UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

_________________________________

|

|

|

|

|

|

|

|

|

|

|

Filed by the Registrant

ý

|

Filed by a Party other than the Registrant

¨

|

|

|

|

|

|

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

ý

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

_________________________________

ALPHATEC HOLDINGS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

_________________________________

|

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

ý

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing:

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No:

|

|

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALPHATEC HOLDINGS, INC.

5818 El Camino Real

Carlsbad, CA 92008

(760) 431-9286

June 22, 2016

Dear Stockholder,

We cordially invite you to attend our 2016 Annual Meeting of Stockholders to be held at 10:00 a.m., Pacific Time, on Thursday,

August 18, 2016

, at our corporate headquarters, which are located at 5818 El Camino Real, Carlsbad, CA 92008.

Details regarding the meeting, the business to be conducted at the meeting, and information about Alphatec Holdings, Inc. that you should consider when you vote your shares are described in this proxy statement.

We are asking stockholders of Alphatec Holdings, Inc.:

|

|

|

|

•

|

to elect seven persons to our Board of Directors;

|

|

|

|

|

•

|

to approve the Alphatec Holdings, Inc. 2016 Equity Incentive Plan;

|

|

|

|

|

•

|

to approve an amendment to our Restated Certificate of Incorporation to effect a reverse stock split of our common stock, par value $0.0001 per share, at a ratio in the range of 1:4 to 1:12, such ratio to be determined by our Board of Directors to be effected in the sole discretion of the Board of Directors at any time within one year of the date of the Annual Meeting without further approval or authorization of our stockholders;

|

|

|

|

|

•

|

to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016; and

|

|

|

|

|

•

|

to approve the compensation of our named executive officers, as disclosed in this proxy statement.

|

The Board of Directors recommends the approval of each of these proposals. Such other business will be transacted as may properly come before the annual meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On June 28, 2016, we intend to begin sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2016 Annual Meeting of Stockholders and our 2015 annual report to stockholders. The Notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the annual meeting. Whether you plan to attend the annual meeting or not, it is important that you cast your vote either in person or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in this proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of Alphatec Holdings, Inc. We look forward to seeing you at the annual meeting.

Sincerely,

|

|

|

|

|

James M. Corbett

|

|

President and Chief Executive Officer

|

|

|

ALPHATEC HOLDINGS, INC.

5818 El Camino Real

Carlsbad, CA 92008

(760) 431-9286

June 22, 2016

NOTICE OF 2016 ANNUAL MEETING OF STOCKHOLDERS

TIME: 10:00 a.m., PT

DATE:

August 18, 2016

PLACE: Alphatec Holdings, Inc., 5818 El Camino Real, Carlsbad, CA 92008

NOTICE IS HEREBY GIVEN that the annual meeting of Alphatec Holdings, Inc. will be held on Thursday,

August 18, 2016

(the “Annual Meeting”), for the following purposes:

|

|

|

|

1.

|

To elect seven directors to serve until the next annual meeting of stockholders and until their respective successors have been duly elected and qualified, or until their earlier death or resignation;

|

|

|

|

|

2.

|

To approve the Alphatec Holdings, Inc. 2016 Equity Incentive Plan;

|

|

|

|

|

3.

|

To approve an amendment to our Restated Certificate of Incorporation to effect a reverse stock split of our common stock, par value $0.0001 per share, at a ratio in the range of 1:4 to 1:12, such ratio to be determined by our Board of Directors, to be effected in the sole discretion of the Board of Directors at any time within one year of the date of the Annual Meeting without further approval or authorization of our stockholders;

|

|

|

|

|

4.

|

To ratify the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for the fiscal year ending

December 31, 2016

;

|

|

|

|

|

5.

|

To approve by an advisory vote, the compensation of our named executive officers, or the Named Executive Officers, as disclosed in this proxy statement; and

|

|

|

|

|

6.

|

To transact such other business as may be properly presented at the Annual Meeting and any adjournments or postponements thereof.

|

Only the stockholders of record of our common stock as of the close of business on

June 21, 2016

are entitled to notice of, and to vote at, the Annual Meeting and at any adjournments thereof. A total of 102,494,745 shares of our common stock were issued and outstanding as of that date. Each share of common stock entitles its holder to one vote. Cumulative voting of shares of common stock is not permitted.

At the Annual Meeting and for the ten-day period immediately prior to the Annual Meeting, the list of stockholders entitled to vote at the Annual Meeting will be available for inspection at our corporate headquarters, which are located at 5818 El Camino Real, Carlsbad, CA 92008 for such purposes as are set forth in the General Corporation Law of the State of Delaware.

At least a majority of all issued and outstanding shares of common stock entitled to vote at a meeting is required to constitute a quorum for the conduct of business at the Annual Meeting. Accordingly, whether you plan to attend the Annual Meeting or not, we ask that you vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

Ebun S. Garner, Esq.

|

|

General Counsel, SVP and Corporate Secretary

|

|

|

Table of Contents

|

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Appendix A -- Form of Proxy Card

|

|

|

Appendix B -- 2016 Equity Incentive Plan

|

|

|

Appendix C -- Form of Certificate of Amendment to Restated Certificate of Incorporation

|

|

ALPHATEC HOLDINGS, INC.

5818 El Camino Real

Carlsbad, CA 92008

(760) 431-9286

PROXY STATEMENT FOR THE ALPHATEC HOLDINGS, INC.

2016 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

This proxy statement, along with the accompanying notice of 2016 Annual Meeting of Stockholders, contains information about the 2016 annual meeting of stockholders of Alphatec Holdings, Inc. (the “Annual Meeting”), including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 10:00 a.m., Pacific Time, on Thursday,

August 18, 2016

, at our corporate headquarters, which are located at 5818 El Camino Real, Carlsbad, CA 92008.

In this proxy statement, we refer to Alphatec Holdings, Inc. as “Alphatec Holdings,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our Board of Directors for use at the Annual Meeting.

On or about June 28, 2016, we intend to begin sending the Important Notice Regarding the Availability of Proxy Materials to all stockholders entitled to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON AUGUST 18, 2016.

