UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

or

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

.

Commission File Number 001-34735

RYERSON

HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

| DELAWARE |

|

26-1251524 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

227 W. Monroe St., 27th Floor

Chicago, Illinois 60606

(Address of principal executive offices)

(312) 292-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act

of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past

90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

x |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ¨ No x

APPLICABLE ONLY TO CORPORATE ISSUERS:

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of May 5, 2015 there were 32,037,500 shares of Common Stock, par value $0.01 per share, outstanding.

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

INDEX

2

PART I. FINANCIAL INFORMATION

| Item 1. |

Financial Statements |

RYERSON HOLDING CORPORATION AND

SUBSIDIARY COMPANIES

Condensed Consolidated Statements of Comprehensive Income (Unaudited)

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Net sales |

|

$ |

868.0 |

|

|

$ |

874.4 |

|

| Cost of materials sold |

|

|

718.0 |

|

|

|

726.7 |

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

150.0 |

|

|

|

147.7 |

|

| Warehousing, delivery, selling, general and administrative |

|

|

116.4 |

|

|

|

117.8 |

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

|

33.6 |

|

|

|

29.9 |

|

| Other income and (expense), net |

|

|

(11.3 |

) |

|

|

2.0 |

|

| Interest and other expense on debt |

|

|

(25.3 |

) |

|

|

(27.4 |

) |

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

(3.0 |

) |

|

|

4.5 |

|

| Provision (benefit) for income taxes |

|

|

(0.2 |

) |

|

|

3.1 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

(2.8 |

) |

|

|

1.4 |

|

| Less: Net loss attributable to noncontrolling interest |

|

|

(0.3 |

) |

|

|

(0.2 |

) |

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

(2.5 |

) |

|

$ |

1.6 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss |

|

$ |

(9.1 |

) |

|

$ |

(5.6 |

) |

| Less: Comprehensive loss attributable to noncontrolling interest |

|

|

(0.3 |

) |

|

|

(0.2 |

) |

|

|

|

|

|

|

|

|

|

| Comprehensive loss attributable to Ryerson Holding Corporation |

|

$ |

(8.8 |

) |

|

$ |

(5.4 |

) |

|

|

|

|

|

|

|

|

|

| Basic and diluted earnings (loss) per share |

|

$ |

(0.08 |

) |

|

$ |

0.08 |

|

|

|

|

|

|

|

|

|

|

See Notes to Condensed Consolidated Financial Statements

3

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In millions)

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| |

|

2015 |

|

|

2014 |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

(2.8 |

) |

|

$ |

1.4 |

|

|

|

|

|

|

|

|

|

|

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

11.1 |

|

|

|

10.8 |

|

| Deferred income taxes |

|

|

(1.0 |

) |

|

|

5.1 |

|

| Provision for allowances, claims and doubtful accounts |

|

|

1.5 |

|

|

|

0.9 |

|

| Loss on retirement of debt |

|

|

0.5 |

|

|

|

— |

|

| Other-than-temporary impairment charge on available-for-sale investments |

|

|

12.3 |

|

|

|

— |

|

| Other items |

|

|

(0.2 |

) |

|

|

(0.1 |

) |

| Change in operating assets and liabilities, net of the effects of acquisitions: |

|

|

|

|

|

|

|

|

| Receivables |

|

|

(16.9 |

) |

|

|

(53.8 |

) |

| Inventories |

|

|

70.8 |

|

|

|

25.1 |

|

| Other assets |

|

|

2.5 |

|

|

|

0.2 |

|

| Accounts payable |

|

|

31.9 |

|

|

|

30.0 |

|

| Accrued liabilities |

|

|

6.8 |

|

|

|

21.9 |

|

| Accrued taxes payable/receivable |

|

|

(1.3 |

) |

|

|

(3.1 |

) |

| Deferred employee benefit costs |

|

|

(13.6 |

) |

|

|

(13.3 |

) |

|

|

|

|

|

|

|

|

|

| Net adjustments |

|

|

104.4 |

|

|

|

23.7 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

101.6 |

|

|

|

25.1 |

|

|

|

|

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

(5.7 |

) |

|

|

(3.4 |

) |

| Proceeds from sales of property, plant and equipment |

|

|

0.1 |

|

|

|

0.1 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(5.6 |

) |

|

|

(3.3 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

| Repayment of debt |

|

|

(30.3 |

) |

|

|

— |

|

| Net repayments of short-term borrowings |

|

|

(26.9 |

) |

|

|

(19.8 |

) |

| Net increase (decrease) in book overdrafts |

|

|

(25.1 |

) |

|

|

25.0 |

|

| Principal payments on capital lease obligation |

|

|

(0.4 |

) |

|

|

(0.2 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

(82.7 |

) |

|

|

5.0 |

|

|

|

|

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

13.3 |

|

|

|

26.8 |

|

| Effect of exchange rate changes on cash and cash equivalents |

|

|

(2.5 |

) |

|

|

(3.8 |

) |

|

|

|

|

|

|

|

|

|

| Net change in cash and cash equivalents |

|

|

10.8 |

|

|

|

23.0 |

|

| Cash and cash equivalents—beginning of period |

|

|

60.0 |

|

|

|

74.4 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents—end of period |

|

$ |

70.8 |

|

|

$ |

97.4 |

|

|

|

|

|

|

|

|

|

|

| Supplemental disclosures: |

|

|

|

|

|

|

|

|

| Cash paid during the period for: |

|

|

|

|

|

|

|

|

| Interest paid to third parties |

|

$ |

5.2 |

|

|

$ |

3.5 |

|

| Income taxes, net |

|

|

0.9 |

|

|

|

0.4 |

|

| Noncash investing activities: |

|

|

|

|

|

|

|

|

| Asset additions under capital leases |

|

$ |

1.1 |

|

|

$ |

2.7 |

|

See Notes to Condensed Consolidated Financial Statements.

