TIDMNANO

RNS Number : 1175I

Nanoco Group PLC

23 March 2015

For immediate release 23 March 2015

NANOCO GROUP PLC

("Nanoco" or "the Company")

Interim results for the six months ended 31 January 2015

Nanoco Group plc (AIM: NANO), a world leader in the development

and manufacture of cadmium-free quantum dots and other

nanomaterials, is pleased to announce its interim results for the

six months ended 31 January 2015.

Highlights

-- Major progress in the commercialisation of Nanoco's

technology in the display industry in partnership with worldwide

licensing partner The Dow Chemical Company ("Dow")

-- Dow building the world's first, large-scale cadmium-free

quantum dot manufacturing plant in South Korea using Nanoco's

patented technology with production expected to begin in

mid-2015

-- LG Electronics signed a partnering agreement with Dow in

January 2015 for the supply of Nanoco quantum dots for LG Ultra HD

ColourPrime TVs, which are close to launch in the USA

-- Considerable technical progress in Nanoco's other key target

markets: LED general lighting, solar and bio-imaging

-- Second grant-funded project on the use of cadmium-free

quantum dots in the in vivo imaging of cancer began in October 2014

with University College London

-- Company continues to explore a move from AIM to a premium listing on the LSE Main Market

-- Cash, cash equivalents and deposits of GBP9.35 million at the

half year end (31 July 2014: GBP12.18 million)

Anthony Clinch, Nanoco's Chairman, commented:

"We're delighted by the pace of progress towards the

commercialisation of our cadmium-free quantum dot technology in the

display market. Our worldwide licensing partner Dow expects to

begin production in mid-2015 at the world's first large-scale

production plant for cadmium-free quantum dots. LG Electronics is

moving closer to the commercial launch of the LG Ultra HD

ColourPrime TV range unveiled earlier this year, which will mark

the first consumer electronics products to incorporate Nanoco

technology.

"We have made considerable technical progress in our other key

target markets of LED general lighting, solar and bio-imaging.

Going forwards we intend to put more emphasis on these additional

markets, all of which offer major commercial potential."

Analyst meeting: A meeting for analysts will be held at 10am

this morning, 23 March 2015, at the offices of Buchanan, 107

Cheapside, London EC2V 6DN. For details contact Buchanan on 020

7466 5000.

For further information please contact:

Nanoco + 44 (0) 161 603 7900

Michael Edelman, Chief

Executive Officer

Mark Sullivan, Interim

Chief Financial Officer

Canaccord Genuity - Nomad

and Joint Broker +44 (0) 20 7523 8000

Simon Bridges

Cameron Duncan

Liberum Capital - Joint

Broker +44 (0) 20 3100 2000

Simon Atkinson

Richard Bootle

Buchanan + 44 (0) 20 7466 5000

Mark Court / Sophie Cowles

/ Stephanie Watson

Notes for editors:

About Nanoco Group plc

Nanoco is a world leader in the development and production of

cadmium-free quantum dots and other nanomaterials for use in

multiple applications including LCD displays, lighting, solar cells

and bio-imaging. In the display market, it has an exclusive

manufacturing and marketing licensing agreement with The Dow

Chemical Company.

Nanoco was founded in 2001 and is headquartered in Manchester,

UK. It has production facilities in Runcorn, UK, and a US

subsidiary, Nanoco Inc, based in Concord, MA. Nanoco also has

business development offices in Japan and Korea Its technology is

protected worldwide by a large and growing patent estate.

Nanoco began trading on the AIM market of the London Stock

Exchange in May 2009 under the ticker symbol NANO. For further

information please visit: www.nanocogroup.com.

Chairman's and Chief Executive Officer's Joint Review

Overview

The half year to 31 January 2015 was a period of significant

milestones towards the commercialisation of Nanoco's cadmium-free

quantum dot technology. One of the most exciting of these

milestones was the announcement by the South Korean electronics

giant LG that it would launch large-screen LCD TVs incorporating

Nanoco quantum dots. These TVs, which will be available in the USA

in the near future, will be the first commercially available

display products to use Nanoco's technology.

