RBA Holds Record Low Rate; Sees Strong Aussie Complicating Economy's Transition

April 04 2016 - 11:37PM

RTTF2

Australia's central bank retained its record low interest rate

for the tenth straight meeting on Tuesday but cautioned that

appreciation of currency could complicate the transition of the

economy.

The policy board of the Reserve Bank of Australia, headed by

Glenn Stevens, left the cash rate unchanged at 2.00 percent.

Policymakers judged that there were reasonable prospects for

continued growth in the economy, with inflation close to target.

The board decided that the current setting of monetary policy

remained appropriate.

The economy expanded at a faster pace of 3 percent in the fourth

quarter. The available information suggests that the economy is

continuing to rebalance following the mining investment boom.

"New information should allow the Board to assess the outlook

for inflation and whether the improvement in labor market

conditions evident last year is continuing," the bank said.

Continued low inflation would provide scope for easier policy,

should that be appropriate to lend support to demand, the RBA

reiterated.

The Australian dollar strengthened recently partly reflecting

some increase in commodity prices and monetary developments

elsewhere in the world. An appreciating exchange rate could

complicate the adjustment under way in the economy, the bank

said.

Today's statement certainly does not identify a trigger level

for the AUD to elicit a policy response, Bill Evans at Westpac

said. The economist does not envisage a further significant surge

in the AUD and remain comfortable with a steady policy outlook.

On global front, the RBA said the world economy is continuing to

grow, though at a slightly lower pace than earlier expected. At the

same time, China's growth rate continued to moderate.

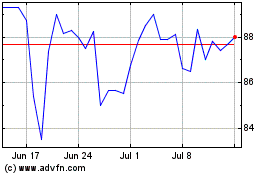

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Mar 2024 to Apr 2024

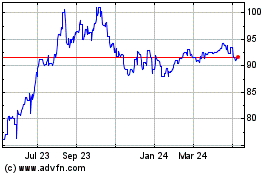

US Dollar vs RUB (FX:USDRUB)

Forex Chart

From Apr 2023 to Apr 2024