Filed pursuant to Rule 424(b)(3)

Registration No. 333-217366

The information contained in the preliminary prospectus supplement

is not complete and may be changed. A registration statement relating to these securities has been declared effective by the Securities Exchange Commission. This preliminary prospectus supplement and the accompanying prospectus are not an offer to

sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where such offer or sale is not permitted.

Subject to completion, dated May 18, 2017

Preliminary prospectus supplement

(To prospectus dated

May 4, 2017)

Identiv, Inc.

Shares of Common Stock

We are offering of shares of our common stock.

Our common stock is listed on The NASDAQ Capital Market under the symbol “INVE.” On May 17, 2017, the last reported sale price

of our shares of common stock on The NASDAQ Capital Market was $4.85 per share.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions (1)

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds to Identiv, Inc., before expenses

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

See “Underwriting” for a description of the compensation payable to the underwriter.

|

We have granted the underwriter an option for a period of 30 days to purchase up to

additional shares of our common stock at the public offering price, less underwriting discounts and commissions.

Investing in our common stock involves a high degree of risk. See “

Risk Factors

” beginning on

page S-4 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares to purchasers on or about

, 2017.

Northland Capital Markets

The date of this prospectus supplement is

, 2017.

Table of contents

Prospectus

About This Prospectus Supplement

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 (File No. 333-217366)

that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process.

This document

contains two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also supplements and updates information contained in the accompanying prospectus and the documents incorporated by

reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering. If the information contained in this

prospectus supplement differs or varies from the information contained in the accompanying prospectus, you should rely on the information set forth in this prospectus supplement.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and

any related free writing prospectus provided or approved by us. We have not, and the underwriter has not, authorized any person to provide you with other or additional information. We and the underwriter take no responsibility for, and can provide

no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted.

You should assume that the information appearing in this prospectus supplement, the accompanying prospectus, any related free writing

prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus are accurate only as of the respective dates of those documents. Our business, financial condition, results of operations and

prospects may have changed since those dates, and neither the delivery of this prospectus supplement and the accompanying prospectus nor any sale hereunder shall, under any circumstances, create any implication to the contrary.

Before you invest in our common stock, you should carefully read the registration statement described in the accompanying prospectus

(including the exhibits thereto) of which this prospectus supplement and the accompanying prospectus form a part, this prospectus supplement, the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and

the accompanying prospectus. See the section entitled “Where You Can Find More Information” in this prospectus supplement.

Unless the context otherwise requires, references in this prospectus supplement and the accompanying prospectus to “Identiv,” the

“company,” “we,” “us” and “our” refer to Identiv, Inc. and its subsidiaries.

S-1

Prospectus Supplement Summary

This summary highlights selected information about us and this offering. Because it is a summary, it does not contain all of the

information that you should consider before investing. Before you decide to invest in our common stock, you should read carefully and in their entirety this entire prospectus supplement and the accompanying prospectus, including the section in this

prospectus supplement entitled “Risk Factors,” and the documents we have incorporated by reference in this prospectus supplement and the accompanying prospectus, along with our financial statements and accompanying notes incorporated by

reference in this prospectus supplement and the accompanying prospectus.

Overview

We are a global security technology company that secures and manages access to physical places, things and information. Global organizations in

government, education, retail, transportation, healthcare and other markets rely upon our solutions. We empower them to create secure and convenient experiences in schools, government offices, factories, critical infrastructure, transportation,

hospitals and virtually every type of facility and for a wide range of products.

Our operating segments focus on the following solutions:

|

|

•

|

|

Physical access solutions, securing buildings via an integrated access control system, included in our Premises (“PACS”) segment.

|

|

|

•

|

|

Information security solutions, securing enterprise information access across PCs, networks, email, login, and printers via delivery of smart card reader products, included in our Identity segment.

|

|

|

•

|

|

Radio frequency identification (“RFID”) based solutions for use in a wide range of applications from asset tracking to product authenticity, product ease-of-use (e.g. pairing), transportation access and other

applications sometimes included in the Internet of Things. The RFID devices are embedded into access cards, transponders and other credentials that enable frictionless access to and interaction with the physical world.

|

The foundation of our business is our expertise in RFID, smart card technology, and access control, our close customer relationships that

allow us to develop customer-relevant products, and our core value of quality.

Company Information

We were founded in 1990 in Munich, Germany and incorporated in 1996 under the laws of the state of Delaware. Our principal executive offices

are located at 2201 Walnut Avenue, Suite 100, Fremont, California, 94538 and our telephone number is (949) 250-8888. Our website address is www.identiv.com. We do not incorporate the information on, or accessible through, our website into this

prospectus supplement or the accompanying prospectus, and you should not consider any information on, or accessible through, our website as part of this prospectus supplement or the accompanying prospectus.

S-2

The Offering

|

Common stock offered by us

|

shares

|

|

Common stock to be outstanding after the offering

|

shares

|

|

Option to purchase additional shares

|

We have granted the underwriter a 30-day option to purchase up to an additional shares of common stock.

|

|

Use of proceeds

|

We currently intend to use the net proceeds from this offering for working capital and other general corporate purposes. We may also use a portion of the net proceeds from this offering to acquire or invest in complementary businesses,

technologies or other assets, although we have no present commitments or agreements to do so. See “Use of Proceeds.”

|

|

Risk factors

|

See “Risk Factors” for a discussion of factors you should consider carefully before deciding to invest in our common stock.

|

|

NASDAQ Capital Market symbol

|

“INVE”

|

The number of shares of common stock to be outstanding immediately after this offering is based on

11,160,182 shares outstanding as of March 31, 2017 and excludes:

|

|

•

|

|

2,703,048 shares of our common stock issuable upon the exercise of options or vesting of restricted stock awards outstanding as of March 31, 2017 under our equity incentive plans, which options have a

weighted-average exercise price of $6.66 per share;

|

|

|

•

|

|

332,544 shares of common stock reserved for future issuance under our 2011 Incentive Compensation Plan;

|

|

|

•

|

|

951,878 shares of common stock issuable upon the exercise of warrants to purchase common stock outstanding as of March 31, 2017 at a weighted average exercise price of $4.58 per share; and

|

|

|

•

|

|

293,888 shares of common stock available for future issuance under our Employee Stock Purchase Plan.

|

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise by the underwriter of its option to purchase

additional shares.

