UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of February, 2015

Commission File Number 001-15216

HDFC BANK

LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Indicate by check mark if the

registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ¨ No x

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted

solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): Yes ¨ No x

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the

registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the

home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether

the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is

marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-Not Applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: 17th February, 2015 |

|

|

|

By |

|

/s/ Sanjay Dongre |

|

|

|

|

Name: |

|

Sanjay Dongre |

|

|

|

|

Title: |

|

Executive Vice President (Legal) & Company Secretary |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this Report pursuant to the General

Instructions for Form 6-K.

Exhibit I

Description

Communication dated 14th February, 2015 addressed to The New York Stock Exchange, New York,

United States of America (USA) intimating about Unaudited Financial Results for the Quarter ended 31st December, 2014.

14th February, 2015

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir / Madam,

Re: Unaudited Financial Results for the quarter ended 31st December, 2014.

Pursuant to the Listing Agreement, we send herewith the unaudited financial results of the Bank for the third quarter ended 31st December, 2014 and Segment-wise Reporting and the press release in this regard. The results were duly approved by the Board of Directors of the Bank at its meeting held today i.e. 14th February, 2015.

A copy of the Limited Review Report of the Statutory Auditors for the quarter

ended 31st December 2014 is also attached.

Kindly take the same on your records.

Thanking you,

Yours faithfully,

For HDFC Bank Limited

Sd/-

Sanjay Dongre

Executive Vice President (Legal) &

Company Secretary

Encl: As above

HDFC BANK LIMITED

FINANCIAL RESULTS FOR THE QUARTER AND NINE MONTHS ENDED DECEMBER 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(

in lacs)

in lacs) |

|

| Particulars |

|

Quarter

ended

31.12.2014 |

|

|

Quarter

ended

30.09.2014 |

|

|

Quarter

ended

31.12.2013 |

|

|

Nine months

ended

31.12.2014 |

|

|

Nine months

ended

31.12.2013 |

|

|

Year ended

31.03.2014 |

|

| |

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited* |

|

| 1 Interest Earned (a)+(b)+(c)+(d) |

|

|

1239583 |

|

|

|

1184763 |

|

|

|

1059068 |

|

|

|

3546354 |

|

|

|

3034698 |

|

|

|

4113554 |

|

| a) Interest / discount on advances / bills |

|

|

954318 |

|

|

|

907385 |

|

|

|

818306 |

|

|

|

2735210 |

|

|

|

2319991 |

|

|

|

3168692 |

|

| b) Income on Investments |

|

|

269561 |

|

|

|

261380 |

|

|

|

230940 |

|

|

|

764842 |

|

|

|

681895 |

|

|

|

903685 |

|

| c) Interest on balances with Reserve Bank of India and other inter bank funds |

