TIDMMCB

RNS Number : 4791X

McBride PLC

22 February 2017

22 February 2017

McBride plc

McBride plc, the leading European manufacturer and supplier of

Co-manufactured and Private Label products for the Household and

Personal Care market, announces its Half-Year Report for the six

months ended 31 December 2016.

Prepare phase on track; Quality of earnings continuing to

improve

Headlines

Half year Half year Constant

to 31 to 31 Reported Currency

GBPm unless otherwise stated Dec 2016 Dec 2015(1) % Change % Change(2)

--------------------------------- ---------- ------------- ---------- -------------

Revenue 360.6 344.1 4.8% (7.0%)

Adjusted operating profit

(3) 22.9 17.6 30.1% 9.6%

Adjusted operating margin

(3) 6.4% 5.1% 1.3ppts 1.0ppts

Operating profit 22.5 17.1 31.6%

Operating margin 6.2% 5.0% 1.2ppts

Adjusted profit before taxation 19.5 13.6 43.4% 15.4%

Profit before taxation 18.8 13.0 44.6% 15.3%

Diluted earnings per share 7.1p 4.9p 44.9%

Adjusted diluted earnings

per share (4) 7.4p 5.2p 42.3%

Interim payment to shareholders

(per ordinary share) 1.4p 1.2p 16.7%

Cash flow from operations

(before exceptional items) 34.4 26.2

Net debt 82.9 90.9

Return on capital employed

(5) 28.0% 23.6%

-- Adjusted operating profit up 30.1% (9.6% at constant currency)

-- Further progress on margins, adjusted operating margin now 6.4% (2015: 5.1%)

-- Underlying Group revenues(6) 4.5% lower on a constant

currency basis, with a further 2.5% reduction in revenues due to

the "customer choices" project

-- Adjusted profit before taxation up 43.4% to GBP19.5m (2015: GBP13.6m)

-- Adjusted diluted EPS up 42.3% to 7.4p (2015: 5.2p)

-- Strong cash generation continues with underlying net cash

inflow of GBP14.8m, resulting in an improved net debt cover ratio

of 1.4x (30 June 2016: 1.7x)

-- Further progress on ROCE at 28.0% (2015: 23.6%)

-- Interim payment to shareholders up 16.7% to 1.4 pence (2015: 1.2p)

-- Growth strategy and associated capital expenditure plans well advanced

-- Board considering third party expressions of interest to

acquire the Group's Aerosols activities

Rik De Vos, Chief Executive Officer, commented:

"I am both encouraged and delighted by the Group's solid

performance in this first half of our financial year, in spite of

the tough trading environment. Encouraged because our financial

results remain strong and on track to meet our key three to five

year objectives for profitability, cash and ROCE during the phased

implementation of our strategy. Delighted as the McBride teams

continue to implement the strategic objectives as defined for this

"Prepare" phase while managing the business effectively in

uncertain market circumstances. Our focus remains on preparing the

company for growth by securing the future building blocks required,

while protecting the quality of the bottom line.

Uncertainty in both the size and timing of raw material

inflation and changes to foreign exchange rates is to be expected

in the second half of the year. We will work closely with customers

to mitigate these but it is likely the second half will see some

lag effect between higher input prices and margin recovery.

While trading conditions in the second half are expected to

remain challenging, we believe our ongoing margin and cost

initiatives position us well to mitigate these effects. As such,

the Board's full year expectations remain unchanged."

McBride plc

Rik De Vos, Chief Executive

Officer 020 3642 1587

Chris Smith, Chief Financial

Officer

020 3642 1587

FTI Consulting

Ed Bridges, Nick Hasell 020 3727 1017

(1) Net debt comparative is as at 30 June 2016, all other

comparatives refer to the six months ended on 31 December 2015

unless otherwise stated.

(2) Comparatives translated at 2017 exchange rates.

(3) Adjustments made for the amortisation of intangible assets

and exceptional items (see Consolidated Income Statement).

(4) Adjustments made for the amortisation of intangible assets,

exceptional items, non-cash financing costs from unwind of discount

on initial recognition of contingent consideration, unwind of

discount on provisions and any related tax (see Consolidated Income

Statement).

(5) Annualised adjusted operating profit for the six months

ended on 31 December 2016 and 31 December 2015 as a percentage of

average period end net assets excluding net debt.

(6) Underlying revenues after adjusting for constant currency

and excluding the impact of "customer choices" project.

Strategy update

In September 2015, the Group presented its 'Manufacturing Our

Future' strategy, with its three phases - 'Repair, Prepare, Grow',

defining a clear roadmap to restore McBride to its core capability

of manufacturing excellence with a three to five year ambition for

adjusted operating margin (EBITA %) of 7.5% and ROCE targeted at

25% to 30%.

In September 2016 and as part of our 2016 Annual results, we

reported the successful delivery of our key Repair objectives

within our Household business and highlighted the continuing work

necessary within our Personal Care and Aerosols business. This has

promoted clarity, simplification and focus in operational execution

across the business and we are pleased to report the results of

this effort are increasingly visible in our financial

performance.

The separation of our Personal Care and Aerosols business from

the Household activities has provided further insight into the

business and the options the Group has for improved value

generation from these activities. Since the separation, the Group

has received a number of approaches from external parties,

expressing interest in acquiring the Group's Aerosols business. The

initial interest has been narrowed down and the Group is making

progress towards concluding its next steps. The Aerosols activities

have annual revenues of approximately GBP60 million, operate from a

manufacturing site in each of the UK and France and supply

customers with a range of personal hygiene, aircare and homecare

products. There can be no certainty that any transaction will

result. The Board will provide updates as appropriate.

We are now preparing the company for the future, by creating

clarity on the markets, products and segments where we will sell in

the future whilst identifying and approving investment programmes

for our key assets to support this ambition. The definitive plans

are nearing completion and in many aspects of the growth plan, the

business is already busy implementing identified actions. We

continue to develop the Group's organisational structure and

culture, and are setting out plans to address improvements needed

in our under-performing businesses. We will provide further detail

on our plans for the Grow phase of our strategy in due course.

Group operating results

The Group has delivered an encouraging performance for the first

half of the financial year.

Group revenues at GBP360.6 million were GBP16.5 million (4.8%)

higher than the revenues reported for the prior half year, aided by

the translation effect of a strong Euro. On a constant currency

basis, sales were lower by GBP27.1 million

(-7.0%), with Household sales lower by 7.2% and Personal Care

& Aerosols ("PCA") lower by 6.2%.

As reported at the 2016 year end, the Group has completed the

process to reduce the levels of complexity in our customer and

product portfolio (our "customer choices" project), the impact of

which is to see revenues reduce on an annualised basis by

approximately GBP20.0 million. This initiative commenced in the

second half year of the previous financial year such that in the

six months to 31 December 2016, the impact lowered revenues by

GBP9.8 million, equating to approximately 2.5% of the period on

period reduction in Group sales (at constant currency).

Excluding "customer choices", overall consumer units are down

3.4% across the Group, 1.5% of which specifically relates to the

exceptionally high volumes in December 2015 as retailers restocked

for January 2016 promotions. Price pressure was most evident in the

North region, which saw pricing lower overall by approximately

2%.

Half year adjusted operating profit was GBP22.9 million (2015:

GBP17.6m) with adjusted operating profit margin increasing to 6.4%

(2015: 5.1%), showing good progress towards our 7.5% ambition.