S-3

Risk Factors

Investing in shares of our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described

below and in our Annual Report on Form 10-K for the year ended December 31, 2016 incorporated by reference in this prospectus supplement and the accompanying prospectus, any amendment or update thereto reflected in our subsequent filings

with the SEC, and all of the other information in this prospectus supplement and the accompanying prospectus, including our financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying

prospectus, before making an investment decision. If any of these risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the trading price of our common

stock could decline and you could lose part or all of your investment. Additional risks and uncertainties that are not yet identified or that we think are immaterial may also materially harm our business, operating results and financial condition

and could result in a complete loss of your investment.

Risks related to this offering

If you purchase shares of our common stock in this offering, you will experience immediate and substantial dilution in the net tangible

book value of your shares. In addition, we may issue additional equity or equity-linked securities in the future, which may result in additional dilution to you.

The price per share of our common stock being offered may be higher than the net tangible book value per share of our outstanding common stock

prior to this offering. Based on the public offering price of $ per share and our net tangible book value (deficit) as of March 31, 2017 of approximately $(0.04) per

share, if you purchase shares of common stock in this offering, you will suffer immediate and substantial dilution of $ per share, representing the difference between the

public offering price and the as adjusted net tangible book value per share of our common stock as of March 31, 2017 after giving effect to this offering. See the section entitled “Dilution” below for a more detailed discussion of the

dilution you will incur if you purchase common stock in this offering. In addition, we have a significant number of outstanding options and warrants to purchase common stock. If the holders of these options and warrants exercise their options and

warrants, you may incur further dilution. Also, to the extent we need to raise additional capital in the future and we issue additional shares of common stock or securities convertible into or exchangeable for our common stock, our then-existing

stockholders may experience dilution and the new securities may have rights senior to those of our common stock offered in this offering.

Our management will have broad discretion in how we use the net proceeds of this offering and may allocate the net proceeds from this

offering in ways that you and other stockholders may not approve.

Our management will have broad discretion in the use of the net

proceeds, including for any of the purposes described in the section entitled “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately.

Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure of our management to use these funds

effectively could harm our business. Pending their use, we may invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed

obligations of the U.S. government. These investments may not yield a favorable return to our stockholders.

We have never paid

dividends on our capital stock and we do not expect to pay dividends in the foreseeable future.

We have never paid dividends on

any of our capital stock and currently intend to retain any future earnings to fund the growth of our business. Any determination to pay dividends in the future will be at the discretion of our board of directors and will depend on our financial

condition, operating results, capital requirements, general business conditions and other factors that our board of directors may deem relevant. As a result, capital appreciation, if any, of our common stock will be the sole source of gain for the

foreseeable future.

S-4

Forward-Looking Statements

This prospectus supplement and the accompanying prospectus and the documents incorporated herein and therein by reference we have filed with

the SEC include and incorporate forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the

Exchange Act. All statements, other than statements of historical fact, included or incorporated by reference in this prospectus supplement or accompanying prospectus regarding our strategy, future operations, financial position, future revenues,

product benefits and attributes, demand for our products, market position, prospects, plans and objectives of management are forward-looking statements. The words “anticipates,” “believes,” “estimates,”

“expects,” “anticipate,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not

all forward-looking statements contain these identifying words. We cannot guarantee that we actually will achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our

forward-looking statements, each of which applies only as of the date set forth herein. There are a number of important factors that could cause our actual results to differ materially from those indicated by these forward-looking statements. These

factors include demand for our products, our ability to successfully compete, trends in our business, economic conditions, and the factors that we identify and other information disclosed in the documents we incorporate by reference into this

prospectus supplement and the accompanying prospectus. Before you invest in our common stock, you should be aware that the occurrence of the events described in the section entitled “Risk Factors” herein, elsewhere in this prospectus

supplement and accompanying prospectus and in the documents incorporated by reference herein and therein could negatively affect our business, operating results, financial condition and stock price. Any forward-looking statement made by us in this

prospectus supplement, the accompanying prospectus, or any of the documents incorporated by reference into this prospectus supplement and the accompanying prospectus speaks only as of the date on which it was made. We expressly disclaim any

obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any

such statement is based. You should, however, review additional disclosures we make in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

S-5

Use of Proceeds

We estimate that the net proceeds to us from this offering after deducting the underwriting discounts and commissions and estimated offering

expenses payable by us will be approximately $ million (or approximately $ million if the underwriter

exercises its option to purchase additional shares in full).

We currently intend to use the net proceeds of this offering for working

capital and other general corporate purposes. We may also use a portion of the net proceeds from this offering to acquire or invest in complementary businesses, technologies or other assert, although we have no present commitments or agreements to

do so. As a result, our management will have broad discretion over the use of these proceeds. Pending application of the net proceeds, we intend to invest the net proceeds in short- and intermediate-term, interest-bearing obligations,

investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

S-6

Dilution

If you purchase our common stock in this offering, your interest will be immediately diluted to the extent of the difference between the

public offering price per share and the net tangible book value per share of our common stock immediately after this offering.

Our net

tangible book value (deficit) at March 31, 2017 was approximately $(0.5) million, or $(0.04) per share, based on 11,160,182 shares of our common stock outstanding as of that date. Net tangible book value per share is calculated by subtracting

our total liabilities from our total tangible assets, which is total assets less intangible assets, and dividing this amount by the number of shares of our common stock outstanding.