|

|

13794 |

|

|

|

14763 |

|

|

|

8515 |

|

|

|

40704 |

|

|

|

27957 |

|

|

|

35599 |

|

| d) Others |

|

|

1910 |

|

|

|

1235 |

|

|

|

1307 |

|

|

|

5598 |

|

|

|

4855 |

|

|

|

5578 |

|

| 2 Other Income |

|

|

253491 |

|

|

|

204710 |

|

|

|

214827 |

|

|

|

643258 |

|

|

|

591822 |

|

|

|

791964 |

|

| 3 TOTAL INCOME (1)+(2) |

|

|

1493074 |

|

|

|

1389473 |

|

|

|

1273895 |

|

|

|

4189612 |

|

|

|

3626520 |

|

|

|

4905518 |

|

| 4 Interest Expended |

|

|

669590 |

|

|

|

633664 |

|

|

|

595591 |

|

|

|

1908101 |

|

|

|

1681698 |

|

|

|

2265290 |

|

| 5 Operating Expenses (i)+(ii) |

|

|

345628 |

|

|

|

349790 |

|

|

|

289507 |

|

|

|

1013259 |

|

|

|

886747 |

|

|

|

1204219 |

|

| i) Employees cost |

|

|

113253 |

|

|

|

116694 |

|

|

|

97297 |

|

|

|

342540 |

|

|

|

311774 |

|

|

|

417898 |

|

| ii) Other operating expenses |

|

|

232375 |

|

|

|

233096 |

|

|

|

192210 |

|

|

|

670719 |

|

|

|

574973 |

|

|

|

786321 |

|

| 6 TOTAL EXPENDITURE (4)+(5) (excluding Provisions & Contingencies) |

|

|

1015218 |

|

|

|

983454 |

|

|

|

885098 |

|

|

|

2921360 |

|

|

|

2568445 |

|

|

|

3469509 |

|

| 7 Operating Profit before Provisions and Contingencies (3)-(6) |

|

|

477856 |

|

|

|

406019 |

|

|

|

388797 |

|

|

|

1268252 |

|

|

|

1058075 |

|

|

|

1436009 |

|

| 8 Provisions (other than tax) and Contingencies |

|

|

56043 |

|

|

|

45589 |

|

|

|

38884 |

|

|

|

149910 |

|

|

|

130189 |

|

|

|

158802 |

|

| 9 Exceptional Items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| 10 Profit / (Loss) from Ordinary Activities before tax (7)-(8)-(9) |

|

|

421813 |

|

|

|

360430 |

|

|

|

349913 |

|

|

|

1118342 |

|

|

|

927886 |

|

|

|

1277207 |

|

| 11 Tax Expense |

|

|

142362 |

|

|

|

122284 |

|

|

|

117343 |

|

|

|

377441 |

|

|

|

312698 |

|

|

|

429367 |

|

| 12 Net Profit / (Loss) from Ordinary Activities after tax (10)-(11) |

|

|

279451 |

|

|

|

238146 |

|

|

|

232570 |

|

|

|

740901 |

|

|

|

615188 |

|

|

|

847840 |

|

| 13 Extraordinary items (net of tax expense) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| 14 Net Profit / (Loss) for the period (12)-(13) |

|

|

279451 |

|

|

|

238146 |

|

|

|

232570 |

|

|

|

740901 |

|

|

|

615188 |

|

|

|

847840 |

|

| 15 Paid up equity share capital (Face Value of

2/-each)

2/-each) |

|

|

48348 |

|

|

|

48286 |

|

|

|

47892 |

|

|

|

48348 |

|

|

|

47892 |

|

|

|

47981 |

|

| 16 Reserves excluding revaluation reserves |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4299884 |

|

| 17 Analytical Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (i) Percentage of shares held by Government of India |

|

|

Nil |

|

|

|

Nil |

|

|

|

Nil |

|

|

|

Nil |

|

|

|

Nil |

|

|

|

Nil |

|

| (ii) Capital Adequacy Ratio |

|

|

15.7 |

% |

|

|

15.7 |

% |

|

|

14.7 |

% |

|

|

15.7 |

% |

|

|

14.7 |

% |

|

|

16.1 |

% |

| (iii) Earnings per share (

)

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Basic EPS before & after extraordinary items (net of tax expense) - not annualized |

|

|

11.5 |

|

|

|

9.9 |

|

|

|

9.8 |

|

|

|

30.7 |

|

|

|

25.8 |

|

|

|

35.5 |

|

| (b) Diluted EPS before & after extraordinary items (net of tax expense) - not annualized |