Another important milestone in the half year was The Dow

Chemical Company ("Dow"), Nanoco's worldwide licensing partner for

the display industry, beginning construction of the world's first

large-scale, cadmium-free quantum dot manufacturing plant in

Cheonan, South Korea. Production at this plant, which Dow has

stated will ultimately be capable of supporting the manufacture of

"millions of cadmium-free quantum dot televisions", is expected to

begin in mid-2015.

The acceleration of interest in quantum dots, owing to their

ability to deliver a step change in the colour performance of LCD

displays, was highlighted by this year's Consumer Electronics Show

(CES) in Las Vegas. At CES, a number of TV makers, including LG and

Samsung, showcased TVs using quantum dots. The first TVs to be

launched by LG and Samsung will mark the beginning of a potentially

substantial industry based on incorporating quantum dots into LCD

TVs. DisplaySearch forecasts that the modest number of 1.3 million

quantum dot TVs will be shipped during 2015, rising to 18.7 million

in 2018.

The majority of the display industry is opting for cadmium-free

quantum dots owing to the threat that cadmium presents to human and

environmental health. European legislation on the Restriction of

Hazardous Substances (RoHS), as well as regulatory codes operating

in certain US states and in a number of other developed countries,

severely restricts the use of cadmium in electronic devices. The

European Commission has been considering an extension of an

exemption to allow the use of cadmium-containing quantum dots for a

limited period to 30 June 2018, which in Nanoco's view is in

conflict with the stated objectives of the RoHS. Should MEPs vote

to enact the extension, there is a right to an immediate appeal

which we would use if necessary.

We are making good progress with the commercialisation of our

technology in the display industry. Whilst further R&D is

required to fully commercialise our technology in the display

market, we will soon have the opportunity to focus more closely on

our other three target areas: LED general lighting, solar power and

bio-imaging. The Company has continued to make progress in all

three of these areas during the half year and is excited by the

potential for value creation that each of these areas presents.

During the half-year, Colin White resigned as the Company's

Chief Financial Officer owing to health reasons. We are very

grateful to Colin for his contribution to the development of Nanoco

and wish him all the best for the future. The recruitment process

for the appointment of a new Chief Financial Officer is proceeding

well. Until the appointment is made, Mark Sullivan, who has

provided accountancy services for Nanoco for the past 10 years,

will continue in the role of Interim Chief Financial Officer.

Commercial applications - displays

Nanoco is driving the commercialisation of its technology in the

LCD display industry through its exclusive worldwide licensing deal

with Dow, which was signed in January 2013. On 24 September 2014

Dow announced that it was starting construction of a large-scale

plant in South Korea to produce Nanoco quantum dots, which Dow is

marketing under the brand name TREVISTA(TM) Quantum Dots. In

January this year, Dow announced a partnering agreement with LG

Electronics in connection with the supply of TREVISTA(TM) Quantum

Dots for the LG Ultra HD ColourPrime TV range, which was launched

at CES.

The ColourPrime TVs, in 65 inch and 55 inch screen sizes, are

expected to be made available in the near future in the US, where

they have the product codes LG 65UF9400 and LG 55UF9400. They can

be viewed on LG's American website at these links:

www.lg.com/us/tvs/lg-65UF9400-led-tvand

www.lg.com/us/tvs/lg-55UF9400-led-tv. The TVs are also listed on

Amazon's US site and on the websites of other US retailers as a

product soon to be launched.

The quantum dots in these TVs will initially be supplied from

the relatively small-scale production at Nanano's Runcorn plant.

The initial launch by LG is therefore likely to be on a modest

scale, awaiting commercial roll-out once Dow's South Korea plant is

in full production. In December 2014, Nanoco and Dow signed a

manufacturing contract to set out details of how materials produced

by Nanoco's production facility in Runcorn are being supplied ahead

of the plant in South Korea starting production. The manufacturing

contract includes the pricing and payment terms associated with

materials supplied by Nanoco to Dow.

