TIDMPFP

RNS Number : 5852R

Pathfinder Minerals Plc

30 June 2015

30 June 2015

Pathfinder Minerals Plc

("Pathfinder", the "Company" or the "Group")

Final results for the year ended 31 December 2014

Chairman's Statement

Introduction

Over the past year as your chairman, I have developed a

comprehensive understanding both of the circumstances in which

Pathfinder was deprived of its principal assets in late 2011; and

of the potential remedies available to the Company. I was keen to

make shareholders aware in my June and September 2014 statements

that the process to recover Pathfinder's assets may be a lengthy

one. It should come as no surprise therefore that it is proving to

be so. The process is, however, advancing.

Steps to recover the Company's assets

There are a number of routes via which the Company may in due

course restore control of its assets or gain compensation for their

loss.

Absent a more immediate diplomatic resolution which compels the

Government of Mozambique to restore control to Pathfinder of the

areas previously licensed to it, it is hoped that Mozambique's

judicial system will ultimately find, as the English courts have

done, that Pathfinder (through its wholly-owned subsidiary, IM

Minerals Limited) did validly acquire its shareholding in Companhia

Mineira de Naburi S.A.R.L ("CMDN"). This, in turn, would allow

Pathfinder to demonstrate to the Government of Mozambique that, as

a matter of Mozambique, as well as English, law, General Veloso and

Diogo Cavaco (the "Defendants") were not entitled to divert the

mining licences away from CMDN for their personal gain. I am

confident that in such a scenario the Government of Mozambique

would take steps akin to reversing the licence transfer.

Following a resounding judgment from the English High Court in

the Company's favour, Pathfinder is continuing to pursue its legal

rights in Mozambique vigorously-and intends to do so until it is

successful in restoring to shareholders the assets of which they

have been deprived. This will not, however, be a short process.

Notwithstanding the multiple proceedings ongoing in Mozambique it

is likely that, whatever their outcome, appeals will follow. For

this reason, the Company has continuously kept an open mind with

regards to the merits of a mediated settlement with the Defendants.

However, the willingness to date of the Defendants to entertain

reasonable terms for Pathfinder's shareholders makes this an

unlikely scenario.

A further legal route, by which the Company may recover its

assets or seek compensation for its loss from the Government of

Mozambique, remains under advanced consideration.

Legal proceedings in Mozambique

There remain several legal proceedings ongoing in the Mozambican

courts, each of which raises the issue of the jurisdiction of the

English court and/or Pathfinder's status as a shareholder of CMDN.

Shortly before the year-end two significant judgments were handed

down.

On 15 December 2014 Pathfinder announced that the Maputo

Commercial Court had confirmed the validity of the Company's

shareholding in CMDN following a hearing which took place on 6

December 2012. In those proceedings Pathfinder had sought the

annulment of certain resolutions purportedly passed at an

extraordinary general meeting of CMDN on 9 December 2011. The

purpose of these resolutions was to dismiss Pathfinder's

representatives on CMDN's Board and to cancel Pathfinder's shares

in CMDN and reissue them to the Defendants. It was therefore wholly

appropriate that the Maputo Commercial Court granted the annulment

sought. Importantly, in its judgment the Maputo Commercial Court

held that Pathfinder did validly acquire its shareholding in

CMDN.

It came as little surprise that, upon notification of this

judgment, the Defendants applied to the Maputo Commercial Court to

appeal the decision. A decision on the appeal is awaited.

Pathfinder will continue to announce any material developments as

and when it is notified of them.

On 31 December 2014 Pathfinder announced a decision from the

Mozambique Supreme Court in respect of the Company's application

for recognition of orders by the English court for costs

aggregating GBP106,000 to be paid by the Defendants. In its

judgment, the Mozambique Supreme Court rejected the Company's claim

for recognition while upholding, with one exception, all of the

Company's arguments.

