TIDMOOA

Octopus AIM VCT plc

Final Results

19 May 2017

Octopus AIM VCT plc, managed by Octopus Investments Limited, today

announces the final results for the year ended 28 February 2017.

These results were approved by the Board of Directors on 19 May 2017.

You may view the Annual Report in full at www.octopusinvestments.com in

due course. All other statutory information will also be found there.

Financial Summary

28 February 29 February

2017 2016

Net assets (GBP'000s) 99,915 77,224

Net profit after tax (GBP'000s) 15,123 742

Net asset value (NAV) per share 114.4p 101.6p

Ordinary Dividends per share paid in year 5.0p 5.3p

Special Dividend per share paid in year - 4.0p

Proposed Final Dividend per share* 3.0p 2.5p

Total Return** 17.5% 0.6%

* Subject to shareholder approval at the Annual General Meeting, the

proposed final dividend will be paid on 4 August 2017 to shareholders on

the register on 7 July 2017.

**Total return is calculated as (movement in NAV + dividends paid in the

period) divided by the NAV at the beginning of the period.

Chairman's Statement

Introduction

The year to 28 February 2017 has included a number of events which, in

the opinion of many commentators, should have upset the stock market.

They included the UK's decision to leave the European Union, the outcome

of the US presidential election and widespread forecasts of a slowing

rate of economic growth in the UK. However, that has not been the case.

Both the Net Asset Value (NAV) and general market indices have made

progress, and more recent forecasts have suggested that the UK's

economic prospects might now be improving.

During the year your company raised GBP14.3 million by the issue of new

shares and a further GBP4.3 million has been raised since the year end.

Your Company continued to buy back from selling shareholders.

Board Composition

As you will be aware, there were changes to the Board in the year

following the retirement of Michael Reeve and Marion Sears. I would like

to thank them both for their counsel and particularly acknowledge the

role played by my predecessor in the growth of your Company since its

inception which I believe has been in the interests of all shareholders,

both past and present. We are happy to have welcomed two new board

directors, Joanne Parfrey and Neal Ransome, to join the Board. Neal is

Chairman of the Audit Committee.

Performance

Against a backdrop of generally improving market sentiment, the NAV has

been able to make good progress in the year to 28 February 2017. Adding

back the 5.0p of ordinary dividends paid out in the year, the NAV per

share rose by 17.5%. This compares with a rise in the AIM index of

33.1%, a rise in the FTSE All Share Index of 22.8% and a rise in the

FTSE Smallcap Index ex Investment Trusts of 21.2%, all on a total return

basis.

In the interim accounts I reported that we had invested GBP2.1 million

in qualifying holdings. In the second half of the year we invested a

further GBP1.3 million in qualifying investments which comprised of a

new holding in FreeAgent Holdings Plc together with two further

follow-on investments into Microsaic Systems plc and Futura Medical plc.

In addition we invested GBP8.9 million in non-qualifying holdings in the

year, in order to put the funds raised to work in the market. We made

disposals totalling GBP3.5 million realising a gain on prior year

opening value of GBP1.2million.

Further details of performance are contained in the Investment Manager's

Review below.

New VCT Rules

It is now well over a year since the latest VCT regulations began to

take effect and our Managers have adjusted to the new environment. At

this stage there has been little impact on the portfolio itself and no

need to change investment policies. That is a situation that may vary

in the future, but any modification is likely to be evolutionary. At

present there are signs of a developing trend towards investing in

smaller and earlier stage companies which fit the HMRC regulations.

These may take a few years to contribute meaningfully to performance,

given their early stage of development.

Making follow-on investments has proved difficult on occasions and is

one concern for the sector as a whole, which needs to be addressed by

the authorities, since the inability to support existing investments

seems to invalidate much of the purpose of VCTs and to undermine the

potential for growth in the UK economy.

Dividends

An interim dividend of 2.5p was paid to shareholders in January 2017 in

addition to the 2.5p final dividend that had been paid in July 2016. It

is your Board's intention to continue to pay a minimum of 2.5p each half

year and to adjust the final dividend annually, based on the year-end

share price, so that shareholders receive either 5p per annum or a 5%

yield, whichever is the greater at the time. This will enable dividends

to progress with a rising NAV, whilst maintaining the minimum historic

level. With respect to the year to February 2017 your Board has so far

declared and paid an interim dividend of 2.5p and now has pleasure in

recommending a final dividend of 3.0p, which brings the total dividend

for the year to 5.5p which is higher than an annualised yield of 5%,

based on the share price of 108.75p on 28 February 2017.

