Portugal's Banco BPI Clears Voting-Cap Hurdle, Making Way for Caixa Takeover -- 2nd Update

September 21 2016 - 4:03PM

Dow Jones News

By Patricia Kowsmann

LISBON -- Shareholders of Portuguese lender Banco BPI SA on

Wednesday approved the removal of a 20% voting-rights cap, paving

the way for Spain's CaixaBank SA to advance with a fresh takeover

offer for the lender.

CaixaBank currently owns about 45% of BPI, but because of the

cap, its power is roughly equivalent to that of Angolan

businesswoman Isabel dos Santos, who owns 18.6% of the lender.

CaixaBank had made removal of the cap a key condition for its

EUR1.113-a-share offer. Late Wednesday, the Spanish bank increased

its offer to EUR1.134 a share, valuing the Portuguese lender at

EUR1.65 billion ($1.84 billion). Shares of the lender, which were

halted from trading Wednesday, last traded Tuesday at EUR1.09.

BPI sought to woo Ms. dos Santos into accepting the cap removal

by offering to give her control of the lender's Angolan unit. Late

Tuesday, BPI said it was willing to sell 2% of Banco de Fomento

Angola SA for EUR28 million to Unitel SA, a mobile operator

controlled by Ms. dos Santos. That would raise Unitel's stake in

the lender to 51.9% from 49.9%.

Small shareholder Violas Ferreira Financial SA, which owns 2.7%

of BPI, signaled it too had run out of options to block the

CaixaBank offer, which it has complained was too low. Two previous

votes had to be postponed because of court injunctions requested by

Violas, mostly on technical grounds.

In a statement, BPI said the cap removal it had proposed was

approved by 94% of those who voted.

CaixaBank and Ms. dos Santos have been involved in a lengthy

battle over the future of BPI and Banco de Fomento after a 2014

European Union ruling placed Portugal's former colony, Angola,

among countries whose debt is riskier than that of its own

members.

That ruling prompted the European Central Bank to tell BPI that

it must either raise more capital to cover its exposure to Angola's

debt or shed the Angolan unit.

At one point, BPI, with CaixaBank's support, proposed spinning

off the Angola unit as a free-standing company while keeping

control to resolve the issue. But Ms. dos Santos, who is the

daughter of Angola's president and Africa's wealthiest woman,

blocked the move in a shareholder vote.

In March, talks between CaixaBank and Ms. dos Santos started

revolving around the Spanish lender buying Ms. dos Santos's stake

in BPI and Ms. dos Santos taking control of Banco de Fomento.

The negotiations, however, fell apar t, and in April, CaixaBank,

Spain's third-largest lender by market value, launched a bid for

BPI. Tuesday's offer from BPI, if accepted by Ms. dos Santos, would

resolve the lender's troubles with the ECB.

CaixaBank, which is looking to expand beyond its domestic

borders to bolster profitability, has said it expected the deal for

BPI to close in the third quarter.

For Portugal, handing BPI over to a larger lender would be a

relief, given the struggles of the banking sector. While Portugal

didn't face a property bubble like eurozone peers Spain and

Ireland, its companies have been hit hard by a sovereign-debt

crisis that led the country to request a EUR78 billion bailout in

2011. A portfolio of souring company loans, along with low interest

rates, are hurting lenders' profitability and eating up their

capital cushion.

Write to Patricia Kowsmann at patricia.kowsmann@wsj.com

(END) Dow Jones Newswires

September 21, 2016 15:48 ET (19:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

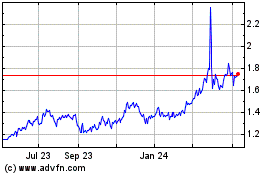

Caixabank (PK) (USOTC:CAIXY)

Historical Stock Chart

From Apr 2023 to Apr 2024