4

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Condensed Consolidated Balance Sheets

(In millions, except shares)

|

|

|

|

|

|

|

|

|

| |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

| |

|

(unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

70.8 |

|

|

$ |

60.0 |

|

| Restricted cash |

|

|

2.0 |

|

|

|

2.0 |

|

| Receivables less provision for allowances, claims and doubtful accounts of $6.6 in 2015 and $5.3 in 2014 |

|

|

412.7 |

|

|

|

400.8 |

|

| Inventories |

|

|

663.3 |

|

|

|

738.9 |

|

| Prepaid expenses and other current assets |

|

|

33.3 |

|

|

|

39.7 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,182.1 |

|

|

|

1,241.4 |

|

| Property, plant, and equipment, at cost |

|

|

656.7 |

|

|

|

654.5 |

|

| Less: Accumulated depreciation |

|

|

236.6 |

|

|

|

228.7 |

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

|

420.1 |

|

|

|

425.8 |

|

| Deferred income taxes |

|

|

130.7 |

|

|

|

134.1 |

|

| Other intangible assets |

|

|

49.2 |

|

|

|

50.9 |

|

| Goodwill |

|

|

101.3 |

|

|

|

102.7 |

|

| Deferred charges and other assets |

|

|

19.8 |

|

|

|

22.0 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

1,903.2 |

|

|

$ |

1,976.9 |

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

226.9 |

|

|

$ |

220.8 |

|

| Salaries, wages and commissions |

|

|

31.8 |

|

|

|

45.1 |

|

| Deferred income taxes |

|

|

104.2 |

|

|

|

106.7 |

|

| Other accrued liabilities |

|

|

69.9 |

|

|

|

51.9 |

|

| Short-term debt |

|

|

32.0 |

|

|

|

66.6 |

|

| Current portion of deferred employee benefits |

|

|

11.0 |

|

|

|

11.1 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

475.8 |

|

|

|

502.2 |

|

| Long-term debt |

|

|

1,170.4 |

|

|

|

1,192.5 |

|

| Deferred employee benefits |

|

|

368.6 |

|

|

|

385.2 |

|

| Taxes and other credits |

|

|

23.4 |

|

|

|

22.9 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

2,038.2 |

|

|

|

2,102.8 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Redeemable noncontrolling interest |

|

|

0.8 |

|

|

|

1.0 |

|

| Equity |

|

|

|

|

|

|

|

|

| Ryerson Holding Corporation stockholders’ equity (deficit): |

|

|

|

|

|

|

|

|

| Preferred Stock, $0.01 par value; 7,000,000 shares authorized and no shares issued at 2015 and 2014 |

|

|

— |

|

|

|

— |

|

| Common stock, $0.01 par value; 100,000,000 shares authorized and 32,250,000 shares issued at 2015 and 2014 |

|

|

0.3 |

|

|

|

0.3 |

|

| Capital in excess of par value |

|

|

302.0 |

|

|

|

302.0 |

|

| Accumulated deficit |

|

|

(135.3 |

) |

|

|

(132.8 |

) |

| Treasury stock at cost – Common stock of 212,500 shares in 2015 and 2014 |

|

|

(6.6 |

) |

|

|

(6.6 |

) |

| Accumulated other comprehensive loss |

|

|

(297.7 |

) |

|

|

(291.4 |

) |

|

|

|

|

|

|

|

|

|

| Total Ryerson Holding Corporation stockholders’ equity (deficit) |

|

|

(137.3 |

) |

|

|

(128.5 |

) |

| Noncontrolling interest |

|

|

1.5 |

|

|

|

1.6 |

|

|

|

|

|

|

|

|

|

|

| Total equity (deficit) |

|

|

(135.8 |

) |

|

|

(126.9 |

) |

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

1,903.2 |

|

|

$ |

1,976.9 |

|

|

|

|

|

|

|

|

|

|

See Notes to Condensed Consolidated Financial Statements.

5

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES

Notes to Condensed Consolidated Financial Statements (Unaudited)

NOTE 1: FINANCIAL STATEMENTS

Ryerson Holding Corporation (“Ryerson”), a Delaware corporation, is the parent company of Joseph T.

Ryerson & Son, Inc. (“JT Ryerson”), a Delaware corporation. Affiliates of Platinum Equity, LLC (“Platinum”) own approximately 21,037,500 shares of our common stock, which is approximately 66% of our issued and

outstanding common stock.

Ryerson conducts materials distribution operations in the United States through JT Ryerson, in Canada through

its indirect wholly-owned subsidiary Ryerson Canada, Inc., a Canadian corporation (“Ryerson Canada”) and in Mexico through its indirect wholly-owned subsidiary Ryerson Metals de Mexico, S. de R.L. de C.V., a Mexican corporation

(“Ryerson Mexico”). In addition to our North American operations, we conduct materials distribution operations in China through Ryerson China Limited (“Ryerson China”), and in Brazil through Açofran Aços e Metais

Ltda (“Açofran”), a company in which we have a 50% direct ownership percentage. Unless the context indicates otherwise, Ryerson, JT Ryerson, Ryerson Canada, Ryerson China, Ryerson Mexico and Açofran together with their

subsidiaries, are collectively referred to herein as “Ryerson,” “we,” “us,” “our,” or the “Company.”

On July 23, 2014, our Board of Directors approved a 4.25 for 1.00 stock split of the Company’s common stock effective

August 5, 2014. Per share and share amounts presented herein have been adjusted for all periods presented to give retroactive effect to 4.25 for 1.00 stock split.

On August 13, 2014, Ryerson completed an initial public offering of 11 million shares of common stock at a price to the public of

$11.00 per share. Net proceeds from the offering totaled $112.4 million, after deducting the underwriting discount and offering expenses, and were used to (i) redeem $99.5 million in aggregate principal amount of the 11 1⁄4% Senior Notes due 2018 (the “2018 Notes”), (ii) pay Platinum Equity Advisors, LLC (“Platinum Advisors”) and its affiliates $15.0

million of the $25.0 million owed as consideration for terminating the advisory services agreement between JT Ryerson and Platinum Advisors, an affiliate of Platinum (the remaining $10.0 million will be paid in August 2015) and (iii) pay

related transaction fees, expenses and debt redemption premiums in connection with the offering, which were approximately $11.2 million. We borrowed an additional $23.3 million under our amended and restated $1.35 billion revolving credit facility

(the “Ryerson Credit Facility”) as part of the funding of these transactions.