Excluding the impact of translation of exchange rates, adjusted

operating profit improved by 9.6% or GBP2.0 million. Half year

operating profit increased by GBP5.4 million to GBP22.5 million

(2015: GBP17.1m). Based on adjusted operating profit, the improved

profitability levels led to an improved return on capital employed

ratio (ROCE), with the measure rising to 28.0% (2015: 23.6%). The

year on year profit improvement reflects cost saving initiatives,

either in overheads or from structural buying improvements.

In the six month period to December 2016 underlying raw material

prices remained in line overall with the same period last year

(excluding currency). However, key feedstock prices, especially

those of natural feedstocks, have moved higher in recent months and

the outlook is for further increases during the first half of

calendar 2017.

Business simplification continues to generate purchasing

efficiencies. Our purchasing teams are active in driving scale

benefits in many aspects of our procurement activities. The

significant effort to drive technically led formulation

simplification and thorough reviews of how and what we buy has led

to a steep fall in the number of components and chemicals used by

the Group, which realised a benefit of over GBP2 million compared

to the prior period. These purchasing benefits and a range of

efficiency initiatives in our factories have delivered improved

gross margins, which rose 1.3 percentage points to 36.8% (2015:

35.5%) despite the ongoing effect of lower unit sales pricing.

Overhead savings of GBP4.3 million were achieved in the six

months to December 2016, comprising further savings (in addition to

the GBP2.2 million achieved in the year to 30 June 2016) of GBP2.5

million representing early and complete delivery of the cost

savings required to balance the margin loss impact of the "customer

choices" project. In addition, a further overhead reduction of

GBP1.8 million has been achieved versus prior year comparatives as

the business remained vigilant on costs given the uncertainty

surrounding material pricing conditions.

The half year was a strong one for cash management with cash

generated from operations before exceptional items of GBP34.4

million (2015: GBP26.2m). Capital expenditure cash flow remained

steady at GBP7.4 million (2015: GBP5.6m) but is expected to

increase during the second half of the financial year as our

capital plans gain momentum in line with our expected GBP100

million capital expenditure investment objective over the coming

four years.

Cash outflow for exceptional items of GBP1.5 million (2015:

GBP3.5m) primarily reflects the impact of the charges taken in

previous years for central overhead restructuring.

Net cash flow before payments to shareholders was GBP19.0

million (2015: GBP13.9m). Cash payments made to shareholders during

the period amounted to GBP4.2 million (2015: GBP3.7m).

Consequently, half year-end net debt decreased to GBP82.9 million

(30 June 2016: GBP90.9m) comprising a strong net cash flow of

GBP14.8 million reduced by GBP6.8 million of translation impact as

a result of the weaker Sterling exchange rates on Euro and

USD-denominated borrowings. Reported half year-end net debt, if

translated using December 2015 exchange rates would have been

GBP71.3 million.

The Group's balance sheet remains robust with net assets of

GBP64.8 million (30 June 2016: GBP69.1m). Gearing improved further

to 56% (30 June 2016: 59%) and the debt cover ratio fell to 1:4x

(30 June 2016: 1:7x). The Group has significant borrowing capacity

with headroom of GBP134.0 million (2015: GBP94.6m) on committed

debt facilities. The Group traded throughout the period with ample

headroom on its banking covenants.

Segmental performance

In line with our year end reporting, we continue to separately

manage the Group's Household and PCA activities, and our segmental

reporting reflects this.

Corporate costs, which include the costs associated with the

Board and the Executive Leadership team, governance and listed

company costs and certain central functions, mostly associated with

financial disciplines such as treasury are reported separately to

Household and PCA.

Household

The Household activities are managed by four regional teams,

ensuring key organisational responsibility within our management

structure. Whilst revenues for the four regions are split, trading

profits are only measured and reported at the total segment

level.

Reported revenues increased by 4.9% to GBP284.4 million (2015:

GBP271.1m) but at constant currency revenues were lower by 7.2%. Of

this sales decrease, GBP7.6 million related to the in-year effect

of our "customer choices" project and GBP11.3 million due to a

reduction in underlying volumes, of which an unusually strong

December 2015 comparative was responsible for GBP5.7 million. The

remaining revenue shortfall related to the effect of pricing

deflation which has been particularly noticeable within our North

region.

Half year Half year

to to Reported Constant

31 Dec 31 Dec

2016 2015 Change Currency

Revenue GBPm GBPm Change(1)

-------- --------- --------- -------- ---------

UK 79.7 85.8 (7.1%) (7.1%)

North 96.0 90.2 6.4% (10.7%)

South 39.2 34.2 14.6% (4.2%)

East 69.5 60.9 14.1% (3.9%)

284.4 271.1 4.9% (7.2%)

-------- --------- --------- -------- ---------

(1) Comparatives translated at 2017 exchange rates.

In the UK, revenues of GBP79.7 million compared to revenue of

GBP85.8 million in 2015, a decline of 7.1%. In addition to an

unusually high December 2015 comparative, the decrease reflected

lower volumes particularly within McBride branded SKUs as a number

of UK retailers delisted some secondary brands as they reduced

their SKU ranges offered to consumers. Approximately GBP3.1 million

of lost revenue resulted from our "customer choices" project.

The UK business imports materials used for manufacturing from

the EU, for which the Group has been hedged at rates consistent

with prior year averages in the first half year. In the second half

of this year, the UK business, along with our competitors, will

face some imported inflation and we will seek to mitigate this via

increased pricing actions with customers.

In the North region, overall sales were impacted by an

increasingly competitive market, particularly in France. Volume

decline of 7.3% during the period was in part due to the "customer

choices" project of 1.1%, in addition to price deflation of 1.8%

driven by an increasingly competitive environment.

Our South region reported underlying flat sales at constant

currency. Our Iberia business continues to show significant

improvement with volumes up 5.4% on prior period following new

business wins at the end of last financial year. Within Italy,

revenue is down primarily driven by the impact from our "customer

choices" project.

The East region, covering Germany, Poland and other East

European countries, saw volumes slightly down on prior year but

prices have remained consistent with the first half of last year.

Germany has continued to perform well with some significant new

Private Label contract wins during the period. In Poland, sales are

weaker as a result of certain key retailers shifting their business

model towards higher proportions of branded SKUs in store.

Headline profits increased in Household by 27.4% (11.3% at

constant currency), broadly matching the improvements seen in the

Group overall. In spite of slightly lower revenues, further

positive progress on margins and costs resulted in trading profit

margins in this segment rising from 7.7% to 9.3%.

Personal Care & Aerosols (PCA)

The PCA division comprises the Personal Care liquids, Skincare

and Aerosols businesses of McBride's European operations and also

the activities of McBride in Asia.

On a reported basis, revenues for this division grew by 4.4% to

GBP76.2 million (2015: GBP73.0m) while at constant currency,

revenues were lower by 6.2%. Within this segment revenues were

significantly higher in Asia, up 16.9% at constant currency. Our

European businesses saw volumes lower by 8% overall at constant

currency with the main markets for these products, UK and France,

continuing to see private label volumes under pressure from

branders and high levels of in-store promotional activity.

Overall reported profitability for this segment reduced by

GBP0.4 million to GBP0.9 million (2015: GBP1.3m). At constant

currency, profitability reduced by GBP0.7m reflecting the volume

challenges during the period within our European business.

