PREMIER ENERGY AND WATER TRUST PLC - Portfolio Update

April 02 2015 - 10:40AM

PR Newswire (US)

Premier Energy and Water Trust PLC announces that at close of business on 31

March 2015 its ten largest investments were as follows:

% of total assets

OPG Power Ventures 8.8

China Power Intl. Develop 6.4

Renewable Energy Generation 5.7

China Everbright Intl. 4.0

Huaneng Power International 3.7

Enersis 3.4

Ecofin Water & Power Conv 6.00% 3.3

Qatar Electricity & Power 3.2

GDF Suez 3.2

National Grid 3.1

At close of business on 31 March 2015 the total net assets of Premier Energy

and Water Trust PLC amounted to £77.6 million. The sector breakdown and

geographical allocation were as follows:

Sector Breakdown:

Electricity 51.0 %

Multi Utilities 22.2 %

Water & Waste 6.8 %

Gas 4.5 %

Cash/Net Current Assets 2.1 %

Renewable Energy 13.4 %

Total 100.0 %

Geographical Allocation:

Europe (excluding UK) 5.5 %

China 21.8 %

North America 12.7 %

Global 6.5 %

Asia (excluding China) 17.1 %

United Kingdom 15.8 %

Latin America 8.5 %

Cash/Net Current Assets 2.1 %

Australasia 1.3 %

Eastern Europe 5.5 %

Middle East 3.2 %

Copyright il 2 PR Newswire

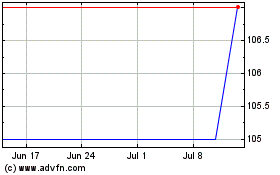

Premier Miton Global Ren... (LSE:PMGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

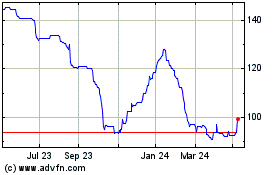

Premier Miton Global Ren... (LSE:PMGR)

Historical Stock Chart

From Apr 2023 to Apr 2024