The following table shows our percentage of sales

by major product lines for the three months ended March 31, 2015 and 2014, respectively:

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

March 31, |

|

| Product Line |

|

2015 |

|

|

2014 |

|

| Carbon Steel Flat |

|

|

23 |

% |

|

|

26 |

% |

| Carbon Steel Plate |

|

|

11 |

|

|

|

11 |

|

| Carbon Steel Long |

|

|

17 |

|

|

|

17 |

|

| Stainless Steel Flat |

|

|

16 |

|

|

|

15 |

|

| Stainless Steel Plate |

|

|

4 |

|

|

|

4 |

|

| Stainless Steel Long |

|

|

4 |

|

|

|

3 |

|

| Aluminum Flat |

|

|

16 |

|

|

|

14 |

|

| Aluminum Plate |

|

|

3 |

|

|

|

3 |

|

| Aluminum Long |

|

|

4 |

|

|

|

4 |

|

| Other |

|

|

2 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

100 |

% |

|

|

100 |

% |

|

|

|

|

|

|

|

|

|

Results of operations for any interim period are not necessarily indicative of results of any other periods or

for the year. The financial statements as of March 31, 2015 and for the three-month periods ended March 31, 2015 and 2014 are unaudited, but in the opinion of management include all adjustments, consisting of normal recurring adjustments,

necessary for a fair presentation of results for such periods. The year-end condensed consolidated balance sheet data contained in this report was derived from audited financial statements, but does not include all disclosures required by accounting

principles generally accepted in the United States of America. These financial statements should be read in conjunction with the financial statements and related notes contained in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2014.

6

NOTE 2: RECENT ACCOUNTING PRONOUNCEMENTS

In April 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update

(“ASU”) 2014-08 “Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” This update amends the criteria for reporting discontinued operations to, among other things, raise the threshold

for disposals to qualify as discontinued operations. Under the revised standard, a discontinued operation must represent a strategic shift that has or will have a major effect on an entity’s operations and financial results. The revised

standard will also allow an entity to have certain continuing cash flows or involvement with the component after the disposal. This update is effective for interim and annual reporting periods, beginning after December 15, 2014, with early

adoption permitted. We adopted this guidance for our fiscal year beginning January 1, 2015. The adoption did not have a material impact on our financial statements.

In May 2014, the FASB issued ASU 2014-09 “Revenue from Contracts with Customers”, which creates ASC 606 “Revenue from

Contracts with Customers” and supersedes the revenue recognition requirements in ASC 605 “Revenue Recognition”. The update outlines a comprehensive model for all entities to use in accounting for revenue arising from

contracts with customers as well as required disclosures. Entities have the option of using either a full retrospective or modified approach to adopt the new guidance. This update is effective for annual reporting periods beginning after

December 15, 2016. We will adopt this guidance for our fiscal year beginning January 1, 2017. We have not decided upon the method of adoption and we are still evaluating the impact the new standard will have, if any, to our financial

statements.

In August 2014, the FASB issued ASU 2014-15 “Presentation of Financial Statements – Going Concern (Subtopic

205-40), Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern.” The guidance in ASU 2014-15 sets forth management’s responsibility to evaluate whether there is substantial doubt about an

entity’s ability to continue as a going concern as well as required disclosures. ASU 2014-15 indicates that, when preparing financial statements for interim and annual periods, management should evaluate whether conditions or events, in the

aggregate, raise substantial doubt about the entity’s ability to continue as a going concern one year from the date the financial statements are issued or are available to be issued. This evaluation should include consideration of conditions

and events that are either known or are reasonably knowable at the date the financial statements are issued or are available to be issued, as well as whether it is probable that management’s plans to address the substantial doubt will be

implemented and, if so, whether it is probable that the plans will alleviate the substantial doubt. ASU 2014-15 is effective for annual periods ending after December 15, 2016, and interim periods and annual periods thereafter. Early adoption is

permitted. We will adopt this guidance for our fiscal year ending December 31, 2016. The adoption of this guidance is not expected to have an impact on our financial statements.

In April 2015, the FASB issued ASU 2015-03, “Interest - Imputation of Interest (Subtopic 835-30): Simplifying the

Presentation of Debt Issuance Costs.” The update requires debt issuance costs related to a recognized debt liability to be presented in the balance sheet as a direct deduction from the carrying amount of the related debt liability

instead of being presented as an asset. Debt disclosures will include the face amount of the debt liability and the effective interest rate. The update requires retrospective application and represents a change in accounting principle. The update is

effective for fiscal years beginning after December 15, 2015. Early adoption is permitted for financial statements that have not been previously issued. If the Company adopted this guidance as of March 31, 2015, the impact of the ASU would

result in the reclassification of approximately $15 million of capitalized debt issuance costs from non-current deferred charges and other assets to long-term debt. We will adopt this guidance for our fiscal year beginning January 1, 2016.

In April 2015, the FASB issued ASU 2015-05, “Intangibles - Goodwill and Other - Internal-Use Software (Subtopic 350-40):

Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement.” The amendments in this update provide guidance to customers about whether a cloud computing arrangement includes a software license. If a cloud computing

arrangement includes a software license, the update specifies that the customer should account for the software license element of the arrangement consistent with the acquisition of other software licenses. The update further specifies that the

customer should account for a cloud computing arrangement as a service contract if the arrangement does not include a software license. ASU 2015-05 is effective for annual periods, including interim periods within those annual periods, beginning

after December 15, 2015. Early adoption is permitted. We will adopt this guidance for our fiscal year beginning January 1, 2016. The adoption of this guidance is not expected to have an impact on our financial statements.

NOTE 3: INVENTORIES

The Company primarily uses the last-in, first-out (LIFO) method of valuing inventory. Interim LIFO calculations are based on

actual inventory levels.