The pattern of introduction of new technologies in the display

sector is that they are first introduced in relatively low volumes

on premium-priced large-size screens before being rolled-out into

mid-market models. We are focusing our research and development

work on optimising the production process to maximise yields at

Dow's South Korea plant. This on-going development work is standard

practice in the introduction of new technologies to drive down

costs and thereby to allow commercial roll-out into the

mid-market.

We continue at various stages of the development process with a

number of display makers from South Korea, Japan, USA, China and

Taiwan in connection with products including TVs, monitors and

tablets. One of the strengths of Nanoco's technology is that it can

be incorporated into any type of LCD display, including 4K, as the

quantum dots sit in a film between the backlight and the

screen.

The display industry has invested billions of dollars in

existing LCD manufacturing supply chains and is therefore keen to

support the further development of LCD technology. During the

period, there was a trend away from OLED by a number of leading

display manufacturers which are focusing instead on extending the

lifetime of LCD through new technologies such as quantum dots.

Commercial applications - general lighting

LEDs are increasingly available on the high street for general

lighting, owing to their key advantages over traditional lighting

particularly long service life and reduced power consumption. The

limiting factor to the widespread adoption of LEDs remains colour

performance as existing products tend to offer either bright cold

light or warm dull light, neither of which is attractive in a home

or office environment.

It should be noted that the use of cadmium in lighting products

is banned under the RoHS legislation and restricted elsewhere,

underlining the risk that cadmium presents to human and

environmental health.

Nanoco's quantum dots have been shown to transform LEDs so they

produce bright, warm light with a high colour rendering index

without the loss of lumens. In addition, as Nanoco quantum dots are

tuneable to any specific wavelength, any shade of light can be

produced.

Nanoco has been working under joint development agreements with

Osram, one of the world's largest lighting companies, since August

2011. We continue to make good progress in this work, which is

focused on encapsulating our quantum dots to protect them from the

relatively high temperatures they experience from proximity to an

LED chip. We are also working with a number of other lighting

companies in Asia, the USA and Europe on both general lighting and

niche applications such as the lighting of food in retail

premises.

We have recently been working with Marl International Limited

("Marl"), a privately held UK company pioneering the use of LED

lighting in niche commercial applications. In this work with Marl,

we are developing LED linear strips and LED flat panels for use in

architectural lighting. Marl has both of these lighting designs

available for customer demonstrations and we look forward to the

commercialisation of these novel products.

Commercial applications - solar

Nanoco's solar ink, developed from cadmium-free nanomaterials,

has been designed to maximise the absorption of solar energy and to

have physical characteristics such that it can be printed by low

cost methods and annealed into a photovoltaic film. Our development

work has been focused on increasing the efficiency of the

conversion of light into electricity and we have now reached

approximately 17%, compared with 13% a year ago.

This level of 17% is, we believe, close to the efficiency level

to form the basis for low cost, printable solar panels. We believe

that we could achieve a cost performance of 0.33$/W, which is very

competitive when compared with existing technologies.

Nanoco's printable thin-film solar technology is based on

copper, indium, gallium, selenium ("CIGS") materials and can be

used in building integrated photo-voltaic applications due to its

high performance, light weight and its potential ease of

integration into different architectural form factors. A

significant amount of intellectual property, both in patents and

know how, has been built up which gives us a strong platform on

which to commercialise this exciting technology in the coming

years.

We have a relatively small team working on this technology

currently and we are considering how best to advance this exciting

application.

Commercial applications - bio-imaging

We have been working since 2009 with University College London

on the use of cadmium-free quantum dots in the in-vivo imaging of

cancer. The fluorescence of Nanoco quantum dots is being used in

this work to pinpoint malignant lymph nodes to guide surgeons in

the removal of cancerous tissue. Other materials have already been

used in this way in clinical practice but Nanoco quantum dots offer

the major advantage of fluorescing for a longer period of time, and

their fluorescence can be detected from deeper tissues, giving

surgeons more time and accuracy to visualise the cancer which we

believe will lead to a greater improvement in healing rates and

patient outcomes.