|

|

11.4 |

|

|

|

9.8 |

|

|

|

9.7 |

|

|

|

30.4 |

|

|

|

25.6 |

|

|

|

35.2 |

|

| (iv) NPA Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Gross NPAs |

|

|

346791 |

|

|

|

336165 |

|

|

|

301784 |

|

|

|

346791 |

|

|

|

301784 |

|

|

|

298928 |

|

| (b) Net NPAs |

|

|

90366 |

|

|

|

91734 |

|

|

|

79734 |

|

|

|

90366 |

|

|

|

79734 |

|

|

|

82003 |

|

| (c) % of Gross NPAs to Gross Advances |

|

|

1.0 |

% |

|

|

1.0 |

% |

|

|

1.0 |

% |

|

|

1.0 |

% |

|

|

1.0 |

% |

|

|

1.0 |

% |

| (d) % of Net NPAs to Net Advances |

|

|

0.3 |

% |

|

|

0.3 |

% |

|

|

0.3 |

% |

|

|

0.3 |

% |

|

|

0.3 |

% |

|

|

0.3 |

% |

| (v) Return on assets (average) - not annualized |

|

|

0.5 |

% |

|

|

0.5 |

% |

|

|

0.5 |

% |

|

|

1.5 |

% |

|

|

1.5 |

% |

|

|

2.0 |

% |

| 18 Non Promoters Shareholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Public Shareholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - No. of shares |

|

|

1467186868 |

|

|

|

1464101398 |

|

|

|

1444372788 |

|

|

|

1467186868 |

|

|

|

1444372788 |

|

|

|

1448829678 |

|

| - Percentage of Shareholding |

|

|

60.7 |

% |

|

|

60.6 |

% |

|

|

60.3 |

% |

|

|

60.7 |

% |

|

|

60.3 |

% |

|

|

60.4 |

% |

| (b) Shares underlying Depository Receipts (ADS and GDR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - No. of shares |

|

|

407004657 |

|

|

|

407004657 |

|

|

|

407004657 |

|

|

|

407004657 |

|

|

|

407004657 |

|

|

|

407004657 |

|

| - Percentage of Shareholding |

|

|

16.8 |

% |

|

|

16.9 |

% |

|

|

17.0 |

% |

|

|

16.8 |

% |

|

|

17.0 |

% |

|

|

17.0 |

% |

| 19 Promoters and Promoter Group Shareholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) Pledged / Encumbered |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - No. of shares |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| - Percentage of Shares (as a % of the total share capital of the Company) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| (b) Non - encumbered |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - No. of shares |

|

|

543216100 |

|

|

|

543216100 |

|

|

|

543216100 |

|

|

|

543216100 |

|

|

|

543216100 |

|

|

|

543216100 |

|

| - Percentage of Shares (as a % of the total shareholding of promoter and promoter group) |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

| - Percentage of Shares (as a % of the total share capital of the Company) |

|

|

22.5 |

% |

|

|

22.5 |

% |

|

|

22.7 |

% |

|

|

22.5 |

% |

|

|

22.7 |

% |

|

|

22.6 |

% |

| * |

Except for disclosure regarding ‘Non Promoters Shareholding’ and ‘Promoters and Promoter Group Shareholding’ which are unaudited. |

Regd. Office : HDFC Bank Ltd., HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai - 400013.

Segment information in accordance with the Accounting Standard on Segment Reporting (AS 17) of the operating

segments of the Bank is as under:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(

in lacs)