After giving effect to the sale of

shares of common stock by us the public offering price of

$ per share, and after deducting the underwriting discounts and commissions and estimated offering expenses payable by us, our as adjusted net tangible book value (deficit)

as of March 31, 2017 would have been $ million, or $ per share. This represents an

immediate increase in the net tangible book value of $ per share to existing stockholders and immediate dilution of

$ per share to investors in this offering, as illustrated by the following table:

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share

|

|

|

|

|

|

$

|

|

|

|

Net tangible book value (deficit) per share as of March 31, 2017

|

|

$

|

(0.04

|

)

|

|

|

|

|

|

Increase in as adjusted net tangible book value (deficit) per share attributable to investors

participating in this offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As adjusted net tangible book value (deficit) per share after giving effect to this

offering

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to investors in this offering

|

|

|

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

If the underwriter exercises in full its option to purchase

$ of additional shares from us at the public offering price of $ per share, the as adjusted net tangible

book value per share after this offering would be $ per share, the increase in as adjusted net tangible book value per share to existing stockholders would be

$ per share and the dilution to new investors purchasing shares in this offering would be $ per share.

For purposes of the above calculation, the number of shares of common stock to be outstanding after this offering is based on 11,160,182 shares

outstanding on March 31, 2017, and excludes:

|

|

•

|

|

2,703,048 shares of our common stock issuable upon the exercise of options or vesting of restricted stock awards outstanding as of March 31, 2017 under our equity incentive plans, which options have a

weighted-average exercise price of $6.66 per share;

|

|

|

•

|

|

332,544 shares of common stock available for future issuance under our 2011 Incentive Compensation Plan;

|

|

|

•

|

|

951,878 shares of common stock issuable upon the exercise of warrants to purchase common stock outstanding as of March 31, 2017 at a weighted average exercise price of $4.58 per share; and

|

|

|

•

|

|

293,888 shares of common stock available for future issuance under our Employee Stock Purchase Plan.

|

To the extent that additional shares are issued pursuant to the foregoing, investors purchasing our common stock in this offering will

experience further dilution.

S-7

Underwriting

We have entered into an underwriting agreement with Northland Securities, Inc. who will act as the underwriter in the offering. Subject to the

terms and conditions of the underwriting agreement, the underwriter has agreed to purchase and pay for all of the common stock offered by this prospectus supplement, if any are purchased, other than those covered by the option to purchase additional

shares described below.

The common stock should be ready for delivery on or about

, 2017 against payment in immediately available funds. The underwriter is offering the shares subject to various conditions and

may reject all or part of any order. The underwriter has advised us that it proposes to offer the shares directly to the public at the public offering price that appears on the cover page of this prospectus supplement. After the shares are released

for sale to the public, the underwriter may change the offering price and other selling terms at various times.

The table below provides

information regarding the amount of the discount to be paid to the underwriter by us. These amounts are shown assuming both no exercise and full exercise of the underwriter’s option to purchase additional shares of our common stock. In addition

to the underwriting discount, we have agreed to pay up to $100,000 of the fees and expenses of the underwriter. The fees and expenses of the underwriter that we have agreed to reimburse are not included in the underwriting discounts set forth in the

table below. The underwriter has not received and will not receive from us any other item of compensation or expense in connection with this offering considered by the Financial Industry Regulatory Authority to be underwriting compensation under its

corporate financing rule. The underwriting discount and reimbursable expenses the underwriter will receive were determined through arms’ length negotiations between us and the underwriter.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

Without

Option

|

|

|

Total

With

Option

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

We estimate that our total expenses of the offering, excluding the underwriting discount, will be

approximately $ , which includes $100,000 that we have agreed to reimburse the underwriter for the fees incurred by it in connection with the offering.

We have agreed to indemnify the underwriter against certain liabilities, including civil liabilities under the Securities Act of 1933, as

amended, or to contribute to payments that the underwriter may be required to make in respect of those liabilities.

We and each of our

directors and executive officers have agreed to a 90-day “lock up” with respect to common stock that they beneficially own, including securities that are convertible into common stock and securities that are exchangeable or exercisable for

common stock. This means that, subject to certain exceptions, for a period of 90 days following the date of this prospectus supplement, we and such persons may not offer, sell, pledge, or otherwise dispose of these securities without the prior

written consent of the underwriter.

We have granted the underwriter an option which is exercisable for up to 30 days after the date of

this prospectus supplement, to purchase a maximum of additional shares from us. If the underwriter exercises all or part of this

option, it will purchase shares covered by the option at the public offering price that appears on the cover page of this prospectus supplement, less the underwriting discount. If this option is exercised in full, the total price to the public will

be approximately $ million and the total proceeds to us, before expenses, will be approximately $

million.

S-8

To facilitate this offering, the underwriter may engage in transactions that stabilize, maintain,

or otherwise affect the price of our common stock during and after the offering. Specifically, the underwriter may over-allot or otherwise create a short position in our common stock for its own account by selling more common stock than we have sold

to the underwriter. The underwriter may close out any short position by either exercising its option to purchase additional shares or purchasing shares in the open market.

In addition, the underwriter may stabilize or maintain the price of our common stock by bidding for or purchasing shares in the open market

and may impose penalty bids. If penalty bids are imposed, selling concessions allowed to broker-dealers participating in this offering are reclaimed if shares previously distributed in this offering are repurchased, whether in connection with

stabilization transactions or otherwise. The effect of these transactions may be to stabilize or maintain the market price of our common stock at a level above that which might otherwise prevail in the open market. The imposition of a penalty bid

may also affect the price of our common stock to the extent that it discourages resale of our common stock. The magnitude or effect of any stabilization or other transactions is uncertain. These transactions may be effected on The NASDAQ Capital

Market or otherwise and, if commenced, may be discontinued at any time.

In connection with this offering, the underwriter and selling group members may

also engage in passive market making transactions in our common stock on The NASDAQ Capital Market. Passive market making consists of displaying bids on The NASDAQ Capital Market limited by the prices of independent market makers and effecting

purchases limited by those prices in response to order flow. Rule 103 of Regulation M promulgated by the SEC limits the amount of net purchases that each passive market maker may make and the displayed size of each bid. Passive market making may

stabilize the market price of our common stock at a level above that which might otherwise prevail in the open market and, if commenced, may be discontinued at any time.

