Prospectus Filed Pursuant to Rule 424(b)(2) (424b2)

October 26 2016 - 1:18PM

Edgar (US Regulatory)

|

|

RBC Capital Markets

®

|

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-208507

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Final Pricing Supplement

Dated October 24, 2016

to the Product Supplement Dated February 1, 2013

and the Offering Circular Dated June 28, 2012

|

|

Mandatorily Exchangeable Notes

Each Linked to a Single Reference Stock

Royal Bank of Canada

|

Royal Bank of Canada is offering three (3) separate offerings of Mandatorily Exchangeable Notes (the “notes”).

Each note offering is a separate offering of the notes linked to one, and only one, Reference Stock named below.

The notes will pay interest at the relevant rate specified below, and will have the terms described in the documents described above, as supplemented or modified by this pricing supplement, as set forth below.

The notes do not guarantee any return of principal at maturity.

Any payments on the

notes are subject to our credit risk.

Investing in the notes involves a number of risks. See “Risk Factors” beginning on page 3 of the offering circular dated June 28, 2012 and “Additional Risk Factors Specific to Your Notes” beginning on page PS-4 of the product supplement dated February 1, 2013.

The notes are our direct, unsecured and unsubordinated general obligations. The notes do not evidence deposits insured under the Canada Deposit Insurance Corporation Act or by the United States Federal Deposit Insurance Corporation (the “FDIC”) or any other Canadian or United States governmental agency.

The notes have not been, and will not be, registered with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”). The notes are being offered in reliance upon the exemption from the registration requirements of the Securities Act to “qualified institutional buyers” in reliance on Rule 144A under the Securities Act and to non-U.S. persons under Regulation S under the Securities Act. By purchasing the notes, you will be subject to the acknowledgments, representations, warranties and agreements discussed in the section “Notice to Investors and Supplement to the Plan of Distribution” below and the section “Transfer Restrictions” in the Offering Circular. In particular, the notes may not be offered or sold in the United States or to U.S. persons unless the notes are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or determined that this pricing supplement or the accompanying product supplement or offering circular is truthful or complete. Any representation to the contrary is a criminal offense.

The issuers of the Reference Stocks did not participate in the preparation of this pricing supplement, will not receive any of the proceeds from these offerings, and will not have any obligation to make any payments to you.

|

|

Issuer:

|

|

Royal Bank of Canada

|

|

Listing:

|

|

None

|

|

|

Pricing Date:

|

|

October 24, 2016

|

|

Maturity Date:

|

|

January 12, 2017

|

|

|

Issue Date:

|

|

October 31, 2016

|

|

Interest Payment Dates:

|

|

As set forth herein.

|

|

|

Payment at Maturity

(if held to maturity):

|

|

At maturity, we will pay to you, for each unit of the notes, the lesser of:

(i)

the closing price of the relevant Reference Stock on the relevant Valuation Date multiplied by the applicable Multiplier; and

(ii)

the relevant Cap Price.

Investors could lose some or all of their investment at maturity if there has been a decline in the trading price of the relevant Reference Stock.

|

|

|

Multiplier:

|

|

One, subject to adjustments as described in “General Terms of the Notes—Anti-Dilution Adjustments” beginning on page PS-17 of the product supplement.

|

|

|

Stock Settlement:

|

|

Not applicable. The payment at maturity will be made solely in cash.

|

|

Note

|

|

Reference Stock

|

|

Denominations (Principal Amount per Unit)

|

|

Interest

Rate (per

Annum)

|

|

Initial Price

|

|

Cap Price

|

|

CUSIP

|

|

Aggregate

Principal Amount

(Total Units)

|

|

Price to Investors

|

|

Broker’s Commission

|

|

Proceeds to Royal

Bank of Canada

|

|

A

|

|

Citizens Financial Group, Inc. (CFG)

|

|

$26.3602

|

|

11.63%

|

|

$26.3602

|

|

$27.6782

|

|

C7979P301

|

|

$7,517,929.04

(285,200

units)

|

|

100%

|

|

$0

0%

|

|

$7,517,929.04

100%

|

|

B

|

|

Eagle Materials Inc. (EXP)