This proxy statement and our Annual Report are available for viewing, printing and downloading at https://materials.proxyvote.com/02081G. To view these materials, please have your 12-digit control number(s) available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended

December 31, 2015

on the website of the Securities and Exchange Commission, or the SEC, at

www.sec.gov

, or in the “Financial Information” section of the “Investor Relations” section of our website at

www.alphatecspine.com

. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to: Alphatec Holdings, Inc., 5818 El Camino Real, Carlsbad, CA 92008, Attention: Michael O’Neill, Chief Financial Officer, Vice President and Treasurer. Exhibits will be provided upon written request and payment of an appropriate processing fee.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The Board of Directors of Alphatec Holdings, Inc. is soliciting your proxy to vote at the Annual Meeting to be held at our corporate headquarters, located at 5818 El Camino Real, Carlsbad, CA 92008 on Thursday,

August 18, 2016

, at 10:00 a.m., Pacific Time, and any adjournments of the meeting. The proxy statement along with the accompanying Notice of 2016 Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know in order to vote at the Annual Meeting.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2015

because you owned shares of Alphatec Holdings, Inc. common stock on the record date. The Company intends to commence distribution of the Important Notice Regarding the Availability of Proxy Materials, which we refer to throughout this proxy statement as the Notice, and, if applicable, the proxy materials to stockholders on or about June 28, 2016.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the annual meeting and help to conserve natural resources. If you received a Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials,

you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Why is the Company seeking approval for the reverse stock split?

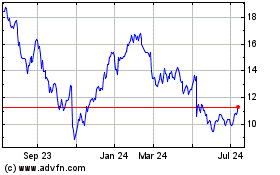

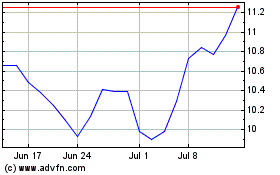

On September 17, 2015, we received written notice from the Listing Qualifications Department of the NASDAQ Stock Market LLC, or NASDAQ, notifying us that for the preceding 30 consecutive business days, our common stock did not maintain a minimum closing bid price of $1.00 per share as required for continued inclusion on The NASDAQ Global Select Market under NASDAQ Listing Rule 5450(a)(1). The notification letter stated that pursuant to NASDAQ Listing Rule 5810(c)(3)(A), we would be afforded 180 calendar days, or until March 15, 2016, to regain compliance with the minimum bid price requirement. On March 21, 2016, we were notified by NASDAQ that we had not regained compliance with the minimum bid price requirement for continued listing set forth in Nasdaq Marketplace Rule 5450(a)(1) and that our common stock would be subject to delisting unless we timely request a hearing before the NASDAQ Listing Qualifications Panel, or the Panel. On April 21, 2016 we had a hearing with NASDAQ, at which we requested an extension within which to pursue our plan to regain and maintain compliance with all applicable requirements for continued listing on NASDAQ. On May 2, 2016 we were informed that NASDAQ had approved our compliance plan and agreed to allow the continued listing of our common stock on NASDAQ until September 12, 2016, at which time we must be in compliance. Our compliance plan includes effecting the reverse stock split of our common stock for which we are seeking stockholder approval in Proposal 3 of this proxy statement. On May 25, 2016, the closing price of our common stock as reported on NASDAQ was $0.20 per share.

The Board of Directors has approved the reverse stock split partly as a means of increasing the share price of our common stock. Our Board of Directors believes that maintaining our listing on The NASDAQ Global Select Market may provide a broader market for our common stock and facilitate the use of our common stock in financing and other transactions. We expect the reverse stock split to facilitate the continuation of such listing. We cannot assure you, however, that the reverse stock split will result in an increase in the per share price of our common stock, or if it does, how long the increase would be sustained, if at all. Although the stock split is designed to raise the stock price, there is no guarantee that the share price will rise proportionately to the reverse stock split, so the end result could be a loss of value.

For more information, see “Proposal 3: Approval of Reverse Stock Split contained in this proxy statement.

Who Can Vote?

Only stockholders who owned our common stock at the close of business on

June 21, 2016

are entitled to vote at the Annual Meeting. On this record date, there were 102,494,745 shares of Alphatec Holdings, Inc. common stock outstanding and entitled to vote. Alphatec Holdings, Inc. common stock is our only class of voting stock.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in time for the meeting and not revoked prior to the meeting, will be voted at the meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for or withheld for each nominee for director and whether your shares should be voted for, against or abstain with respect to both of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare, Inc. (“Computershare”), 480 Washington Ave., Jersey City, NJ 07310, or you have stock certificates registered in your name, you may vote:

|

|

|

|

•

|

By Internet or by telephone.

Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote by Internet or telephone.

|

|

|

|

|

•

|

By mail.

If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the recommendation of our Board of Directors as noted below.

|

|

|

|

|

•

|

In person at the meeting.

If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the Annual Meeting.

|

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on August 17, 2016.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the meeting, you should contact the broker or agent to obtain a legal proxy or broker’s proxy card and bring it with you to the Annual Meeting in order to vote. You will not be able to vote at the Annual Meeting unless you have a proxy card from your broker.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Board of Directors recommends that you vote as follows:

|

|

|

|

•

|

“FOR”

the election of the nominees for director;

|

|

|

|

|

•

|

“FOR”

the approval of the Alphatec Holdings, Inc. 2016 Equity Incentive Plan;

|

|

|

|

|

•

|

“FOR”

the approval of an amendment to our Restated Certificate of Incorporation to effect a reverse stock split of our common stock, par value $0.0001 per share, at a ratio in the range of 1:4 to 1:12, such ratio to be determined by our Board of Directors, to be effected in the sole discretion of the Board of Directors at any time within one year of the date of the Annual Meeting without further approval or authorization of our stockholders;

|

|

|

|

|

•

|

“FOR”

the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending

December 31, 2016

; and

|

|

|

|

|

•

|

“FOR”

the compensation of our Named Executive Officers as disclosed in this proxy statement.

|

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

|

|

|

|

•

|

if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above;

|

|

|

|

|

•

|

by re-voting by Internet or by telephone as instructed above;

|

|

|

|

|

•

|

by notifying us at 5818 El Camino Real, Carlsbad, CA 92008, Attention: Ebun S. Garner, Esq., General Counsel, Senior Vice President and Corporate Secretary, in writing before the Annual Meeting that you have revoked your proxy; or

|

|

|

|

|

•

|

by attending the Annual Meeting in person and voting in person.

|

Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy. You must specifically request at the Annual Meeting that the proxy be revoked.

