not provide any additional benefit.

14

Key figures service business

|

|

|

Twelve months ended December 31, 2014 |

|

|

audited |

|

Clinics |

|

Growth

in % |

|

De novos |

|

Patients |

|

Growth

in % |

|

Treatments |

|

Growth

in % |

|

|

Total |

|

3,361 |

|

3 |

% |

79 |

|

286,312 |

|

6 |

% |

42,744,977 |

|

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

North America |

|

2,162 |

|

1 |

% |

48 |

|

176,203 |

|

3 |

% |

26,610,624 |

|

4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International |

|

1,199 |

|

7 |

% |

31 |

|

110,109 |

|

12 |

% |

16,134,353 |

|

9 |

% |

|

Europe/Middle East/Africa |

|

635 |

|

0 |

% |

16 |

|

52,848 |

|

3 |

% |

8,053,633 |

|

4 |

% |

|

Latin America |

|

247 |

|

7 |

% |

6 |

|

31,983 |

|

9 |

% |

4,811,640 |

|

9 |

% |

|

Asia-Pacific |

|

317 |

|

25 |

% |

9 |

|

25,278 |

|

41 |

% |

3,269,080 |

|

23 |

% |

Quality data

|

|

|

North America |

|

Europe/Middle East/

Africa |

|

Asia-Pacific |

|

|

in % of patients |

|

Q4 2014 |

|

Q3 2014 |

|

Q4 2014 |

|

Q3 2014 |

|

Q4 2014 |

|

Q3 2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clinical Performance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single Pool Kt/v > 1.2 |

|

96 |

|

97 |

|

95 |

|

95 |

|

97 |

|

97 |

|

|

No catheter (> 90 days) |

|

83 |

|

83 |

|

83 |

|

83 |

|

92 |

|

92 |

|

|

Hemoglobin = 10-12 g/dl |

|

74 |

|

73 |

|

76 |

|

75 |

|

60 |

|

59 |

|

|

Hemoglobin = 10-13 g/dl |

|

80 |

|

78 |

|

77 |

|

76 |

|

69 |

|

67 |

|

|

Albumin > 3.5 g/dl1) |

|

83 |

|

82 |

|

92 |

|

91 |

|

91 |

|

91 |

|

|

Phosphate < 5.5 mg/dl |

|

64 |

|

64 |

|

79 |

|

76 |

|

70 |

|

71 |

|

|

Calcium = 8.4-10.2 mg/dl |

|

85 |

|

84 |

|

76 |

|

75 |

|

76 |

|

75 |

|

|

Hospitalization days |

|

9.1 |

|

8.9 |

|

9.4 |

|

9.5 |

|

4.3 |

|

4.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demographics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average age (in years) |

|

62 |

|

62 |

|

64 |

|

64 |

|

64 |

|

64 |

|

|

Average time on dialysis (in years) |

|

4.0 |

|

4.0 |

|

5.5 |

|

5.5 |

|

4.9 |

|

4.9 |

|

|

Average body weight (in kg) |

|

82 |

|

82 |

|

72 |

|

72 |

|

60 |

|

60 |

|

|

Prevalence of diabetes (in%) |

|

60 |

|

60 |

|

29 |

|

29 |

|

39 |

|

40 |

|

1) International standard BCR CRM470

15

CONTACT

Fresenius Medical Care AG & Co. KGaA

Investor Relations

61352 Bad Homburg v. d. H.

Germany

www.freseniusmedicalcare.com

Oliver Maier

Head of Investor Relations &

Corporate Communications

Tel. +49 6172 609 2601

Fax +49 6172 609 2301

email: ir@fmc-ag.com

Published by

Fresenius Medical Care AG & Co. KGaA

Investor Relations

Annual reports, interim reports and further

information on the company is also available on our website.

Please visit us at www.freseniusmedicalcare.com

For printed material, please contact Investor Relations.

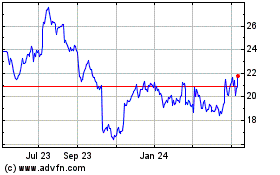

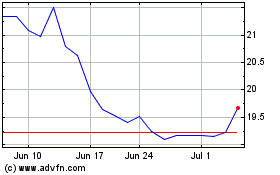

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Apr 2023 to Apr 2024