The basis upon which the Mozambique Supreme Court rejected

Pathfinder's claim appears to be absurd. The court determined that

the jurisdiction clauses contained in the agreements which were the

subject of the dispute were not valid as a matter of Mozambique law

because they conferred jurisdiction on the courts of England and

Wales without specifying which court in England and Wales was to

have jurisdiction (or providing the criteria for selecting the

competent court). Such a ruling has serious implications for other

investors in Mozambique whose jurisdiction clauses would typically

be no different to the standard formulation contained in

Pathfinder's contracts. Pathfinder has asked the Supreme Court for

permission to appeal against its decision.

In the meantime, a further application for recognition - which

includes Pathfinder's application for recognition of the English

High Court's declarations in respect of the Company's acquisition

of shares in CMDN - is still pending. It is not known when judgment

on this further claim might be delivered. It may still be a

considerable time.

Financial results and current financial position

The financial results of Pathfinder are, as for any pre-revenue

company which does not currently have operations, very

straightforward. The most important financial measurement continues

to be whether Pathfinder has sufficient cash to see through its

strategy to recover its assets. The Board continues to exercise

prudence with expenditure and believes the Company does have

sufficient reserves for the foreseeable future.

Nevertheless, the Company wishes to maintain the ability to

raise equity finance in the future should it be required. In that

context, although there are no immediate plans to seek such

funding, in order that the Company might promptly take advantage of

any offer of additional finance, the Board is seeking from

shareholders at the forthcoming Annual General Meeting the powers

required by company law to achieve this. In the light of the

current share price, it is likely that the subscription price for

any further issue of ordinary shares, should such an issue occur,

would be less than their nominal value. Consequently, a share

capital reorganisation will also be necessary in order to effect

such allotment. This is explained more fully in the Notice of

Annual General Meeting which is being sent to shareholders

simultaneously with this report.

The financial statements of the Pathfinder Group for the year

ended 31 December 2014 follow later in this report. The Income

Statement shows a loss of GBP1.1 million (2013 - GBP1.5 million).

The conclusion of the legal action in England during 2013 brought

about a reduction in the rate of expenditure. Since the Company has

been prevented from conducting any activity relating to mining, the

whole of this loss can be attributed to the Company's attempts to

recover its expropriated licences.

The Group's Statement of Financial Position shows net assets at

31 December 2014 of GBP1.1 million (2013 - GBP2.2 million). The

assets are held largely in the form of cash deposits (totalling

GBP1.2 million at the year-end).

Outlook

Pathfinder is advancing the legal proceedings in Mozambique as

efficiently and as expeditiously as the judicial infrastructure

allows. It is a slow process and judgments have been shown to take

up to two years to be handed down. While the Company is prepared to

enforce its rights through the courts, we continue to pursue in the

background other possible routes to achieve a faster resolution;

while at the same time considering other ways to add value to the

Company. Above all the Board's objective is to seek the best

possible outcome for shareholders from the appalling actions which

have afflicted the Company. I believe that a positive outcome is

achievable.

Henry Bellingham

Chairman

29 June 2015

Statement of Consolidated Comprehensive Income

For the Year Ended 31 December 2014

Year ended 31 December 2014 2013

GBP'000 GBP'000

CONTINUING OPERATIONS

Revenue - -

Administrative expenses (1,070) (1,480)

---------- ----------

OPERATING LOSS (1,070) (1,480)

Finance income 14 21

---------- ----------

LOSS BEFORE INCOME TAX (1,056) (1,459)

Income tax - -

---------- ----------

LOSS FOR THE YEAR (1,056) (1,459)

OTHER COMPREHENSIVE INCOME - -

TOTAL COMPREHENSIVE LOSS FOR THE

YEAR (1,056) (1,459)

========== ==========

Loss per share (expressed in pence

per share)

Basic (0.1) (0.1)

Diluted (0.1) (0.1)

========== ==========

Statement of Consolidated Financial Position

31 December 2014

2014 2013

GBP'000 GBP'000

ASSETS

CURRENT ASSETS

Trade and other receivables 61 185

Cash and cash equivalents 1,172 2,134

--------- ---------

1,233 2,319

--------- ---------

TOTAL ASSETS 1,233 2,319

========= =========

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 18,289 18,289

Share premium 11,022 11,022

Retained earnings (28,176) (27,120)