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?”

If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above under “How Do I Vote?,” the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 2 of this proxy statement) if it does not receive instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee does not have the ability to vote your uninstructed shares in the election of

directors. Therefore, if you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for the election of directors (Proposal 1 of this proxy statement). In addition, your bank, broker or other nominee is prohibited from voting your uninstructed shares on the adoption of the Alphatec Holdings, Inc. 2016 Equity Incentive Plan or the advisory vote on the compensation of our Named Executive Officers (Proposal 2 or 5 of this proxy statement). Thus, if you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote with respect to the election of directors, the equity incentive plan or the advisory vote on the compensation of our Named Executive Officers (Proposals 1, 2 and 5), no votes will be cast on these proposals on your behalf. We believe that Proposal 3 (reverse stock split) and Proposal 4 (ratification of selection of independent registered public accounting firm) are considered routine matters and, thus, we expect that brokers will be able to vote uninstructed shares on these proposals.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

|

|

|

|

|

|

Proposal 1: Election of Directors

|

The nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

|

|

Proposal 2: Approval of 2016 Equity Incentive Plan

|

The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to approve the adoption of the Alphatec Holdings, Inc. 2016 Equity Incentive Plan. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote.

|

|

Proposal 3: Approval of Amendment to Our Certificate Of Incorporation to Effect a Reverse Stock Split

|

The affirmative vote of a majority of the voting power of all of the outstanding shares of our common stock entitled to vote thereon is required to approve the amendment to our Certificate of Incorporation to effect the reverse stock split. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have the same effect as a vote against this proposal. Abstentions will have the same effect as a vote against this proposal.

|

|

Proposal 4: Ratify Selection of Independent Registered Public Accounting Firm

|

The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to ratify the selection of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2016, the Audit Committee of our Board of Directors will reconsider its selection.

|

|

Proposal 5: Approval of an Advisory Vote on the Compensation of our Named Executive Officers

|

The affirmative vote of a majority of the votes cast affirmatively or negatively for this proposal is required to approve, on an advisory basis, the compensation of our Named Executive Officers, as disclosed in this proxy statement. Abstentions have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the Nominating, Governance and Compensation Committee and the Board of Directors will review the voting results and take them into consideration when making future decisions regarding executive compensation.

|

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, Ebun S. Garner, Esq., and Computershare, examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make

on the proxy card or elsewhere.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting and we will publish preliminary results, or final results if then available, by filing a Current Report on Form 8-K within four business days after the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended Current Report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

If we solicit proxies, what are the Costs of Soliciting these Proxies?

If we solicit proxies, we will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. If we ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies, then we will reimburse them for their expenses. In addition, we have currently not engaged any third parties to assist in the solicitation of proxies. If we decide at a later date that solicitation services are advisable, we may engage The Proxy Advisory Group, LLC to provide these services for an expected fee of approximately $10,000 plus expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Attending the Annual Meeting

The Annual Meeting will be held at 10:00 a.m. Pacific Time, on Thursday,

August 18, 2016

at our corporate headquarters, which are located at 5818 El Camino Real, Carlsbad, CA 92008. When you arrive at our headquarters, signs will direct you to the appropriate meeting room. You need not attend the Annual Meeting in order to vote.

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our annual report and proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare, by calling their toll free number, 1-866-265-1875.

If you do not wish to participate in “householding” and would like to receive your own Notice or, if applicable, set of Alphatec Holdings, Inc.’s proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another Alphatec Holdings, Inc. stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

|

|

|

|

•

|

If your shares of Alphatec Holdings, Inc. common stock are registered in your own name, please contact our transfer agent, Computershare, and inform them of your request by calling them at 1-866-265-1875 or writing them at 480 Washington Ave., Jersey City, NJ 07310.

|

|

|

|

|

•

|

If a broker or other nominee holds your shares of Alphatec Holdings, Inc. common stock, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of May 20, 2016 for (a) each of our Named Executive Officers listed in the Summary Compensation Table, (b) each of our directors, all of which are director nominees, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders. Percentage of ownership is based on 102,494,745 shares of common stock outstanding on May 20, 2016. Except as otherwise indicated in the table below, addresses of beneficial owners listed in the table below are in care of Alphatec Holdings, Inc., 5818 El Camino Real, Carlsbad, California 92008.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

Number of Shares of

Common Stock

Beneficially Owned(1)

|

Percentage of

Outstanding

Common Stock

|

|

Directors and Named Executive Officers

|

|

|

|

|

Leslie H. Cross(2)

|

1,420,475

|

|

1.4

|

%

|

|

Mortimer Berkowitz III(3)

|

31,787,738

|

|

31.0

|

%

|

|

R. Ian Molson(4)

|

524,597

|

|

*

|

|

|

Stephen E. O’Neil(5)

|

284,735

|

|

*

|

|

|

Siri S. Marshall(6)

|

282,098

|

|

*

|

|

|

Donald A. Williams(7)

|

49,248

|

|

*

|

|

|

James M. Corbett(8)

|

318,204

|

|

*

|

|

|

Michael O’Neill(9)

|

530,931

|

|

*

|

|

|

Michael C. Plunkett(10)

|

401,364

|

|

*

|

|

|

Mitsuo Asai(11)

|

462,348

|

|

*

|

|

|

Ebun S. Garner, Esq.(12)

|

453,752

|

|

*

|

|

|

All current executive officers and directors as a group (12 persons)(13)

|

36,704,274

|

|

34.9

|

%

|

|

|

|

|

|

|

Five Percent Stockholders

|

|

|

|

|

HealthpointCapital Partners, L.P.(14)

505 Park Avenue, 12

th

Floor

New York, NY 10022

|

10,777,173

|

|

10.5

|

%

|

|

|

|

|

|

|

HealthpointCapital Partners II, L.P.(15)

505 Park Avenue, 12

th

Floor

New York, NY 10022

|

21,010,565

|

|

20.5

|

%

|

|

|

|

|

|

|

John H. Foster(16)

c/o HealthpointCapital Partners, L.P.