|

|

$80.2452

|

|

11.02%

|

|

$80.2452

|

|

$85.8624

|

|

C7979P293

|

|

$7,543,851.25

(94,010

units)

|

|

100%

|

|

$0

0%

|

|

$7,543,851.25

100%

|

|

C

|

|

T-Mobile US, Inc. (TMUS)

|

|

$51.1708

|

|

11.78%

|

|

$51.1708

|

|

$53.7293

|

|

C7979P319

|

|

$7,491,916.83

(146,410

units)

|

|

100%

|

|

$0

0%

|

|

$7,491,916.83

100%

|

The price at which you purchase the

notes

includes hedging costs and profits that Royal Bank of Canada or its affiliates expect to incur or realize. These costs and profits will reduce the secondary market price, if any secondary market develops, for the

notes

. As a result, you may experience an immediate and substantial decline in the market value of your

notes

on the Issue Date.

We may use this pricing supplement in the initial sale of the notes. In addition, RBC Capital Markets, LLC or another of our affiliates may use this pricing supplement in a market-making transaction in the notes after their initial sale.

Unless we or

our agent informs the purchaser otherwise in the confirmation of sale, this pricing supplement is being used in a

market-making transaction.

RBC Capital Markets, LLC

NOTICE TO INVESTORS AND SUPPLEMENT TO THE PLAN OF DISTRIBUTION

The notes have not been, and will not be, registered under the Securities Act or the state securities laws of any state of the United States or the securities laws of any other jurisdiction. The notes may not be offered or sold in the United States or to U.S. persons unless the notes are registered under the Securities Act, or an exemption from the registration requirements of the Securities Act is available.

In the initial offering of the notes, RBC Capital Markets, LLC will purchase the notes from us, and resell them only to (a) “qualified institutional buyers,” or “QIBs,” as such term is defined in Rule 144A under the Securities Act and (b) to non-U.S. persons in accordance with Regulation S under the Securities Act.

Each holder and beneficial owner of notes acquired in connection with their initial distribution and each transferee of notes from any such holder or beneficial owner will be required to have represented and agreed with us regarding the notes as follows (terms used below that are defined in Rule 144A and Regulation S are used as defined therein):

If such investor is purchasing the notes pursuant to Rule 144A, such investor:

|

|

(b)

|

is aware that the sale of the notes to it is being made in reliance on Rule 144A;

|

|

|

(c)

|

is acquiring such notes for its own account or for the account of a QIB; and

|

|

|

(d)

|

has not been formed for the purpose of investing in the notes.

|

If such investor is purchasing the notes pursuant to Regulation S, such investor:

(a) it is not a U.S. person; and

(b) it was outside of the U.S. at the time it effected its order to buy the notes.

In each case, the investor understands and acknowledges that the notes have not been, and will not be, registered under the Securities Act and may not be resold, pledged, or otherwise transferred by it except to a QIB in a transaction complying with Rule 144A or in a resale transaction pursuant to Rule 904 of Regulation S, and in each case, in compliance with any applicable state securities laws and the laws of any applicable foreign jurisdictions. It will, and each subsequent holder or beneficial owner is required to, notify any subsequent purchaser of the notes from it of the resale restrictions referred to above, and obtain their agreement in writing to be so bound. In making this purchase, it represents and warrants that is not acting with the intention of evading, either alone or in conjunction with any other person, the requirements of the Securities Act.

Any resale, trade, pledge, transfer or other delivery of the notes or any beneficial interest therein may be subject to the satisfaction of certain conditions as may be required by the issuer or RBC Capital Markets in order to ensure compliance with applicable securities laws. For the avoidance of doubt, a holder of the notes will not be required to provide an opinion of counsel to the issuer or RBC Capital Markets in connection with a resale made in accordance with Rule 144A or Regulation S.

Any notes issued in connection with this offering may contain such restrictive legends as are necessary to comply with applicable U.S. securities laws.