In Asia, the local teams have successfully turned a break-even

operation to one that now makes underlying profit margins close to

the Group average.

Corporate Costs

Costs remain consistent with last half year at GBP4.5 million

(2015: GBP4.5m).

Outlook

For the second half year, current expectations are for constant

currency underlying revenues to be slightly lower year-on-year, in

line with the performance witnessed in the first half year. As

planned the impact from the "customer choices" project will reduce

second half revenues by approximately GBP6.0 million. A number of

business wins however, secured in the past six months, will start

to be evident in our top line as we start the new financial year in

July 2017.

Uncertainty in both the size and timing of raw material

inflation and changes to foreign exchange rates is to be expected

in the second half of the year. We will work closely with customers

to mitigate these but it is likely the second half will see some

lag effect between higher input prices and margin recovery.

While trading conditions in the second half are expected to

remain challenging, we believe our ongoing margin and cost

initiatives position us well to mitigate these effects. As such,

the Board's full year expectations remain unchanged.

Other financial information

Exceptional items

During the period ended 31 December 2016, the Group recognised

no exceptional items (2015: GBPnil).

Net finance costs

Net finance costs were GBP3.7 million (2015: GBP4.1m) with the

decrease mainly due to foreign exchange losses on financing

activities in the prior year not being incurred during the current

period.

Profit before taxation and tax rate

Reported profit before taxation was GBP18.8 million (2015:

GBP13.0m) with adjusted profit before taxation totalling GBP19.5

million (2015: GBP13.6m). The tax charge on adjusted profit before

taxation for the first half of 2016/17 of GBP6.0 million represents

a 31% effective tax rate (30 June 2016: 31%).

Earnings per share

On an adjusted basis, diluted earnings per share (EPS) increased

by 42.3% to 7.4 pence (2015: 5.2p) with basic EPS at 7.1 pence

(2015: 4.9p).

Payments to shareholders

In line with the new policy on payments to shareholders

implemented in September 2015, the Group expects to distribute

adjusted earnings to shareholders based on a dividend cover range

of 2x-3x, progressive with earnings of the Group, taking into

account funding availability.

The Board recommends an interim payment of 1.4 pence (2015:

1.2p) to shareholders in May and it is intended this will be issued

using the Company's B Share scheme.

Covenants

The Group's funding arrangements are subject to covenants,

representations and warranties that are customary for unsecured

borrowing facilities, including two financial covenants: Debt Cover

(the ratio of net debt to EBITDA) may not exceed 3:1 and Interest

Cover (the ratio of EBITDA to net interest) may not be less than

4:1. For the purpose of these calculations, net debt excludes

amounts drawn under the invoice discounting facilities. The Group

remains comfortably within these covenants.

Pensions

The Group operates a funded defined benefit scheme in the UK. At

31 December 2016, the Group recognised a deficit on its UK scheme

of GBP41.8 million (30 June 2016: GBP31.1m); the increase during

the period is principally due to both a fall in the applied

discount rate and an increase in expectations of long term

inflation.

The Group also has other unfunded post-employment benefit

obligations outside the UK that amounted to GBP1.8 million (30 June

2016: GBP1.8m).

Going Concern

The Group meets its funding requirements through internal cash

generation and bank credit facilities, most of which are committed

until April 2019.

At 31 December 2016, committed undrawn facilities amounted to

GBP134.0 million. The Group's forecasts and projections, taking

account of reasonably possible changes in trading performance, show

that the Group will be able to operate comfortably within its

current bank facilities.

The Group has a relatively conservative level of debt to

earnings. As a result, the Directors believe that the Group is well

placed to manage its business risks successfully despite the

current uncertain economic outlook. After making enquiries, the

Directors have a reasonable expectation that the Company and the

Group have adequate resources to continue in operational existence

for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

the preparation of the financial statements.

Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties of the Company, have been eliminated on

consolidation and, therefore, are not required to be disclosed in

these condensed interim financial statements.

Key management compensation and transactions with the Group's

pension and post-employment schemes for the financial year ended 30

June 2016 are detailed in note 28 (page 106) of McBride plc's

Annual Report and Accounts 2016. A copy of McBride plc's Annual

Report and Accounts 2016 is available on McBride's website at

www.mcbride.co.uk. Although there have been changes to the

Executive Leadership Team since the year-end, there are no other

related party transactions.

Principal risks and uncertainties

The Group is subject to risk factors both internal and external

to its business, and has a well established set of risk management

procedures. The following risks and uncertainties are those that

the Directors believe could have the most significant impact on the

Group's business:

-- Market competitiveness

-- Change agenda

-- Input costs

-- Legislation and consumer trends

-- Financial risks

-- Breach of IT security

For greater detail of these risks, please refer to pages 22 to

24 of the McBride plc Annual Report and Accounts 2016 - which is

available on the Group's website www.mcbride.co.uk.

Forward looking statements

This announcement contains forward-looking statements that are

subject to risk factors associated with, among other things the

economic and business circumstances occurring from time to time in

the countries, sectors and markets in which the Group operates. It

is believed that the expectations reflected in these statements are

reasonable but they may be affected by a wide range of variables

which could cause actual results to differ materially from those

currently anticipated. No assurances can be given that the

forward-looking statements in this announcement will be

realised.

The forward-looking statements reflect the knowledge and

information available at the date of preparation of this

announcement and the Company undertakes no obligation to update

these forward-looking statements. Nothing in this announcement

should be construed as a profit forecast.

Responsibility statement

The Directors confirm that to the best of their knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' as adopted

by the EU;

-- The interim management report includes a fair review of the information required by:

(a) DTR 4.2.7 of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

(b) DTR 4.2.8 of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any material changes in the related party

transactions described in the last annual report that could do

so.

On behalf of the Board

Rik De Vos, Chief Executive

Officer

Chris Smith, Chief Financial

Officer

22 February 2017

CONDENSED INTERIM CONSOLIDATED INCOME STATEMENT

Unaudited Unaudited Audited

Half year Half year

to to Year ended

31 Dec 31 Dec 30 June

2016 2015 2016

Continuing Operations Note GBPm GBPm GBPm

----------------------------------- ---- --------- --------- ----------

Revenue 4 360.6 344.1 680.9

Cost of sales (227.9) (221.9) (437.1)

Gross profit 132.7 122.2 243.8

Distribution costs (23.8) (24.1) (46.5)

Administrative expenses (86.4) (81.0) (164.4)

---------

Operating profit 22.5 17.1 32.9

Net finance costs (3.7) (4.1) (7.1)

Profit before taxation 18.8 13.0 25.8

Taxation 5 (5.8) (4.0) (8.8)

----------------------------------- ---- --------- --------- ----------

Profit for the period attributable

to owners of

the Parent 13.0 9.0 17.0

----------------------------------- ---- --------- --------- ----------

Earnings per ordinary share 6

Basic 7.1p 4.9p 9.3p

Diluted 7.1p 4.9p 9.3p

----------------------------------- ---- --------- --------- ----------

Operating profit 22.5 17.1 32.9

Adjusted for:

Amortisation of intangible

assets 0.4 0.5 0.9

Exceptional items 7 - - 2.4

----------------------------------- ---- --------- --------- ----------

Adjusted operating profit 22.9 17.6 36.2

----------------------------------- ---- --------- --------- ----------

Profit before taxation 18.8 13.0 25.8

Adjusted for:

Amortisation of intangibles

assets 0.4 0.5 0.9

Exceptional items - - 2.4

Unwind of discount on contingent

consideration 0.1 - 0.1

Unwind of discount on provisions 0.2 0.1 0.2

----------------------------------- ---- --------- --------- ----------

Adjusted profit before taxation 19.5 13.6 29.4

----------------------------------- ---- --------- --------- ----------

CONDENSED INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Unaudited Unaudited Audited

Half year Half year

to to Year ended

31 Dec 31 Dec 30 June

2016 2015 2016

GBPm GBPm GBPm

------------------------------------------ --------- --------- ----------

Profit for the period attributable

to owners of the Parent 13.0 9.0 17.0

------------------------------------------ --------- --------- ----------

Other comprehensive income/(expense)

Items that may be reclassified

to profit and loss:

Currency translation differences

on foreign subsidiaries 3.7 3.0 12.0

Loss on net investment hedges (2.3) (2.5) (10.4)

Gain on cash flow hedges 4.8 3.9 12.4

Loss on cash flow hedges transferred

to profit or loss (8.1) (3.1) (10.3)

Taxation relating to items above 0.1 (0.1) (0.6)

------------------------------------------ --------- --------- ----------

(1.8) 1.2 3.1

Items that will not be reclassified

to profit or loss:

Net actuarial loss on post-employment

benefits (11.9) (1.2) (2.6)

Taxation relating to item above 0.8 (0.7) (0.4)

------------------------------------------ --------- --------- ----------

(11.1) (1.9) (3.0)

------------------------------------------ --------- --------- ----------

Total other comprehensive expense (12.9) (0.7) 0.1

------------------------------------------ --------- --------- ----------

Total comprehensive income for

the period 0.1 8.3 17.1

------------------------------------------ --------- --------- ----------

CONDENSED INTERIM CONSOLIDATED BALANCE SHEET

Unaudited Unaudited Audited

as at as at as at

31 Dec 31 Dec 30 June

2016 2015 2016

Note GBPm GBPm GBPm

----------------------------------- ---- --------- --------- -------

Non-current assets

Goodwill 17.5 17.6 17.5

Other intangible assets 2.8 2.1 2.5

Property, plant and equipment 8 136.4 126.9 136.2

Derivative financial instruments 9 15.2 12.1 12.7

Deferred tax assets 10.5 9.0 9.3

Other non-current assets 0.5 0.5 0.5

182.9 168.2 178.7

----------------------------------- ---- --------- --------- -------

Current assets

Inventories 81.2 74.2 75.7

Trade and other receivables 132.2 129.6 135.7

Derivative financial instruments 9 0.7 1.3 2.6

Cash and cash equivalents 10 28.9 27.7 24.8

Assets classified as held

for sale 1.3 1.1 1.2

244.3 233.9 240.0

----------------------------------- ---- --------- --------- -------

Total assets 427.2 402.1 418.7

----------------------------------- ---- --------- --------- -------

Current liabilities

Trade and other payables 187.2 176.1 181.7

Borrowings 9 36.8 29.3 30.3

Derivative financial instruments 9 0.9 0.4 1.2

Current tax liabilities 5.9 5.9 2.9

Provisions 2.1 1.4 3.5

232.9 213.1 219.6

Non-current liabilities

Trade and other payables 9 - 0.5 2.3

Borrowings 9 75.0 84.7 85.4

Derivative financial instruments 9 0.1 - -

Pensions and other post-employment

benefits 11 43.6 32.3 32.9

Provisions 3.5 3.3 2.9

Deferred tax liabilities 7.3 5.8 6.5

129.5 126.6 130.0

----------------------------------- ---- --------- --------- -------

Total liabilities 362.4 339.7 349.6

Net assets 64.8 62.4 69.1

Equity

Issued share capital 18.3 18.3 18.3

Share premium account 92.3 98.9 96.7

Other reserves 46.8 40.4 44.4

Accumulated loss (93.2) (95.8) (90.9)

----------------------------------- ---- --------- --------- -------

Equity attributable to owners

of the Parent 64.2 61.8 68.5

Non-controlling interests 0.6 0.6 0.6

----------------------------------- ---- --------- --------- -------

Total equity 64.8 62.4 69.1

----------------------------------- ---- --------- --------- -------

CONDENSED INTERIM CONSOLIDATED CASH FLOW STATEMENT

Unaudited Unaudited Audited

Half year Half year

to to Year ended

31 Dec 31 Dec 30 June

Note 2016 2015 2016

GBPm GBPm GBPm

----------------------------------- ---- --------- --------- ----------

Operating activities

Profit before taxation 18.8 13.0 25.8

Net finance costs 3.7 4.1 7.1

Exceptional items 7 - - 2.4

Share-based payments charge 1.2 0.7 1.8

Depreciation of property,

plant and equipment 8 9.7 9.3 18.2

Amortisation of intangible

assets 0.4 0.5 0.9

----------------------------------- ---- --------- --------- ----------

Operating cash flow before

changes in working capital 33.8 27.6 56.2

Decrease in receivables 7.2 5.4 11.0

Increase in inventories (3.7) (6.1) (1.5)

(Decrease)/Increase in payables (1.4) 0.6 (10.1)

----------------------------------- ---- --------- --------- ----------

Operating cash flow after

changes in working capital 35.9 27.5 55.6

Additional cash funding of

pension schemes (1.5) (1.3) (3.1)

----------------------------------- ---- --------- --------- ----------

Cash flow from operations

before exceptional items 34.4 26.2 52.5

Cash outflow in respect of

exceptional items (1.5) (3.5) (4.2)

----------------------------------- ---- --------- --------- ----------

Cash generated from operations 32.9 22.7 48.3

Interest paid (2.8) (2.7) (5.2)

Taxation paid (2.6) (0.2) (8.2)

Net cash from operating activities 27.5 19.8 34.9

----------------------------------- ---- --------- --------- ----------

Investing activities

Proceeds from sale of non-current

assets - - 0.1

Purchase of property, plant

and equipment (6.8) (5.1) (11.5)

Purchase of intangible assets (0.6) (0.5) (1.3)

Settlement of derivatives

used in net investment hedging (0.9) (0.3) (2.5)

Net cash used in investing

activities (8.3) (5.9) (15.2)

----------------------------------- ---- --------- --------- ----------

Financing activities

Redemption of B Shares (4.2) (3.7) (5.8)

Drawdown of borrowings 27.6 60.0 131.2

Repayment of borrowings (38.6) (66.1) (145.3)

Repurchase of own Shares (0.2) - -

Capital element of finance

lease rentals (0.1) (0.2) (0.1)

Net cash generated used in

financing activities (15.5) (10.0) (20.0)

----------------------------------- ---- --------- --------- ----------

Increase/(decrease) in net

cash and cash equivalents 3.7 3.9 (0.3)

Net cash and cash equivalents

at start of the period 24.8 23.3 23.3

Currency translation differences 0.4 0.5 1.8

Net cash and cash equivalents

at end of the period 28.9 27.7 24.8

----------------------------------- ---- --------- --------- ----------

CONDENSED INTERIM CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Other reserves

--------------------------------

Equity

attributable

Cash to owners

Issued Share flow Currency Capital of the Non-

share premium hedge translation redemption Accumulated Parent controlling Total

capital account reserve reserve reserve loss Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