Dividend Reinvestment scheme

In common with many other VCTs in the industry, your Company has

established a Dividend Reinvestment Scheme (DRIS). Some shareholders

have already taken advantage of this opportunity. For investors who do

not need income, but value the additional tax relief on their reinvested

dividends, this is an attractive scheme and I hope more shareholders

will find it useful. In the course of the year 467,393 new shares have

been issued under this scheme. The dividend referred to above will be

eligible for the DRIS.

Share Buybacks

During the year to 28 February 2017 your Company continued to buy back

shares in the market from selling shareholders and purchased 2,059,061

Ordinary shares for a total consideration of GBP2,054,339. We have

maintained a discount of approximately 4.5% (equating to a 5.0% discount

to the selling shareholder after costs), which your Board monitors and

intends to retain as a policy which fairly balances the interests of

both remaining and selling shareholders. Buybacks remain an essential

practice for VCTs as providing a means of selling is an important part

of the initial investment decision and has enabled your Company to grow.

As such therefore I hope you will all support the appropriate resolution

at the AGM.

Share Issues

In the year to 28 February 2017 we have raised a total of GBP14.3

million of new capital in two offers. A prospectus was published on 21

December 2015, which allowed for a maximum of GBP20 million to be

raised. This offer closed on 3 October 2016 having raised GBP18 million

in total, although only GBP14 million of this fell into the Company's

accounting year.

Your Board also launched a small GBP4.3 million Top-up issue on 6

February 2017, which closed fully subscribed on 27 February 2017 and was

well supported by existing shareholders. This resulted in the issue of

3,649,371 new Ordinary shares. It would be the Board's present

intention to have a fund raising each year and details will be sent to

you when they are next available.

VCT Status

PricewaterhouseCoopers LLP provides your Board and Investment Manager

with advice concerning continuing compliance with HMRC regulations for

VCTs. Your Board has been advised that Octopus AIM VCT is in compliance

with the conditions laid down by HMRC for maintaining approval as a VCT.

A key requirement is to maintain at least a 70% qualifying investment

level. As at 28 February 2017 some 88.61% of the portfolio as measured

by HMRC rules was invested in qualifying investments.

Risks and uncertainties

In accordance with the Listing Rules under which your Company operates

your Board has to comment on the potential risks and uncertainties which

could have a material impact on the Company's performance. A risk arises

from the requirement to maintain compliance with HMRC regulations

requiring 70% of your Company's assets to be invested in qualifying

holdings. Other risks include economic conditions which impact

particularly on smaller companies in which your Company invests and this

could have an adverse impact on share prices. Further details of the

risks faced by the Company and the processes in place to mitigate them

are set out in the Business Review within the full Annual Report and

Accounts.

Annual General Meeting

The Annual General Meeting will be held on 20 July 2017. I very much

hope that you will be able to come. After the formal business our

Investment Managers will make a presentation. At the Annual General

Meeting, a resolution will be proposed to extend the life of the Company

until 2022 in order to preserve the VCT status of the Company for the

benefit of both existing shareholders and new investors participating in

the present share offer.

Outlook

There are a number of short term uncertainties at present which make

forecasting more difficult than usual. We must hope that they do not

combine to undermine investor confidence, although it seems unlikely

that they will disrupt the good trading of many of your Company's

holdings in the remainder of this new financial year. It is encouraging

that the NAV has continued to rise since the year end and was 119.5p as

at 30 April 2017. The flow of VCT qualifying deals has also picked up

after a slow start to 2017, and your Manager has made four further

qualifying investments totalling GBP2.6 million since the year end.

I look forward to seeing as many of you as possible at the Annual

General Meeting at 11 am on 20 July 2017.

Roger Smith

Chairman

19 May 2017

Investment Manager's Review

Introduction

In a year in which some significant economic and political events have

taken markets by surprise, the expectation that volatility would follow

as a consequence has been confounded by a stronger market, particularly

towards the end of the year to 28 February 2017. All indices have risen,

particularly in the last few months of the year. Large companies with

overseas earnings had a particularly strong period of performance after

the Referendum in June 2016 as Sterling fell and the oil price began to

recover. However, smaller companies have also performed well, so we are

pleased to report a rise in the NAV and the maintenance of the 5% yield

objective.