in lacs) |

|

| |

|

Quarter

ended

31.12.2014 |

|

|

Quarter

ended

30.09.2014 |

|

|

Quarter

ended

31.12.2013 |

|

|

Nine months

ended

31.12.2014 |

|

|

Nine months

ended

31.12.2013 |

|

|

Year ended

31.03.2014 |

|

| Particulars |

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Audited |

|

| 1 Segment Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| a) Treasury |

|

|

334369 |

|

|

|

310464 |

|

|

|

301530 |

|

|

|

915194 |

|

|

|

911927 |

|

|

|

1178670 |

|

| b) Retail Banking |

|

|

1256012 |

|

|

|

1191868 |

|

|

|

1065006 |

|

|

|

3592171 |

|

|

|

2992363 |

|

|

|

4080486 |

|

| c) Wholesale Banking |

|

|

593676 |

|

|

|

564503 |

|

|

|

517842 |

|

|

|

1702796 |

|

|

|

1456406 |

|

|

|

1964534 |

|

| d) Other Banking Operations |

|

|

167827 |

|

|

|

145899 |

|

|

|

132924 |

|

|

|

441742 |

|

|

|

358107 |

|

|

|

503355 |

|

| e) Unallocated |

|

|

823 |

|

|

|

— |

|

|

|

— |

|

|

|

823 |

|

|

|

258 |

|

|

|

258 |

|

| Total |

|

|

2352707 |

|

|

|

2212734 |

|

|

|

2017302 |

|

|

|

6652726 |

|

|

|

5719061 |

|

|

|

7727303 |

|

| Less: Inter Segment Revenue |

|

|

859633 |

|

|

|

823261 |

|

|

|

743407 |

|

|

|

2463114 |

|

|

|

2092541 |

|

|

|

2821785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from Operations |

|

|

1493074 |

|

|

|

1389473 |

|

|

|

1273895 |

|

|

|

4189612 |

|

|

|

3626520 |

|

|

|

4905518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2 Segment Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| a) Treasury |

|

|

26641 |

|

|

|

8395 |

|

|

|

8006 |

|

|

|

29744 |

|

|

|

28665 |

|

|

|

41230 |

|

| b) Retail Banking |

|

|

164963 |

|

|

|

145845 |

|

|

|

151297 |

|

|

|

462445 |

|

|

|

410648 |

|

|

|

568541 |

|

| c) Wholesale Banking |

|

|

195012 |

|

|

|

188860 |

|

|

|

154934 |

|

|

|

562850 |

|

|

|

443974 |

|

|

|

594011 |

|

| d) Other Banking Operations |

|

|

72046 |

|

|

|

54967 |

|

|

|

61150 |

|

|

|

174511 |

|

|

|

144426 |

|

|

|

192046 |

|

| e) Unallocated |

|

|

(36849 |

) |

|

|

(37637 |

) |

|

|

(25474 |

) |

|

|

(111208 |

) |

|

|

(99827 |

) |

|

|

(118621 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Profit Before Tax |

|

|

421813 |

|

|

|

360430 |

|

|

|

349913 |

|

|

|

1118342 |

|

|

|

927886 |

|

|

|

1277207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3 Capital Employed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Segment Assets - Segment Liabilities) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| a) Treasury |

|

|

12588592 |

|

|

|

12113999 |

|

|

|

10436562 |

|

|

|

12588592 |

|

|

|

10436562 |

|

|

|

12241141 |

|

| b) Retail Banking |

|

|

(16204827 |

) |

|

|

(15190170 |

) |

|

|

(11518070 |

) |

|

|

(16204827 |

) |

|

|

(11518070 |

) |

|

|

(12909019 |

) |

| c) Wholesale Banking |

|

|

8817771 |

|

|

|

8179230 |

|

|

|

5711662 |

|

|

|

8817771 |

|

|

|

5711662 |

|

|

|

5305539 |

|

| d) Other Banking Operations |

|

|

1460408 |

|

|

|

1307222 |

|

|

|

1113961 |

|

|

|

1460408 |

|

|

|

1113961 |

|

|

|

1259579 |

|

| e) Unallocated |

|

|

(1494667 |

) |

|

|

(1538801 |

) |

|

|

(1454981 |

) |

|

|

(1494667 |

) |

|

|

(1454981 |

) |

|

|

(1549375 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

5167277 |

|

|

|

4871480 |

|

|

|

4289134 |

|

|

|

5167277 |

|

|

|

4289134 |

|

|

|

4347865 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Segments have been identified and reported taking into account the target customer profile, the nature of products

and services, the differing risks and returns, the organisation structure, the internal business reporting system and the guidelines prescribed by RBI.

Regd. Office : HDFC Bank Ltd., HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai - 400013.

Notes :

| 1 |

Statement of Assets and Liabilities as on December 31, 2014 is given below. |

|

|

|

|

|

|

|

|

|

| |

|

(

in lacs)

in lacs) |

|

| |

|

As at

31.12.2014 |

|

|

As at

31.12.2013 |

|

| Particulars |

|

Unaudited |

|

|

Unaudited |

|

| CAPITAL AND LIABILITIES |

|

|

|

|

|

|

|

|

| Capital |

|

|

48348 |

|

|

|

47892 |

|

| Reserves and Surplus |

|

|

5118929 |

|

|

|

4241242 |

|

| Deposits |

|

|

41412826 |

|

|

|

34921516 |

|

| Borrowings |

|

|

3965852 |

|

|

|

4384845 |

|

| Other Liabilities and Provisions |

|

|

2939564 |

|

|

|

3217722 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

53485519 |

|

|

|

46813217 |

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Cash and Balances with Reserve Bank of India |