7

Inventories, at stated LIFO value, were classified at March 31, 2015 and December 31,

2014 as follows:

|

|

|

|

|

|

|

|

|

| |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

| |

|

(In millions) |

|

| In process and finished products |

|

$ |

663.3 |

|

|

$ |

738.9 |

|

If current cost had been used to value inventories, such inventories would have been $37 million and $25

million lower than reported at March 31, 2015 and December 31, 2014, respectively. Approximately 89% and 90% of inventories are accounted for under the LIFO method at March 31, 2015 and December 31, 2014,

respectively. Non-LIFO inventories consist primarily of inventory at our foreign facilities using the weighted-average cost and the specific cost methods. Substantially all of our inventories consist of finished products.

The Company has consignment inventory at certain customer locations, which totaled $10.6 million and $10.0 million at March 31, 2015 and

December 31, 2014, respectively.

NOTE 4: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill, which represents the excess of cost over the fair value of net assets acquired, amounted to $101.3 million at

March 31, 2015. Pursuant to ASC 350, “Intangibles – Goodwill and Other,” we review the recoverability of goodwill annually as of October 1 or whenever significant events or changes occur which might impair the

recovery of recorded amounts. The most recently completed impairment test of goodwill was performed as of October 1, 2014 and it was determined that no impairment existed. Other intangible assets with finite useful lives continue to be

amortized over their useful lives. We review the recoverability of our long-lived assets whenever events or changes in circumstances indicate the carrying amount of such assets may not be recoverable.

NOTE 5: ACQUISITIONS

Fay Industries

On

December 31, 2014, the Company acquired all of the issued and outstanding capital stock of Fay Industries, Inc. and the membership interests of Fay Group, Ltd. (collectively, “Fay”). Fay is a distributor of long products,

predominantly processed bars, and is based in Strongsville, Ohio. The acquisition is not material to our consolidated financial statements.

NOTE 6: LONG-TERM DEBT

Long-term debt consisted of the following at March 31, 2015 and December 31, 2014:

|

|

|

|

|

|

|

|

|

| |

|

March 31,

2015 |

|

|

December 31,

2014 |

|

| |

|

(In millions) |

|

| Ryerson Secured Credit Facility |

|

$ |

407.0 |

|

|

$ |

435.0 |

|

| 9% Senior Secured Notes due 2017 |

|

|

583.2 |

|

|

|

600.0 |

|

| 11 1⁄4% Senior Notes due 2018 |

|

|

187.5 |

|

|

|

200.5 |

|

| Foreign debt |

|

|

24.7 |

|

|

|

23.6 |

|

|

|

|

|

|

|

|

|

|

| Total debt |

|

|

1,202.4 |

|

|

|

1,259.1 |

|

| Less: |

|

|

|

|

|

|

|

|

| Short-term credit facility borrowings |

|

|

7.3 |

|

|

|

43.0 |

|

| Foreign debt |

|

|

24.7 |

|

|

|

23.6 |

|

|

|

|

|

|

|

|

|

|

| Total long-term debt |

|

$ |

1,170.4 |

|

|

$ |

1,192.5 |

|

|

|

|

|

|

|

|

|

|

Ryerson Credit Facility

On April 3, 2013, Ryerson amended and restated its $1.35 billion revolving credit facility agreement (as amended and restated, the

“Ryerson Credit Facility”), to, among other things, extend the maturity date to the earlier of (a) April 3, 2018 or (b) August 16, 2017 (60 days prior to the scheduled maturity date of the 9% Senior Secured Notes due

October 15, 2017 (“2017 Notes”)), if the 2017 Notes are then outstanding. At March 31, 2015, the Company had $407.0 million of outstanding borrowings, $20 million of letters of credit issued and $235 million available under the

$1.35 billion Ryerson Credit Facility compared to $435.0 million of outstanding borrowings, $20 million of letters of credit issued and $245 million available at December 31, 2014. Total credit availability is limited by the amount of eligible

accounts receivable and inventory pledged as collateral under the agreement insofar as the Company is subject to a borrowing base comprised of the aggregate of these two amounts, less applicable reserves.

8

Eligible accounts receivable, at any date of determination, are comprised of the aggregate value of all accounts directly created by a borrower in the ordinary course of business arising out of

the sale of goods or the rendition of services, each of which has been invoiced, with such receivables adjusted to exclude various ineligible accounts, including, among other things, those to which a borrower does not have sole and absolute title

and accounts arising out of a sale to an employee, officer, director, or affiliate of a borrower. Eligible inventory, at any date of determination, is comprised of the aggregate value of all inventory owned by a borrower, with such inventory

adjusted to exclude various ineligible inventory, including, among other things, any inventory that is classified as “supplies” or is unsaleable in the ordinary course of business and 50% of the value of any inventory that (i) has not

been sold or processed within a 180 day period and (ii) which is calculated to have more than 365 days of supply based upon the immediately preceding 6 months consumption. The weighted average interest rate on the borrowings under the Ryerson

Credit Facility was 2.2 percent and 2.0 percent at March 31, 2015 and December 31, 2014, respectively.

The total $1.35 billion

revolving credit facility has an allocation of $1.215 billion to the Company’s subsidiaries in the United States and an allocation of $135 million to Ryerson Canada. Amounts outstanding under the U.S. facility bear interest at a rate determined

by reference to the base rate (Bank of America’s prime rate) or a LIBOR rate or, for the Canadian facility a rate determined by reference to the Canadian base rate (Bank of America-Canada Branch’s “Base Rate” for loans in U.S.

Dollars in Canada) or the BA rate (average annual rate applicable to Canadian Dollar bankers’ acceptances) or a LIBOR rate and the Canadian prime rate (Bank of America-Canada Branch’s “Prime Rate.”). The spread over the base rate

and Canadian prime rate is between 0.50% and 1.00% and the spread over the LIBOR and for the bankers’ acceptances is between 1.50% and 2.00%, depending on the amount available to be borrowed. Overdue amounts and all amounts owed during the

existence of a default bear interest at 2% above the rate otherwise applicable thereto. The Company also pays commitment fees on amounts not borrowed at a rate between 0.25% and 0.375% depending on the average borrowings as a percentage of the total

$1.35 billion agreement during a rolling three month period.