At 1 July 2016 18.3 96.7 (0.5) (3.0) 47.9 (90.9) 68.5 0.6 69.1

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Profit for the

period - - - - - 13.0 13.0 - 13.0

Other

comprehensive

income /(expense)

Items that may

be reclassified

to profit or

loss:

Currency

translation

differences

on foreign

subsidiaries - - - 3.7 - - 3.7 - 3.7

Loss on net

investment

hedges - - - (2.3) - - (2.3) - (2.3)

Gain on cash

flow hedges

in the period - - 4.8 - - - 4.8 - 4.8

Loss on cash

flow hedges

transferred

to profit or

loss - - (8.1) - - - (8.1) - (8.1)

Taxation relating

to items above - - 0.1 - - - 0.1 - 0.1

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

- - (3.2) 1.4 - - (1.8) - (1.8)

Items that will

not be

reclassified

to profit or

loss:

Net actuarial

loss on post

employment

benefits - - - - - (11.9) (11.9) - (11.9)

Taxation relating

to items above - - - - - 0.8 0.8 - 0.8

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

- - - - - (11.1) (11.1) - (11.1)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Total other

comprehensive

income/(expense) - - (3.2) 1.4 - (11.1) (12.9) - (12.9)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Total

comprehensive

income/(expense) - - (3.2) 1.4 - 1.9 0.1 - 0.1

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Transactions

with owners

of the Parent

Issue of B Shares - (4.4) - - - - (4.4) - (4.4)

Redemption of

B Shares - - - - 4.2 (4.2) - - -

Share-based

payments charge - - - - - 0.2 0.2 - 0.2

Repurchase of

own shares - - - - - (0.2) (0.2) - (0.2)

At 31 December

2016 18.3 92.3 (3.7) (1.6) 52.1 (93.2) 64.2 0.6 64.8

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Other reserves

--------------------------------

Equity

attributable

Cash to owners

Issued Share flow Currency Capital of the Non-

share premium hedge translation redemption Accumulated Parent controlling Total

capital account reserve reserve reserve loss Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

At 1 July 2015 18.3 102.4 (2.0) (4.6) 42.1 (99.3) 56.9 0.6 57.5

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Profit for the

period - - - - - 9.0 9.0 - 9.0

Other

comprehensive

income /(expense)

Items that may

be reclassified

to profit or

loss:

Currency

translation

differences

on foreign

subsidiaries - - - 3.0 - - 3.0 - 3.0

Loss on net

investment

hedges - - - (2.5) - - (2.5) - (2.5)

Gain on cash

flow hedges

in the period - - 3.9 - - - 3.9 - 3.9

Loss on cash

flow hedges

transferred

to profit or

loss - - (3.1) - - - (3.1) - (3.1)

Taxation relating

to items above - - (0.1) - - - (0.1) - (0.1)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

- - 0.7 0.5 - - 1.2 - 1.2

Items that will

not be

reclassified

to profit or

loss:

Net actuarial

loss on post

employment

benefits - - - - - (1.2) (1.2) - (1.2)

Taxation relating

to items above - - - - - (0.7) (0.7) - (0.7)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

- - - - - (1.9) (1.9) - (1.9)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Total other

comprehensive

income/(expense) - - 0.7 0.5 - (1.9) (0.7) - (0.7)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Total

comprehensive

income - - 0.7 0.5 - 7.1 8.3 - 8.3

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Transactions

with owners

of the Parent

Issue of B Shares - (3.5) - - - - (3.5) - (3.5)

Redemption of

B Shares - - - - 3.7 (3.7) - - -

Share-based

payments charge - - - - - 0.1 0.1 - 0.1

At 31 December

2015 18.3 98.9 (1.3) (4.1) 45.8 (95.8) 61.8 0.6 62.4

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Other reserves

--------------------------------

Equity

attributable

Cash to owners

Issued Share flow Currency Capital of the Non-

share premium hedge translation redemption Accumulated Parent controlling Total

capital account reserve reserve reserve loss Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

At 1 July 2015 18.3 102.4 (2.0) (4.6) 42.1 (99.3) 56.9 0.6 57.5

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Profit for the

year - - - - - 17.0 17.0 - 17.0

Other

comprehensive

income/(expense)

Items that may

be reclassified

to profit or

loss:

Currency

translation

differences

on foreign

subsidiaries - - - 12.0 - - 12.0 - 12.0

Loss on net

investment

hedges - - - (10.4) - - (10.4) - (10.4)

Gain on cash

flow hedges

in the year - - 12.4 - - - 12.4 - 12.4

Loss on cash

flow hedges

transferred

to profit or

loss - - (10.3) - - - (10.3) - (10.3)

Taxation relating

to items above - - (0.6) - - - (0.6) - (0.6)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

- - 1.5 1.6 - - 3.1 - 3.1

Items that will

not be

reclassified

to profit or

loss:

Net actuarial

loss on post

employment

benefits - - - - - (2.6) (2.6) - (2.6)

Taxation relating

to items above - - - - - (0.4) (0.4) - (0.4)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

- - - - - (3.0) (3.0) - (3.0)

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Total other

comprehensive

income/(expense) - - 1.5 1.6 - (3.0) 0.1 - 0.1

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Total

comprehensive

income - - 1.5 1.6 - 14.0 17.1 - 17.1

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

Transactions

with owners

of the Parent

Issue of B Shares - (5.7) - - - - (5.7) - (5.7)

Redemption of

B Shares - - - - 5.8 (5.8) - - -

Share-based

payments charge - - - - - 0.2 0.2 - 0.2

At 30 June 2016 18.3 96.7 (0.5) (3.0) 47.9 (90.9) 68.5 0.6 69.1

----------------- ------- -------- ------- ----------- ---------- ----------- ------------ ----------- ------

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS

1) Basis of preparation

McBride plc ('the Company') is a company incorporated and

domiciled in the United Kingdom. The Company's ordinary shares are

listed on the London Stock Exchange. The registered office of the

Company is Middleton Way, Middleton, Manchester, M24 4DP. For the

purposes of DTR 6.4.2R, the Home State of McBride plc is the United

Kingdom.

The Company and its subsidiaries (together, 'the Group')

comprise of the leading European manufacturer and supplier of

Co-manufactured and Private Label products for the Household and

Personal Care market.

This half-year report has been prepared in accordance with the

Disclosure and Transparency Rules of the United Kingdom Financial

Conduct Authority; IAS 34 'Interim Financial Reporting' as adopted

by the European Union; on the basis of the accounting policies and

the recognition and measurement requirements of IFRS applied in the

financial statements at 30 June 2016 and those standards that have

been endorsed by the European Union and will be applied at 30 June

2017. This report should be read in conjunction with the financial

statements for the year ended 30 June 2016.

The results for each half-year are unaudited and do not

represent the Group's statutory accounts within the meaning of

Section 434 of the Companies Act 2006. The interim financial

information has been reviewed, not audited. The Group's statutory

accounts were approved by the Directors on 7 September 2016 and

have been reported on by PricewaterhouseCoopers LLP and delivered

to the Registrar of Companies. The report of PricewaterhouseCoopers

LLP was (i) unqualified, (ii) did not include a reference to any

matters to which the auditors drew attention by way of emphasis

without qualifying their report and (iii) did not contain a

statement under section 498 of the Companies Act 2006.

