Marchex, Inc. (NASDAQ:MCHX), a mobile advertising analytics

company, today announced its financial results for the second

quarter ended June 30, 2015.

"We are seeing greater demand for Marchex’s mobile advertising

analytics from enterprise marketers across the world. This is

leading to increased adoption of our products with the channels and

clients we view as most strategically important," said Pete

Christothoulou, Chief Executive Officer. “Advertising leaders

want products that provide an unparalleled level of visibility

into the entire mobile consumer journey and increasingly, these

leaders are choosing Marchex to improve their mobile

performance and drive overall growth."

Q2 2015 Financial

Highlights1

- GAAP revenue was $35.3

million for the second quarter of 2015, compared to $47.0

million for the second quarter of 2014. In the second quarter

Marchex sold the bulk of its domain portfolio, which included a

sale to GoDaddy Inc. for proceeds of $28.1 million.

- GAAP net income including discontinued

operations was $20.9 million for the second quarter of 2015

compared to a GAAP net income including discontinued operations of

$980,000 in second quarter of 2014. GAAP net loss from continuing

operations was $1.3 million for the second quarter of 2015,

compared to GAAP net loss from continuing operations of $102,000

for the second quarter of 2014.

- GAAP net income including discontinued

operations attributable to common stockholders per diluted share

for the second quarter of 2015 was $0.50, compared to $0.02 for the

second quarter of 2014. GAAP net loss from continuing operations

attributable to common stockholders per diluted share was $0.03 for

the second quarter of 2015 compared to GAAP net loss from

continuing operations of $0.00 for the second quarter of 2014.

Q2 2015 Q2 2014 GAAP

Revenue $35.3 million $47.0 million

Call-Driven and related revenue $34.5 million

$45.9 million

Non-GAAP Results: Call-Driven Adjusted

OIBA2 $1.4 million $2.9 million

Call-Driven Adjusted EBITDA2 $2.4 million

$3.8 million

Adjusted OIBA2 $1.3

million $3.1 million

Adjusted EBITDA2

$2.3 million $4.0 million

Archeo Revenue $0.8 million $1.1 million

Domain transaction proceeds3 $28.1 million

Domain sales proceeds4 $0.4

million $2.2 million

- Adjusted non-GAAP EPS2 including

discontinued operations1 for the second quarter of 2015 was $0.37,

compared to $0.07 for the second quarter of 2014. Adjusted non-GAAP

EPS2 from continuing operations for the second quarter of 2015 was

$0.02, compared to $0.05 for the second quarter of 2014.

1The Company sold certain Archeo domain name and related assets

in April 2015 and certain pay-per-click assets in July 2013. As a

result, the financial results of these dispositions are presented

as discontinued operations net of tax in our condensed consolidated

statements of operations in accordance with GAAP, and are excluded

from all other results unless otherwise noted.

2Reconciliations of non-GAAP measures are included in the

financial tables attached to this press release and we encourage

investors to examine the reconciling adjustments between the GAAP

and non-GAAP measures.

3Represents proceeds from the sale of certain Archeo domain name

and related assets recognized in discontinued operations.

4Represents proceeds from domain sales recognized in

discontinued operations.

Marchex Q2 2015 and Recent Business

Highlights:

- Strategic integrations. In July,

Marchex announced a strategic, exclusive global partnership with

Light Reaction, a mobile-first performance advertising business

that is part of Xaxis, to launch M-Call, a new click-to-call mobile

performance product that enables advertisers to generate high

quality phone leads directly from mobile Web and in-app ads across

hundreds of top publishers, social media sites and apps. Through

the partnership, Light Reaction and Xaxis clients also gain access

to Marchex Call Analytics, a real-time mobile advertising platform

that measures sales, audiences and consumer intent from mobile,

click-to-call campaigns. M-Call and Call Analytics are available to

both Light Reaction and Xaxis clients, including GroupM

agencies.

- Increased global scale. In June,

Marchex announced its expansion into Europe, Canada, Australia and

New Zealand to support enterprise marketers that need to tie mobile

advertising spend to sales at scale - globally and seamlessly.

Marchex now has clients utilizing its products within multiple

geographies including CDK Global, Hearst, Yell and Intuit.

- YP contributed $10.4 million in

call-driven revenues in the second quarter of 2015, compared to

$10.2 million in the second quarter 2014.