|

|

2098119 |

|

|

|

2125138 |

|

| Balances with Banks and Money at Call and Short notice |

|

|

1205758 |

|

|

|

1393926 |

|

| Investments |

|

|

13398096 |

|

|

|

11061648 |

|

| Advances |

|

|

34708798 |

|

|

|

29674161 |

|

| Fixed Assets |

|

|

293530 |

|

|

|

293855 |

|

| Other Assets |

|

|

1781218 |

|

|

|

2264489 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

53485519 |

|

|

|

46813217 |

|

|

|

|

|

|

|

|

|

|

| 2 |

The above results have been approved by the Board of Directors at its meeting held on February 14, 2015. |

| 3 |

The results for the quarter and nine months ended December 31, 2014 have been subjected to a “Limited Review” by the Statutory Auditors of the Bank. An unqualified report has been issued by them thereon.

|

| 4 |

The Bank has followed the same significant accounting policies in the preparation of the above financial results as those followed in the annual financial statements for the year ended March 31, 2014.

|

| 5 |

In accordance with RBI circular DBOD.No.BP.BC.2/21.06.201/2013-14 dated July 1, 2013, banks are required to make Pillar 3 disclosures under Basel III capital regulations. The Bank has made these disclosures which

are available on its website at the following link: http://www.hdfcbank.com/aboutus/basel_disclosures/default.htm. The disclosures have not been subjected to audit or limited review. |

| 6 |

Pursuant to the shareholder and regulatory approvals, the Bank on February 10, 2015, concluded a Qualified Institutions Placement (QIP) of 1,87,44,142 equity shares at a price of

1,067 per equity share aggregating

1,067 per equity share aggregating

2,000 crore and an American Depository Receipt (ADR) offering of 2,20,00,000 ADRs (representing 6,60,00,000 equity shares) at a price of USD 57.76 per ADR, aggregating USD 1,271 million. Pursuant to these

issuances, the Bank allotted 8,47,44,142 additional equity shares upon receipt of funds aggregating

2,000 crore and an American Depository Receipt (ADR) offering of 2,20,00,000 ADRs (representing 6,60,00,000 equity shares) at a price of USD 57.76 per ADR, aggregating USD 1,271 million. Pursuant to these

issuances, the Bank allotted 8,47,44,142 additional equity shares upon receipt of funds aggregating

9,766 crore.

9,766 crore. |

| 7 |

During the quarter and nine months ended December 31, 2014, the Bank allotted 30,85,470 and 1,83,57,190 shares pursuant to the exercise of options under the approved employee stock option schemes.

|

| 8 |

Other income relates to income from non-fund based banking activities including commission, fees, earnings from foreign exchange and derivative transactions, profit and loss (including revaluation) from investments and

recoveries from accounts written off. |

| 9 |

As at December 31, 2014, the total number of branches (including extension counters) and ATM network stood at 3659 branches and 11633 ATMs respectively. |

| 10 |

Information on investor complaints pursuant to Clause 41 of the listing agreement for the quarter ended December 31, 2014: |

Opening: Nil; Additions: 802; Disposals:

794; Closing position: 8.

| 11 |

Figures of the previous periods have been regrouped / reclassified wherever necessary to conform to current period’s classification. |

| 12 |

10 lac =

10 lac =

1 million

1 million |

10 million =

10 million =

1 crore

1 crore

|

|

|

|

|

|

|

|

|

| Place : |

|

Mumbai |

|

|

|

Aditya Puri |

|

|

|

|

|

|

|

| Date : |

|

February 14, 2015 |

|

|

|

Managing Director |

|

|

Regd. Office : HDFC Bank Ltd., HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai - 400013.