Nanoco won a second grant award from Innovate UK, the UK's

innovation agency, totalling GBP308,000, in support of the current

phase of this research work. This grant funded phase commenced in

October 2014.

Production at Runcorn

We have four Semi-Tech lines at The Heath Business and Technical

Park in Runcorn. We use these production lines to produce high

quality sample materials for the display industry and we are also

satisfying initial commercial orders from the display industry. Our

technical team at Runcorn is focused on the continual improvement

of production processes, reactor yields and quantum dot

performance.

Financial results

Revenues in the six months to 31 January 2015 were GBP1.61

million (H1 2014: GBP0.68 million) and the loss before tax was

GBP4.13 million (H1 2014: loss of GBP4.99 million). As has

historically been the case, the timing of revenue receipts in the

form of milestone and joint development payments from strategic

partners continued to be the major determinant of the results of

the business. In the period under review, revenue has benefited

from the inclusion of a milestone payment from Dow, triggered by

the announcement that it was beginning the construction of the

cadmium-free quantum dot manufacturing plant in South Korea.

The research and development element of cost of sales decreased

as compared with the prior period, as a consequence of the absence

of commissioning and material costs associated with scaling up the

Runcorn facility and reduced large scale trialling. The primary

reason behind the increase in administrative expenses was

additional scientific and managerial staff related costs.

The additional research and development led tax credit as

compared with the prior period stems from a combination of a higher

credit in respect of the current period augmented by an adjustment

from GBP1.21m to GBP1.32m to the credit receivable in respect of

the year to 31 July 2014.

Statutory cash, cash equivalents and deposits, at 31 January

2015 were GBP9.35 million (31 January 2014: GBP14.48 million; 31

July 2014: GBP12.18 million). The tax credit of GBP1,323,000 in

respect of the year ended 31 July 2014 was received on 3 February

2015. Both cash and costs continue to be prudently and tightly

managed.

The Company received cash funds of GBP0.78 million in October,

following an employee share option exercise round.

Capital markets strategy

As stated in earlier financial results statements, we continue

to consider a move from AIM to a premium listing on the Official

List of the London Stock Exchange.

Outlook

We're delighted by the pace of progress towards the

commercialisation of our cadmium-free quantum dot technology in the

display market. Our worldwide licensing partner Dow expects to

begin production in mid-2015 at the world's first mass-production

plant for cadmium-free quantum dots in South Korea. LG Electronics

is moving closer to the commercial launch of the LG Ultra HD

ColourPrime TV range, which will mark the first consumer

electronics products to incorporate Nanoco technology.

We have made considerable technical progress in our other key

target markets of LED general lighting, solar and bio-imaging.

Going forwards we intend to put more emphasis on these additional

markets, all of which offer major commercial potential.

Anthony Clinch Michael Edelman

Non-executive Chairman Chief Executive Officer

23 March 2015 23 March 2015

Consolidated Statement of Comprehensive Income

For the six months ended 31 January 2015

Six months Six months Year

to to 31 to

31 January January 31 July

2015 2014 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Notes

Revenue 4 1,612 679 1,433

Cost of sales (672) (859) (1,563)

Gross profit/(loss) 940 (180) (130)

Administrative expenses (5,113) (4,907) (9,119)

Operating loss

--------------------------------------

- before share-based

payment (3,940) (4,787) (8,676)

- share-based payment (233) (300) (573)

----------------------------- ------ ------------ ------------ ----------

(4,173) (5,087) (9,249)

Finance income 46 102 194

Finance costs (2) (3) (5)

Loss on ordinary activities

before taxation (4,129) (4,988) (9,060)

Taxation 5 984 650 1,249

Loss for the period and

total comprehensive loss

for the period (3,145) (4,338) (7,811)

============ ============ ==========

Loss per share:

Basic and diluted loss

for the period 6 (1.45)p (2.07)p (3.65)p

============ ============ ==========

Consolidated Statement of Changes in Equity

For the six months ended 31 January 2015

Share-

Issued based

equity payment Merger Revenue Total

capital reserve reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 August 2013 28,054 1,253 (1,242) (13,671) 14,394