Non-Operating Q2 2015

Highlights:

- During the second quarter, Marchex

purchased 79,000 shares of its outstanding Class B common stock for

a total price of $355,000. This brings Marchex’s total shares

repurchased under its November 2014 share repurchase program to

973,000 shares or 3% of its outstanding Class B common stock.

Business Outlook

The following forward-looking statements

reflect Marchex's expectations as of August 5, 2015, and exclude

any impact from Archeo operating results and discontinued

operations. Archeo operating results are not included in our

Call-Driven revenue, profitability, and other measures

below:

Call-Driven

financial guidance for the Third Quarter ending September 30,

2015

Call-Driven Revenue $34.5 million or more Call-Driven

Adjusted OIBA 5 $1.0 million or more Call-Driven Adjusted

EBITDA 5 $2.0 million or more

5 These non-GAAP Call-Driven measures assign all Marchex

corporate overhead costs to the Call-Driven results.

Reconciliations of non-GAAP measures are included in the financial

tables attached to this press release and we encourage investors to

examine the reconciling adjustments between the GAAP and non-GAAP

measures.

Conference Call and Webcast

Information

Management will hold a conference call, starting at 5:00 p.m. ET

on Wednesday, August 5, 2015 to discuss its second quarter ended

June 30, 2015 financial results, and other company updates. Access

to the live webcast of the conference call will be available online

from the Investors section of Marchex’s website at www.marchex.com. An archived version of the

webcast will also be available at the same location, beginning two

hours after completion of the call.

About Marchex

Marchex is a mobile advertising analytics company that connects

online behavior to real-world, offline actions. By linking critical

touchpoints in the customer journey, Marchex’s products enable a

360-degree view of marketing effectiveness. Brands and agencies

utilize Marchex’s products to transform business performance.

Please visit www.marchex.com,

blog.marchex.com or @marchex on Twitter (Twitter.com/Marchex),

where Marchex discloses material information from time to time

about the Company, its financial information, and its business.

Forward-Looking

Statements:

This press release contains forward-looking statements that

involve substantial risks and uncertainties. All statements, other

than statements of historical facts, included in this press release

regarding our strategy, future operations, future financial

position, future revenues, other financial guidance, acquisitions,

dispositions, projected costs, prospects, plans and objectives of

management are forward-looking statements. We may not actually

achieve the plans, intentions, or expectations disclosed in our

forward-looking statements and you should not place undue reliance

on our forward-looking statements. Actual results or events could

differ materially from the plans, intentions and expectations

disclosed in the forward-looking statements we make. There are a

number of important factors that could cause Marchex's actual

results to differ materially from those indicated by such

forward-looking statements which are described in the "Risk

Factors" section of our most recent periodic report and

registration statement filed with the SEC. All of the information

provided in this release is as of August 5, 2015 and Marchex

undertakes no duty to update the information provided herein.

Non-GAAP Financial

Information:

To supplement Marchex's consolidated financial statements

presented in accordance with GAAP and to provide clarity internally

and externally, Marchex uses certain non-GAAP measures of financial

performance and liquidity, including OIBA, Adjusted OIBA, Adjusted

EBITDA, Adjusted non-GAAP EPS and Call-Driven and Archeo Adjusted

OIBA and EBITDA. Additionally, Marchex also provides Call-Driven

and Archeo Revenue excluding revenue generated from our contracts

with Yellowpages.com LLC (“YP”). In conjunction with the sale of

the bulk of Marchex’s domain portfolio and certain related assets

in April 2015, Marchex has also presented Adjusted OIBA and EBITDA

from discontinued operations and Adjusted non-GAAP EPS including

discontinued operations.

OIBA represents income (loss) from

operations plus (1) stock-based compensation expense and (2)

amortization of intangible assets from acquisitions. This measure,

among other things, is one of the primary metrics by which Marchex

evaluates the performance of its business. Additionally, Marchex's

management uses Adjusted OIBA, which

excludes acquisition and disposition related costs, as this item is

not indicative of Marchex’s recurring core operating results.

Adjusted OIBA is the basis on which Marchex's internal budgets are

based and by which Marchex's management is currently evaluated.

Marchex believes these measures are useful to investors because

they represent Marchex's consolidated operating results, taking

into account depreciation and other intangible amortization, which

Marchex believes is an ongoing cost of doing business, but

excluding the effects of certain other expenses such as stock-based

compensation, amortization of intangible assets from acquisitions

and acquisition and disposition related costs. Adjusted EBITDA represents income before interest,

income taxes, depreciation, amortization, stock compensation

expense, and acquisition and disposition related cost. Marchex

believes that Adjusted EBITDA is another alternative measure of

liquidity to GAAP net cash provided by operating activities that

provides meaningful supplemental information regarding liquidity

and is used by Marchex's management to measure its ability to fund

operations and its financing obligations.