Borrowings under the Ryerson Credit Facility are secured by (i) in the

case of the U.S. facility, first-priority liens on all of the inventory, accounts receivable, lockbox accounts (excluding any proceeds therein of collateral securing the 2017 Notes on a first priority lien basis) and related U.S. assets of JT

Ryerson, the other U.S. subsidiary borrowers and certain other U.S. subsidiaries of the Company that act as guarantors, and (ii) in the case of the Canadian facility, the assets securing the U.S. Facility and also first priority liens on all of

the inventory, accounts receivable, lockbox accounts and related assets of Ryerson’s Canadian subsidiary borrower and its Canadian subsidiaries that act as guarantors thereof.

The Ryerson Credit Facility contains covenants that, among other things, restrict the Company and its subsidiaries with respect to the

incurrence of debt, the creation of liens, transactions with affiliates, mergers and consolidations, sales of assets and acquisitions. The Ryerson Credit Facility also requires that, if availability under such facility falls below a certain level,

the Company maintain a minimum fixed charge coverage ratio as of the end of each calendar month.

The Ryerson Credit Facility contains

events of default with respect to, among other things, default in the payment of principal when due or the payment of interest, fees and other amounts due thereunder after a specified grace period, material misrepresentations, failure to perform

certain specified covenants, certain bankruptcy events, the invalidity of certain security agreements or guarantees, material judgments and the occurrence of a change of control of the Company. If such an event of default occurs, the lenders under

the Ryerson Credit Facility will be entitled to various remedies, including acceleration of amounts outstanding under the Ryerson Credit Facility and all other actions permitted to be taken by secured creditors.

The lenders under the Ryerson Credit Facility have the ability to reject a borrowing request if any event, circumstance or development has

occurred that has had or could reasonably be expected to have a material adverse effect on the Company. If JT Ryerson or any significant subsidiaries of the other borrowers becomes insolvent or commences bankruptcy proceedings, all amounts borrowed

under the Ryerson Credit Facility will become immediately due and payable.

Proceeds from borrowings under the Ryerson Credit Facility and

repayments of borrowings thereunder that are reflected in the Consolidated Statements of Cash Flows represent borrowings under the Company’s revolving credit agreement with original maturities greater than three months. Net proceeds

(repayments) under the Ryerson Credit Facility represent borrowings under the Ryerson Credit Facility with original maturities less than three months.

2017 and 2018 Notes

On October 10,

2012, JT Ryerson issued $600 million in aggregate principal amount of the 2017 Notes and $300 million in aggregate principal amount of the 2018 Notes (together with the 2017 Notes, the “2017 and 2018 Notes”). The 2017 Notes bear interest

at a rate of 9% per annum. The 2018 Notes bear interest at a rate of 11.25% per annum. The 2017 Notes are fully and unconditionally guaranteed on a senior secured basis and the 2018 Notes are fully and unconditionally guaranteed on a

senior unsecured basis by all of our existing and future domestic subsidiaries that are co-borrowers or that have guarantee obligations under the Ryerson Credit Facility.

9

The 2017 Notes and related guarantees are secured by a first-priority lien on substantially all

of our and our guarantors’ present and future assets located in the United States (other than receivables, inventory, related general intangibles, certain other assets and proceeds thereof), subject to certain exceptions and customary permitted

liens. The 2017 Notes and related guarantees are secured on a second-priority basis by a lien on the assets that secure our obligations under the Ryerson Credit Facility. The 2018 Notes are not secured. The 2017 and 2018 Notes contain customary

covenants that, among other things, limit, subject to certain exceptions, our ability, and the ability of our restricted subsidiaries, to incur additional indebtedness, pay dividends on our capital stock or repurchase our capital stock, make

investments, sell assets, engage in acquisitions, mergers or consolidations or create liens or use assets as security in other transactions. Subject to certain exceptions, JT Ryerson may only pay dividends to Ryerson to the extent of 50% of future

net income, once prior losses are offset.

The 2017 Notes will become redeemable by the Company, in whole or in part, at any time on or

after April 15, 2015 (the “2017 Redemption Date”) and the 2018 Notes will become redeemable, in whole or in part, at any time on or after October 15, 2015 (the “2018 Redemption Date”), in each case at specified

redemption prices. The 2017 and 2018 Notes are redeemable prior to such dates, as applicable, at a redemption price equal to 100% of the principal amount, together with accrued and unpaid interest, if any, to the redemption date, plus a make-whole

premium. Additionally, we may redeem up to 35% of each of the 2017 and 2018 Notes prior to the 2017 Redemption Date or 2018 Redemption Date, as applicable, with net cash proceeds from certain equity offerings at a price equal to (a) 109.000%,

with respect to the 2017 Notes and (b) 111.250%, with respect to the 2018 Notes, of the principal amount thereof, plus any accrued and unpaid interest. On August 13, 2014, Ryerson completed an initial public offering of 11 million

shares of common stock at a price to the public of $11.00 per share. Net proceeds from the offering were used to redeem $99.5 million in aggregate principal amount of the 2018 Notes and pay redemption premiums of $11.2 million, which were recorded

within other income and (expense), net. If a change of control occurs, JT Ryerson must offer to purchase the 2017 and 2018 Notes at 101% of their principal amount, plus accrued and unpaid interest.

As of March 31, 2015, $583.2 million and $187.5 million of the original outstanding principal amount of the 2017 and 2018 Notes remain

outstanding, respectively. The Company has repurchased and in the future may repurchase 2017 and 2018 Notes in the open market. During the first three months of 2015, a principal amount of $16.8 million of the 2017 Notes were repurchased for $17.0

million and retired, resulting in the recognition of a $0.2 million loss within other income and (expense), net on the consolidated statement of comprehensive income. During the first three months of 2015, a principal amount of $13.0 million of the

2018 Notes were repurchased for $13.3 million and retired, resulting in the recognition of a $0.3 million loss within other income and (expense), net on the consolidated statement of comprehensive income.

Foreign Debt

At March 31, 2015,

Ryerson China’s total foreign borrowings were $24.6 million, which were owed to banks in Asia at a weighted average interest rate of 4.4% and secured by inventory and property, plant and equipment. At December 31, 2014, Ryerson

China’s total foreign borrowings were $23.6 million, which were owed to banks in Asia at a weighted average interest rate of 4.4% and secured by inventory and property, plant and equipment. At March 31, 2015, Açofran’s total

foreign borrowings were $0.1 million, which were owed to foreign banks at a weighted average interest rate of 3.8%. At December 31, 2014, Açofran had no foreign borrowings.