The underwriter may facilitate the marketing of this offering online directly or through one of its affiliates. In those cases, prospective

investors may view offering terms and a prospectus supplement online and place orders online or through their financial advisors.

Electronic Delivery of Prospectus Supplements

. A prospectus supplement in electronic format may be delivered to potential investors by

the underwriter participating in this offering. The prospectus supplement in electronic format will be identical to the paper version of such prospectus supplement. Other than the prospectus supplement in electronic format, the content or

information on the underwriter’s website and any information contained in any other website maintained by the underwriter is not part of the prospectus supplement or the registration statement of which this prospectus supplement forms a part.

Selling Restrictions

No action has

been taken in any jurisdiction except the United States that would permit a public offering of our common stock, or the possession, circulation or distribution of this prospectus or any other material relating to us or our common stock in any

jurisdiction where action for that purpose is required. Accordingly, the shares may not be offered or sold, directly or indirectly, and neither this prospectus nor any other offering material or advertisements in connection with the shares may be

distributed or published, in or from any country or jurisdiction except in compliance with any applicable rules and regulations of any such country or jurisdiction.

Canada

The securities may be sold

only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument 45-106

Prospectus Exemptions

or subsection 73.3(1) of the

Securities Act

(Ontario), and are

permitted clients, as defined in National Instrument 31-103

Registration Requirements, Exemptions and Ongoing Registrant Obligations

. Any resale of the securities must be made in accordance with an exemption from, or in a transaction not

subject to, the prospectus requirements of applicable securities laws.

S-9

Securities legislation in certain provinces or territories of Canada may provide a purchaser with

remedies for rescission or damages if this prospectus (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the

securities legislation of the purchaser’s province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory for particulars of these rights or consult with

a legal advisor.

Pursuant to section 3A.3 of National Instrument 33-105

Underwriting Conflicts

(NI 33-105), the underwriters are

not required to comply with the disclosure requirements of NI 33-105 regarding underwriter conflicts of interest in connection with this offering.

United Kingdom

Each of the

underwriters has, separately and not jointly, represented and agreed that:

|

|

•

|

|

it has not made or will not make an offer of the securities to the public in the United Kingdom within the meaning of section 102B of the Financial Services and Markets Act 2000 (as amended), or the FSMA, except to

legal entities which are authorized or regulated to operate in the financial markets or, if not so authorized or regulated, whose corporate purpose is solely to invest in securities or otherwise in circumstances which do not require the publication

by us of a prospectus pursuant to the Prospectus Rules of the Financial Services Authority, or FSA;

|

|

|

•

|

|

it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of section 21 of FSMA) to

persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 or in circumstances in which section 21 of FSMA does not apply

to us; and

|

|

|

•

|

|

it has complied with and will comply with all applicable provisions of FSMA with respect to anything done by it in relation to the securities in, from or otherwise involving the United Kingdom.

|

Switzerland

The securities will

not be offered, directly or indirectly, to the public in Switzerland and this prospectus does not constitute a public offering prospectus as that term is understood pursuant to article 652a or 1156 of the Swiss Federal Code of Obligations.

Israel

In the State of Israel

this prospectus shall not be regarded as an offer to the public to purchase shares of common stock under the Israeli Securities Law, 5728—1968, which requires a prospectus to be published and authorized by the Israel Securities Authority, if it

complies with certain provisions of Section 15 of the Israeli Securities Law, 5728—1968, including,

inter alia

, if: (i) the offer is made, distributed or directed to not more than 35 investors, subject to certain conditions

(the “Addressed Investors”); or (ii) the offer is made, distributed or directed to certain qualified investors defined in the First Addendum of the Israeli Securities Law, 5728—1968, subject to certain conditions (the

“Qualified Investors”). The Qualified Investors shall not be taken into account in the count of the Addressed Investors and may be offered to purchase securities in addition to the 35 Addressed Investors. The company has not and will not

take any action that would require it to publish a prospectus in accordance with and subject to the Israeli Securities Law, 5728—1968. We have not and will not distribute this prospectus or make, distribute or direct an offer to subscribe for

our common stock to any person within the State of Israel, other than to Qualified Investors and up to 35 Addressed Investors.

S-10

Qualified Investors may have to submit written evidence that they meet the definitions set out in

of the First Addendum to the Israeli Securities Law, 5728—1968. In particular, we may request, as a condition to be offered common stock, that Qualified Investors will each represent, warrant and certify to us and/or to anyone acting on our

behalf: (i) that it is an investor falling within one of the categories listed in the First Addendum to the Israeli Securities Law, 5728—1968; (ii) which of the categories listed in the First Addendum to the Israeli Securities Law,

5728—1968 regarding Qualified Investors is applicable to it; (iii) that it will abide by all provisions set forth in the Israeli Securities Law, 5728—1968 and the regulations promulgated thereunder in connection with the offer to be

issued common stock; (iv) that the shares of common stock that it will be issued are, subject to exemptions available under the Israeli Securities Law, 5728—1968: (a) for its own account; (b) for investment purposes only; and

(c) not issued with a view to resale within the State of Israel, other than in accordance with the provisions of the Israeli Securities Law, 5728—1968; and (v) that it is willing to provide further evidence of its Qualified Investor

status. Addressed Investors may have to submit written evidence in respect of their identity and may have to sign and submit a declaration containing,

inter alia

, the Addressed Investor’s name, address and passport number or Israeli

identification number.

European Economic Area

In relation to each Member State of the European Economic Area, or the EEA, which has implemented the European Prospectus Directive (each, a

“Relevant Member State”), an offer of our shares may not be made to the public in a Relevant Member State other than:

|

|

•

|

|

to any legal entity which is a qualified investor, as defined in the European Prospectus Directive;

|

|

|

•

|

|

to fewer than 100 or, if the Relevant Member State has implemented the relevant provision of the 2010 PD Amending Directive, 150 natural or legal persons (other than qualified investors as defined in the European

Prospectus Directive), subject to obtaining the prior consent of the relevant dealer or dealers nominated by us for any such offer; or

|

|

|

•

|

|

in any other circumstances falling within Article 3(2) of the European Prospectus Directive;

|

provided that no

such offer of our shares shall require us or any underwriter to publish a prospectus pursuant to Article 3 of the European Prospectus Directive or supplement prospectus pursuant to Article 16 of the European Prospectus Directive.