SUMMARY

The information in this “Summary” section is qualified by the more detailed information set forth in this pricing supplement, the product supplement, and the offering circular.

|

General:

|

This pricing supplement relates to three (3) separate offerings of Mandatorily Exchangeable Notes. Each note offering is a separate offering of the notes linked to one, and only one, Reference Stock. All of the notes offered by this pricing supplement are collectively referred to as the “notes”. The notes offered by this pricing supplement do not represent notes linked to a basket of the Reference Stocks.

|

|

Issuer:

|

Royal Bank of Canada (“Royal Bank”)

|

|

Pricing Date:

|

October 24, 2016

|

|

Issue Date:

|

October 31, 2016

|

|

Denominations:

|

As set forth on the cover page.

|

|

Specified Currency:

|

U.S. Dollars

|

|

Payment at Maturity

(if held to maturity):

|

At maturity, we will pay to you, for each unit of the notes, the lesser of:

(i)

the Final Price; and

(ii)

the Cap Price.

Investors will lose some or all of their investment at maturity if the Final Price is less than the Initial Price.

|

|

Final Price:

|

The closing price of the relevant Reference Stock on the relevant Valuation Date multiplied by the applicable Multiplier.

|

|

Multiplier:

|

With respect to each Reference Stock, one, subject to adjustment as described in “General Terms of the Notes—Anti-Dilution Adjustments” beginning on page PS-17 of the product supplement.

|

|

Calculation Agent:

|

RBC Capital Markets, LLC

|

|

Secondary Market:

|

RBC Capital Markets, LLC (or one of its affiliates), though not obligated to do so, plans to maintain a secondary market in the notes after the Issue Date. The amount that an investor may receive upon sale of the notes prior to maturity may be less than the principal amount of those notes.

|

|

Listing:

|

None

|

|

U.S. Tax Treatment:

|

By purchasing a Note, each holder agrees (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to treat the Note as a pre-paid cash-settled income-bearing derivative contract for U.S. federal income tax purposes. However, the U.S. federal income tax consequences of your investment in the Notes are uncertain and the IRS could assert that the Notes should be taxed in a manner that is different from that described in the preceding sentence. Please see the discussion herein under “Supplemental Discussion of U.S. Federal Income Tax Consequences” and the discussion in the product supplement dated February 1, 2013 under “Supplemental Discussion of U.S. Federal Income Tax Consequences,” which applies to the Notes.

|

|

Clearance and

Settlement:

|

DTC global notes

|

Note A:

|

Reference Stock:

|

Citizens Financial Group, Inc.

|

|

Interest Payments

and Relevant Dates:

|

Interest will be paid as follows:

|

|

|

|

Ex-Coupon Date*

|

|

Record Date

|

|

Interest Payment Date

|

|

Interest Payment per

Unit of the Notes

|

|

|

|

|

November 4, 2016

|

|

November 8, 2016

|

|

November 15, 2016

|

|

$0.12773714

|

|

|

|

|

November 21, 2016

|

|

November 23, 2016

|

|

November 30, 2016

|

|

$0.12773714

|

|

|

|

|

December 6, 2016

|

|

December 8, 2016

|

|

December 15, 2016

|

|

$0.12773714

|

|

|

|

|

December 21, 2016

|

|

December 23, 2016

|

|

December 30, 2016

|

|

$0.12773714

|

|

|

|

|

January 3, 2017

|

|

January 5, 2017

|

|

January 12, 2017

|

|

$0.10218971

|

|

|

|

* An investor will receive the relevant interest payment if the notes are sold on or after the applicable Ex-Coupon Date and the resale is made on a “T+3” basis. For example, if investor A sells the notes to investor B in a secondary market transaction on November 4, 2016 and the sale settles on November 9, 2016, the relevant interest payment will be paid to investor A, since investor A will be the record holder of the notes on the applicable record date.

|

|

Valuation Date:

|

January 10, 2017

|

|

Maturity Date:

|

January 12, 2017

|

|

Payment at Maturity

(if held to maturity):

|

At maturity, we will pay to you, for each unit of the notes, the lesser of:

(i)

the Final Price; and

(ii)

the Cap Price.