Availability under the foreign credit lines was $21 million and $12 million at March 31, 2015 and December 31, 2014, respectively.

Letters of credit issued by our foreign subsidiaries totaled $2 million at March 31, 2015 and December 31, 2014.

NOTE 7: EMPLOYEE BENEFITS

The following table summarizes the components of net periodic benefit cost for the three month periods ended March 31,

2015 and 2014 for the Ryerson pension plans and postretirement benefits other than pension:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

| |

|

Pension Benefits |

|

|

Other Benefits |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| |

|

(In millions) |

|

| Components of net periodic benefit cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service cost |

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Interest cost |

|

|

9 |

|

|

|

10 |

|

|

|

1 |

|

|

|

1 |

|

| Expected return on assets |

|

|

(12 |

) |

|

|

(12 |

) |

|

|

— |

|

|

|

— |

|

| Recognized prior service credit |

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

| Recognized actuarial net (gain) loss |

|

|

3 |

|

|

|

3 |

|

|

|

(2 |

) |

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net periodic benefit cost (credit) |

|

$ |

1 |

|

|

$ |

1 |

|

|

$ |

(2 |

) |

|

$ |

(1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10

Contributions

The Company has contributed $11 million to the pension plan fund through the three months ended March 31, 2015 and anticipates that it

will have a minimum required pension contribution funding of approximately $32 million for the remaining nine months of 2015.

NOTE 8: COMMITMENTS AND CONTINGENCIES

From time to time, we are named as a defendant in legal actions incidental to our ordinary course of business. We do not

believe that the resolution of these claims will have a material adverse effect on our financial position, results of operations or cash flows. We maintain liability insurance coverage to assist in protecting our assets from losses arising from or

related to activities associated with business operations.

In October 2011, the United States Environmental Protection Agency named us as

one of more than 100 businesses that may be a potentially responsible party for the Portland Harbor Superfund Site (“Portland Harbor”). We do not currently have sufficient information available to us to determine the total cost of any

required investigation or remediation of the Portland Harbor site and therefore, management cannot predict the ultimate outcome of this matter or estimate a range of potential loss at this time.

There are various claims and pending actions against the Company. The amount of liability, if any, for those claims and actions at

March 31, 2015 is not determinable but, in the opinion of management, such liability, if any, will not have a material adverse effect on the Company’s financial position, results of operations or cash flows.

NOTE 9: DERIVATIVES AND FAIR VALUE MEASUREMENTS

Derivatives

The

Company is exposed to certain risks relating to its ongoing business operations. The primary risks managed by using derivative instruments are interest rate risk, foreign currency risk, and commodity price risk. Interest rate swaps are entered into

to manage interest rate risk associated with the Company’s floating-rate borrowings. We use foreign currency exchange contracts to hedge our Canadian subsidiaries’ variability in cash flows from the forecasted payment of currencies other

than the functional currency. From time to time, we may enter into fixed price sales contracts with our customers for certain of our inventory components. We may enter into metal commodity futures and options contracts periodically to reduce

volatility in the price of metals. We may also enter into natural gas and diesel fuel price swaps to manage the price risk of forecasted purchases of natural gas and diesel fuel. The Company currently does not account for its derivative contracts as

hedges but rather marks them to market with a corresponding offset to current earnings. The Company regularly reviews the creditworthiness of its derivative counterparties and does not expect to incur a significant loss from the failure of any

counterparties to perform under any agreements.

11

The following table summarizes the location and fair value amount of our derivative instruments

reported in our Consolidated Balance Sheets as of March 31, 2015 and December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Asset Derivatives |

|

|

Liability Derivatives |

|

| |

|

March 31, 2015 |

|

|

December 31, 2014 |

|

|

March 31, 2015 |

|

|

December 31, 2014 |

|

| |

|

Balance

Sheet

Location |

|

Fair Value |

|

|

Balance

Sheet

Location |

|

Fair Value |

|

|

Balance

Sheet

Location |

|

Fair Value |

|

|

Balance

Sheet

Location |

|

Fair Value |

|

| |

|

(In millions) |

|

| Derivatives not designated as hedging instruments under ASC 815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange contracts |

|

Prepaid

expenses

and other

current

assets |

|

$ |

0.1 |

|

|

Prepaid

expenses

and other

current

assets |

|

|

— |

|

|

Other

accrued

liabilities |

|

|

— |

|

|

Other

accrued

liabilities |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Commodity contracts |

|

Prepaid

expenses

and other

current

assets |

|

|

— |

|

|

Prepaid

expenses

and other

current

assets |

|

$ |

0.1 |

|

|

Other

accrued

liabilities |

|

$ |

4.1 |

|

|

Other

accrued

liabilities |

|

|

1.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total derivatives |

|

|

|

$ |

0.1 |

|

|

|

|

$ |

0.1 |

|

|

|

|

$ |

4.1 |

|

|

|

|

$ |

1.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of March 31, 2015 and December 31, 2014, the Company’s foreign currency exchange contracts

had a U.S. dollar notional amount of $3.2 million. As of March 31, 2015 and December 31, 2014, the Company had 593 tons and 144 tons, respectively, of nickel futures or option contracts related to forecasted purchases. As of March 31,

2015 and December 31, 2014, the Company had 10,860 tons and 14,700 tons, respectively, of hot roll steel coil option contracts related to forecasted purchases. The Company has aluminum price swaps related to forecasted purchases, which had a

notional amount of 14,597 tons and 6,366 tons as of March 31, 2015 and December 31, 2014, respectively. As of March 31, 2015 and December 31, 2014, the Company has 962,000 gallons and 624,000 gallons, respectively, of diesel fuel

hedge contracts related to forecasted purchases.