For the purposes of this description, the expression an “offer to the public” in relation to the securities in any Relevant Member

State means the communication in any form and by any means of sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide to purchase or subscribe for the securities, as the expression may

be varied in that Relevant Member State by any measure implementing the European Prospectus Directive in that member state, and the expression “European Prospectus Directive” means Directive 2003/71/EC (and amendments hereto, including the

2010 PD Amending Directive, to the extent implemented in the Relevant Member State) and includes any relevant implementing measure in each Relevant Member State. The expression 2010 PD Amending Directive means Directive 2010/73/EU.

We have not authorized and do not authorize the making of any offer of securities through any financial intermediary on our behalf, other than

offers made by the underwriters and their respective affiliates, with a view to the final placement of the securities as contemplated in this document. Accordingly, no purchaser of the shares, other than the underwriters, is authorized to make any

further offer of shares on our behalf or on behalf of the underwriters.

Hong Kong

The contents of this document have not been reviewed or approved by any regulatory authority in Hong Kong. This document does not constitute an

offer or invitation to the public in Hong Kong to acquire shares. Accordingly, unless permitted by the securities laws of Hong Kong, no person may issue or have in its

S-11

possession for the purposes of issue, this document or any advertisement, invitation or document relating to the shares, whether in Hong Kong or elsewhere, which is directed at, or the contents

of which are likely to be accessed or read by, the public in Hong Kong other than in relation to shares which are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” (as such term is defined in

the Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) (“SFO”) and the subsidiary legislation made thereunder); or in circumstances which do not result in this document being a “prospectus” as defined in the Companies

(Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32, Laws of Hong Kong) (“CO”); or which do not constitute an offer or an invitation to the public for the purposes of the SFO or the CO. The offer of the shares is personal to the

person to whom this document has been delivered, and a subscription for shares will only be accepted from such person. No person to whom a copy of this document is issued may issue, circulate or distribute this document in Hong Kong, or make or give

a copy of this document to any other person. You are advised to exercise caution in relation to the offer. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Singapore

This prospectus has not

been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the shares may not be

circulated or distributed, nor may the shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor pursuant

to Section 274 of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”), (ii) to a relevant person (as defined in Section 275(2) of the SFA), or any person pursuant to Section 275(1A), and in accordance with

the conditions, specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the shares are subscribed or purchased pursuant to an offer made in reliance on Section 275 of the SFA by a relevant person which

is:

|

|

(a)

|

a corporation (which is not an accredited investor) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

|

|

|

(b)

|

a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary is an accredited investor;

|

shares, debentures and units of shares, and debentures of that corporation, or the beneficiaries’ rights and interest (howsoever described) in that trust

shall not be transferable for six months after that corporation or that trust has acquired the shares under Section 275 except:

|

|

(1)

|

to an institutional investor or to a relevant person (as defined in Section 275(2) of the SFA), or any person pursuant to Section 275(1A) of the SFA (in the case of that corporation) or

Section 276(4)(i)(B) of the SFA (in the case of that trust);

|

|

|

(2)

|

where no consideration is or will be given for the transfer; or

|

|

|

(3)

|

where the transfer is by operation of law.

|

Other Relationships

Certain of the underwriters and their affiliates have provided, and may in the future provide, various investment banking, commercial banking

and other financial services for us and our affiliates for which they have received, and may in the future receive, customary fees.

Additional

Information

Northland Capital Markets is the trade name for certain capital markets and investment banking services of Northland

Securities, Inc., member FINRA/SIPC.

S-12

Legal Matters

The validity of the shares of common stock being offered hereby will be passed upon for us by Pillsbury Winthrop Shaw Pittman LLP, Palo

Alto, California. The underwriter is represented in this offering by Faegre Baker Daniels LLP, Minneapolis, Minnesota.

Experts

The consolidated financial statements of Identiv, Inc. as of December 31, 2016 and 2015 and for each of the two

years in the period ended December 31, 2016, incorporated in this prospectus supplement and elsewhere in the registration statement by reference to the Annual Report on Form 10-K for the year ended December 31, 2016, have been so

incorporated in reliance on the report of BPM LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

Where You Can Find More Information

We have filed a registration statement on Form S-3 with the SEC under the Securities Act. This prospectus supplement and the accompanying

prospectus are part of the registration statement but the registration statement includes and incorporates by reference additional information and exhibits. We file annual, quarterly and current reports, proxy statements and other information with

the SEC. You may read and copy the registration statement and any document we file with the SEC at the Public Reference Room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the

public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a web site that contains reports, proxy and information statements and other information regarding companies, such as ours, that file documents electronically with

the SEC. The address of that site on the world wide web is http://www.sec.gov. The information on the SEC’s web site is not part of this prospectus supplement or the accompanying prospectus, and any references to this web site or any other web

site are inactive textual references only.

The SEC permits us to “incorporate by reference” the information contained in

documents we file with the SEC, which means that we can disclose important information to you by referring you to those documents rather than by including them in this prospectus supplement or the accompanying prospectus. Information that is

incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus and you should read it with the same care that you read this prospectus supplement and the accompanying prospectus. Later information

that we file with the SEC will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus supplement and the accompanying prospectus, and will be considered to be a part of this

prospectus supplement and the accompanying prospectus from the date those documents are filed. We have filed with the SEC, and incorporate by reference in this prospectus supplement and the accompanying prospectus:

|

|

•

|

|

our Annual Report on Form 10-K for the year ended December 31, 2016;

|

|

|

•

|

|

our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2017;

|

|

|

•

|

|

our Current Reports on Form 8-K filed on February 14, 2017 (with respect to items 1.01, 1.02, 2.03 and 3.02 only) and February 17, 2017; and

|

|

|

•

|

|

the description of our common stock contained in our Registration Statement on Form 8-A filed on September 5, 1997, including any amendment or report filed for the purpose of updating such description.

|

We also incorporate by reference all additional documents that we file with the SEC under the terms of Section 13(a),

13(c), 14 or 15(d) of the Exchange Act that are made after the initial filing date of the registration

S-13

statement of which this prospectus supplement and the accompanying prospectus is a part and the effectiveness of the registration statement, as well as between the date of this prospectus

supplement and the termination of any offering of securities offered by this prospectus supplement and the accompanying prospectus. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not

file in accordance with SEC rules.