505 Park Avenue, 12th Floor

New York, NY 10022

|

31,969,038

|

|

31.2

|

%

|

|

|

|

|

|

|

Deerfield Mgmt., L.P.(17)

780 Third Avenue, 37

th

Floor

New York, NY 10017

|

15,432,738

|

|

13.6

|

%

|

|

|

|

|

*

|

Represents beneficial ownership of less than 1% of the outstanding shares of common stock.

|

|

|

|

|

(1)

|

Beneficial ownership is determined in accordance with the rules promulgated by the Securities and Exchange Commission and includes sole or shared voting or investment power with respect to the securities. Shares of common stock that may be acquired by an individual or group within 60 days of May 20, 2016, pursuant to the exercise of stock options or any other right are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. The inclusion in this table of any shares deemed beneficially owned does not constitute an admission of beneficial ownership of those shares.

|

|

|

|

|

(2)

|

Includes 857,929 shares issuable pursuant to options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(3)

|

Includes 10,777,173 shares held by HealthpointCapital Partners, L.P. and 21,010,565 shares held by HealthpointCapital Partners II, L.P. Mr. Berkowitz is a managing member of HGP, LLC, which is the general partner of HealthpointCapital Partners, L.P. and he is a managing member of HGP II, LLC, which is the general partner of HealthpointCapital Partners II, L.P., and therefore Mr. Berkowitz may be deemed to beneficially own the shares held by HealthpointCapital Partners, L.P. and HealthpointCapital Partners II, L.P. Mr. Berkowitz disclaims beneficial ownership of such shares except to the extent of his pecuniary interest in such shares. Also includes 11,200 shares owned by Mr. Berkowitz’s spouse.

|

|

|

|

|

(4)

|

Includes 199,988 shares held by the Swiftsure Trust. Mr. Molson controls Nantel Investment, Ltd., which is the beneficiary of the Swiftsure Trust. Mr. Molson disclaims beneficial ownership of the shares held by the Swiftsure Trust except to his proportionate pecuniary interest in such shares. Also, includes 136,497 shares of common stock issuable pursuant to the exercise of options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(5)

|

Includes 115,923 shares issuable pursuant to the exercise of options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(6)

|

Includes 115,923 shares issuable pursuant to the exercise of options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(7)

|

Includes 13,214 shares issuable pursuant to the exercise of options that are or will become exercisable within 60 days of May 20, 2016.

|

|

|

|

|

(8)

|

Includes 250,000 shares issuable pursuant to the exercise of options that are or will become exercisable within 60 days of May 20, 2016.

|

|

|

|

|

(9)

|

Includes 412,421 shares issuable pursuant to the exercise of options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(10)

|

Includes 207,499 shares issuable pursuant to the exercise of options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(11)

|

Includes 210,703 shares issuable pursuant to the exercise of options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(12)

|

Includes 366,346 shares issuable pursuant to the exercise of options that are or will become vested within 60 days of May 20, 2016.

|

|

|

|

|

(13)

|

See footnotes (2) through (11) above, Also includes 39,375 shares issuable pursuant to the exercise of options held by Kristin Machacek Leary, our Senior Vice President, Global Human Resources, that are or will become vested within 60 days of May 20, 2016. Includes 10,777,173 shares held by HealthpointCapital Partners, L.P., and 21,010,565 shares held by HealthpointCapital Partners II, L.P., which may be deemed to be beneficially owned by our director, Mortimer Berkowitz III. See also footnotes (3) and (4) above.

|

|

|

|

|

(14)

|

Includes shares held by HealthpointCapital Partners, L.P. Mr. Berkowitz is a managing member of HGP, LLC, which is the general partner of HealthpointCapital Partners, L.P. Mr. Berkowitz and HGP, LLC may be deemed to beneficially own the shares held by HealthpointCapital Partners, L.P., but disclaims beneficial ownership of such shares except to the extent of his or its pecuniary interest in such shares. Based on Amendment No. 4 to Schedule 13D filed jointly by HealthpointCapital Partners, L.P., HGP, LLC, HealthpointCapital Partners II, L.P., HCPII Co-Invest Vehicle II, L.P., HGP II, LLC, and Mortimer Berkowitz III on March 19, 2012 and the Form 4 filed by HealthpointCapital Partners L.P. on November 30, 2012.

|

|

|

|

|

(15)

|

Includes shares held by HealthpointCapital Partners, II L.P. Mr. Berkowitz is a managing member of HGP II, LLC, which is the general partner of HealthpointCapital Partners II, L.P. Mr. Berkowitz and HGP II, LLC may be deemed to beneficially own the shares held by HealthpointCapital Partners II, L.P., but disclaims beneficial ownership of such shares except to the extent of his or its pecuniary interest in such shares. Based on Amendment No. 4 to Schedule 13D filed jointly by HealthpointCapital Partners, L.P., HGP, LLC, HealthpointCapital Partners II, L.P., HCPII Co-Invest Vehicle II, L.P., HGP II, LLC, and Mortimer Berkowitz III on March 19, 2012 and the Form 4 filed by HealthpointCapital Partners II L.P. on November 30, 2012.

|

|

|

|

|

(16)

|

Includes 10,777,173 shares held by HealthpointCapital Partners, L.P. and 21,010,565 shares held by HealthpointCapital Partners II, L.P. Mr. Foster, our former director, is a managing member of HGP, LLC, which is the general partner of HealthpointCapital Partners, L.P. and he is a managing member of HGP II, LLC, which is the general partner of HealthpointCapital Partners II, L.P., and therefore Mr. Foster may be deemed to beneficially own the shares held by HealthpointCapital Partners, L.P. and HealthpointCapital Partners II, L.P. Mr. Foster disclaims beneficial ownership of such shares except to the extent of his pecuniary interest in such shares. Also includes 150,900 shares held by Mr. Foster

|

individually and 30,400 shares held by John H. Foster, trustee u/w/o of Virginia C. Foster. Mr. Foster is a trustee and the principal beneficiary of such trust.