Investors will lose some or all of their investment at maturity if the Final Price is less than the Initial Price.

|

|

Initial Price:

|

$26.3602

|

|

Cap Price:

|

$27.6782, which is equal to 105.00% of the Initial Price.

|

|

CUSIP:

|

C7979P301

|

|

ISIN:

|

USC7979P3013

|

Note B:

|

Reference Stock:

|

Eagle Materials Inc.

|

|

Interest Payments

and Relevant Dates:

|

Interest will be paid as follows:

|

|

|

|

Ex-Coupon Date*

|

|

Record Date

|

|

Interest Payment Date

|

|

Interest Payment per

Unit of the Notes

|

|

|

|

|

November 4, 2016

|

|

November 8, 2016

|

|

November 15, 2016

|

|

$0.36845921

|

|

|

|

|

November 21, 2016

|

|

November 23, 2016

|

|

November 30, 2016

|

|

$0.36845921

|

|

|

|

|

December 6, 2016

|

|

December 8, 2016

|

|

December 15, 2016

|

|

$0.36845921

|

|

|

|

|

December 21, 2016

|

|

December 23, 2016

|

|

December 30, 2016

|

|

$0.36845921

|

|

|

|

|

January 3, 2017

|

|

January 5, 2017

|

|

January 12, 2017

|

|

$0.29476737

|

|

|

|

* An investor will receive the relevant interest payment if the notes are sold on or after the applicable Ex-Coupon Date and the resale is made on a “T+3” basis. For example, if investor A sells the notes to investor B in a secondary market transaction on November 4, 2016 and the sale settles on November 9, 2016, the relevant interest payment will be paid to investor A, since investor A will be the record holder of the notes on the applicable record date.

|

|

Valuation Date:

|

January 10, 2017

|

|

Maturity Date:

|

January 12, 2017

|

|

Payment at Maturity

(if held to maturity):

|

At maturity, we will pay to you, for each unit of the notes, the lesser of:

(i)

the Final Price; and

(ii)

the Cap Price.

Investors will lose some or all of their investment at maturity if the Final Price is less than the Initial Price.

|

|

Initial Price:

|

$80.2452

|

|

Cap Price:

|

$85.8624, which is equal to 107.00% of the Initial Price.

|

|

CUSIP:

|

C7979P293

|

|

ISIN:

|

USC7979P2932

|

Note C:

|

Reference Stock:

|

T-Mobile US, Inc.

|

|

Interest Payments

and Relevant Dates:

|

Interest will be paid as follows:

|

|

|

|

Ex-Coupon Date*

|

|

Record Date

|

|

Interest Payment Date

|

|

Interest Payment per

Unit of the Notes

|

|

|

|

|

November 4, 2016

|

|

November 8, 2016

|

|

November 15, 2016

|

|

$0.25116334

|

|

|

|

|

November 21, 2016

|

|

November 23, 2016

|

|

November 30, 2016

|

|

$0.25116334

|

|

|

|

|

December 6, 2016

|

|

December 8, 2016

|

|

December 15, 2016

|

|

$0.25116334

|

|

|

|

|

December 21, 2016

|

|

December 23, 2016

|

|

December 30, 2016

|

|

$0.25116334

|

|

|

|

|

January 3, 2017

|

|

January 5, 2017

|

|

January 12, 2017

|

|

$0.20093067

|

|

|

|

* An investor will receive the relevant interest payment if the notes are sold on or after the applicable Ex-Coupon Date and the resale is made on a “T+3” basis. For example, if investor A sells the notes to investor B in a secondary market transaction on November 4, 2016 and the sale settles on November 9, 2016, the relevant interest payment will be paid to investor A, since investor A will be the record holder of the notes on the applicable record date.

|

|

Valuation Date:

|

January 10, 2017

|

|

Maturity Date:

|

January 12, 2017

|

|

Payment at Maturity

(if held to maturity):

|

At maturity, we will pay to you, for each unit of the notes, the lesser of:

(i)

the Final Price; and

(ii)

the Cap Price.

Investors will lose some or all of their investment at maturity if the Final Price is less than the Initial Price.

|

|

Initial Price:

|

$51.1708

|

|

Cap Price:

|

$53.7293, which is equal to 105.00% of the Initial Price.

|

|

CUSIP:

|

C7979P319

|

|

ISIN:

|

USC7979P3195

|

SUPPLEMENTAL DISCUSSION OF U.S. FEDERAL INCOME TAX CONSEQUENCES

The following disclosure supplements, and to the extent inconsistent, supersedes, the discussion in the product supplement dated February 1, 2013 under “Supplemental Discussion of U.S. Federal Income Tax Consequences,” which applies to the Notes.