You may request a copy of any or all of the documents incorporated by reference but not delivered with

this prospectus, at no cost, by writing or telephoning us at the following address and number: Investor Relations, Identiv, Inc., 2201 Walnut Avenue, Suite 100, Fremont, California 94538, telephone (949) 553-4251. We will not, however, send

exhibits to those documents, unless the exhibits are specifically incorporated by reference in those documents.

We make available free of

charge on our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports, as soon as reasonably practicable after we electronically file or furnish such

materials to the SEC. You may obtain a free copy of these reports on the Investor Relations section of our website, www.identiv.com.

S-14

PROSPECTUS

$40,000,000

Identiv, Inc.

Common Stock

We may, from

time to time, offer and sell up to $40,000,000 of our common stock in one or more offerings. We will specify in the accompanying prospectus supplement more specific information about any such offering.

We may offer the shares of common stock for sale directly to investors or through underwriters, dealers, or agents. We will set forth the

names of any underwriters, dealers or agents and their compensation in the accompanying prospectus supplement.

Our common stock is listed

on The NASDAQ Capital Market under the symbol “INVE.” On April 18, 2017, the last reported sale price of our common stock on The NASDAQ Capital Market was $6.34 per share.

Investing in our securities involves risks. See the section entitled “Risk Factors” included in or incorporated by reference into

the accompanying prospectus supplement and in the documents we incorporate by reference in this prospectus.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 4, 2017

TABLE OF CONTENTS

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus, any

applicable prospectus supplement or any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others

may give you. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this prospectus and any prospectus supplement, or incorporated by reference, is

accurate only as of the dates of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a

“shelf” registration, or continuous offering, process. Under this shelf registration process, we may, from time to time, sell up to $40,000,000 of our common stock in one or more offerings.

This prospectus provides you with a general description of our common stock and the general manner in which we will offer our common stock.

Each time we sell shares of common stock, we will provide a prospectus supplement that will contain specific information about the terms of that offering. Any prospectus supplement may also add, update or change information contained in this

prospectus. Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in a prospectus supplement. The registration statement we filed with the SEC includes exhibits that provide more detail

of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any prospectus supplement, together with additional information described under the heading “Where You Can Find More

Information,” before making your investment decision.

Unless the context otherwise requires, references in this prospectus to

“Identiv,” “we,” “us” and “our” refer to Identiv, Inc. and its subsidiaries.

RISK FACTORS

Investing in our common stock involves risk. The prospectus supplement relating to a particular offering will

contain a discussion of risks applicable to an investment in our common stock. Prior to making a decision about investing in our common stock, you should carefully consider the specific factors discussed under the heading “Risk Factors”

included in or incorporated by reference into the applicable prospectus supplement together with all of the other information contained in the prospectus supplement or appearing in or incorporated by reference into this prospectus, including the

risk factors incorporated by reference to our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. The occurrence of any of these risks might cause you to lose all or part of your

investment in our common stock.

IDENTIV, INC.

Identiv, Inc. is a global security technology company that secures data, physical places and things. Global organizations in the government,

education, retail, transportation, healthcare and other markets rely upon our solutions.

Identiv, Inc. was founded in 1990 in Munich,

Germany and incorporated in 1996 under the laws of the state of Delaware. Our principal executive offices are located at 2201 Walnut Avenue, Suite 100, Fremont, California, and our telephone number is (949) 250-8888.

FORWARD-LOOKING STATEMENTS

When used in this prospectus, the words “expects,” “believes,” “anticipates,” “estimates,”

“may,” “could,” “intends,” and similar expressions are intended to identify forward-looking statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ

materially from those projected or otherwise implied by the forward-looking statements. These forward-looking statements speak only as of the date of this prospectus. Given these risks and uncertainties, you should not place undue reliance on these

forward-looking statements. We will discuss many of these risks and uncertainties in greater detail in any prospectus supplement under the heading “Risk Factors.” Additional cautionary statements or discussions of risks and uncertainties

that could affect our results or the achievement of the expectations described in forward-looking statements may also be contained in the documents we incorporate by reference into this prospectus.

These forward-looking statements speak only as of the date of this prospectus. We expressly disclaim any obligation or undertaking to release

publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. You should,

however, review additional disclosures we make in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC.

2

USE OF PROCEEDS

Unless we state otherwise in the applicable prospectus supplement, we intend to use the net proceeds from the sale of the common stock offered

by this prospectus for general corporate purposes. General corporate purposes may include additions to working capital, financing of capital expenditures, repayment or redemption of existing indebtedness, repurchases of stock, and future

acquisitions and strategic investment opportunities. Unless we state otherwise in the applicable prospectus supplement, pending the application of net proceeds, we expect to invest the net proceeds in investment grade, interest-bearing securities.

DESCRIPTION OF CAPITAL STOCK

This section describes the general terms and provisions of the shares of our common stock, $0.001 par value per share, and preferred stock,

$0.001 par value per share. This description is only a summary. Our amended and restated certificate of incorporation, as amended, and our amended and restated bylaws have been filed as exhibits to our periodic reports filed with the SEC, which are

incorporated by reference in this prospectus. You should read our amended and restated certificate of incorporation, as amended, which we refer to in this section as our certificate of incorporation, and our amended and restated bylaws, which we

refer to in this section as our bylaws, for additional information before you buy any of our common stock, preferred stock or other securities. See “Where You Can Find More Information.”