|

|

|

|

(17)

|

This information is based solely on a Schedule 13G/A filed by Deerfield Mgmt., L.P. with the SEC on February 16, 2016, which reported ownership as of December 31, 2015. Includes an aggregate of 4,982,738 shares of common stock and warrants to purchase 11,450,000 shares of common stock, or the Warrants held by Deerfield Special Situations Funds, L.P., Deerfield Private Design Fund II, L.P. and Deerfield Private Design Internationals II, L.P., of which Deerfield Mgmt. L.P. is the general partner and which we refer to collectively as Deerfield. The provisions of the Warrants restrict the exercise of the Warrants to the extent that, upon such exercise, the number of shares then beneficially owned by Deerfield and any other person or entities with which Deerfield would constitute a Section 13(d) “group” would exceed 9.985% of our total number of shares then outstanding, or the Ownership Cap. Accordingly, notwithstanding the number of shares reported, Deerfield disclaims beneficial ownership of the shares underlying the Warrants to the extent beneficial ownership of such shares would cause Deerfield, in the aggregate to exceed the Ownership Cap.

|

MANAGEMENT

As of May 20, 2016, our Board of Directors, or the Board, consisted of seven directors: Leslie H. Cross, Mortimer Berkowitz III, R. Ian Molson, Stephen E. O’Neil, Siri S. Marshall, James M. Corbett, and Donald A. Williams.

Set forth below are the names of the persons nominated as directors, their ages, their offices in the Company if any, their principal occupations or employment for the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. Each director is elected to serve until our next annual meeting of stockholders or the sooner of his or her resignation or the date when his or her successor is duly appointed and qualified. Additionally, set forth below is information about the specific experience, qualifications, attributes or skills that led to our Board of Directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director.

|

|

|

|

|

|

Name

|

Age

|

|

Leslie Cross, Chairman of the Board of Directors(1)

|

65

|

|

Mortimer Berkowitz III(1)

|

62

|

|

R. Ian Molson(1)(2)(3)

|

61

|

|

Stephen O’Neil(2)

|

83

|

|

Siri Marshall(3)

|

67

|

|

James Corbett, President and Chief Executive Officer and Director(1)

|

58

|

|

Donald Williams(3)

|

57

|

|

|

|

|

(1)

|

Member of Executive Committee.

|

|

|

|

|

(2)

|

Member of the Nominating, Governance and Compensation Committee. Mr. Molson is Chairman of the committee.

|

|

|

|

|

(3)

|

Member of the Audit Committee. Mr. Williams is Chairman of the committee.

|

Leslie Cross

has served as the Chairman of the Board of Directors since July 2011, and has served as a director since March 2011. Mr. Cross also served as our Chief Executive Officer from February 2012 to May 2014. Mr. Cross is the former President and Chief Executive Officer of DJO Global, Inc. Mr. Cross served as a Director of DJO Global until December, 2012. DJO Global is a manufacturer and worldwide leading distributor of electrotherapy products for pain therapy and rehabilitation, clinical devices for the treatment of patients in physical therapy clinics, knee, hip and shoulder implant products, and orthopedic rehabilitation products, including rigid knee bracing, orthopedic soft goods, cold therapy systems, vascular systems and bone growth stimulation devices. Mr. Cross has held principal executive roles at DJO Global and its predecessors since 1995. From 1990 to 1994, Mr. Cross held the position of Senior Vice President of Marketing and Business Development of the Bracing & Support Systems division of Smith & Nephew. He was a Managing Director of two different divisions of Smith & Nephew from 1982 to 1990.

The Board selected Mr. Cross to serve as a director and our Chairman because of his knowledge and experience in the medical device industry and his experience at DJO Global, each of which contribute to the breadth of knowledge of the Board.

Mortimer Berkowitz III

has served as a member of the Board of Directors since March 2005. From April 2007 through July 2011, he served as the Chairman of the Board of Directors of us and Alphatec Spine. Since August 2011, Mr. Berkowitz has served as the Chairman of the Executive Committee of the Board of Directors. He is currently a managing member of HGP, LLC, which is the general partner of HealthpointCapital Partners, LP, and President, a member of the Board of Managers and a managing director of HealthpointCapital, LLC. He has held the position with HGP, LLC since its formation in August 2002, the

positions of managing director and member of the Board of Managers of HealthpointCapital, LLC since its formation in July 2002 and the position of President of HealthpointCapital, LLC since February 2005. Prior to joining HealthpointCapital, LLC, Mr. Berkowitz was managing director and co-founder of BPI Capital Partners, LLC, a private equity firm founded in 1990. Prior to 1990, Mr. Berkowitz spent 11 years in the investment banking industry with Goldman, Sachs & Co., Lehman Brothers Incorporated and Merrill Lynch & Co. He is Chairman of the Board of Directors of Blue Belt Holdings, Inc., a surgical robotics company, a director of BioHorizons, Inc., a privately-held dental implant company, and a director of MicroDental Inc., a leading dental laboratory company, all of which are HealthpointCapital portfolio companies. He also serves on the Leadership Council of the Harvard School of Public Health.

The Board selected Mr. Berkowitz to serve on the Board because of his investment and financial expertise and experience in the orthopedics and spine industries, each of which contribute to the breadth of knowledge of the Board.

R. Ian Molson

has served as a Director of us and Alphatec Spine since July 2005. Mr. Molson has served as a Director of Cayzer Continuation PCC, an investment company, since September 2004. Mr. Molson has served as a Director of HealthpointCapital, LLC since 2004. Mr. Molson has served as a Director since December 2009 and Deputy Chairman since December 2010 of Central European Petroleum Ltd. Since October 2013, Mr. Molson has also served as Chairman of RM2. Since December 2010 Mr. Molson has also served as Chairman of the Royal Marsden NHS Foundation Trust and the Royal Marsden Hospital Charity. From June 1996 until May 2004 Mr. Molson served as a Director of Molson, Inc., a leader in the brewing industry. From June 1999 until May 2004 he also served as Deputy Chairman and Chairman of the Executive Committee at Molson, Inc. Between 1977 and 1997, he was employed by Credit Suisse First Boston in various capacities, including Managing Director. From 1993 to 1997, Mr. Molson served as Co-Head of the Investment Banking Department in Europe, a position which encompassed corporate finance, corporate advisory, mergers and acquisitions businesses in Europe, Russia, Africa and the Middle East. In the past five years, Mr. Molson has served as a director of Sapphire Industrial Corp., a special purpose acquisition company, which was publicly traded when Mr. Molson served on its board of directors. Mr. Molson is no longer a director of Sapphire Industrials Corp.