The year to 28 February 2017 has continued to see AIM raise new capital

for companies, both already quoted and new flotations and your Company

has invested steadily throughout the year as well as raising new capital

for future investments. The prospectus offer closed in October 2016 and

we have recently closed the Top-Up offer for GBP4.3 million to give

existing and new shareholders a chance to invest in the current tax

year. We are starting to see the number of VCT qualifying investment

opportunities rise, after a slow start to this year.

The Alternative Investment Market

Despite some volatility in the first half of the financial year, the

FTSE AIM All-Share Index rose in that period. The rise in the second

half of the year was more consistent and felt stronger, but in fact the

rise in the second half of 14.6% compared with an increase of 14.1% in

the first half. Contributing particularly strongly to the rise in the

AIM index were both the oil and resources sectors, whose indices rose by

approximately 57% and 71%. Share trading volumes also picked up, helped

by a sense of stability, if not outright confidence, despite the result

of the Referendum to leave the EU. Smaller companies continued to be

seen as an increasingly attractive asset class.

In addition, September 2016 saw a reasonable results season confirming

that for many smaller companies the economy remained supportive. Against

that background the number of AIM companies has shrunk further, to 973

at 28 February 2017, compared to 1,029 a year earlier. However, we

believe that the quality has continued to rise and see nothing

fundamentally wrong with AIM just because it has fewer companies on the

market. New issues in the last twelve months include such names as

Joules, the clothing manufacturer and retailer, and Hotel Chocolat, the

chocolatier. AIM remains the UK stock market of choice for smaller

growing companies.

AIM listed companies have continued to raise new capital throughout the

year. In the twelve months to 28 February 2017 AIM raised a further

GBP3.6 billion of new capital for existing companies and a total of

GBP1.1 billion for new companies floating on the market. Although the

level of fundraising for existing companies was lower than last year,

these figures show conclusively that AIM remains open for the funding of

good growth companies and continues to attract new entrants. VCTs play a

significant part in that funding process and we identify below the

companies we have invested in during the second half of the year.

Performance

Adding back the dividends paid during the year to show the total return,

the Net Asset Value increased in the year, giving a total return of

17.5%. This compares with a total return for the FTSE Smallcap Index ex

Investment Trusts of 21.2% and for AIM of 33.1% and the FTSE All Share

Index of 22.8% in the twelve month period. Individual months in the

year under review saw share prices suffering significant bouts of

volatility and the market has generally remained wary for most of the

year of smaller companies which have yet to make a profit, although more

established companies, which have outperformed expectations, have been

well rewarded by rising prices. While the rise in NAV is encouraging, it

fell short of the performance of the AIM Index, which has been driven

particularly by some sectors, such as resources and oil and gas, in

which your Company is unable under VCT rules to make direct investments,

and which have risen by 57% and 71% respectively. The FTSE Smallcap

Index ex Investment Trusts, which rose less than the AIM Index, is

probably more representative of the types of companies in which this VCT

invests, as we have remarked before, and its performance was more

comparable to the rise in the NAV. The FTSE Smallcap Index ex Investment

Trusts is made up of fully-listed stocks and does not, therefore, have

the smaller pre-profit companies that we have in your portfolio.

Within the portfolio there was once again a good contribution from the

more established and already profitable companies which includes many of

the individual non-qualifying holdings such as RWS, Abcam, Next Fifteen

and Gooch and Housego. However, the polarisation we talked about in the

interim statement persisted with companies deemed to be exposed to the

'Brexit effect', such as Staffline and Vertu Motors, continuing to

underperform despite producing decent figures and encouraging trading

statements. In addition Tasty's exposure to rising costs caused it to

re-evaluate some of its new opening pipeline and raise extra funds to

reduce its debt financing, all of which caused its shares to

underperform. We do not share the market's current pessimism about

these companies, which have been held in the portfolio for a number of

years and where the management teams have successfully grown in

challenging economic conditions in the past. We believe that their share

prices will recover as they deliver on their growth plans.