NEWS RELEASE

HDFC Bank Limited

FINANCIAL RESULTS (INDIAN GAAP)

FOR THE QUARTER AND NINE MONTHS ENDED DECEMBER 31, 2014

The Board of Directors of HDFC Bank Limited approved the Bank’s (Indian GAAP) results for the quarter and nine months ended

December 31, 2014, at their meeting held in Mumbai on Saturday, February 14, 2015. The accounts have been subjected to a ‘Limited Review’ by the statutory auditors of the Bank.

FINANCIAL RESULTS:

Profit & Loss

Account: Quarter ended December 31, 2014

The Bank’s total income for the quarter ended December 31, 2014 was

14,930.7 crore, as against

14,930.7 crore, as against

12,739.0 crore for the quarter ended December 31, 2013. Net revenues (net interest income plus other income) were at

12,739.0 crore for the quarter ended December 31, 2013. Net revenues (net interest income plus other income) were at

8,234.8 crore for the quarter ended December 31, 2014, an increase of 21.4% over

8,234.8 crore for the quarter ended December 31, 2014, an increase of 21.4% over

6,783.0 crore for the corresponding quarter of the previous year. Interest earned increased from

6,783.0 crore for the corresponding quarter of the previous year. Interest earned increased from

10,590.7 crore in the quarter ended December 31, 2013 to

10,590.7 crore in the quarter ended December 31, 2013 to

12,395.8 crore in the quarter ended December 31, 2014, up by 17.0%. With interest expense increasing by 12.4% to

12,395.8 crore in the quarter ended December 31, 2014, up by 17.0%. With interest expense increasing by 12.4% to

6,695.9 crore for the quarter ended December 31, 2014, the net interest income (interest earned less interest expended) grew by 23.0% to

6,695.9 crore for the quarter ended December 31, 2014, the net interest income (interest earned less interest expended) grew by 23.0% to

5,699.9 crore from

5,699.9 crore from

4,634.8 crore for the quarter ended December 31, 2013. Net interest margin for the quarter was at 4.4% as against 4.2% for corresponding quarter ended December 31, 2013.

4,634.8 crore for the quarter ended December 31, 2013. Net interest margin for the quarter was at 4.4% as against 4.2% for corresponding quarter ended December 31, 2013.

Other income (non-interest revenue) at

2,534.9 crore was 30.8% of net revenues for the quarter ended December 31, 2014 and grew by 18.0% over

2,534.9 crore was 30.8% of net revenues for the quarter ended December 31, 2014 and grew by 18.0% over

2,148.3 crore in the corresponding quarter ended December 31, 2013. The four components of other income for the quarter ended December 31, 2014 were fees & commissions of

2,148.3 crore in the corresponding quarter ended December 31, 2013. The four components of other income for the quarter ended December 31, 2014 were fees & commissions of

1,806.5 crore (

1,806.5 crore (

1,575.0 crore in the corresponding quarter of the previous year), foreign exchange & derivatives revenue of

1,575.0 crore in the corresponding quarter of the previous year), foreign exchange & derivatives revenue of

253.4 crore (

253.4 crore (

333.2 crore for the corresponding quarter of the previous year), gain on revaluation / sale of investments of

333.2 crore for the corresponding quarter of the previous year), gain on revaluation / sale of investments of

265.5 crore (

265.5 crore (

50.9 crore for the corresponding quarter of the previous year) and miscellaneous income including recoveries of

50.9 crore for the corresponding quarter of the previous year) and miscellaneous income including recoveries of

209.5 crore (

209.5 crore (

189.1 crore for the corresponding quarter of the previous year).

189.1 crore for the corresponding quarter of the previous year).

Regd. Office: HDFC Bank Limited, HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai 400013

Operating expenses for the quarter

ended December 31, 2014 were

3,456.3 crore, an increase of 19.4% over

3,456.3 crore, an increase of 19.4% over

2,895.1 crore during the corresponding quarter of the previous year. The cost-to-income ratio for the quarter was at 42.0% as against 42.7% for the corresponding quarter ended December 31, 2013.