Common Stock

We are authorized to issue

50,000,000 shares of common stock. As of March 31, 2017, there were 11,135,804 shares of common stock issued and outstanding. Each holder of common stock is entitled to one vote for each share of common stock held on all matters submitted to a

vote of stockholders. We have not provided for cumulative voting for the election of directors in our certificate of incorporation. This means that the holders of a majority of the shares voted can elect all of the directors then standing for

election. Subject to preferences that may apply to shares of preferred stock outstanding at the time, the holders of outstanding shares of our common stock are entitled to receive dividends out of assets legally available at the times and in the

amounts that our board of directors may determine from time to time. Upon our liquidation, dissolution or winding-up, the holders of common stock are entitled to share ratably in all assets remaining after payment of all liabilities and the

liquidation preferences of any outstanding preferred stock. Holders of common stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable to the common stock. All

outstanding shares of common stock are fully paid and nonassessable.

Preferred Stock

We are authorized to issue 10,000,000 shares of preferred stock. As of March 31, 2017, no shares of preferred stock were issued and outstanding

and 40,000 shares of Series A participating preferred stock were authorized. We may issue the remaining unauthorized shares of preferred stock in series, with such designations, powers, preferences and other rights and qualifications, limitations or

restrictions as our board of directors may authorize, without further action by our stockholders, including:

|

|

•

|

|

the distinctive designation of each series and the number of shares that will constitute the series;

|

|

|

•

|

|

the voting rights, if any, of shares of the series and the terms and conditions of the voting rights;

|

|

|

•

|

|

the dividend rate on the shares of the series, the dates on which dividends are payable, any restriction, limitation or condition upon the payment of dividends, whether dividends will be cumulative, and the dates from

and after which dividends shall accumulate;

|

|

|

•

|

|

the prices at which, and the terms and conditions on which, the shares of the series may be redeemed, if the shares are redeemable;

|

3

|

|

•

|

|

the terms and conditions of a sinking or purchase fund for the purchase or redemption of shares of the series, if such a fund is provided;

|

|

|

•

|

|

any preferential amount payable upon shares of the series in the event of the liquidation, dissolution or winding up of, or upon the distribution of any of our assets; and

|

|

|

•

|

|

the prices or rates of conversion or exchange at which, and the terms and conditions on which, the shares of the series may be converted or exchanged into other securities, if the shares are convertible or exchangeable.

|

The particular terms of any series of preferred stock, and the transfer agent and registrar for that series, will be

described in a prospectus supplement. Any material United States federal income tax consequences and other special considerations with respect to any preferred stock offered under this prospectus will also be described in the applicable prospectus

supplement.

The issuance of preferred stock could decrease the amount of earnings and assets available for distribution to holders of our

common stock or adversely affect the rights and powers, including voting rights, of the holders of our common stock. The issuance of preferred stock could have the effect of delaying, deferring or preventing a change in control of our company, which

could depress the market price of our common stock.

Certain Provisions of Delaware Law and of the Charter and Bylaws

The provisions of Delaware law, our certificate of incorporation and our bylaws described below may have the effect of delaying, deferring or

discouraging another party from acquiring control of us.

Delaware Law

. We are subject to the provisions of Section 203 of the

General Corporation Law of the State of Delaware regulating corporate takeovers. In general, those provisions prohibit a publicly-held Delaware corporation from engaging in any business combination with any interested stockholder for a period of

three years following the date that the stockholder became an interested stockholder, unless:

|

|

•

|

|

prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the

transaction commenced, excluding for purposes of determining the voting stock outstanding (1) shares owned by persons who are directors and also officers and (2) shares owned by employee stock plans in which employee participants do not

have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

•

|

|

on or after the date the business combination is approved by the board of directors of the corporation and authorized at a meeting of stockholders by at least two-thirds of the outstanding voting stock that is not owned

by the interested stockholder.

|

Section 203 defines “business combination” to include the following:

|

|

•

|

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

4

|

|

•

|

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 defines an interested stockholder as any entity or person beneficially owning 15% or more of the outstanding

voting stock of the corporation and any entity or person affiliated with or controlling or controlled by any of these entities or persons.

A Delaware corporation may opt out of these provisions either with an express provision in its original certificate of incorporation or in an

amendment to its certificate of incorporation or bylaws approved by its stockholders. However, we have not opted out, and do not currently intend to opt out of, these provisions. The statute could prohibit or delay mergers or other takeover or

change in control attempts and, accordingly, may discourage attempts to acquire us.

Charter and Bylaws

. Our certificate of

incorporation and bylaws provide that:

|

|

•

|

|

our bylaws may be amended or repealed only by a majority vote of our board of directors or a two-thirds stockholder vote;

|

|

|

•

|

|

no action can be taken by stockholders except at an annual or special meeting of the stockholders called in accordance with our bylaws, and stockholders may not act by written consent;

|

|

|

•

|

|

stockholders may not fill vacancies on the board;

|

|

|

•

|

|

our board of directors is authorized to issue preferred stock without stockholder approval; and

|

|

|

•

|

|

we will indemnify officers and directors against losses that they may incur in investigations and legal proceedings resulting from their services to us, which may include services in connection with takeover defense

measures.

|

Transfer Agent

The transfer agent and registrar for our common stock is American Stock Transfer and Trust Company.

PLAN OF DISTRIBUTION

We may sell the shares of common stock offered by this prospectus to one or more underwriters or dealers for public offering and sale by them

or to investors directly or through agents. The accompanying prospectus supplement will set forth the terms of the offering and the method of distribution and will identify any firms acting as underwriters, dealers or agents in connection with the

offering, including:

|

|

•

|

|

the name or names of any underwriters, dealers or agents;

|

|

|

•

|

|

the purchase price of the shares being offered and the proceeds to us from the sale;

|

|

|

•

|

|

any underwriting discounts and other items constituting compensation to underwriters, dealers or agents;

|

|

|

•

|

|

any public offering price;

|

|

|

•

|

|

any discounts or concessions allowed or reallowed or paid to dealers; and

|

5

|

|

•

|

|

any securities exchange or market on which the securities offered in the prospectus supplement may be listed.

|

Only those underwriters identified in such prospectus supplement are deemed to be underwriters in connection with the shares of common stock

offered in the prospectus supplement.