Elsewhere, underperformance came from the earlier stage companies in the

portfolio, particularly those that had setbacks or showed themselves in

need of further cash to reach profitability. Nektan, Oxford

Pharmascience and Microsaic all performed poorly in the year. Nektan

raised new capital in December and Microsaic had a fundraising where we

made a further investment to support the management team who believe

they now have a product which they can sell. Oxford Pharmascience is

trading at around the GBP21 million value of cash in the balance sheet

reflecting disappointment that it has so far failed to negotiate a

licensing deal for its taste masking technology for NSAIDS. The other

poor performers were TLA where a bid and a move to Nasdaq had boosted

the shares for much of 2016 and Midatech, which has now raised GBP16

million in new funds which should be sufficient to finance the business

to profitability.

There were several corporate developments during the year. Breedon

completed the acquisition of Hope, doubling the size of the business and

giving it a much prized cement railhead into London. GB Group also made

an important acquisition in scanning technology and, although its shares

suffered a setback on the news that revenue growth would be affected by

the slow roll-out of a UK Government contract, the holding remained a

strong performer. Ergomed raised money and acquired another

pharmacovigilance business in a very earnings enhancing deal, which was

much better received by the market than its earlier acquisition of

Haemostatix, and the shares have started to recover. Idox, EKF and

Animalcare were all positive contributors to performance after their

core businesses started to show growth after a period of consolidation.

In EKF's case this was after the business was pared back to its core and

re-focussed under the direction of the new Chairman.

Several shares performed particularly well as the underlying businesses

demonstrated that they were delivering on, or ahead of, their plans at

the time that we invested. Gear4music is now a profitable business with

a third of its revenues coming from Europe and growing at more than 50%

in the current year. DP Poland has also finally demonstrated that the

Domino's model works in Poland and is now signing up sub-franchisees for

new sites. Quixant has also increased its customer base and has had

several upgrades to its forecasts this year, making it the biggest

positive contributor to the fund's performance this year. Craneware has

also re-established its growth credentials although it has had more of a

roller-coaster performance as it outperformed on the back of weak

sterling before underperforming on fears over changes to the US

healthcare market under President Trump, although the shares have since

recovered helped by news of new contracts.

The non-qualifying element of the equity portfolio also did well in the

year as our existing strategy of investing in larger more liquid,

profitable companies to counterbalance new earlier stage qualifying

holdings continued to pay off. We have now supplemented these with

holdings in Octopus Portfolio Manager and the FP Octopus Micro Cap

Growth funds to manage liquidity, while cash is awaiting investment.

Portfolio Activity

Having made four new qualifying investments in the first half of the

year, we added three further qualifying holdings in the second half. Of

these one was new, FreeAgent Holdings, into which we invested just under

GBP0.3 million in a popular issue and the others were additions to

Microsaic and Futura Medical. These two added up to just under GBP1

million. This made a total investment of GBP3.4 million in qualifying

investments in the year to 28 February 2017, which was considerably

lower than last year's GBP5.9 million reflecting slightly lower levels

of fundraising activity on AIM and the short term effects of digesting

the new VCT rules. The new holding, FreeAgent, is a supplier of cloud

based accounting software sold as a service to enable sole traders and

small businesses to file their tax returns on line or via mobile. It is

expected to be profitable for the year to March 2019.

We have also invested a proportion of our newly raised cash in

non-qualifying holdings with a view to improving returns by putting

liquid assets to work. In total we invested GBP8.9 million into new

non-qualifying holdings in the year.

There were no major disposals in the year, although we took the

opportunity to dispose of some of the smaller holdings that were not

contributing to performance. Thus we sold Vianet, Tanfield and Lombard

Medical each at a loss and accepted the offer for Tangent Communications,

also realising a loss. We also sold Altitude realising a profit and, at

the end of a protracted process, accepted the offer for Bond

International. All being well this sale will produce a very small

further sum in 2018. We have taken profits from a number of holdings,

such as Vectura, Abcam, WANdisco and Futura, although in this latter

case we subsequently re-invested in the company's most recent

fundraising. In total during the year we made disposals of GBP3.5

million realising a gain on prior year opening value of GBP1.2m.

Since the year end, we have seen a pick up in the number of fundraisings

on AIM and have invested in four new qualifying holdings. They are

Escape Hunt, a leisure company, into which we have invested GBP1 million,

Velocity Composites where we invested GBP0.8 million, Maxcyte, a

healthcare company, where we invested GBP0.5 million and Faron

Pharmaceuticals where we invested GBP0.3 million. Further details of the

post year end transactions are provided in Note 18 to the financial

statements.