Going concern basis

The Group meets its funding requirements through internal cash

generation and bank credit facilities, most of which are committed

until April 2019.

At 31 December 2016, committed undrawn facilities amounted to

GBP134.0 million. The Group's forecasts and projections, taking

account of reasonably possible changes in trading performance, show

that the Group will be able to operate comfortably within its

current bank facilities.

The Group has a relatively conservative level of debt to

earnings. As a result, the Directors believe that the Group is well

placed to manage its business risks successfully despite the

current uncertain economic outlook. After making enquiries, the

Directors have a reasonable expectation that the Company and the

Group have adequate resources to continue in operational existence

for the foreseeable future. Accordingly, they continue to adopt the

going concern basis.

The condensed interim consolidated financial statements were

approved by the Board on 22 February 2017.

2) Accounting policies

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 30 June 2016.

The Group has applied the following standards and amendments for

the first time for the annual reporting period commencing 1 July

2016:

- Accounting for acquisitions of interests in joint operations - Amendments to IFRS 11;

- Clarification of acceptable methods of depreciation and

amortisation - Amendments to IAS 16 and IAS 38;

- Annual improvements to IFRSs 2012 - 2014 cycle; and

- Disclosure initiative - amendments to IAS 1.

All of the above changes to accounting policies will have no

material financial effect on the consolidated financial statements

for the year ended 30 June 2017.

Adjusted results

The Group believes that adjusted operating profit, adjusted

profit before taxation and adjusted earnings per share provide

additional useful information to shareholders on the underlying

performance achieved by the Group. These measures are used for

internal performance analysis and short and long-term incentive

arrangements for employees. Adjusting items include amortisation of

intangible assets, exceptional items, any non-cash financing costs

from unwind of discount on initial recognition of contingent

consideration, unwind of discount on provisions and any related

tax.

Taxation

Taxation in the interim period is accrued using the tax rate

that would be applicable to the expected annual profit or loss.

Accounting standards issued but not yet adopted

Recently issued accounting standards that are relevant to the

Group but have not yet been adopted are outlined below:

- IFRS 9 - Financial Instruments;

- IFRS 15 - Revenue from Contracts with Customers; and

- IFRS 16 - Leases.

The Group will undertake an assessment of the impact of these

new standards and interpretations in due course. There are no other

standards that are not yet effective and that would be expected to

have a material impact on the entity in the current or future

reporting periods and on foreseeable future transactions.

3) Critical accounting judgments and estimates

The preparation of the condensed interim financial statements

requires management to make judgments, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing these condensed interim financial statements, the

significant judgments made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those applied to the consolidated financial

statements for the year ended 30 June 2016.

4) Segment information

Financial information is presented to the Board by product

category for the purposes of allocating resources within the Group

and assessing the performance of the Group's businesses. It is

considered that Household Products have different market

characteristics to Personal Care & Aerosols in terms of

volumes, market share and production requirements. Accordingly, the

Group's operating segments are determined by product category.

The Board uses adjusted operating profit to measure the

profitability of the Group's businesses. Adjusted operating profit

is, therefore, the measure of segment profit presented in the

Group's segment disclosures. Adjusted operating profit represents

operating profit before specific items that are considered to

hinder comparison of the trading performance of the Group's

businesses either period-on-period or with other businesses. During

the periods under review, the items excluded from operating profit

in arriving at adjusted operating profit were the amortisation

of

intangibles assets and exceptional items.

Analysis by reportable segment

Household

------------------------------------------------

Personal

Care

Total & Aerosols Total Corporate Total

UK North(1) South(2) East(3) Household (4) Segments (5) Group

31 December

2016 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Segment revenue 79.7 96.0 39.2 69.5 284.4 76.2 360.6 - 360.6

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Adjusted operating

profit/(loss) 26.5 0.9 27.4 (4.5) 22.9

Amortisation

of intangible

assets (0.4)

Exceptional

items (see note

7) -

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Operating profit 22.5

Net finance

costs (3.7)

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Profit before

taxation 18.8

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Inventories 62.7 18.5 81.2 - 81.2

Capital expenditure 6.6 0.8 7.4 - 7.4

Amortisation

and depreciation 8.6 1.5 10.1 - 10.1

==== ======== ======== ========= =========== =========== ========= ========= ======

(1) France, Belgium, Holland and Scandinavia

(2) Italy and Spain

(3) Germany, Poland, Luxembourg & other Eastern Europe

(4) Includes Asia

(5) Corporate represents costs related to the Board, the

Executive leadership team and key supporting functions.

Household

------------------------------------------------

Personal

Care

Total & Aerosols Total Corporate Total

UK North(1) South(2) East(3) Household (4) Segments (5) Group

31 December 2015 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Segment revenue 85.8 90.2 34.2 60.9 271.1 73.0 344.1 - 344.1

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Adjusted operating

profit/(loss) 20.8 1.3 22.1 (4.5) 17.6

Amortisation

of intangible

assets (0.5)

Exceptional items

(see note 7) -

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Operating profit 17.1

Net finance costs (4.1)

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Profit before

taxation 13.0

---- -------- -------- --------- ----------- ----------- --------- --------- ------

Inventories 54.6 19.6 74.2 - 74.2

Capital expenditure 5.1 0.5 5.6 - 5.6

Amortisation

and depreciation 8.3 1.5 9.8 - 9.8

==== ======== ======== ========= =========== =========== ========= ========= ======

Household

-------------------------------------------------

Personal

Care

Total & Aerosols Total Corporate Total

UK North(1) South(2) East(3) Household (4) Segments (5) Group

30 June 2016 GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----- -------- -------- --------- ----------- ----------- --------- --------- ------

Segment revenue 164.9 179.0 69.2 121.9 535.0 145.9 680.9 - 680.9

----- -------- -------- --------- ----------- ----------- --------- --------- ------

Adjusted operating

profit/(loss) 42.7 2.7 45.4 (9.2) 36.2

Amortisation

of intangible

assets (0.9)

Exceptional items (2.4)

----- -------- -------- --------- ----------- ----------- --------- --------- ------

Operating profit 32.9

Net finance costs (7.1)

----- -------- -------- --------- ----------- ----------- --------- --------- ------

Profit before

taxation 25.8

----- -------- -------- --------- ----------- ----------- --------- --------- ------

Inventories 56.9 18.8 75.7 - 75.7

Capital expenditure 10.6 2.2 12.8 - 12.8

Amortisation

and depreciation 16.0 3.1 19.1 - 19.1

===== ======== ======== ========= =========== =========== ========= ========= ======

5) Taxation

The tax charge reflects an effective tax rate of 31% (30 June

2016: 31%) on adjusted profit before taxation of GBP19.5 million

(30 June 2016: GBP29.4m).

6) Earnings per ordinary share

Basic earnings per ordinary share is calculated by dividing the

profit for the period attributable to owners of the Company by the

weighted average number of the Company's ordinary shares in issue

during the financial period. The weighted average number of the

Company's ordinary shares in issue excludes 0.7 million shares

(2015: 0.6m shares), being the weighted average number of own

shares held during the year in relation to employee share

schemes.