We intend to treat the interest payments as U.S. source income for U.S. federal income tax purposes.

Non-U.S. Holders

. A “dividend equivalent” payment is treated as a dividend from sources within the U.S. and such payments generally would be subject to a 30% U.S. withholding tax if paid to a non-U.S. Holder. Under U.S. Treasury Department regulations, payments (including deemed payments) with respect to equity-linked instruments (“ELIs”) that are “specified ELIs” may be treated as dividend equivalents if such specified ELIs reference an interest in an “underlying security,” which is generally any interest in an entity taxable as a corporation for U.S. federal income tax purposes if a payment with respect to such interest could give rise to a U.S. source dividend. However, this withholding on “dividend equivalent” payments, if any, will not apply to Notes issued before January 1, 2017. If any payments are treated as dividend equivalents subject to withholding, we (or the applicable paying agent) would be entitled to withhold taxes without being required to pay any additional amounts with respect to amounts so withheld.

Foreign Account Tax Compliance Act.

The Foreign Account Tax Compliance Act (“FATCA”) imposes a 30% U.S. withholding tax on certain U.S. source payments, including interest (and OID), dividends, other fixed or determinable annual or periodical gain, profits, and income, and on the gross proceeds from a disposition of property of a type which can produce U.S. source interest or dividends (“Withholdable Payments”), if paid to a foreign financial institution (including amounts paid to a foreign financial institution on behalf of a holder), unless such institution enters into an agreement with the U.S. Treasury Department to collect and provide to the U.S. Treasury Department certain information regarding U.S. financial account holders, including certain account holders that are foreign entities with U.S. owners, with such institution or otherwise complies with FATCA. In addition, the Notes may constitute a “financial account” for these purposes and thus, be subject to information reporting requirements pursuant to FATCA. FATCA also generally imposes a withholding tax of 30% on Withholdable Payments made to a non-financial foreign entity unless such entity provides the withholding agent with a certification that it does not have any substantial U.S. owners or a certification identifying the direct and indirect substantial U.S. owners of the entity. Under certain circumstances, a holder may be eligible for refunds or credits of such taxes.

The U.S. Treasury Department and the IRS have announced that withholding on payments of gross proceeds from a sale or redemption of the Notes will only apply to payments made after December 31, 2018. If we determine withholding is appropriate with respect to the Notes, we will withhold tax at the applicable statutory rate, and we will not pay any additional amounts in respect of such withholding. Foreign financial institutions and non-financial foreign entities located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules. Prospective investors are urged to consult with their own tax advisors regarding the possible implications of FATCA on their investment in the Notes.

THE REFERENCE STOCKS

Each Reference Stock is registered under the Securities Exchange Act of 1934 (the “Exchange Act”).

Companies with securities registered under that Act are required to file periodically certain financial and other

information specified by the Securities and Exchange Commission (the “SEC”). Information provided to or filed with the SEC

can be inspected and copied at the public reference facilities maintained by the SEC or through the SEC’s website at www.sec.gov. In addition, information regarding each Reference Stock may be obtained from other sources including, but not limited to, press releases, newspaper articles and other publicly disseminated documents.

The following information regarding each issuer of the Reference Stocks is derived from publicly available information.

We have not independently verified

the accuracy or completeness of reports filed by each issuer with the SEC, information published by them on their respective websites or in any other format, information about the issuers obtained from any other source or the information provided below.

|

|

·

|

Citizens Financial Group, Inc. provides a range of commercial banking services for retail and Institutional customers. It offers consumer loans, commercial loans, mortgage loans, deposit products, internet banking, and trust services.

|

|

|

·

|

Eagle Materials Inc. manufactures and distributes cement, gypsum wallboard, recycled paperboard, and concrete and aggregates. The company's products are used in the construction of homes, commercial and industrial buildings, and governmental buildings across the United States.

|

|

|

·

|

T-Mobile US, Inc. is one of four national wireless carriers in the US. The company was created as the combination of T-Mobile USA and MetroPCS.

|

|

P

9

|

RBC Capital Markets, LLC

|

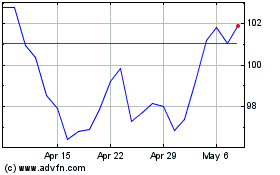

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024