2,895.1 crore during the corresponding quarter of the previous year. The cost-to-income ratio for the quarter was at 42.0% as against 42.7% for the corresponding quarter ended December 31, 2013.

Provisions and contingencies were

560.4 crore for the quarter ended December 31, 2014 as against

560.4 crore for the quarter ended December 31, 2014 as against

388.8 crore for the corresponding quarter ended December 31, 2013. After providing

388.8 crore for the corresponding quarter ended December 31, 2013. After providing

1,423.6 crore for taxation, the Bank earned a net profit of

1,423.6 crore for taxation, the Bank earned a net profit of

2,794.5 crore for the quarter ended December 31, 2014, an increase of 20.2% over the quarter ended December 31, 2013.

2,794.5 crore for the quarter ended December 31, 2014, an increase of 20.2% over the quarter ended December 31, 2013.

Balance Sheet: As of December 31, 2014

Total deposits as of December 31, 2014 were

414,128 crore, an increase of 18.6% over December 31, 2013. Savings account deposits grew 18.6% over the previous year to reach

414,128 crore, an increase of 18.6% over December 31, 2013. Savings account deposits grew 18.6% over the previous year to reach

112,284 crore and current account deposits at

112,284 crore and current account deposits at

57,105 grew 17.6% over the previous year. CASA mix was 40.9% as at December 31, 2014. Advances as of December 31, 2014 were

57,105 grew 17.6% over the previous year. CASA mix was 40.9% as at December 31, 2014. Advances as of December 31, 2014 were

347,088 crore, an increase of 17.0% over December 31, 2013. The domestic loan growth was contributed by both retail and wholesale segments with the domestic loan mix between retail : wholesale of 51:49. Total

advances in overseas branches as of December 31, 2014 were at 7.4% of the total advances.

347,088 crore, an increase of 17.0% over December 31, 2013. The domestic loan growth was contributed by both retail and wholesale segments with the domestic loan mix between retail : wholesale of 51:49. Total

advances in overseas branches as of December 31, 2014 were at 7.4% of the total advances.

Nine months ended December 31, 2014:

For the nine months ended December 31, 2014, the Bank earned a total income of

41,896.1 crore as against

41,896.1 crore as against

36,265.2 crore in the corresponding period of the previous year. Net revenues (net interest income plus other income) for the nine months ended December 31, 2014 were

36,265.2 crore in the corresponding period of the previous year. Net revenues (net interest income plus other income) for the nine months ended December 31, 2014 were

22,815.1 crore, as against

22,815.1 crore, as against

19,448.2 crore for the nine months ended December 31, 2013, an increase of 17.3%. Net profit for the nine months ended December 31, 2014 was

19,448.2 crore for the nine months ended December 31, 2013, an increase of 17.3%. Net profit for the nine months ended December 31, 2014 was

7,409.0 crore, up by 20.4% over the corresponding nine months ended December 31, 2013.

7,409.0 crore, up by 20.4% over the corresponding nine months ended December 31, 2013.

Regd. Office: HDFC Bank Limited, HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai 400013

Capital Adequacy:

The Bank’s total Capital Adequacy Ratio (CAR) as at December 31, 2014 (computed as per Basel III guidelines) stood at 15.7% as

against a regulatory requirement of 9%. Of this, Tier-I CAR was 11.97%.

Regd. Office: HDFC Bank Limited, HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai 400013

ASSET QUALITY

Gross non-performing assets (NPAs) were at 0.99% of gross advances as on December 31, 2014, as against 1.02% as on September 30, 2014

and 1.01% as on December 31, 2013. Net non-performing assets were at 0.26% of net advances as on December 31, 2014. Total restructured loans (including applications under process for restructuring) were at 0.1% of gross advances as of

December 31, 2014 as against 0.2% as of December 31, 2013.

BUSINESS UPDATE

As of December 31, 2014, the Bank’s distribution network was at 3,659 branches and 11,633 ATMs in 2,287 cities / towns, an

increase of 323 branches and 160 ATMs over 3,336 branches and 11,473 ATMs in 2,104 cities / towns as of December 31, 2013. Number of employees increased from 68,181 as of December 31, 2013 to 76,253 as of September 30, 2014.