--------- ---------

TOTAL EQUITY 1,135 2,191

--------- ---------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 98 128

--------- ---------

TOTAL LIABILITIES 98 128

--------- ---------

TOTAL EQUITY AND LIABILITIES 1,233 2,319

========= =========

Statement of the Company's Financial Position

31 December 2014

2014 2013

GBP'000 GBP'000

ASSETS

NON-CURRENT ASSETS

Investments - -

--------- ---------

- -

--------- ---------

CURRENT ASSETS

Trade and other receivables 61 185

Cash and cash equivalents 1,172 2,134

--------- ---------

1,233 2,319

--------- ---------

TOTAL ASSETS 1,233 2,319

========= =========

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 18,289 18,289

Share premium 11,022 11,022

Retained earnings (deficit) (28,307) (27,251)

--------- ---------

TOTAL EQUITY 1,004 2,060

--------- ---------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables 229 259

--------- ---------

TOTAL LIABILITIES 229 259

--------- ---------

TOTAL EQUITY AND LIABILITIES 1,233 2,319

========= =========

Statement of Changes in Equity

For the Year Ended 31 December 2014

Called Profit Share Total

up and premium equity

share loss

capital account

GBP'000 GBP'000 GBP'000 GBP'000

Group

Balance at 1 January

2013 18,289 (25,661) 11,022 3,650

Changes in equity

Total comprehensive loss - (1,459) - (1,459)

--------- ----------- --------- --------

Balance at 31 December

2013 18,289 (27,120) 11,022 2,191

Changes in equity

Total comprehensive loss - (1,056) - (1,056)

--------- ----------- --------- --------

Balance at 31 December

2014 18,289 (28,176) 11,022 1,135

========= =========== ========= ========

Company

Balance at 1 January

2013 18,289 (25,792) 11,022 3,519

Changes in equity

Total comprehensive loss - (1,459) - (1,459)

--------- ----------- --------- --------

Balance at 31 December

2013 18,289 (27,251) 11,022 2,060

Changes in equity

Total comprehensive loss - (1,056) - (1,056)

--------- ----------- --------- --------

Balance at 31 December

2014 18,289 (28,307) 11,022 1,004

========= =========== ========= ========

Statement of Cash Flows - Group and Company

For the Year Ended 31 December 2014

2014 2013

GBP'000 GBP'000

Cash flows from operating activities

Loss before income tax (1,056) (1,459)

Finance income (14) (21)

(1,070) (1,480)

Decrease (increase) in trade and

other receivables 124 (22)

Decrease in trade and other payables (30) (152)

Net cash from operating activities (976) (1,654)

Cash flows from investing activities

Interest received 14 21

-------- ----------

Net cash from investing activities 14 21

-------- ----------

Decrease in cash and cash equivalents (962) (1,633)

Cash and cash equivalents at beginning

of the year 2,134 3,767

-------- ----------

Cash and cash equivalents at end

of the year 1,172 2,134

======== ==========

Annual Report and Accounts

Copies of the Annual Report and Accounts, together with a notice

convening an annual general meeting, are being posted to

shareholders today and are available within the Investor Relations

section of the Company's website www.pathfinderminerals.com.

Annual General Meeting

The annual general meeting of the Company will be held at Becket

House, 36 Old Jewry, London, EC2R 8DD on 7 September 2015 at 11

a.m.

Enquiries:

Pathfinder Minerals Plc

Nick Trew, Chief Executive

Tel.: +44 (0)20 3440 7775

WH Ireland Limited (Nomad and Broker)

Paul Shackleton

Tel.: +44 (0)20 7220 1756

Vigo Communications

Ben Simons or Ali Roper

Tel.: +44 (0)20 7016 9595

Email: pathfinderminerals@vigocomms.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR PKCDKBBKBKAB

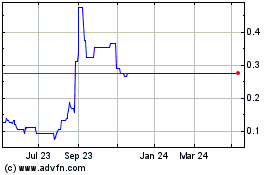

Pathfinder Minerals (LSE:PFP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pathfinder Minerals (LSE:PFP)

Historical Stock Chart

From Apr 2023 to Apr 2024