NZ Dollar Extends Decline Ahead Of RBNZ Rate Decision

April 27 2016 - 3:31AM

RTTF2

The New Zealand dollar extended its early slide against most

major counterparts in European trading on Wednesday, as traders

await the Reserve Bank of New Zealand's interest rate decision

tomorrow, with expectations that the bank would keep the official

cash rate unchanged at the current record low of 2.25 percent.

Investors look forward to the comments from the Governor Graeme

Wheeler for signals about future easing.

The central bank is likely to talk down the kiwi, as an overly

valued currency exerts downward pressures on domestic inflation,

and hint that lower currency exchange rate would be

appropriate.

The Federal Reserve will announce latest monetary policy

decision at the end of a two-meeting concluding later today.

The U.S. central bank is widely expected to leave interest rates

unchanged, but investors are eager to know if a move is likely at

the next FOMC meeting in June.

European shares are mostly higher, as encouraging data out of

Germany and higher oil prices offset worries over a steep fall in

Greek shares.

In economic front, figures from Statistics New Zealand showed

that New Zealand's foreign trade deficit widened notably in March,

posting the largest annual trade deficit in seven years.

The trade deficit widened to NZ$3.8 billion in the twelve months

ended March from NZ$2.37 billion in the corresponding month last

year. It was the biggest annual trade deficit since April 2009.

The kiwi has been weaker against its key counterparts, except

the aussie, in Asian deals.

The kiwi slipped to a new 2-week low of 1.6524 against the euro,

from an early 2-day high of 1.6345. If the kiwi extends decline,

1.67 is likely seen as its next support level.

Survey data from market research group GfK showed that German

consumer optimism improved unexpectedly in May.

The forward-looking consumer sentiment index rose to 9.7 from

9.4 in April. It was forecast to remain unchanged in May.

The kiwi dropped to a 2-day low of 0.6839 against the greenback,

compared to 0.6892 hit late New York Tuesday. The kiwi is seen

finding support around the 0.67 zone.

The kiwi fell to 76.14 against the yen, from an early 1-week

high of 76.84. The next likely support for the kiwi may be found

around the 74.00 area.

Figures from the Ministry of Economy, Trade and Industry showed

that Japan's all industry activity decreased at a

slower-than-expected pace in February, after rising in the previous

month.

The all industry activity index fell 1.2 percent

month-over-month in February, in contrast to a 1.2 percent climb in

January. Economists had expected a 1.3 percent decline for the

month.

On the flip side, the kiwi advanced to near a 2-week high of

1.1060 against the aussie, off its session's low of 1.1252. The

pair was worth 1.1223 when it ended Tuesday's trading.

Looking ahead, U.S. pending home sales data for March and weekly

crude oil inventories data are set to be published in the New York

session.

At 2:00 pm ET, the Federal Reserve will announce its decision on

monetary policy. The Fed is expected to hold the funds rate at 0.25

to 0.5 percent.

At 3:00 pm ET, Canadian Finance Minister Bill Morneau is

expected to speak to the Greater Vancouver Board of Trade, giving

an overview of the Canadian government's plan to strengthen the

middle class and invest in the economy, in Vancouver.

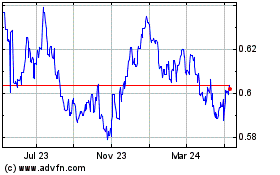

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

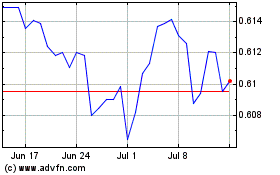

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024