On February 5, 2015 the Bank made concurrent Qualified Institutions Placement (QIP) of 18,744,142 equity shares at

1,067 per equity share and a public offering of 22,000,000 American Depositary Shares (ADSs), each representing three equity shares, at a price of $ 57.76 per ADS. The aggregate funds received from these

issuances were

1,067 per equity share and a public offering of 22,000,000 American Depositary Shares (ADSs), each representing three equity shares, at a price of $ 57.76 per ADS. The aggregate funds received from these

issuances were

9,766 crore.

9,766 crore.

Note:

= Indian Rupees

= Indian Rupees

1 crore = 10 million

All figures and ratios are in accordance with Indian GAAP.

NYSE:

HDB

Certain statements are included in this release which contain words or phrases such as “will,” “aim,” “will likely

result,” “believe,” “expect,” “will continue,” “anticipate,” “estimate,” “intend,” “plan,” “contemplate,” “seek to,” “future,”

“objective,” “goal,” “project,” “should,” “will pursue” and similar expressions or variations of these expressions, that are “forward-looking statements.” Actual results may differ

materially from those suggested by the forward-looking statements due to certain risks or uncertainties associated with our expectations with respect to, but not limited to, our ability to implement our strategy successfully, the market acceptance

of and demand for various banking services, future levels of our non-performing loans, our growth and expansion, the adequacy of our allowance for credit and investment losses, technological changes, volatility in investment income, our ability to

market new products, cash flow projections, the outcome of any legal, tax or regulatory proceedings in India and in other jurisdictions we are or become a party to, the future impact of new accounting standards, our ability to pay dividends, the

impact of changes in banking regulations and other regulatory changes on us in India and other jurisdictions, our ability to roll over our short-term funding sources and our exposure to market and operational risks. By their nature, certain of the

market risk disclosures are only estimates and could be materially different from what may actually occur in the future. As a result, actual future gains, losses or impact on net income could materially differ from those that have been estimated. In

addition, other factors that could cause actual results to differ materially from those estimated by the forward-looking statements contained in this document include, but are not limited to: general economic and political conditions, instability or

uncertainty in India and the other countries which have an impact on our business activities or investments caused by any factor, including terrorist attacks in India, the United States or elsewhere, anti-terrorist or other attacks by the United

States, a United States-led coalition or any other country, tensions between India and Pakistan related to the Kashmir region or between India and China, military armament or social unrest in any part of India; the monetary and interest rate

policies of the government of India, natural calamities, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices; the performance of the financial markets in India and

globally, changes in Indian and foreign laws and regulations, including tax, accounting and banking regulations, changes in competition and the pricing environment in India, and regional or general changes in asset valuations.

Regd. Office: HDFC Bank Limited, HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai 400013

For media queries please contact:

Neeraj Jha

Head, Corporate Communication

HDFC Bank Ltd., Mumbai.

Tel: 91 - 22 - 6652 1308 (D) / 6652

1000 (B)

Mobile: +91 93236 20828

neeraj.jha@hdfcbank.com

For investor queries please contact:

Bhavin

Lakhpatwala

HDFC Bank Ltd., Mumbai.

Tel: 91 - 22 - 6652

1083 (D) / 6652 1000 (B)

Mobile: +91 74983 51730

bhavin.lakhpatwala@hdfcbank.com

Regd. Office: HDFC Bank Limited, HDFC Bank House, Senapati Bapat Marg, Lower Parel (West), Mumbai 400013

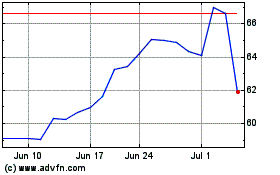

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Mar 2024 to Apr 2024

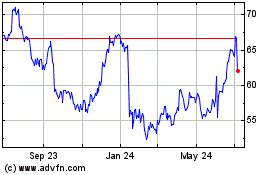

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Apr 2023 to Apr 2024