The following table summarizes the location and amount of gains and losses reported in

our Consolidated Statements of Comprehensive Income for the three months ended March 31, 2015 and 2014:

|

|

|

|

|

|

|

|

|

|

|

| Derivatives not designated as

hedging instruments under

ASC 815 |

|

Location of Gain/(Loss)

Recognized in Income on

Derivatives |

|

Amount of Gain/(Loss) Recognized in

Income on Derivatives

Three Months Ended March

31, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

|

|

(In millions) |

|

| Metal commodity contracts |

|

Cost of materials sold |

|

$ |

(3.0 |

) |

|

$ |

0.2 |

|

| Foreign exchange contracts |

|

Other income and (expense), net |

|

|

0.1 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

|

$ |

(2.9 |

) |

|

$ |

0.2 |

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements

To increase consistency and comparability in fair value measurements, ASC 820 establishes a fair value hierarchy that prioritizes the inputs to

valuation techniques used to measure fair value into three levels as follows:

| |

1. |

Level 1 – quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access as of the reporting date. |

| |

2. |

Level 2 – inputs other than quoted prices included within Level 1 that are directly observable for the asset or liability or indirectly observable through corroboration with observable market data.

|

| |

3. |

Level 3 – unobservable inputs, such as internally-developed pricing models for the asset or liability due to little or no market activity for the asset or liability. |

12

The following table presents assets and liabilities measured and recorded at fair value on our

Consolidated Balance Sheets on a recurring basis and their level within the fair value hierarchy as of March 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At March 31, 2015 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

| |

|

(In millions) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash equivalents: |

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial paper |

|

$ |

16.7 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prepaid and other current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock – available-for-sale investment |

|

$ |

5.1 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mark-to-market derivatives: |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange contracts |

|

$ |

— |

|

|

$ |

0.1 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Mark-to-market derivatives: |

|

|

|

|

|

|

|

|

|

|

|

|

| Commodity contracts |

|

$ |

— |

|

|

$ |

4.1 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table presents assets and liabilities measured and recorded at fair value on our Consolidated

Balance Sheets on a recurring basis and their level within the fair value hierarchy as of December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At December 31, 2014 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

| |

|

(In millions) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Prepaid and other current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock – available-for-sale investment |

|

$ |

11.2 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mark-to-market derivatives: |

|

|

|

|

|

|

|

|

|

|

|

|

| Commodity contracts |

|

$ |

— |

|

|

$ |

0.1 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Mark-to-market derivatives: |

|

|

|

|

|

|

|

|

|

|

|

|

| Commodity contracts |

|

$ |

— |

|

|

$ |

1.3 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The fair value of each derivative contract is determined using Level 2 inputs and the market approach

valuation technique, as described in ASC 820. The Company has various commodity derivatives to lock in nickel prices for varying time periods. The fair value of these derivatives is determined based on the spot price each individual contract was

purchased at and compared with the one-month daily average actual spot price on the London Metals Exchange for nickel on the valuation date. The Company also has commodity derivatives to lock in hot roll coil and aluminum prices for varying time

periods. The fair value of hot roll coil and aluminum derivatives is determined based on the spot price each individual contract was purchased at and compared with the one-month daily average actual spot price on the New York Mercantile Exchange and

the London Metals Exchange, respectively, for the commodity on the valuation date. The Company has various commodity derivatives to lock in diesel prices for varying time periods. The fair value of these derivatives is determined based on the spot

price each individual contract was purchased at and compared with the one-month daily average actual spot price of the Platts Index for Gulf Coast Ultra Low Sulfur Diesel on the valuation date. In addition, the Company has numerous foreign exchange

contracts to hedge our Canadian subsidiaries’ variability in cash flows from the forecasted payment of currencies other than the functional currency, the Canadian dollar. The Company defines the fair value of foreign exchange contracts as the

amount of the difference between the contracted and current market value at the end of the period. The Company estimates the current market value of foreign exchange contracts by obtaining month-end market quotes of foreign exchange rates and

forward rates for contracts with similar terms. The Company uses the exchange rates provided by Reuters. Each contract term varies in the number of months, but on average is between 3 to 12 months in length.

13

The carrying and estimated fair values of the Company’s financial instruments at

March 31, 2015 and December 31, 2014 were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At March 31, 2015 |

|

|

At December 31, 2014 |

|

| |

|

Carrying

Amount |

|

|

Fair Value |

|

|

Carrying

Amount |

|

|

Fair Value |

|

| |

|

(In millions) |

|

| Cash and cash equivalents |

|

$ |

70.8 |

|

|

$ |

70.8 |

|

|

$ |

60.0 |

|

|

$ |

60.0 |

|

| Restricted cash |

|

|

2.0 |

|

|

|

2.0 |

|

|

|

2.0 |

|

|

|

2.0 |

|

| Receivables less provision for allowances, claims and doubtful accounts |

|

|

412.7 |

|

|

|

412.7 |

|

|

|

400.8 |

|

|

|

400.8 |

|

| Accounts payable |

|

|

226.9 |

|

|

|

226.9 |

|

|

|

220.8 |

|

|

|

220.8 |

|

| Long-term debt, including current portion |

|

|

1,202.4 |

|

|

|

1,213.0 |

|

|

|

1,259.1 |

|

|

|

1,288.7 |

|

The estimated fair value of the Company’s cash and cash equivalents, receivables less provision for

allowances, claims and doubtful accounts and accounts payable approximate their carrying amounts due to the short-term nature of these financial instruments. The estimated fair value of the Company’s long-term debt and the current portions

thereof is determined by using quoted market prices of Company debt securities (Level 2 inputs).

Assets Held for Sale

The Company had $2.9 million and $2.5 million of assets held for sale, classified within “prepaid expenses and other current assets,”

as of March 31, 2015 and December 31, 2014, respectively. The Company recorded a $0.4 million gain and zero in the three months ended March 31, 2015 and 2014, respectively, related to certain assets held for sale in order to recognize

the assets at their fair value less cost to sell in accordance with ASC 360-10-35-43, “Property, Plant and Equipment – Other Presentation Matters.” The fair values less costs to sell of long-lived assets held for sale are

assessed each reporting period that they remain classified as held for sale. Any increase or decrease in the held for sale long-lived asset’s fair value less cost to sell is reported as an adjustment to its carrying amount, except that the

adjusted carrying amount cannot exceed the carrying amount of the long-lived asset at the time it was initially classified as held for sale. The fair values of each property were determined based on appraisals obtained from a third-party, pending

sales contracts, or recent listing agreements with third-party brokerage firms.