The Board selected Mr. Molson to serve on the Board because of his experience in the investing banking field, his investment and financial expertise and his experience as a director of other public companies, each of which contribute to the breadth of knowledge of the Board.

Stephen O’Neil

has served as a Director of us and Alphatec Spine since July 2005. In May 1991, he founded The O’Neil Group, which provided legal and financial advice to clients primarily in the areas of mergers and acquisitions, financings and corporate strategy. Prior to that, Mr. O’Neil formed a law partnership with Paul Mishkin under the name Mishkin, O’Neil for the purpose of engaging in general corporate and business law. Prior to that, he co-founded two corporations, Syntro Corporation and NovaCare, Inc., which became public companies. Mr. O’Neil commenced his legal career at Cravath Swaine & Moore. Mr. O’Neil has also held a series of executive positions at City Investing Company, including President and Vice Chairman.

The Board selected Mr. O’Neil to serve on the Board because of his experience as an attorney, his investment and financial expertise and his experience as a director of other companies, each of which contribute to the breadth of knowledge of the Board.

Siri Marshall

has served as a Director of us and Alphatec Spine since October 2008. Ms. Marshall is the former Senior Vice President, General Counsel, Corporate Secretary and Chief Governance and Compliance Officer at General Mills, Inc., having retired from those positions in January 2008. Prior to joining General Mills in 1994, Ms. Marshall was Senior Vice President, General Counsel and Corporate Secretary of Avon Products, Inc. In the past five years, Ms. Marshall has served as a director of the following companies, each of which is publicly traded: Ameriprise Financial, Inc., a diversified financial services company, and Equifax, Inc., a global provider of information solutions for businesses and consumers. Ms. Marshall is also a director of the Yale Center for the Study of Corporate Law, and a Distinguished Advisor to the Strauss Institute for Dispute Resolution. In the past she has served as a director of the American Arbitration Association and the Yale Law School Fund. She has also served as a member of The New York Stock Exchange Legal Advisory Committee.

The Board selected Ms. Marshall to serve on the Board because of her experience as a General Counsel of a publicly traded company, her financial expertise and her experience as a director of publicly traded companies, each of which contribute to the breadth of knowledge of the Board.

James Corbett

has served as a Director of us and Alphatec Spine since May 2014. On May 1, 2014, Mr. Corbett was appointed as the President and Chief Executive Officer of us and Alphatec Spine. Prior to joining us, Mr. Corbett had been the President and CEO of Vertos Medical, Inc., a position he held since November 2008. Vertos is the manufacturer of novel, percutaneous treatment for lumbar spine stenosis. From January 2002 to April 2008 he worked at ev3 Inc. During such time period he held various positions, including member of the board of directors of ev3, Chairman of the Board of Directors of MicroTherapeutics (an affiliate of ev3), Chief Operating Officer of ev3, Chief Executive Officer of ev3 and Chairman of the Board of Directors of ev3. Ev3 is a leading medical device company engaged in vascular and neuro-radiology technologies.

Over the course of his career, Mr. Corbett has held the position of Chief Executive Officer, Home Diagnostics Inc.; President, Boston Scientific International; and General Manager, Baxter Healthcare, Japan, as well as a number of executive roles in his 11 years at Baxter Healthcare.

The Board selected Mr. Corbett to serve as a director because it believes that his knowledge and experience in the medical device industry and his experience at his prior positions, each of which contribute to the breadth of knowledge of the Board.

Donald Williams

has served as a director of us and Alphatec Spine since April 2015. Mr. Williams is a 35-year veteran of the public accounting industry, retiring in 2014. Mr. Williams spent 18 years as an Ernst & Young partner and the last seven years as a Partner with Grant Thornton. Mr. Williams’ career focused on private and public companies in the technology and life sciences sectors. During the last seven years at Grant Thornton, he served as the national leader of Grant Thornton’s life sciences practice and the managing partner of the San Diego Office. He was the lead partner for both Ernst & Young and Grant Thornton on multiple initial public offerings; secondary offerings; private and public debt financings; as well as numerous mergers and acquisitions. From 2001 to 2014, Mr. Williams served on the board of directors and is past president and chairman of the San Diego Venture Group. Mr. Williams also has served as a director of Marina Biotech, Inc., Proove Biosciences, Inc. and is on the Board of Advisors of the Southern Illinois University School of Accountancy.

The Board selected Mr. Williams to serve on the Board because it believes that his knowledge and experience as a partner in the public accounting industry and his knowledge in the medical device industry contribute to the breadth of knowledge of the Board.

Executive Officers

Set forth below is certain information, as of May 20, 2016, regarding our executive officers who are not also directors. We have employment agreements with all of our executive officers. Other than with respect to Mitsuo Asai, the President of our subsidiary, Alphatec Pacific, Inc., all other executive officers are at-will employees.

|

|

|

|

|

|

|

Name

|

Age

|

Position

|

|

Michael O’Neill

|

56

|

Chief Financial Officer, Vice President and Treasurer

|

|

Mitsuo Asai

|

61

|

President, Alphatec Pacific, Inc.

|

|

Michael Plunkett

|

58

|

Chief Operating Officer

|

|

Ebun Garner, Esq.

|

44

|

General Counsel, Senior Vice President and Corporate Secretary

|

|

Kristin Machacek Leary

|

47

|

Senior Vice President, Global Human Resources

|

Michael O’Neill

has served as the Chief Financial Officer, Vice President and Treasurer of us and Alphatec Spine since October 2010. From November 2007 to March 2009, he was Vice President and Chief Financial Officer of Mentor Corporation, a surgical aesthetics manufacturer. Mentor Corporation was acquired by Johnson & Johnson in January 2009. Prior to joining Mentor Corporation, Mr. O’Neill had spent the previous twenty years with Johnson & Johnson, with his most recent position being Vice President and Chief Financial Officer, Johnson & Johnson Worldwide Information Technology. From 2001 through 2007, Mr. O’Neill served as the Vice President, Finance and Chief Financial Officer for LifeScan, a division of Johnson & Johnson, a leading supplier of blood glucose monitoring systems. Mr. O’Neill began working for Johnson & Johnson in 1987 and moved through a series of progressively more responsible positions including International Controller, Operations Controller, Finance Director, and Group Finance Director.