Loss for the six months

to 31 January 2014 - - - (4,338) (4,338)

Issue of share capital 10,000 - - - 10,000

Expenses of placing (253) - - - (253)

Share-based payments - 300 - - 300

At 31 January 2014 37,801 1,553 (1,242) (18,009) 20,103

-------- -------- -------- --------- --------

Loss for the six months

to 31 July 2014 - - - (3,473) (3,473)

Expenses of prior period

placing (10) - - - (10)

Share-based payments - 273 - - 273

At 31 July 2014 37,791 1,826 (1,242) (21,482) 16,893

-------- -------- -------- --------- --------

Loss for the six months

to 31 January 2015 - - - (3,145) (3,145)

Issue of share capital 486 - - - 486

Issue of shares by EBT - - - 297 297

Share-based payments - 233 - - 233

At 31 January 2015 38,277 2,059 (1,242) (24,330) 14,764

======== ======== ======== ========= ========

Consolidated Statement of Financial Position

As at 31 January 2015

31 January 31 January 31 July

2015 2014 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and equipment 2,414 3,270 2,783

Intangible assets 1,703 1,451 1,557

4,117 4,721 4,340

-------------------------- ------------------ ----------

Current assets

Inventories 137 129 134

Trade and other receivables 673 955 633

Income tax asset 2,198 1,528 1,210

Short-term investments

and cash on deposit 1,134 9,728 5,791

Cash and cash equivalents 8,216 4,750 6,391

12,358 17,090 14,159

-------------------------- ------------------ ----------

Total assets 16,475 21,811 18,499

Liabilities

Current liabilities

Trade and other payables 1,585 1,518 1,448

Financial liabilities 63 63 63

1,648 1,581 1,511

-------------------------- ------------------ ----------

Non-current liabilities

Financial liabilities 63 127 95

63 127 95

-------------------------- ------------------ ----------

Total liabilities 1,711 1,708 1,606

-------------------------- ------------------ ----------

Net assets 14,764 20,103 16,893

========================== ================== ==========

Capital and reserves

Issued equity capital 38,277 37,801 37,791

Share-based payment reserve 2,059 1,553 1,826

Merger reserve (1,242) (1,242) (1,242)

Revenue reserve (24,330) (18,009) (21,482)

Total equity 14,764 20,103 16,893

========================== ================== ==========

Approved by the Board and authorised for issue on 23 March

2015

Michael Edelman

Director

Consolidated Cash Flow Statement

For the six months ended 31 January 2015

Six months Six months

to to Year to

31 January 31 January 31 July

2015 2014 2014

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Loss before interest

and tax (4,173) (5,087) (9,249)

Adjustments for:

Depreciation of property,

plant and equipment 554 599 1,181

Amortisation of intangible

assets 125 97 209

Share-based payments 233 300 573

Changes in working capital

:

Increase in inventories (3) (9) (14)

(Increase)/decrease in

trade and other receivables (59) (67) 256

Increase)/(decrease)

in trade and other payables 256 (321) (510)

(Decrease)/increase in

deferred revenue (119) (112) 7

Cash outflow from operating

activities (3,186) (4,600) (7,547)

Research and development

tax credit received - - 918

Overseas corporation

tax paid (4) (8) (9)

------------- -------------------- -----------

Net cash outflow from

operating activities (3,190) (4,608) (6,638)

------------- -------------------- -----------

Cash flows from investing

activities:

Purchases of property,

plant and equipment (185) (399) (494)

Purchases of intangible

fixed assets (271) (318) (536)

Decrease/(increase) in

cash placed on deposit 4,657 (3,552) 385

Interest received 65 146 237

Net cash inflow/(outflow)

from investing activities 4,266 (4,123) (408)

------------- -------------------- -----------

Cash flows from financing

activities:

Issue of share capital 783 10,000 10,000

Expenses of placing - (253) (263)

Interest paid (2) (3) (5)

Loan repayment (32) (31) (63)

