Report of Foreign Issuer (6-k)

November 21 2014 - 6:02AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Issuer

Pursuant to Section 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

|

For the month of: November, 2014 |

Commission File Number: 001-12384 |

SUNCOR ENERGY INC.

(Name of registrant)

150-6th Avenue S.W.

P.O. Box 2844

Calgary, Alberta,

Canada T2P 3E3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F þ

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

SUNCOR ENERGY INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: November 20, 2014 |

By: |

/s/ Shawn Poirier |

|

|

|

Name: Shawn Poirier |

|

|

|

Title: Assistant Corporate Secretary |

EXHIBIT INDEX

Exhibit Description of Exhibit

1. Press Release, dated November 20, 2014.

Exhibit 99.1

|

|

News Release |

|

|

|

FOR IMMEDIATE RELEASE

Suncor Energy announces pricing of US$750 million notes offering

Calgary, Alberta (November 20, 2014) – Suncor Energy announced today that it has priced an offering of US$750 million in aggregate principal amount of senior unsecured notes due on December 1, 2024 (the “2024 Notes). The 2024 Notes will have a coupon of 3.60%. The offering is expected to close on November 25, 2014, subject to customary closing conditions.

Suncor Energy intends to use the net proceeds from the sale of the 2024 Notes to replenish cash balances following the recent repayment of outstanding indebtedness. Such net proceeds will subsequently be used to fund Suncor Energy’s capital program and for general corporate purposes

The offering is being made pursuant to an effective shelf registration statement in the United States. Morgan Stanley & Co. LLC, Citigroup Global Markets Inc., HSBC Securities (USA) Inc., BNP Paribas Securities Corp. and RBS Securities Inc. are acting as joint book running managers for the offering.

A copy of the prospectus supplement and the accompanying prospectus for the offering may be obtained by contacting Morgan Stanley & Co. LLC by telephone at 1-866-718-1649 (toll free); Citigroup Global Markets Inc. by telephone at 1-800-831-9146 (toll free); HSBC Securities (USA) Inc. by telephone at 1-866-811-8049 (toll free); BNP Paribas Securities Corp. by telephone at 1-800-854-5674 (toll free) and RBS Securities Inc. by telephone at 1-866-884-2071 (toll free).

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor will there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Certain statements in this news release constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation (collectively, “forward-looking statements”). All forward-looking statements are based on Suncor’s current expectations, estimates, projections, beliefs and assumptions based on information available at the time the statement was made and in light of Suncor’s experience and its perception of historical trends.

Forward-looking statements in this news release include references to the offering, which is expected to close on November XXX, 2014. Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to our company. Suncor’s actual results may differ materially from those expressed or implied by our forward-looking statements and you are cautioned not to place undue reliance on them.

Suncor’s Earnings Release, Quarterly Report and Management’s Discussion & Analysis for the third quarter of 2014 and its most recently filed Annual Information Form/Form 40-F, Annual Report to Shareholders and other documents it files from time to time with securities regulatory authorities describe the risks, uncertainties, material assumptions and other factors that could influence actual results and such factors are incorporated herein by reference. Copies of these documents are available without charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta T2P 3Y7, by calling 1-800-558-9071, or by email request to info@suncor.com or by referring to

|

|

Suncor Energy

150 6 Avenue S.W. Calgary, Alberta T2P 3E3

suncor.com |

the company’s profile on SEDAR at sedar.com or EDGAR at sec.gov. Except as required by applicable securities laws, Suncor disclaims any intention or obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Suncor Energy is Canada’s leading integrated energy company. Suncor’s operations include oil sands development and upgrading, conventional and offshore oil and gas production, petroleum refining, and product marketing under the Petro-Canada brand. A member of Dow Jones Sustainability indexes, FTSE4Good and CDP, Suncor is working to responsibly develop petroleum resources while also growing a renewable energy portfolio. Suncor is listed on the UN Global Compact 100 stock index and the Corporate Knights’ Global 100. Suncor’s common shares (symbol: SU) are listed on the Toronto and New York stock exchanges.

– 30 –

For more information about Suncor Energy visit our web site at suncor.com, follow us on Twitter @SuncorEnergy, read our blog, OSQAR or come and See what Yes can do.

Media inquiries:

403-296-4000

media@suncor.com

Investor inquiries:

800-558-9071

invest@suncor.com

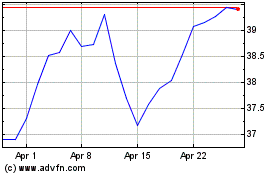

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Apr 2023 to Apr 2024