Mitsuo Asai

has served as President of Alphatec Pacific, Inc., a wholly owned subsidiary of Alphatec Spine, since April 2008. From 2006 until he joined Alphatec Pacific, Inc. in 2008, Mitsuo Asai was the President of Tokai Co., Ltd., a manufacturer of consumer goods. From 2002 to 2004, Mitsuo Asai served as General Manager and President of Virbac Japan Co., Ltd., a company that focused on veterinary pharmaceuticals and healthcare products. From 1998 to 2002, Mitsuo Asai served as President and CEO of Vital Link Corporation, a distributor of cardiovascular medical devices. From 1985 to 1996, Mitsuo Asai held various positions of increasing responsibility with Beckman Coulter, K.K., and a manufacturer of biomedical testing instrument systems.

Michael Plunkett

joined Alphatec Spine in March 2012 as Vice President of Operations and was promoted to Chief Operating Officer in January 2014. He has held numerous positions in Operations, Information Technology, and Program Management. Prior to joining us, Mr. Plunkett had increasing positions of authority from August 2003 to March 2012 at First Marblehead Corporation. His final position was Managing Director. Prior to joining First Marblehead, Mike served over 24 years in the U.S. Navy and retired with the rank of Captain in July 2003. While in the Navy he served in a variety of ashore and afloat positions, including Supply Officer, USS John C. Stennis (CVN 74) and the primary assistant to the Deputy Chief of Naval Operations, Fleet Readiness and Logistics.

Ebun Garner, Esq.

has served as General Counsel, Senior Vice President and Corporate Secretary of us and Alphatec Spine since April 2010. Mr. Garner originally joined us in 2005 as Vice President of Legal Affairs and Corporate Secretary. In 2006, he became General Counsel and Corporate Secretary. Prior to joining us, Mr. Garner was a corporate associate in the New York office of the law firm of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. Prior to that, he was a corporate associate in the New York office of the law firm of Squadron, Ellenoff, Plesent and Sheinfeld, LLP. Mr. Garner is admitted to practice law in the State of New York and is a registered in-house attorney in the State of California.

Kristin Machacek Leary

has served as Senior Vice President of Global Human Resources of us and Alphatec Spine since July 2014. Prior to joining us, Ms. Leary worked at Quintiles, a leading provider of biopharmaceutical development and commercial outsourcing services from 2012 to 2014 where she led the Global Talent function. From 2007 to 2011 Ms. Leary worked at Hewlett-Packard Corporation where she was responsible for Executive Leadership Development worldwide. From 1996 to 2007, Ms. Leary worked at Boston Scientific Corporation from where she held various senior leadership roles across the divisions, international regions, and Human Resources function. Ms. Leary graduated from Concordia College in Moorhead, Minnesota, USA with a BA in Organizational Communication and a BA in English.

CORPORATE GOVERNANCE MATTERS

Board of Directors Leadership Structure

While the Board does not have a written policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, in 2014 the Board determined that having a non-employee director serve as Chairman is in the best interest of the Company’s stockholders because it allows the Chairman to focus on the decision-making process of the Board as a whole. It also allows the Chief Executive Officer to focus on our day-to-day operations and the execution of our strategic plan. We have a strong governance structure in place, including independent directors, to ensure the powers and duties of the dual role are handled responsibly. Furthermore, consistent with NASDAQ listing requirements, the independent directors regularly have the opportunity to meet as an independent group. We do not have a lead independent director.

Mr. Cross has served as Chairman of the Board of Directors since July 2011. The Chairman of the Board of Directors provides leadership to the Board and works with the Board to define its activities and the calendar for fulfillment of its responsibilities. The Chairman of the Board of Directors approves the meeting agendas after input from management, facilitates communication among members of the Board and presides at meetings of our Board and stockholder.

The Chairman of the Board of Directors, the Chairman of the Audit Committee, the Chairman of the Nominating, Governance and Compensation Committee and the other members of the Board work in concert to provide oversight of our management and affairs. The leadership of Mr. Cross fosters a culture of open discussion and deliberation, with a thoughtful evaluation of risk, to support our decision-making. Our Board encourages communication among its members and between management and the Board to facilitate productive working relationships. Working with the other members of the Board, Mr. Cross also strives to ensure that there is an appropriate balance and focus among key Board responsibilities such as strategic development, review of operations and risk oversight.

The Board of Directors’ Role in Risk Oversight

The Board plays an important role in risk oversight through direct decision-making authority with respect to significant matters and the oversight of management by the Board and its committees. In particular, the Board administers its risk oversight function through: (1) the review and discussion of regular periodic reports to the Board and its committees on topics relating to the risks that we face; (2) the required approval by the Board (or a committee of the Board) of significant transactions and other decisions; (3) the direct oversight of specific areas of our business by the Audit Committee and the Nominating, Governance and Compensation Committee; and (4) regular periodic reports from our auditors and outside advisors regarding various areas of potential risk, including, among others, those relating to our internal control over financial reporting. The Board also relies on management to bring significant matters impacting us to the Board’s attention.

Pursuant to the Audit Committee’s charter, the Audit Committee is responsible for discussing the guidelines and policies that govern the process by which our exposure to risk is assessed and managed by management. As part of this process, the Audit Committee discusses our major financial risk exposures and steps that management has taken to monitor and control such exposure. In addition, we, under the supervision of the Audit Committee, have established procedures available to all employees for the anonymous and confidential submission of complaints relating to any matter in order to encourage employees to report questionable activities directly to our senior management and the Audit Committee.