Net cash inflow from

financing activities 749 9,713 9,699

------------- -------------------- -----------

Increase in cash and

cash equivalents 1,825 982 2,623

Cash and cash equivalents

at the start of period 6,391 3,768 3,768

------------- -------------------- -----------

Cash and cash equivalents

at the end of the period 8,216 4,750 6,391

Monies placed on deposit 1,134 9,728 5,791

------------- -------------------- -----------

Cash, cash equivalents

and deposits at the end

of the period 9,350 14,478 12,182

============= ==================== ===========

Notes to the interim financial statements

For the six months ended 31 January 2015

1. Corporate information

The Company is a UK incorporated and domiciled company whose

shares are publicly traded on AIM. The registered office of the

Company is located at 46 Grafton Street, Manchester, M13 9NT.

2. Accounting policies

Basis of preparation

The accounting policies adopted in these interim condensed

consolidated financial statements are consistent with those

followed in the preparation of the Group's annual report and

accounts for the year to 31 July 2014. The interim condensed

financial statements for the six months ended 31 January 2015 and

31 January 2014 is unaudited and does not constitute statutory

accounts as defined in the Companies Act 2006. This interim

condensed financial report includes audited comparatives for the

year to 31 July 2014. The 2014 annual report and accounts, which

are prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union, received an

unqualified audit opinion and has been filed with the Registrar of

Companies. These interim condensed consolidated financial

statements have been prepared in accordance with IAS 34 Interim

Financial Reporting as adopted by the European Union and using the

recognition and measurement principles of International Financial

Reporting Standards (IFRS) as adopted by the European Union and

have been prepared under the historical cost convention.

Going concern

Having made appropriate enquiries and having prepared cash flow

projections, the Directors believe that in the event of delays in

the receipt of revenues, the Company may need to implement cost and

capital savings in the 12 months from the date of these interim

financial statements. On this basis, the Directors have a

reasonable expectation that the Group has adequate resources to

continue in business for the foreseeable future. For this reason,

they have adopted the going concern basis in preparing the interim

financial statements.

Accounting policies

Accounting policies adopted in the preparation of the interim

condensed consolidated financial statements are consistent with

those followed in the preparation of the Group's annual financial

statements for the year ended 31 July 2014, except for the adoption

of new Standards and Interpretations noted below.

-- IFRS 10, IFRS 12 and IAS 27 Investment Entities - Amendments to IFRS 10, IFRS 12 and IAS 27

-- IAS 32 Offsetting Financial Assets and Financial Liabilities (Amendments)

-- IAS 36 Recoverable Amount Disclosures for Non-Financial Assets (Amendments)

-- IAS 39 Novation of Derivatives and Continuation of Hedge Accounting (Amendments)

-- Annual Improvements to IFRSs 2010 to 2012 Cycle (EU endorsed December 2014)

-- Annual Improvements to IFRSs 2011 to 2013 Cycle (EU endorsed December 2014)

Basis of consolidation

These interim condensed consolidated financial statements

include the financial statements of Nanoco Group PLC and the

entities it controls (its subsidiaries).

3. Risks and uncertainties

The Group has successfully managed to reduce the inherent risk

for the business by partnering with Dow, through the licensing of

CFQD(R) quantum dot materials to Dow for use in display

applications. The principal risks to achieving full

commercialisation and to becoming cash generative are those

relating to technology, production scale-up, customers, regulatory,

market and competition, intellectual property and attraction and

retention of key employees. These risks and uncertainties facing

our business were reported in detail in the Strategic Report in the

2014 Annual Report and Accounts. There have been no changes to the

Group's principal risks and uncertainties in the six month period

to 31 January 2015 and the Board of Directors do not anticipate any

changes to the principal risks and uncertainties in the second half

of the year.

4. Segmental information

Operating segments

At 31 January 2015, 31 July 2014 and 31 January 2014 the Group

operated as one segment, being the provision of high performance

nano-particles for research and development purposes. This is the

level at which operating results are reviewed by the chief

operating decision maker (i.e. the CEO) to make decisions about

resources, and for which financial information is available. All

revenues have been generated from continuing operations and are

from external customers.