Call-Driven Adjusted OIBA and

EBITDA include the above descriptions of Adjusted OIBA and

EBITDA for the Call-Driven segment. The Call-Driven Adjusted OIBA

and EBITDA assign all Marchex general corporate overhead costs to

the Call-Driven results. Archeo Adjusted OIBA

and EBITDA include the above descriptions of Adjusted OIBA

and EBITDA for the Archeo segment. Adjusted

OIBA and EBITDA from discontinued operations include revenue

and adjusted OIBA and EBITDA contributed by discontinued

operations. Call-Driven and Archeo Revenue

excluding YP excludes revenue generated through our

contracts with YP. Financial analysts and investors may use

Adjusted OIBA and EBITDA and Revenue excluding YP to help with

comparative financial evaluation to make informed investment

decisions. Adjusted non-GAAP EPS

represents Adjusted non-GAAP net income applicable to common

stockholders divided by GAAP diluted shares outstanding. Adjusted

non-GAAP net income applicable to common stockholders generally

captures those items on the statement of operations that have been,

or ultimately will be, settled in cash exclusive of certain items

that are not indicative of Marchex’s recurring core operating

results and represents net income applicable to common stockholders

plus the net of tax effects of: (1) stock-based compensation

expense, (2) amortization of intangible assets from acquisitions,

(3) acquisition and disposition related costs, (4) interest and

other income (expense), (5) discontinued operations, net of tax and

(6) dividends paid to participating securities. Adjusted non-GAAP EPS including discontinued

operations includes the above description of Adjusted

non-GAAP EPS but includes the results of discontinued operations.

Financial analysts and investors may use Adjusted non-GAAP EPS to

analyze Marchex's financial performance since these groups have

historically used EPS related measures, along with other measures,

to estimate the value of a company, to make informed investment

decisions, and to evaluate a company's operating performance

compared to that of other companies in its industry.

Marchex's management believes that investors should have access

to, and Marchex is obligated to provide, the same set of tools that

management uses in analyzing the company's results. These non-GAAP

measures should be considered in addition to results prepared in

accordance with GAAP, and should not be considered in isolation, as

a substitute for, or superior to, GAAP results. Marchex’s non-GAAP

financial measures may be defined differently from time to time and

may be defined differently than similar titled terms used by other

companies, and accordingly, care should be exercised in

understanding how Marchex defines its non-GAAP financial measures

in this release. Marchex endeavors to compensate for the

limitations of the non-GAAP measures presented by providing the

comparable GAAP measure with equal or greater prominence, GAAP

financial statements, and detailed descriptions of the reconciling

items and adjustments, including quantifying such items, to derive

the non-GAAP measure.

MARCHEX, INC. AND SUBSIDIARIES Condensed Consolidated

Statements of Operations (in thousands, except per share

data) (unaudited) Three months

ended June 30, 2014 2015 Revenue $

47,042 $ 35,346 Expenses: Service costs (1) 31,455 19,797

Sales and marketing (1) 2,711 4,245 Product development (1) 7,458

8,147 General and administrative (1) 5,386 4,505 Amortization of

intangible assets from acquisitions 31 - Acquisition and

disposition related costs (68 ) 118

Total operating expenses 46,973 36,812

Income (loss) from operations 69 (1,466 ) Interest expense

and other, net (22 ) (16 ) Income (loss) from

continuing operations before provision for income taxes 47 (1,482 )

Income tax expense (benefit) 149 (185 )

Net loss from continuing operations (102 ) (1,297 ) Discontinued

operations: Income (loss) from discontinued operations, net of tax

1,082 (92 ) Gain on sale from discontinued operations, net of tax

- 22,257 Discontinued

operations, net of tax 1,082 22,165

Net income 980 20,868 Dividends paid to participating

securities (33 ) (19 ) Net income applicable

to common stockholders $ 947 $ 20,849

Basic and diluted net income (loss) per Class A and Class B share

applicable to common stockholders: Continuing operations $ 0.00 $

(0.03 ) Discontinued operations, net of tax $ 0.02

0.53 Basic and diluted net income per Class A and

Class B share applicable to common stockholders $ 0.02 $ 0.50

Dividends paid per share $ 0.02 $ 0.02 Shares used to calculate

basic net income (loss) per share applicable to common stockholders

Class A 5,243 5,233 Class B 35,441 36,072 Shares used to calculate

diluted net income (loss) per share applicable to common

stockholders Class A 5,243 5,233 Class B 40,684 41,305

(1) Includes stock-based compensation

allocated as follows:

Service costs $ 360 $ 552 Sales and marketing 231 309 Product

development 691 644 General and administrative 1,831

1,162 Total $ 3,113 $ 2,667

MARCHEX, INC. AND SUBSIDIARIES Condensed

Consolidated Statements of Operations (in thousands, except

per share data) (unaudited) Six Months

Ended June 30, 2014 2015 Revenue $

95,137 $ 71,261 Expenses: Service costs (1) 62,957 39,163

Sales and marketing (1) 5,946 7,703 Product development (1) 15,018

15,839 General and administrative (1) 10,747 10,204 Amortization of

intangible assets from acquisitions 434 - Acquisition and

disposition related costs (68 ) 118

Total operating expenses 95,034 73,027 Income (loss) from

operations 103 (1,766 ) Interest expense and other, net (24

) (41 ) Income (loss) from continuing operations

before provision for income taxes 79 (1,807 ) Income tax expense

(benefit) 260 (180 ) Net loss from

continuing operations (181 ) (1,627 ) Discontinued operations:

Income from discontinued operations, net of tax 2,016 5,047 Gain on

sale from discontinued operations, net of tax -

22,032 Discontinued operations, net of tax

2,016 27,079 Net income 1,835

25,452 Dividends paid to participating securities (69 )

(37 ) Net income applicable to common stockholders $

1,766 $ 25,415 Basic and diluted net

income (loss) per Class A and Class B share applicable to common

stockholders Continuing operations $ 0.00 $ (0.04 ) Discontinued

operations, net of tax $ 0.05 0.66

Basic and diluted net income per Class A and Class B share

applicable to common stockholders: $ 0.05 $ 0.62 Dividends paid per

share $ 0.04 $ 0.04 Shares used to calculate basic net income

(loss) per share applicable to common stockholders Class A 6,483

5,233 Class B 32,277 35,919 Shares used to calculate diluted net

income (loss) per share applicable to common stockholders Class A

6,483 5,233 Class B 38,760 41,152

(1) Includes stock-based compensation

allocated as follows:

Service costs $ 640 $ 772 Sales and marketing 434 554 Product

development 1,350 1,223 General and administrative 3,569

2,909 Total $ 5,993 $

5,458

MARCHEX, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (in thousands)

(unaudited) December 31, June

30, Assets 2014 2015 Current

assets: Cash and cash equivalents $ 80,032 $ 104,431 Accounts

receivable, net 25,941 30,513 Prepaid expenses and other current

assets 3,143 2,615 Refundable taxes 131

120 Total current assets 109,247 137,679 Property and

equipment, net 5,430 6,471 Intangibles and other assets, net 313

245 Goodwill 65,679 63,305 Total

Assets $ 180,669 $ 207,700

Liabilities and Stockholders' Equity Current

liabilities: Accounts payable $ 13,766 $ 13,369 Accrued expenses

and other current liabilities 7,515 7,942 Deferred revenue

2,117 1,305 Total current liabilities

23,398 22,616 Other non-current liabilities 1,118

898 Total Liabilities 24,516 23,514

Class A common stock 55 55 Class B common stock 373

372 Treasury stock (2,503 ) (144 ) Additional paid-in capital

348,467 348,690 Accumulated deficit (190,239 )

(164,787 ) Total Stockholders' Equity 156,153

184,186 Total Liabilities and Stockholders' Equity $

180,669 $ 207,700

MARCHEX, INC. AND

SUBSIDIARIES Reconciliation of GAAP Income (Loss) from

Operations to Operating Income Before Amortization (OIBA)

and Adjusted Operating Income Before Amortization (Adjusted

OIBA) (in thousands) (unaudited)

Three Months Ended June 30, 2014

2015 Income (loss) from operations $ 69 $ (1,466 )

Stock-based compensation 3,113 2,667 Amortization of intangible

assets from acquisitions 31 -

Operating income before amortization (OIBA) 3,213 1,201 Acquisition

and disposition related costs (68 ) 118

Adjusted operating income before amortization (Adjusted

OIBA) $ 3,145 $ 1,319

Six Months Ended June 30, 2014

2015 Income (loss) from operations $ 103 $

(1,766 ) Stock-based compensation 5,993 5,458 Amortization of

intangible assets from acquisitions 434

- Operating income before amortization (OIBA) 6,530 3,692

Acquisition and disposition related costs (68 )