New VCT Regulations

During the year under review, to 28 February 2017, we were required to

assimilate the consequences of the new rules established in the Summer

Budget of 2015. We have not found that there needed to be any material

change to our investment approach. We are determined to maintain a

threshold of quality and to invest where we see returns from growth.

However, the emphasis of the regulations is definitely to encourage

investment into earlier stage companies and to that extent, it seems

highly likely over a number of years, that the portfolio will see a rise

in the number of smaller companies receiving our initial investment. We

would hope and expect to invest further in those companies as they grow.

To summarise the changes, in order to qualify companies must:

-- have fewer than 250 full time equivalent employees; and

-- have less than GBP15 million of gross assets at the time of investment

and no more than GBP16 million immediately post investment; and

-- be less than seven years old from the date of its first commercial sale

(or 10 years if a knowledge intensive company) if raising State Aided (ie

VCT) funds for the first time; and

-- have raised no more than GBP5 million of State Aided funds in the

previous 12 months and less than the lifetime limit of GBP12 million (or

GBP20 million if a knowledge intensive company); and

-- produce a business plan to show that the funds are being raised for

growth and development.

Although there is a longer period and higher funding limit allowed for

knowledge intensive companies, it seems possible that a new funding gap

will open up for smaller companies, which reach their funding limit, but

which are still in a development phase. This would particularly affect

a company which has failed, for whatever reason, to qualify as a

knowledge intensive one. It is also possible that capital intensive

companies, which potentially form a key part of the new government's

industrial strategy, will face funding challenges as VCTs will not be

able to follow on with further investment and the companies may be too

small to attract investment from more conventional and larger

institutional investors. This financing issue is probably a long way

down any government department's list of priorities, but it is to be

hoped that the funding gap fails to materialise for any of our holdings.

One of our major and consistent reasons for refusing to invest is the

belief that a company is not raising enough capital at a particular

time. We will persist with that criterion.

Outlook & Future Prospects

Markets have enjoyed a strong start to 2017, buoyed by better than

expected economic growth figures and a sense of relief that the

immediate disaster predicted by those opposing the decision to exit the

European Union has not materialised. However, political and

macro-economic issues remain and newspaper headlines are still dominated

by speculation about Brexit's eventual impact on our economy as well as

the shape of our future relationships with Europe and the rest of the

world. These questions are unlikely to be settled quickly, and it seems

therefore that investors have to be prepared for bouts of uncertainty

and volatility. On the plus side, the rising level of confidence has

resulted in an increased interest in smaller companies and support for

fundraisings through March and April, and there are no immediate signs

of this reversing. We remain confident that smaller companies can

continue to grow. The dominant theme of the recent reporting season with

a few exceptions was confident trading statements that led to forecast

upgrades. In the immediate future there is no economic upset to that

trend, and any impact from Brexit itself will be felt much further into

the future than February 2018.

The portfolio now contains 76 holdings with investments across a range

of sectors including several such as Craneware, Gooch and Housego,

Gear4music, Clinigen, Cello, DP Poland and GB Group, which have

significant international exposure. Domestic companies such as Breedon,

Vertu and Staffline have already demonstrated their management's ability

to grow their businesses successfully in difficult economic conditions,

and the latter two should see scope for further share price recovery if

they continue to meet market expectations. The balance of the portfolio

still remains towards profitable companies, with several expected to

start paying dividends in 2017. The top-up fundraising for GBP4.3

million adds to the funds available for new investments and allows us to

take advantage of any dip in valuations should sentiment weaken in the

future. We will, as we have in the past, remain selective when viewing

new investment opportunities.

The AIM Team

Octopus Investments Limited

19 May 2017

Directors' Responsibilities Statement

The Directors are responsible for preparing the Annual Report and the

financial statements in accordance with applicable law and regulations.

Company law requires the Directors to prepare financial statements for

each financial year. Under that law the Directors are required to

prepare the financial statements and have elected to prepare the

Company's financial statements in accordance with United Kingdom

Generally Accepted Accounting Practice (United Kingdom Accounting

Standards and applicable law) including FRS 102 - "The Financial

Reporting Standard applicable in the UK and Republic of Ireland". Under

company law the Directors must not approve the financial statements

unless they are satisfied that they give a true and fair view of the

state of affairs of the Company and of the profit or loss for the

Company for that period.