The following table presents those assets that were

measured and recorded at fair value on our Consolidated Balance Sheets on a non-recurring basis and their level within the fair value hierarchy at March 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

March 31, 2015 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

| |

|

(In millions) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Prepaid expenses and other current assets – assets held for sale |

|

$ |

— |

|

|

$ |

2.9 |

|

|

$ |

— |

|

14

The following table presents those assets that were measured and recorded at fair value on our

Consolidated Balance Sheets on a non-recurring basis and their level within the fair value hierarchy at December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At December 31, 2014 |

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

| |

|

(In millions) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Prepaid expenses and other current assets – assets held for sale |

|

$ |

— |

|

|

$ |

2.5 |

|

|

$ |

— |

|

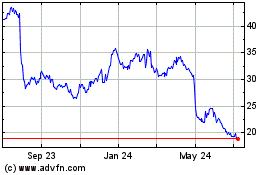

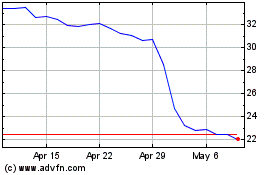

Available-For-Sale Investments

The Company has classified investments made during 2010 and 2012 as available-for-sale at the time of their purchase. Investments classified as

available-for-sale are recorded at fair value with the related unrealized gains and losses included in accumulated other comprehensive income. Management evaluates investments in an unrealized loss position on whether an other-than-temporary

impairment has occurred on a periodic basis. Factors considered by management in assessing whether an other-than-temporary impairment has occurred include: the nature of the investment; whether the decline in fair value is attributable to specific

adverse conditions affecting the investment; the financial condition of the investee; the severity and the duration of the impairment; and whether we intend to sell the investment or will be required to sell the investment before recovery of its

amortized cost basis. When it is determined that an other-than-temporary impairment has occurred, the investment is written down to its market value at the end of the period in which it is determined that an other-than-temporary decline has

occurred. The investment has been in a gross unrealized loss position for twelve months. Based on the duration and severity of our unrealized loss, management has determined that an other-than-temporary impairment has occurred and thus recognized a

$12.3 million impairment charge within other income and (expense), net for the three months ended March 31, 2015. Realized gains and losses are recorded within the statement of operations upon sale of the security and are based on specific

identification.

The Company’s available-for-sale securities as of March 31, 2015 can be summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At March 31, 2015 |

|

| |

|

Cost |

|

|

Gross

Unrealized

Gains |

|

|

Gross

Unrealized

Losses |

|

|

Fair Value |

|

| |

|

(In millions) |

|

| Common stock |

|

$ |

5.1 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

5.1 |

|

The Company’s available-for-sale securities as of December 31, 2014 can be summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

At December 31, 2014 |

|

| |

|

Cost |

|

|

Gross

Unrealized

Gains |

|

|

Gross

Unrealized

Losses |

|

|

Fair Value |

|

| |

|

(In millions) |

|

| Common stock |

|

$ |

17.4 |

|

|

$ |

— |

|

|

$ |

(6.2 |

) |

|

$ |

11.2 |

|

There is no maturity date for these investments and there have been no sales during the three months ended

March 31, 2015.

15

NOTE 10: STOCKHOLDERS’ EQUITY (DEFICIT), ACCUMULATED OTHER COMPREHENSIVE INCOME AND REDEEMABLE NONCONTROLLING INTEREST

The following table details changes in these accounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Ryerson Holding Corporation Stockholders |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Accumulated Other

Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

|

|

| |

|

Common

Stock |

|

|

Treasury

Stock |

|

|

Capital in

Excess of

Par Value |

|

|

Accumulated

Deficit |

|

|

Foreign

Currency

Translation |

|

|

Benefit Plan

Liabilities |

|

|

Changes in

Available-For-

Sale Investments |

|

|

Noncontrolling

Interest |

|

|

Total

Equity |

|

|

Redeemable

Noncontrolling

Interest |

|

| |

|

Shares |

|

|

Dollars |

|

|

Shares |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

|

Dollars |

|

| |

|

(In millions, except shares in thousands) |

|

| Balance at January 1, 2015 |

|

|

32,250 |

|

|

$ |

0.3 |

|

|

|

213 |

|

|

$ |

(6.6 |

) |

|

$ |

302.0 |

|

|

$ |

(132.8 |

) |

|

$ |

(32.8 |

) |

|

$ |

(255.8 |

) |

|

$ |

(2.8 |

) |

|

$ |

1.6 |

|

|

$ |

(126.9 |

) |

|

$ |

1.0 |

|

| Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(2.5 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.1 |

) |

|

|

(2.6 |

) |

|

|

(0.2 |

) |

| Foreign currency translation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6.3 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6.3 |

) |

|

|

— |

|

| Loss on intra-entity foreign currency transactions |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4.4 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4.4 |

) |

|

|

— |

|

| Changes in defined benefit pension and other post-retirement benefit plans, net of tax provision of $0.3 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.6 |

|

|

|

— |

|

|

|

— |

|

|

|

0.6 |

|

|

|

— |

|

| Unrealized loss on available-for-sale investment, net of tax benefit of $2.3 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3.8 |

) |

|

|

— |

|

|

|

(3.8 |

) |

|

|

— |

|

| Other-than-temporary impairment, net of tax benefit of $4.7 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7.6 |

|

|

|

— |

|

|

|

7.6 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at March 31, 2015 |

|

|

32,250 |

|

|

$ |

0.3 |

|

|

|

213 |

|

|

$ |

(6.6 |

) |

|

$ |

302.0 |

|

|

$ |

(135.3 |

) |

|

$ |

(43.5 |

) |

|

$ |

(255.2 |

) |

|

$ |

1.0 |

|

|

$ |

1.5 |

|

|

$ |

(135.8 |

) |

|

$ |

0.8 |

|

|

|

|

|