By Russell Gold and Cassandra Sweet

Utilities are closing U.S. nuclear-power plants at a rapid clip

as they face competition from cheaper sources of electricity and

political pressure from critics.

New York's Indian Point plant about 35 miles north of Manhattan,

a major source of power for the city and its surrounding suburbs,

looks to be the latest casualty. Owner Entergy Corp. and New York

Gov. Andrew Cuomo, who has long criticized the plant as a safety

threat, are expected to announce a deal this week to close it, say

people familiar with the matter.

Its closure would bring the tally of plants set to close by 2025

to four, including PG&E Corp.'s Diablo Canyon plant in

California and Entergy's Palisades unit in Michigan. Four others

have already closed in the past four years, including Dominion

Resources Inc.'s Kewaunee plant in Wisconsin.

The retirements are poised to leave 61 nuclear plants in the

U.S. by the middle of the next decade. That includes two facilities

that are building new reactors. A small number of nuclear plants

have closed in the past due to safety or the need for expensive

repairs. What's new is the number of plants closing that are

licensed and operational, but no longer profitable in competitive

markets.

Nuclear plants everywhere are facing a powerful economic foe:

fracking. The extraction technique has unlocked vast amounts of

natural gas, making generating electricity from that fuel much less

expensive and lowering power prices across the country.

Nuclear plants generated 20% of U.S. power in the past 12

months, following natural gas at 35% and coal at 30%, according to

federal energy data. The balance was 7% hydro, 6% wind and 1%

solar.

The increasingly poor economics of nuclear power have led

nuclear plant operators in New York, Illinois and elsewhere to seek

new state subsidies to keep the plants operating. The owners argue

that they create high-paying jobs in rural areas, and are critical

tools to combat air pollution and climate change because they

produce emissions-free electricity.

Lawmakers in Connecticut, Ohio and Pennsylvania are expected to

face tough choices in the next couple of years: Approve rate

increases or other changes to bolster the finances of nuclear

plants, or prepare for them to close.

Exelon Corp., the nation's largest nuclear-power plant operator,

has succeeded in persuading states to provide new financial

incentives to keep its nuclear-power plants open.

Last month, Illinois lawmakers voted to allow Exelon to collect

up to $235 million annually from customers in exchange for keeping

two nuclear-power plants open. Earlier in 2016, the New York Public

Service Commission agreed to pay as much as $480 million annually

to keep three upstate nuclear plants open. Exelon operates two of

the three, and has a deal to purchase the third from Entergy,

pending federal approval.

Joe Dominguez, Exelon's executive vice president for public

policy, said states were paying for clean electricity, similar to

how the federal government subsidizes wind and solar energy.

Nuclear power "is the cheapest and most reliable zero-carbon

resource," he said.

FirstEnergy Corp. said recently it could close three plants in

Ohio and Pennsylvania if it couldn't arrange better compensation

for the power they provide. A FirstEnergy spokeswoman said the

company had watched the Illinois legislation closely and hoped to

negotiate something similar.

Kristine Hartman, who tracks energy laws for the National

Conference of State Legislatures, said she expects Arizona, New

Jersey and New Mexico to consider modifying laws that encourage

wind and solar to include nuclear as a power source free of

greenhouse-gas emissions.

Without additional support, "you will continue to see plants

that are challenged," said Maria G. Korsnick, the president and

chief executive of the Nuclear Energy Institute, an industry

advocacy group.

An analysis by the U.S. Energy Information Administration found

that when nuclear plants were closed, states increased their use of

natural gas and coal to generate power.

Jessica Lovering, director of the energy program at the

Breakthrough Institute, an environmental think tank, said a modern

gas plant can have just a dozen employees, while nuclear plants

need upward of 1,000.

But those large workforces are proving to be a political selling

point as owners argue to state legislators that nuclear-power

plants have great economic importance in rural areas. All five

nuclear-power plants receiving new subsidies in Illinois and New

York are located in rural areas.

Still, the deals have been controversial. "I am pronuclear

power, but I am not pro-bailing nuclear out," said Jeanne Ives, a

Republican state representative from Wheaton, Ill.

In New York, the deal brokered by Mr. Cuomo, a Democrat, to keep

three upstate nuclear-power plants alive has been met by protests

against what activists claim is a nuclear tax.

The new subsidies have also riled up independent power

producers, which claim that nuclear operators are being given an

unfair advantage.

Dynegy Inc. and NRG Energy Inc., which operate coal- and

natural-gas-fired power plants, are suing New York regulators to

reverse their decision to provide what they estimate could be more

than $7 billion in subsidies to nuclear plants.

Bob Flexon, chief executive of Houston-based Dynegy, said he

hopes the Trump administration will set a national energy policy

that allows for a level playing field.

"Someone needs to let them know that you're killing coal if you

throw billion-dollar subsidies to nuclear," Mr. Flexon said.

--Mike Vilensky contributed to this article.

Write to Russell Gold at russell.gold@wsj.com and Cassandra

Sweet at cassandra.sweet@wsj.com

(END) Dow Jones Newswires

January 09, 2017 05:44 ET (10:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

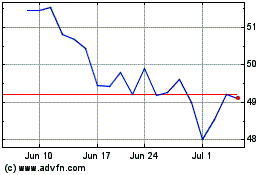

Dominion Energy (NYSE:D)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dominion Energy (NYSE:D)

Historical Stock Chart

From Sep 2023 to Sep 2024