Unaudited

Half Unaudited Audited

year Half year Year

to to ended

31 Dec 31 Dec 30 Jun

Reference 2016 2015 2016

------------------------------------- ----------- ---------- ----------- ----------

Weighted average number of ordinary

shares in issue (million) a 182.1 182.2 182.2

Effect of dilutive share incentive

plans (million) 0.7 0.4 0.4

-------------------------------------------------- ---------- ----------- ----------

Weighted average number of ordinary

shares for calculating diluted

earnings per share (million) b 182.8 182.6 182.6

------------------------------------- ----------- ---------- ----------- ----------

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares in issue assuming the

conversion of all potentially dilutive ordinary shares. During the

period, the Company had both equity-settled LTIP awards and

Deferred Annual Bonus Plan awards (together the "share incentive

plans") that are potentially dilutive ordinary shares.

Adjusted earnings per share measures are calculated based on

profit for the year attributable to owners of the Company before

adjusting items as follows:

Unaudited Unaudited

Half Half

year year Audited

to to Year ended

31 Dec 31 Dec 30 Jun

2016 2015 2016

Reference GBPm GBPm GBPm

----------------------------------- ----------- ----------- ---------- -------------

Earnings for calculating basic

and diluted earnings per share c 13.0 9.0 17.0

Adjusted for:

Amortisation of intangible assets 0.4 0.5 0.9

Exceptional items (see note 7) - - 2.4

Unwind of discount on contingent

consideration 0.1 - 0.1

Unwind of discount on provisions 0.2 0.1 0.2

Taxation relating to the above

items (0.2) (0.1) (0.4)

------------------------------------------------ ----------- ---------- -------------

Earnings for calculating adjusted

earnings per share d 13.5 9.5 20.2

----------------------------------- ----------- ----------- ---------- -------------

Unaudited

Unaudited Half

Half year year Audited

to to Year ended

31 Dec 31 Dec 30 Jun

2016 2015 2016

pence pence pence

----------------------------------- ----------- ----------- ---------- -------------

Basic earnings per share c/a 7.1 4.9 9.3

Diluted earnings per share c/b 7.1 4.9 9.3

Adjusted basic earnings per

share d/a 7.4 5.2 11.1

Adjusted diluted earnings per

share d/b 7.4 5.2 11.1

----------------------------------- ----------- ----------- ---------- -------------

7) Exceptional items

Exceptional items are presented separately as, due to their

nature or the infrequency of the events giving rise to them, this

allows users of the financial statements to better understand the

elements of financial performance for the year, to facilitate

comparison with prior periods, and to assess the trends of

financial performance.

During the period ended 31 December 2016, the Group recognised

no exceptional costs (2015: GBPnil).

8) Property, plant and equipment

Total

GBPm

----------------------------------------------- -----

Net book value at 1 July 2016 (audited) 136.2

Exchange movements 3.3

Additions 6.8

Disposals (0.2)

Depreciation charge (9.7)

Net book value at 31 December 2016 (unaudited) 136.4

----------------------------------------------- -----

Capital commitments as at 31 December 2016 amounted to GBP7.0

million (2015: GBP2.5m).

9) Financial risk management

The Group's activities expose it to a variety of financial

risks: market risk (including currency risk, fair value interest

rate risk, cash flow interest rate risk and price risk), credit

risk and liquidity risk.

The condensed interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements and they should be read in

conjunction with the Group's annual financial statements as at 30

June 2016. There have been no material changes in the risk

management policies since the year-end.

The table below analyses financial instruments carried at fair

value, by valuation method. The different levels have been defined

as follows:

-- Level 1 - unadjusted quoted prices in active markets for identical assets or liabilities;

-- Level 2 - inputs other than Level 1 that are observable for

the asset or liability, either directly (prices) or indirectly

(derived from prices); and

-- Level 3 - inputs that are not based on observable market data (unobservable inputs).

Unaudited Unaudited Audited

as at as at as at

31 Dec 31 Dec 30 Jun

2016 2015 2016

GBPm GBPm GBPm

--------------------------------- --------- --------- -------

Assets

Level 2:

Derivative financial

instruments

- Forward currency

contracts 0.8 1.5 2.4

- Cross currency interest

rate swaps 15.1 11.9 12.7

- Contract for Difference

(HDPE) - - 0.2

------------------------------------ --------- --------- -------

Total assets 15.9 13.4 15.3

------------------------------------ --------- --------- -------

Liabilities

Level 2:

Derivative financial

instruments

- Forward currency

contracts (1.0) (0.4) (1.2)

(1.0) (0.4) (1.2)

Level 3:

Trade and other payables

- Contingent consideration (2.6) (0.5) (2.3)

----------------------------------- --------- --------- -------

Total liabilities (3.6) (0.9) (3.5)

----------------------------------- --------- --------- -------

Derivative financial instruments

Derivative financial instruments comprise the foreign currency

derivatives, non-deliverable commodity derivatives and interest

rate derivatives that are held by the Group in designated hedging

relationships. Foreign currency forward contracts are measured by

reference to prevailing forward exchange rates. Commodity forward

contracts are measured by the difference to prevailing market

prices. Foreign currency options are measured using a variant of

the Monte Carlo valuation model. Interest rate swaps and caps are

measured by discounting the related cash flows using yield curves

derived from prevailing market interest rates.

Contingent consideration

Contingent consideration is measured at fair value based upon

management's estimates of the future sales and profitability of the

acquired business. At each reporting date, the Directors estimate

the contingent consideration payable in relation to the 70%

interest acquired and the liability to acquire the remaining 30%

interest.

Valuation levels and techniques

There were no transfers between levels during the period and no

changes in valuation techniques.

Financial assets and liabilities measured at amortised cost

The fair value of borrowings are as follows:

Unaudited Unaudited Audited

as at as at as at

31 Dec 31 Dec 30 Jun

2016 2015 2016

GBPm GBPm GBPm

----------------- --------- --------- -------

Current 36.8 29.3 30.3

Non current 75.0 84.7 85.4

Total borrowings 111.8 114.0 115.7

-------------------- --------- --------- -------

The fair value of the following financial assets and liabilities

approximate to their carrying amount:

-- Trade and other receivables

-- Other current financial assets

-- Cash and cash equivalents

-- Trade and other payables

10) Net debt

Audited Unaudited

as at as at

30 Jun Exchange 31 Dec

2016 Cash flow differences 2016

GBPm GBPm GBPm GBPm

--------------------------- -------- ---------- ------------- ----------

Cash and cash equivalents 24.8 3.7 0.4 28.9

Overdrafts (8.3) 4.2 (0.1) (4.2)

Bank and other loans (106.9) 6.8 (7.1) (107.2)

Finance lease liabilities (0.5) 0.1 - (0.4)

--------------------------- -------- ---------- ------------- ----------

Net debt (90.9) 14.8 (6.8) (82.9)

--------------------------- -------- ---------- ------------- ----------

11) Pensions and post-employment benefits.

The Group operates a number of post-employment benefit

arrangements. In the UK, the Group operates a defined benefit

pension scheme and defined contribution schemes. Together, these

schemes cover most of the Group's UK employees. Elsewhere in

Europe, the Group has a number of unfunded post-employment benefit

arrangements.

At 31 December 2016, the Group recognised a deficit on its UK

Defined Benefit pension plan of GBP41.8 million (30 June 2016:

GBP31.1m). The Group's post-employment benefit obligations outside

the UK amounted to GBP1.8 million (30 June 2016: GBP1.8m).