Because of the role of the Board in risk oversight, the Board believes that any leadership structure that it adopts must allow it to effectively oversee the management of the risks relating to our operations. The Board recognizes that there are

multiple leadership structures that could allow it to effectively oversee the management of the risks relating to our operations. The Board believes its current leadership structure enables it to effectively provide oversight with respect to such risks.

Committees of the Board and Meetings

Meeting Attendance

. During the 2015 fiscal year, there were nine meetings of our entire Board. In addition, the Audit Committee and Nominating, Governance and Compensation Committee met a total of 10 times. No director attended fewer than 75% of the total number of meetings of the Board or committees of the Board on which he or she served during the 2015 fiscal year. The Board has adopted a policy under which each member of the Board is strongly encouraged, but not required, to attend each annual meeting of our stockholders. Six directors attended our annual meeting of stockholders held in 2015.

Audit Committee

. Our Audit Committee met four times during the 2015 fiscal year. This committee currently has three members: Donald Williams (Chairman), R. Ian Molson and Siri Marshall. In 2015, Mr. James Glynn served as the Chairman of this committee until his retirement from the Board in November of 2015. Our Audit Committee’s role and responsibilities are set forth in the Audit Committee’s written charter and include the authority to retain and terminate the services of our independent registered public accounting firm, review annual and quarterly financial statements, consider matters relating to accounting policy and internal controls and review the scope of annual audits.

All members of the Audit Committee satisfy the current independence standards promulgated by the Securities and Exchange Commission and The NASDAQ Stock Market, as such standards apply specifically to members of audit committees. The Board has determined that Messrs. Williams and Molson are each an “audit committee financial expert,” as the Securities and Exchange Commission has defined that term in Item 407 of Regulation S-K.

A copy of the Audit Committee’s written charter is publicly available on our website at www.alphatecspine.com under “Investor Relations-Corporate Governance.” Please also see the report of the Audit Committee set forth elsewhere in this proxy statement.

Nominating, Governance and Compensation Committee

. Our Nominating, Governance and Compensation Committee met six times during the 2015 fiscal year. This committee currently has three members: R. Ian Molson (Chairman), and Stephen O’Neil. Mr. Rohit Desai was a member of this committee, until he resigned from the Board in March of 2016, and Mr. Tom Davis was a member of this committee, until he resigned from the Board in May of 2016. Our Nominating, Governance and Compensation Committee’s role and responsibilities are set forth in the committee’s written charter and includes: (i) reviewing, approving, and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the Board are carried out and that such policies, practices and procedures contribute to our success, (ii) evaluating and making recommendations to the full Board as to the size and composition of the Board and its committees, and (iii) evaluating and making recommendations as to potential director candidates.

With respect to compensation matters, the Nominating, Governance and Compensation Committee is responsible for the determination of the compensation of our Chief Executive Officer, and conducts its decision-making process with respect to that determination without the presence of the Chief Executive Officer. This committee also administers our Amended and Restated 2005 Employee, Director and Consultant Stock Plan, or the 2005 Stock Plan, and our 2007 Employee Stock Purchase Plan, or the 2007 ESPP Plan.

With respect to nominations for our Board, the committee may consider Board candidates recommended by stockholders as well as from other sources such as other directors or officers, third party search firms or other appropriate sources. For all potential candidates, the committee may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the Board, and concern for the long-term interests of the stockholders. Although the Company has no policy regarding diversity, the committee seeks a broad range of perspectives and considers both the personal characteristics (such as gender, ethnicity, and age) and experience (such as industry, professional, public service) of directors and prospective nominees to the Board. In general, persons recommended by stockholders will be considered on the same basis as candidates from other sources.

If a stockholder wishes to nominate a candidate to be considered for election as a director at the 2017 Annual Meeting of Stockholders, it must comply with the procedures set forth in our By-laws and give timely notice of the nomination in writing to our Corporate Secretary not less than 45 nor more than 75 days prior to the date that is one year from the date on which we first mail our proxy statement relating to our 2016 Annual Meeting of Stockholders. See “Stockholder Proposals and Nominations for Directors.” If a stockholder wishes simply to propose a candidate for consideration as a nominee by the Nominating, Governance and Compensation Committee, it must make such proposal for such candidate in writing, addressed to the Nominating, Governance and Compensation Committee in care of our Corporate Secretary at our principal offices. Submissions must be made by mail, courier or personal delivery and must contain the information set forth in our Nominating,

Governance and Compensation Committee Charter, which is available on our website at www.alphatecspine.com under “Investor Relations-Corporate Governance.”

All members of the Nominating, Governance and Compensation Committee qualify as independent directors under the standards promulgated by The NASDAQ Stock Market.

A copy of the Nominating, Governance and Compensation Committee’s written charter is publicly available on our website at www.alphatecspine.com under “Investor Relations-Corporate Governance.” Please also see the report of the Nominating, Governance and Compensation Committee set forth elsewhere in this proxy statement.

Further discussion of the process and procedures for considering and determining executive compensation, including the role that our executive officers play in determining compensation for other senior management, is included below in the section entitled “Compensation Discussion and Analysis.”

Executive Committee

. Our Executive Committee consists of Mortimer Berkowitz III, R. Ian Molson, Leslie Cross and James Corbett. Our Executive Committee evaluates and, if appropriate, makes recommendations to the Board with respect to any strategic transactions or decisions affecting the Company, which primarily consist of: (i) any merger, consolidation, dissolution or liquidation of the Company; (ii) any annual budget or forecast for the Company; (iii) any issuance, authorization, cancellation, alteration, modification, redemption or any change in, of, or to, any equity security of the Company; and (iv) any hiring or termination issues related to any senior vice president level employee. The Executive Committee is not authorized to act on behalf of the Board.

The Executive Committee has not adopted a formal written charter and does not currently have a chairperson. During the fiscal year ended December 31, 2015, the Executive Committee met six times. Mr. Molson is the only member of the Executive Committee that qualifies as independent directors under the standards promulgated by The NASDAQ Stock Market.

Stockholder Communications to the Board