Report of Foreign Issuer (6-k)

November 28 2014 - 1:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month: November, 2014

Commission File Number

AGNICO EAGLE MINES LIMITED

(Translation of registrant’s name into English)

145 King Street East, Suite 400, Toronto, Ontario M5C 2Y7

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)( 1): o

Note: Regulation S-T Rule 101 (b)( 1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b)(7): o

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

EXHIBITS

|

Exhibit No. |

|

Exhibit Description |

|

99.1 |

|

Press Release dated November 28, 2014 announcing that the Corporation completes acquisition of Cayden Resources Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

AGNICO EAGLE MINES LIMITED |

|

|

(Registrant) |

|

|

|

|

|

|

|

Date: November 28, 2014 |

By: |

/s/ R. Gregory Laing |

|

|

|

R. Gregory Laing |

|

|

|

General Counsel, Sr. Vice-President, Legal |

|

|

|

and Corporate Secretary |

2

Exhibit 99.1

|

Stock Symbol: |

AEM (NYSE and TSX) |

AGNICO EAGLE COMPLETES ACQUISITION OF CAYDEN RESOURCES INC.

Toronto (November 28, 2014) — Agnico Eagle Mines Limited (NYSE:AEM, TSX:AEM) (“Agnico Eagle” or the “Company”) is pleased to announce today the completion of the previously announced plan of arrangement (the “Arrangement”) pursuant to which Agnico Eagle has acquired 100% of the issued and outstanding common shares of Cayden Resources Inc. (“Cayden”), including common shares issuable on the exercise of outstanding options and warrants of Cayden. Cayden is now a wholly-owned subsidiary of Agnico Eagle.

The Arrangement was approved at a special meeting held for Cayden securityholders on October 27, 2014 by approximately 99.0% of the votes cast by securityholders. Final approval for the Arrangement was obtained from the Supreme Court of British Columbia on October 29, 2014, and Mexican anti-trust approval was obtained on November 12, 2014.

As a result, Cayden’s common shares will be delisted from the TSX Venture Exchange and Agnico Eagle will apply to the relevant securities commissions for Cayden to cease to be a reporting issuer under Canadian securities laws.

“Cayden’s management did a commendable job of creating shareholder value through its portfolio of Mexican properties. With the acquisition of Cayden now completed, Agnico Eagle looks forward to further advancing the El Barqueno gold project through focused exploration,” said Sean Boyd, President and Chief Executive Officer of Agnico Eagle. “A $15 million exploration program is anticipated in 2015 with the intent of delineating an initial resource estimate to further enhance shareholder value,” added Mr. Boyd.

Former Cayden President and CEO, Ivan Bebek commented “I would like to thank the entire Cayden team for their efforts which resulted in the favorable transaction. On behalf of the company, I would like to thank all of our shareholders who financed and supported us since the inception of Cayden and congratulate Agnico Eagle on the acquisition of Cayden and its robust projects.”

The Arrangement

Under the Arrangement, each Cayden common share was exchanged for 0.09 of an Agnico Eagle share and C$0.01 in cash.

1

Full details of the Arrangement and certain other matters are set out in the management information circular of Cayden dated September 26, 2014 (the “Information Circular”). A copy of the Information Circular can be found under Cayden’s profile on SEDAR at www.sedar.com.

Cayden shareholders who have questions or who may need assistance with the completion of letters of transmittal are advised to contact Computershare Investor Services Inc., the depository for the Arrangement, at:

North American Toll Free: 1-800-564-6253

Email: corporateactions@computershare.com

About Agnico Eagle

Agnico Eagle is a senior Canadian gold mining company that has produced precious metals since 1957. Its nine mines are located in Canada, Finland and Mexico, with exploration and development activities in each of these regions as well as in the United States. The Company and its shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. Agnico Eagle has declared a cash dividend every year since 1983.

Further Information

For further information regarding Agnico Eagle, contact Investor Relations at info@agnicoeagle.com or call (416) 947-1212.

Forward-Looking Statements

The information in this document has been prepared as at November 28, 2014. Certain statements contained in this document constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward looking information under the provisions of Canadian provincial securities laws and are referred to herein as forward-looking statements. When used in this document, the words “anticipate”, “believe”, “expect”, “estimate”, “forecast”, “intend”, “will”, “planned”, and similar expressions are intended to identify forward-looking statements or information. Such statements include without limitation: statements regarding Agnico Eagle’s intention to delist the Cayden common shares and cause Cayden to cease being a reporting issuer; and to conduct a $15 million exploration program at El Barqueno. Such statements and information reflect Agnico Eagle’s views as at the date of this document and are subject to certain risks, uncertainties and assumptions, and undue reliance should not be placed on such statements and information. Many factors, known and unknown could cause the actual results to be materially different from those expressed or implied by such forward looking statements. Such risks include, but are not limited to: the volatility of prices of gold and other metals; uncertainty of mineral reserves, mineral resources, mineral grades and mineral recovery estimates; uncertainty of future production, capital expenditures, and other costs; currency fluctuations; financing of additional capital requirements; cost of exploration and development programs; mining

2

risks; community protests; risks associated with foreign operations; governmental and environmental regulation; the volatility of stock prices; and risks associated with byproduct metal derivative strategies. For a more detailed discussion of such risks and other factors that may affect Agnico Eagle’s ability to achieve the expectations set forth in the forward-looking statements contained in this document, see Agnico Eagle’s Annual Information Form for the year ended December 31, 2013 filed on SEDAR at www.sedar.com and included in Agnico Eagle’s Form 40-F for the year ended December 31, 2013 filed on EDGAR at www.sec.gov and Cayden’s Annual Information Form for the year ended December 31, 2013 filed on SEDAR at www.sedar.com, as well as both of Agnico Eagle’s and Cayden’s other filings with the Canadian securities regulators and Agnico Eagle’s filings with the U.S. Securities and Exchange Commission (the “SEC”). Agnico Eagle does not intend, nor does it they assume any obligation, to update these forward-looking statements and information. For a detailed breakdown of Agnico Eagle’s reserve and resource position see Agnico Eagle’s Annual Information Form or Form 40-F.

3

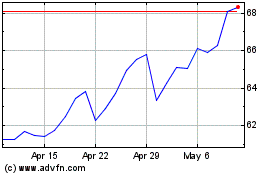

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

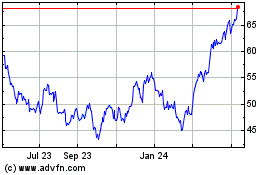

Agnico Eagle Mines (NYSE:AEM)

Historical Stock Chart

From Apr 2023 to Apr 2024