By Timothy Puko

Oil sold off dramatically all of Tuesday afternoon as warnings

of oversupply and tumbling stock markets around the world highlight

the worst-case possibilities for a struggling market.

Despite 20 months of an oil market collapse dragging down prices

more than 70%, stockpiles are still growing even more than

expected. Refiners aren't consuming as much crude as hoped. And

fears of a global economic slowdown are weighing on the market,

damaging hopes that long-term demand increases could help end oil's

fall.

On Tuesday, the U.S. Energy Information Administration forecast

rising inventories this year and cut its price forecasts, taking

global oil down 6.5% from last month's prediction. Analysts said

upcoming government data is likely to show record high U.S.

stockpiles grew again last week. And oil prices for futures about a

year out fell harder than shorter-term futures--more in one day

than they had the entire month before--a sign some big sellers may

be realizing oil's recovery will take even longer than

expected.

Few things changed on Tuesday to accelerate a selloff, traders

and brokers said. But now that last month's speculation about

global exporters has ended with no sign of such a deal, people are

focusing on unrelenting signs from all around the world that a glut

is getting worse instead of getting better.

"You're seeing a lot of fear," said James Koutoulas, chief

executive at Typhon Capital Management, which manages about $100

million in assets. "Oil will end up going lower before a sustained

recovery."

Light, sweet crude for March delivery settled down $1.75, or

5.9%, at $27.94 a barrel on the New York Mercantile Exchange. It

has posted six losing sessions out of the last seven, sinking

nearly 16% in that span.

Brent, the global benchmark, fell $2.56, or 7.8%, to $30.32 a

barrel on ICE Futures Europe. It has lost 13% during a four-session

losing streak, its biggest percentage losses in four sessions since

the financial crisis.

In its monthly market report, the International Energy Agency

said crude oil prices are likely to fall even further as the

world's vast oversupply of petroleum only got worse in January,

with a surge in production from OPEC. Commercial oil stockpiles

rose to more than three billion barrels in December and are likely

to keep building in the first quarter, a time of year when

stockpiles usually shrink, the IEA said.

The IEA said there also are ominous signs for oil consumption

this year, with "risks to growth in Brazil, Russia and, of course,

slower growth in China." The IEA said it sees no reason yet to

change its demand-growth outlook of 1.2% for the year, calling it a

"very respectable rate," but adding that "economic headwinds

suggest that any change will likely be downward."

An official at the Kuwait Petroleum Corp. also said Tuesday that

Kuwait plans to increase its crude production by 150,000 barrels a

day by the third quarter of the year. It is the latest member of

the Organization of the Petroleum Exporting Countries to shrug off

calls to cut production to support prices, and to instead plan to

produce more to court customers. Iran leads the group, pledging to

increase production by a million barrels a day this year now that

economic sanctions have ended.

All of this production is likely to keep global inventories

growing by 1.4 million barrels a day in the first quarter, keeping

Brent prices below $40 a barrel through August, U.S. government

analysts at the EIA said. Its forecast for Brent in 2016 is now

$37.52 a barrel, down from $40.15 a month ago. U.S. oil is likely

to average $37.59 this year, down from the $38.54 the agency

forecast last month.

Stock markets around the world also retreated Tuesday, another

sign investors around the world are fretting about a slowing global

economy. Japan's Nikkei led the way down, losing more than 5%,

European markets lost 1% to 2%, and U.S. markets also suffered

losses before a late rebound. Much of the concern is about the

health of oil producers because a slate of bankruptcies could crash

many of the banks that lent them money, spreading pain across the

economy, Mr. Koutoulas said.

An official at the Kuwait Petroleum Corp. also said Tuesday that

Kuwait plans to increase its crude production by 150,000 barrels a

day by the third quarter of the year. It is the latest member of

the Organization of the Petroleum Exporting Countries to shrug off

calls to cut production to support prices, and to instead plan to

produce more to court customers. Iran leads the group, pledging to

increase production by a million barrels a day this year now that

economic sanctions have ended.

Many traders have tried to pick a bottom in the market, most

recently buying at $30 a barrel and causing oil to rebound from

that key marker near a 12-year low, brokers said. But as deals on

output cuts fail to materialize, supply keeps rising in many places

around the world and more analysts keep calling for oil to fall

below $20 a barrel, that speculative trade loses its justification,

brokers said.

"From all angles right now, there's just no reason to buy," said

Ric Navy, senior vice president for energy futures at brokerage

R.J. O'Brien & Associates LLC.

Oil demand had hit a five-year high in the third quarter of

2015, said Keisuke Sadamori, director of energy markets and

security at the International Energy Agency, who was speaking at

the meeting. But demand was underpinned by oil products, such as

gasoline, and demand in these markets is expected to slow this

year, which means support in the crude oil market could be limited,

he said.

Just last week, U.S. crude stockpiles likely increased another

3.7 million barrels, according to analysts surveyed by The Wall

Street Journal. The analysts also expect refinery work to slow by

0.3%, and gasoline stockpiles to build by 1 million, though

distillate supplies, including diesel, are likely to decline by

900,000 barrels.

The American Petroleum Institute reported late Tuesday a 2.4

million-barrel increase in U.S. crude supplies in the week ended

Feb. 5, according to a market participant. It also reported a 3.1

million-barrel increase in gasoline stocks and a 1.7 million-barrel

increase in distillate inventories, the market participant

said.

The EIA issues its official inventory numbers on Wednesday, a

widely watched measure of supply and demand.

Declining spreads are likely hurting refiners that make such

products as gasoline and diesel, encouraging them to slow their

work and start on overdue maintenance on their plants, said Jim

Ritterbusch, president of energy-advisory firm Ritterbusch &

Associates. Shares of several refinery companies have sold off in

recent days as investors expect their recent run of big profits to

end. As they slow down, it can only hurt demand for oil, analysts

said.

"There are no bullish triggers to point to until we get out of

refinery-maintenance season," said Michael Tran, commodity

strategist at RBC Capital Markets.

Gasoline futures settled down 5.72 cents, or 6%, at 89.89 cents

a gallon. Diesel futures fell 7.15 cents, or 6.8%, to 97.49 cents a

gallon.

Benoît Faucon and Summer Said contributed to this article.

Write to Timothy Puko at tim.puko@wsj.com

(END) Dow Jones Newswires

February 09, 2016 17:11 ET (22:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

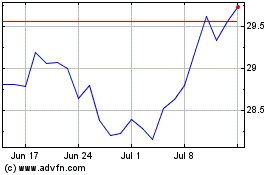

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Australia And New Zealan... (ASX:ANZ)

Historical Stock Chart

From Apr 2023 to Apr 2024