The distribution of the shares of common stock may be effected from time to time in one or more

transactions at a fixed price or prices, which may be changed, or at prices determined as the applicable prospectus supplement specifies. The shares may be sold through an at the market offering, a rights offering, forward contracts or similar

arrangements. In addition, we may enter into derivative transactions with third parties, or sell securities not covered by this prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement so indicates,

in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or

borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in

such sale transactions will be an underwriter and, if not identified in this prospectus, will be named in the applicable prospectus supplement (or a post-effective amendment). In addition, we may otherwise loan or pledge securities to a financial

institution or other third party that in turn may sell the securities short using this prospectus and an applicable prospectus supplement. Such financial institution or other third party may transfer its economic short position to investors in our

securities or in connection with a concurrent offering of other securities.

In connection with the sale of the shares of common stock,

underwriters, dealers or agents may be deemed to have received compensation from us in the form of underwriting discounts or commissions and also may receive commissions from securities purchasers for whom they may act as agent. Underwriters may

sell the shares of common stock to or through dealers, and the dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters or commissions from the purchasers for whom they may act as agent.

We will provide in the applicable prospectus supplement information regarding any underwriting discounts or other compensation that we pay to

underwriters or agents in connection with the offering of the shares, and any discounts, concessions or commissions that underwriters allow to dealers. Underwriters, dealers and agents participating in the distribution of the shares may be deemed to

be underwriters, and any discounts, commissions or concessions they receive and any profit they realize on the resale of the shares may be deemed to be underwriting discounts and commissions under the Securities Act of 1933. Underwriters and their

controlling persons, dealers and agents may be entitled, under agreements entered into with us, to indemnification against and contribution toward specific civil liabilities, including liabilities under the Securities Act. Some of the underwriters,

dealers or agents who participate in the distribution of the shares may engage in other transactions with, and perform other services for, us or our subsidiaries in the ordinary course of business.

Our common stock is currently listed on The NASDAQ Capital Market. To facilitate the offering of the shares of common stock, certain persons

participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the common stock. This may include over-allotments or short sales of the shares of common stock, which involve the sale by persons

participating in the offering of more shares than were sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open market or by exercising their over-allotment option, if

any. In addition, these persons may stabilize or maintain the price of the common stock by bidding for or purchasing common stock in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the

offering may be reclaimed if shares of common stock sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the common stock at a level above

that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

6

LEGAL MATTERS

The validity of any securities offered by this prospectus will be passed upon for us by Pillsbury Winthrop Shaw Pittman LLP.

EXPERTS

The consolidated financial statements of Identiv, Inc. as of December 31, 2016 and 2015 and for each of the two years in the period

ended December 31, 2016, incorporated in this Registration Statement on Form S-3 by reference to the Annual Report on Form 10-K for the year ended December 31, 2016, have been so incorporated in reliance on the report of BPM LLP,

an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement on Form S-3 with the SEC under the Securities Act of

1933. This prospectus is part of the registration statement but the registration statement includes and incorporates by reference additional information and exhibits. We file annual, quarterly and current reports, proxy statements and other

information with the SEC. You may read and copy the registration statement and any other document we file with the SEC at the public reference room maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on

the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding companies, such as ours, that file documents

electronically with the SEC. The address of that website is http://www.sec.gov. The information on the SEC’s website is not part of this prospectus, and any references to this website or any other website are inactive textual references only.

The SEC permits us to “incorporate by reference” the information contained in documents we file with the SEC, which means that

we can disclose important information to you by referring you to those documents rather than by including them in this prospectus. Information that is incorporated by reference is considered to be part of this prospectus and you should read it with

the same care that you read this prospectus. Later information that we file with the SEC will automatically update and supersede the information that is either contained, or incorporated by reference, in this prospectus, and will be considered to be

a part of this prospectus from the date those documents are filed. We have filed with the SEC, and incorporate by reference in this prospectus:

|

|

•

|

|

our Annual Report on Form 10-K for the year ended December 31, 2016;

|

|

|

•

|

|

our Current Reports on Form 8-K filed on February 14, 2017 (with respect to items 1.01, 1.02, 2.03 and 3.02 only) and February 17, 2017; and

|

|

|

•

|

|

the description of our common stock contained in our Registration Statement on Form 8-A filed on September 5, 1997, including any amendment or report filed for the purpose of updating such description.

|

We also incorporate by reference all additional documents that we file with the SEC under the terms of Section 13(a), 13(c), 14 or

15(d) of the Exchange Act that are made after the initial filing date of the registration statement of which this prospectus is a part and the effectiveness of the registration statement, as well as between the date of this prospectus and the

termination of any offering of securities offered by this prospectus. We are not, however, incorporating, in each case, any documents or information that we are deemed to furnish and not file in accordance with SEC rules.

You may request a copy of any or all of the documents incorporated by reference but not delivered with this prospectus, at no cost, by writing

or telephoning us at the following address and number: Investor Relations, Identiv, Inc., 2201 Walnut Avenue, Suite 100, Fremont, California 94538, telephone (949) 553-4251. We will not, however, send exhibits to those documents, unless the

exhibits are specifically incorporated by reference in those documents.

7

Shares

Common Stock

Northland

Capital Markets

, 2017

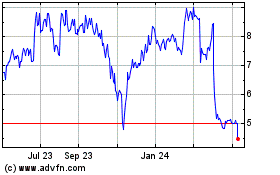

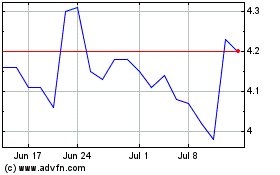

Identiv (NASDAQ:INVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Identiv (NASDAQ:INVE)

Historical Stock Chart

From Apr 2023 to Apr 2024