Pound Rises After U.K. Construction PMI

July 02 2015 - 6:02AM

RTTF2

The British pound strengthened against most major currencies in

the early European session on Thursday, after data showed that U.K.

construction sector activity rose better-than-expected in June.

Data from Markit and the CIPS showed that the U.K. construction

PMI increased to 58.1 in June, from a score of 55.9 in the previous

month. It was above the expected reading of 56.5.

Traders now focus on the developments on the Greek debt crisis

front and also keep a close eye on the Labor Department's U.S.

monthly jobs report. The report is being released a day earlier

than usual due to the July 4th holiday.

Economists currently expect the report to show an increase of

about 230,000 jobs in June, following an addition of 280,000 jobs

in May. The unemployment rate is also expected to dip to 5.4

percent.

In other economic news, data from the Nationwide Building

Society showed that U.K. house prices dropped 0.2 percent

month-on-month in June, confounding expectations for a 0.5 percent

rise. This was the first fall in four months and reversed a 0.2

percent rise in May.

On a yearly basis, house price growth moderated to 3.3 percent

from 4.6 percent a month ago. Economists had forecast the growth to

slow marginally to 4.5 percent in June.

In the Asian trading today, the pound held steady against its

major rivals.

In the European trading now, the pound rose to session's high of

192.92 against the yen, from an early low of 192.26. If the pound

extends its uptrend, it is likely to find resistance around the

197.00 area.

Moving away from an early more than a 2-week low of 1.5580

against the U.S. dollar, the pound advanced to session's high of

1.5617. On the upside, 1.60 is seen as the next resistance level

for the pound.

Against the Swiss franc, the pound advanced to a 3-1/2-month

high of 1.4821 from an early low of 1.4753. The pound may test

resistance near the 1.50 area.

Meanwhile, the pound fell to 0.7103 against the euro earlier.

Thereafter, the pair held steady.

Looking ahead, U.S. weekly jobless claims for the week ended

June 27, U.S. jobs data for June and factory orders for May are set

to be announced in the New York session.

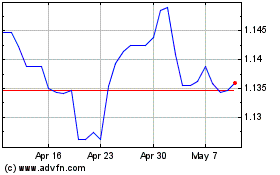

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024