Six months Six months Year to

to to 31 July

31 January 31 January 2014

2015 2014

GBP'000 GBP'000 GBP'000

Analysis of revenue

Products sold 181 50 178

Rendering of services 199 629 1,255

Royalties and licences 1,232 - -

1,612 679 1,433

------------ ------------ ---------

Rendering of services in the six months to 31 January 2014

included revenue from one customer amounting to GBP388,000, year to

31 July 2014 one customer amounting to GBP754,000). Included in

rendering of services is GBP29,000 from government grants (six

months to 31 January 2014 GBP93,000 and in the year to 31 July 2014

GBP184,000).

Revenue from royalties and licences comprises a milestone

payment receivable on the commencement of construction of a

cadmium-free quantum dot manufacturing plant.

Geographical information

The Group operates in four main geographic areas, although all

are managed in the UK. The Group's revenue per geographical segment

is as follows:

Six months Six months Year to

to to 31 July

31 January 31 January 2014

2015 2014

GBP'000 GBP'000 GBP'000

Analysis of revenue

UK 29 93 159

Europe (excluding UK) - 1 26

Asia 297 539 1,139

USA 1,286 46 109

------------------------------ ------------ ---------

1,612 679 1,433

------------------------------ ------------ ---------

All the Group's assets are held in the UK and all of its capital

expenditure arises in the UK.

5. Tax

The tax credit of GBP984,000 recorded in the consolidated

statement of comprehensive income for the six months ended 31

January 2015 comprises a research and development tax credit

receivable of GBP875,000 plus a revision in respect of a prior

period of GBP113,000, net of overseas corporation tax charged of

GBP4,000.

Prior period tax credits receivable comprised: for the six

months ended 31 January 2014, GBP658,000 in respect of a research

and development tax credit receivable, net of overseas tax charged

of GBP8,000 and for the year ended 31 July 2014, the GBP1,249,000

credit comprised, GBP1,210,000 in respect of a research and

development tax credit, plus a revision in respect of a prior

period of GBP48,000, net of overseas corporation tax charged of

GBP9,000.

The income tax asset of GBP1,323,000 in respect of the year

ended 31 July 2014 was received on 3 February 2015.

6. Loss per share

31 January 31 January 31 July

2015 2014 2014

GBP'000 GBP'000 GBP'000

------------------------------ ------------ ------------ ------------

Loss for the financial

period

attributable to equity

shareholders (3,145) (4,338) (7,811)

Share-based payments 233 300 573

Loss for the financial

period before share-based

payments (2,912) (4,038) (7,238)

Weighted average number

of shares: No. No. No.

Ordinary shares in issue(1) 216,294,181 209,564,972 214,248,996

Adjusted loss per share

before share-based payments

(pence) (1.35)p (1.93)p (3.38)p

------------------------------ ------------ ------------ ------------

Basic loss per share (pence) (1.45)p (2.07)p (3.65)p

------------------------------ ------------ ------------ ------------

(1) Excludes shares held by the Nanoco Employee Benefit Trust

Diluted loss per share has not been presented above as the

effect of share options issued is anti-dilutive.

7. Share capital

During the period 799,947 shares with an average exercise price

of 60.7 pence were issued on the exercise of share options

resulting in share proceeds of GBP486,000.

During the period 320,411 jointly owned Employee Benefit Trust

shares were taken up at an exercise price of 92.6 pence resulting

in share proceeds of GBP297,000.

8. Interim financial report

A copy of these interim condensed consolidated financial

statements will be distributed to shareholders and is also

available on the Company's website at www.nanocogroup.com.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UURURVAAOUUR

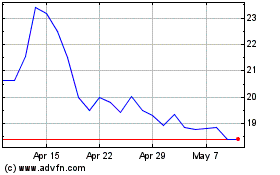

Nanoco (LSE:NANO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nanoco (LSE:NANO)

Historical Stock Chart

From Apr 2023 to Apr 2024