Edwards Lifesciences

Corporation’s (EW) fourth-quarter 2013 adjusted earnings

per share (EPS) rose 1.1% year over year to 91 cents, reflecting a

beat of 9.6% over the Zacks Consensus Estimate. Fiscal 2013

adjusted earnings of $3.13 per share showed a robust 16.4% growth

from the year-ago figure and also remained well ahead of the Zacks

Consensus Estimate of $3.05. Apart from healthy sales growth, EPS

growth was boosted by a reduced share count.

However, without taking into

consideration the one-time items, reported EPS for the fourth

quarter came in at 68 cents, up 11.7% year over year. Full year

reported EPS surged 38.7% from the prior year to reach $3.44.

Revenue

Details

Edwards reported sales of $536

million, up 5.1% year over year (considering foreign exchange

fluctuations and the transcatheter heart valves (THV) sales return

reserve, underlying growth was 10.3%). The top line was on par with

the Zacks Consensus Estimate. Sales for full year 2013 came in at

$2.05 billion, registering an increase of 7.7% (or up 10.8% on an

underlying basis). Revenues were, once again, in line with the

Zacks Consensus Estimate. The figure also remained within the

company provided guidance range.

During 2013, Edwards launched many

new products, demonstrated strong clinical data and made

significant progress on several key developments indicating

sustainable future growth at the company.

Domestically, sales amounted to

$239.1 million, up 9.6% year over year (underlying growth rate)

while internationally, sales were $296.9 million, up 10.9% year

over year. In the overseas market, sales in Europe improved 13.9%

to $162.3 million while revenues from rest of the world were up

10.6% at CER to $67.0 million. Sales in Japan increased 6.1% to

$67.6 million.

Segments

In fourth-quarter 2013, surgical

heart valve therapy product group reported sales of $207.0 million,

up 4.7% year over year (up 7.6% on an underlying basis). The

quarter’s performance reflects solid contributions from the U.S.

and Europe. Also, strong sales of Intuity valve in Europe

contributed to growth.

Globally, THV product group

reported sales of $183.9 million, up 14.2% year over year (up 21.6%

on an underlying basis). Revenues of this product group were mainly

driven by healthy growth in Europeon the back of greater adoption

of THV and the expected contribution from the Sapien valve in the

U.S.

Critical care product group sales

were $145.1 million, down 4.4% year over year (up 1.8% on an

underlying basis). Strength in most of the regions globally was

tempered by the continued reduction of distributor inventories in

China and the ongoing exit of the Access product line.

Margins

In the fourth quarter, gross margin

contracted 250 basis points (bps) to 72.9%. Despite a more

profitable product mix, margin contraction was primarily due to

reduced benefit from foreign exchange hedges, the impact from the

sales return reserve and higher manufacturing costs for new THV

product launches in the U.S. and Europe.

Selling, general and administrative

expense increased 7.1% year over year to $190.5 million (or 35.5%

of sales), primarily due to the U.S. Medical Device Excise Tax and

transcatheter valve launch-related expenses in Japan, partially

offset by foreign exchange.

Research and development

expenditure increased 4.9% year over year to $78.6 million or 14.7%

of sale. The higher expenses were on account of additional

investments in multiple heart valve clinical studies. With higher

operating expenses, adjusted operating margin contracted 319 bps to

22.6% in the quarter.

Cash Position

Edwards exited the fiscal with

cash, cash equivalents and short-term investments of $936.9 million

compared with $521.4 million at the end of 2012. Long-term debt of

the company was $593.1 million compared with $189.3 million at the

end of 2012.

Operating cash flow was $111.3

million while capital spending came in at $20.1 million.

Consequently, free cash flow was $91.2 million in the fourth

quarter. Edwards repurchased almost 6.8 million shares for $496.9

million during the quarter. Edwards’ consistent share buyback

activity reduced outstanding shares by 5.8% from the year-ago

quarter, leading to a positive impact on the bottom line.

Guidance

Following the fourth quarter,

Edwards maintained its guidance for 2014 which it first announced

at the annual investor conference last December. The company

continues to expect adjusted EPS for 2014 in a wide range around

$3.00 on revenues of $2.05 billion to $2.25 billion

(unchanged).

The current Zacks Consensus

estimate for EPS and revenues of $3.00 and $2.14 billion

respectively remain in line with the company’s projection.

Moreover, 2014 free cash flow (excluding special items) is still

expected to remain within $325 million and $425 million. Also full

year diluted shares outstanding should remain within 107 million

and 109 million.

For the first quarter of 2014,

adjusted EPS is expected to remain within 61 cents to 71 cents on

revenues of $500 million to $550 million. The Zacks Consensus

Estimate for EPS of 72 cents exceeds the guidance range while

revenues of $528 million fall within the range.

Our Take

Edwards exited the year 2013 with

several positive takeaways including the recent European CE mark

approval for its latest transcatheter aortic valve, Sapien 3;

reimbursement for Sapien XT in Japan (effective Oct 1, 2013);

regulatory approval for Sapien in Australia and Sapien XT in

Canada. Edwards is also optimistic about the expected U.S. approval

of the company’s next generation Sapien XT valve in the first half

of 2014.

Nonetheless, we are worried about

the earlier-than-expected FDA approval of its peer

Medtronic Inc.’s (MDT) less-invasive heart valve,

CoreValve. This approval will enable the launch of CoreValve in the

U.S. market – the only U.S. rival of Edwards’ Sapien. CoreValve –

whose market price is expected to remain on par with that of Sapien

– should bring down Edwards' revenue growth rate significantly by

weakening its dominance in the U.S market.

Edwards currently carries a Zacks

Rank #5 (Strong Sell). Some of the better-placed medical devices

stocks such as Covidien plc (COV) and

Stryker Corporation (SYK), which carry a Zacks

Rank #2 (Buy), are worth considering.

COVIDIEN PLC (COV): Free Stock Analysis Report

EDWARDS LIFESCI (EW): Free Stock Analysis Report

MEDTRONIC (MDT): Free Stock Analysis Report

STRYKER CORP (SYK): Free Stock Analysis Report

To read this article on Zacks.com click here.

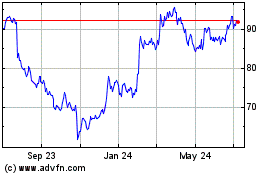

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Aug 2024 to Sep 2024

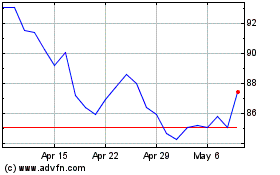

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Sep 2023 to Sep 2024