Defined Benefit schemes had the following effect on the Group's

results and financial position:

Unaudited Unaudited Audited

Half Half Year

year to year to ended

31 Dec 31 Dec 30 Jun

2016 2015 2016

GBPm GBPm GBPm

------------------------------------- --------- --------- -------

Profit or loss

Service cost and administration

expenses (0.3) (0.9) (1.5)

------------------------------------- --------- --------- -------

Charge to operating profit (0.3) (0.9) (1.5)

------------------------------------- --------- --------- -------

Net interest cost on defined benefit

obligation (0.5) (0.6) (1.1)

------------------------------------- --------- --------- -------

Charge to profit before taxation (0.8) (1.5) (2.6)

------------------------------------- --------- --------- -------

Other comprehensive expense

Net actuarial loss (11.9) (1.2) (2.6)

------------------------------------- --------- --------- -------

Other comprehensive expense (11.9) (1.2) (2.6)

------------------------------------- --------- --------- -------

Unaudited Unaudited Audited

as at as at as at

31 Dec 31 Dec 30 Jun

2016 2015 2016

GBPm GBPm GBPm

------------------------------------- --------- --------- -------

Balance sheet

Defined benefit obligations:

UK - funded (162.1) (133.5) (145.2)

Other - unfunded (1.8) (1.6) (1.8)

------------------------------------- --------- --------- -------

(163.9) (135.1) (147.0)

Fair value of scheme assets 120.3 102.8 114.1

Deficit on the schemes (43.6) (32.3) (32.9)

------------------------------------- --------- --------- -------

Following consultation with staff and the UK plan's Trustees,

the UK Defined Benefit plan was closed to future service accrual

from 29 February 2016. Staff affected by this change were offered a

new defined contribution scheme from that date.

For accounting purposes, the Fund's benefit obligation as at 31

December 2016 has been calculated based on data gathered for the

triennial actuarial valuation as at March 2015 and by applying

assumptions made by the Group on the advice of an independent

actuary in accordance with IAS 19, 'Employee Benefits'.

Following the last triennial valuation at March 2015, the

Company and Trustees agreed a new deficit reduction plan based on

the scheme funding deficit of GBP44.2 million. The deficit cash

funding requirement of GBP3.0 million per annum took effect from 31

March 2015.

12) Payments to shareholders

Payments to ordinary shareholders are made by way of the issue

of B Shares in place of income distributions. Ordinary shareholders

are able to redeem any number of the B Shares issued to them for

cash. Any B Shares that they retain attract a dividend of 75% of

LIBOR on the 0.1 pence nominal value of each share, paid on a

twice-yearly basis.

Payments to ordinary shareholders made or proposed in respect of

each period were as follows:

Unaudited Unaudited Audited

Half year Half year

to to Year ended

31 Dec 31 Dec 30 Jun

2016(*) 2015 2016

-------- --------- --------- ----------

Interim 1.4p 1.2p 1.2p

Final n/a n/a 2.4p

-------- --------- --------- ----------

* Interim payment to shareholders that is not recognised within

these condensed interim consolidated financial statements.

Movements in the B Shares were as

follows: Nominal

Number value

000 GBPm

---------------------------------- ----------- -------

At 1 July 2015 (audited) 969,007 1.0

Issued 3,461,977 3.5

Redeemed (3,674,427) (3.7)

---------------------------------- ----------- -------

At 31 December 2015 (unaudited) 756,557 0.8

---------------------------------- ----------- -------

Issued 2,188,512 2.2

Redeemed (2,086,541) (2.1)

---------------------------------- ----------- -------

At 30 June 2016 (audited) 858,528 0.9

---------------------------------- ----------- -------

Issued 4,373,024 4.4

Redeemed (4,231,289) (4.2)

---------------------------------- ----------- -------

At 31 December 2016 (unaudited) 1,000,263 1.0

---------------------------------- ----------- -------

13) Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties of the Company, have been eliminated on

consolidation and, therefore, are not required to be disclosed in

these condensed interim financial statements.

Key management compensation and transactions with the Group's

pension and post-employment schemes for the financial year ended 30

June 2016 are detailed in note 28 (page 106) McBride plc's Annual

Report and Accounts 2016. A copy of McBride plc's Annual Report and

Accounts 2016 is available on McBride's website at

www.mcbride.co.uk. Although there have been changes to the

Executive Leadership Team since the year end, there are no other

related party transactions.

14) Key Performance Indicators (KPIs)

Management uses a number of KPIs to measure the Group's

performance and progress against its strategic objectives. The most

important of these are noted and defined below:

-- Organic revenue growth - change in revenue adjusted for the

effect of exchange rate movements (constant currency).

-- Adjusted operating profit - operating profit before adjusting items.

-- Adjusted operating margin - adjusted operating profit as a percentage of revenue.

-- Labour cost/revenue - labour cost as a percentage of revenue.

-- Customer Service Level - volume of products delivered in the

correct volumes and within agreed timescales as a percentage of

total volumes ordered by customers.

-- Adjusted diluted earnings per share - profit attributable to

shareholders before adjusting items divided by the weighted average

number of ordinary shares used for calculating diluting earnings

per share.

-- Return on capital employed - adjusted operating profit as a

percentage of average year-end net assets excluding net debt.

Other information

Financial calendar for the year ending 30 June 2017

Payments to shareholders

-------------------------- ----------------------- ----------------

Interim Announcement 22 February 2017

Entitlement to B Shares 21 April 2017

Redemption of B Shares 26 May 2017

Final Announcement 7 September

2017

Entitlement to B Shares 27 October

2017

Redemption of B Shares 1 December

2017

------------------------ -----------------------------

Results

------------------------ ------------------------- ----------------

Interim Announcement 22 February

2017

Preliminary statement Announcement 7 September

for full year 2017

Annual Report and Circulated September 2017

Accounts 2017

Annual General Meeting To be held 24 October 2017

-------------------------- --------------------------- ------------------

Exchange rates

The exchange rates used for conversion to Sterling were as

follows:

Unaudited Unaudited Audited

Half year Half year

to to Year ended

31 Dec 30 June

31 Dec 2016 2015 2016

-------------------- ----------- --------- ----------

Average rate:

Euro 1.16 1.39 1.34

US Dollar 1.28 1.53 1.48

Polish Zloty 5.08 5.87 5.74

Czech Koruna 31.47 37.62 36.19

Malaysian Ringgit 5.35 6.39 6.14

Australian Dollar 1.69 2.12 2.04

Chinese Yuan 8.62 9.73 9.55

Closing rate:

Euro 1.17 1.36 1.21

US Dollar 1.23 1.48 1.34

Polish Zloty 5.15 5.81 5.37

Czech Koruna 31.56 36.82 32.83

Malaysian Ringgit 5.52 6.40 5.36

Australian Dollar 1.70 2.10 1.81

Chinese Yuan 8.55 9.62 8.92

-------------------- ----------- --------- ----------

Note: This announcement contains inside information which is

disclosed in accordance with the Market Abuse Regulation which came

into effect on 3 July 2016.

-Ends-

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR MMGZZNMZGNZM

(END) Dow Jones Newswires

February 22, 2017 02:00 ET (07:00 GMT)

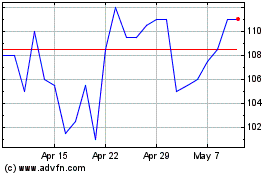

Mcbride (LSE:MCB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mcbride (LSE:MCB)

Historical Stock Chart

From Apr 2023 to Apr 2024