In preparing these financial statements, the Directors are required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable UK accounting standards have been followed,

subject to any material departures disclosed and explained in the

financial statements;

-- prepare the financial statements on the going concern basis unless it is

inappropriate to presume that the Company will continue in business; and

-- prepare a Strategic Report, a Director's Report and Director's

Remuneration Report which comply with the requirements of the Companies

Act 2006.

The Directors are responsible for keeping adequate accounting records

that are sufficient to show and explain the Company's transactions and

disclose with reasonable accuracy at any time the financial position of

the Company and enable them to ensure that the financial statements

comply with the Companies Act 2006. They are also responsible for

safeguarding the assets of the Company and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

The Directors are responsible for ensuring that the annual report and

accounts, taken as a whole, are fair, balanced, understandable and

provide the information necessary for shareholders to assess the

Company's position and performance, business model and strategy.

Website Publication

The Directors are responsible for ensuring the Annual Report and the

financial statements are made available on a website. Financial

statements are published on the Company's website in accordance with

legislation in the United Kingdom governing the preparation and

dissemination of financial statements, which may vary from legislation

in other jurisdictions. The maintenance and integrity of the Company's

website is the responsibility of the Directors. The Directors'

responsibility also extends to the ongoing integrity of the financial

statements contained therein.

Directors' Responsibility Statement pursuant to DTR4

Roger Smith (Chairman), Stephen Hazell-Smith, Joanne Parfrey and Neal

Ransome the Directors, confirm to the best of their knowledge that:

-- the financial statements have been prepared in accordance with the

Financial Reporting Standard applicable in the United Kingdom and

Republic of Ireland ("FRS 102") and give a true and fair view of the

assets, liabilities, financial position and profit and loss of the

Company.

-- the Annual Report includes a fair review of the development and

performance of the business and the financial position of the Company,

together with a description of the principal risks and uncertainties that

it faces.

For and on behalf of the Board

Roger Smith

Chairman

19 May 2017

Income Statement

Year to 28 February 2017 Year to 29 February 2016

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gain on disposal

of fixed asset

investments - 1,178 1,178 - 59 59

Gain on

valuation of

fixed asset

investments - 14,258 14,258 - 1,684 1,684

Gain on

valuation of

current asset

investments - 668 668 - - -

Investment

income 858 - 858 816 - 816

Investment

management

fees (353) (1,059) (1,412) (340) (1,021) (1,361)

Other expenses (427) - (427) (456) - (456)

Net return on

ordinary

activities

before

taxation 78 15,045 15,123 20 722 742

Taxation - - - - - -

Net return on

ordinary

activities

after taxation 78 15,045 15,123 20 722 742

Earnings per 0.1p 17.7p 17.8p 0.0p 1.0p 1.0p

share - basic

and diluted

-- the 'Total' column of this statement represents the statutory Income

Statement of the Company; the supplementary revenue return and capital

return columns have been prepared in accordance with the AIC Statement of

Recommended Practice

-- all revenue and capital items in the above statement derive from

continuing operations

-- the Company has only one class of business and derives its income from

investments made in shares and securities and from bank and money market

funds, as well as OEIC funds.

The Company has no recognised gains or losses other than the results for

the period as set out above. Accordingly a Statement of Comprehensive

Income is not required.

Balance Sheet

As at 28 February As at 29 February

2017 2016

GBP'000 GBP'000 GBP'000 GBP'000

Fixed asset investments 79,919 64,578

Current assets:

Investments 14,858 5,269

Debtors 332 48

Cash at bank 13,679 9,751

28,869 15,068

Creditors: amounts falling due

within one year (8,873) (2,422)

Net current assets 19,996 12,646

Net assets 99,915 77,224

Called up equity share capital 873 760

Share premium 35,422 21,643

Capital redemption reserve 45 24

Special distributable reserve 53,717 60,062

Capital reserve realised (28,020) (26,518)

Capital reserve unrealised 37,445 20,898

Revenue reserve 433 355

Total equity shareholders' funds 99,915 77,224

Net asset value per share - basic 114.4p 101.6p

and diluted

The statements were approved by the Directors and authorised for issue

on 19 May 2017 and are signed on their behalf by:

Roger Smith

Chairman

Company number: 03477519

Statement of Changes in Equity

Shares Capital Special* Capital* Capital

Share Share to be redemption distributable reserve reserve Revenue*

Capital Premium issued reserve reserves realised unrealised reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 March

2015 656 13,951 319 9 63,684 (29,810) 23,468 335 72,612

Management fee

allocated as

capital

expenditure - - - - - (1,021) - - (1,021)

Current year

gains on

disposal - - - - - 59 - - 59

Current period

gains on fair

value of

investments - - - - - - 1,684 - 1,684

Prior years'

holding

gains/losses

now realised - - - - - 4,254 (4,254) - -

Net Revenue on

ordinary

activities

after tax - - - - - - - 20 20

Cancellation

of Share

Premium - (4,658) - - 4,658 - - - -

Total

comprehensive

income for

the year - (4,658) - - 4,658 3,292 (2,570) 20 742

Contributions

by and

distributions

to owners:

Repurchase and

cancellation

of own

shares (15) - - 15 (1,499) - - - (1,499)

Issue of

shares 119 12,989 (319) - - - - - 12,789

Share issue

costs - (639) - - - - - - (639)

Dividends paid - - - - (6,781) - - - (6,781)

Balance as at

29 February

2016 760 21,643 - 24 60,062 (26,518) 20,898 355 77,224

As at 1 March

2016 760 21,643 - 24 60,062 (26,518) 20,898 355 77,224

Management fee

allocated as

capital

expenditure - - - - - (1,059) - - (1,059)

Current year

gains on

disposal - - - - - 1,178 - - 1,178

Current period

gain on fair

value of

investments - - - - - - 14,926 - 14,926

Prior years'

holding

gains/losses

now realised - - - - - (1,621) 1,621 - -

Net Revenue on

ordinary

activities

after tax - - - - - - - 78 78

Total

comprehensive

income for

the year - - - - - (1,502) 16,547 78 15,123

Contributions

by and

distributions

to owners:

Repurchase and

cancellation

of own

shares (21) - - 21 (2,054) - - - (2,054)

Issue of

shares 134 14,413 - - - - - - 14,547

Share issue

costs - (634) - - - - - - (634)

Dividends paid - - - - (4,291) - - - (4,291)

Balance as at

28 February

2017 873 35,422 - 45 53,717 (28,020) 37,445 433 99,915

*Included in these reserves is an amount of GBP26,130,000 (2016:

GBP33,899,000) which is considered distributable to shareholders.

Cash Flow Statement

Year to 28 Year to 29 February

February 2017 2016

GBP'000 GBP'000

Cash flows from operating activities

Return on ordinary activities before

tax 15,123 742

Adjustments for:

(Increase)/decrease in debtors (284) 155

Increase in creditors 6,451 1,674

(Gain) on disposal of fixed assets (1,178) (59)

(Gain) on valuation of fixed asset

investments (14,258) (1,684)

(Gain) on valuation of current asset

investments (668) -

Cash from operations 5,186 828

Cash flows from investing activities

Purchase of fixed asset investments (3,391) (11,043)

Purchase of current asset investments (8,900) -

Sale of fixed asset investments 3,486 5,919

Net cash flows from investing

activities (8,805) (5,124)

Cash flows from financing activities

Purchase of own shares (2,054) (1,499)

Share issues 13,913 12,469

Decrease in shares to be issued - (319)

Dividends Paid (4,291) (6,781)

Net cash flows from financing

activities 7,568 3,870

Increase/(decrease) in cash and cash

equivalents 3,949 (426)

Opening cash and cash equivalents 15,020 15,446

Closing cash and cash equivalents 18,969 15,020

Cash and cash equivalents comprise

Cash at Bank 13,679 9,751

Money Market Funds 5,290 5,269

18,969 15,020

This announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the information

contained therein.

Source: Octopus AIM VCT PLC via Globenewswire

http://www.octopusinvestments.com

(END) Dow Jones Newswires

May 19, 2017 11:10 ET (15:10 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

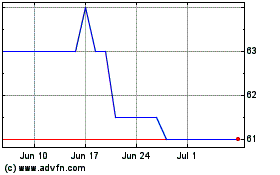

Octopus Aim Vct (LSE:OOA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Octopus Aim Vct (LSE:OOA)

Historical Stock Chart

From Apr 2023 to Apr 2024