118

Adjusted operating income before amortization

(Adjusted OIBA) $ 6,462 $

3,810 MARCHEX, INC. AND SUBSIDIARIES

Reconciliation from Net Cash provided by (used in) Operating

Activities to Adjusted EBITDA (in thousands)

(unaudited) Three Months Ended June

30, 2014 2015 Net cash provided by

(used in) operating activities $ 3,289 $ (1,814 ) Changes in assets

and liabilities 1,672 3,883 Income tax expense (benefit) 149 (185 )

Acquisition and disposition related costs - 118 Interest expense

and other, net 22 16 Loss (income) from discontinued operations,

net of tax (1,120 ) 91 Tax effect on gain on sale of discontinued

operations - 163

Adjusted

EBITDA $ 4,012 $

2,272 Net cash provided by (used in) investing

activities $ (545 ) $ 23,767 Net cash provided

by (used in) financing activities $ 33,680 $ (1,181 )

Six Months Ended June 30, 2014

2015 Net cash provided by operating activities $

11,367 $ 4,437 Changes in asset and liabilities (1,312 ) 6,111

Income tax expense (benefit) 260 (180 ) Acquisition and disposition

related costs - 118 Interest expense and other, net 24 41 Income on

discontinued operations, net of tax (2,109 ) (5,065 ) Tax effect on

gain on sale of discontinued operations -

163

Adjusted EBITDA $ 8,230

$ 5,625 Net cash provided

by (used in) investing activities $ (1,352 ) $ 22,840

Net cash provided by (used in) financing activities $ 34,023

$ (2,878 )

MARCHEX, INC. AND

SUBSIDIARIES Reconciliation of GAAP EPS to Adjusted Non-GAAP

EPS (in thousands, except per share data)

(unaudited) Three Months Ended June

30, 2014 2015 Adjusted Non-GAAP EPS from

continuing operations $ 0.05 $ 0.02 Net

income (loss) from continuing operations applicable to common

stockholders - diluted (GAAP EPS) $ 0.00 $ (0.03 ) Shares used to

calculate diluted net income (loss) per share applicable to common

stockholders 40,684 41,305 Net income applicable to common

stockholders $ 947 $ 20,849 Stock-based compensation 3,113 2,667

Acquisition and disposition related costs (68 ) 118 Amortization of

intangible assets from acquisitions 31 - Interest expense and

other, net 22 16 Dividends paid to participating securities 33 19

Discontinued operations, net of tax (1,082 ) (22,165 ) Estimated

impact of income taxes (973 ) (646 )

Adjusted Non-GAAP net income from continuing operations

$ 2,023 $ 858 Discontinued operations,

net of tax 1,086 22,164 Estimated impact of income taxes -

(7,706 ) Adjusted Non-GAAP net income

including discontinued operations $ 3,109 $ 15,316

Adjusted Non-GAAP EPS from continuing

operations $ 0.05 $

0.02 Adjusted Non-GAAP EPS including discontinued

operations $ 0.07 $ 0.37

Shares used to calculate diluted net

income (loss) per share applicable to common stockholders

(GAAP)

40,684 41,305 Weighted average stock options and common shares

subject to purchase or cancellation (if applicable) 2,769

415 Diluted shares used to calculate

Adjusted Non-GAAP EPS (1) 43,453 41,720

(1) For the purpose of computing the number of diluted shares

for Adjusted Non-GAAP EPS, Marchex uses the accounting guidance

that would be applicable for computing the number of diluted shares

for GAAP EPS.

Certain reclassifications have been made to prior periods to

conform to current presentation.

MARCHEX, INC. AND SUBSIDIARIES Reconciliation of

GAAP EPS to Adjusted Non-GAAP EPS (in thousands, except per

share data) (unaudited) Six Months

Ended June 30, 2014 2015 Adjusted

Non-GAAP EPS from continuing operations $ 0.10 $ 0.06

Net income (loss) from continuing operations applicable to common

stockholders - diluted (GAAP EPS) $ 0.00 $ (0.04 ) Shares used to

calculate diluted net income (loss) per share applicable to common

stockholders 38,760 41,152 Net income (loss) applicable to

common stockholders $ 1,766 $ 25,415 Stock-based compensation 5,993

5,458 Acquisition and disposition related costs (68 ) 118

Amortization of intangible assets from acquisitions 434 - Interest

expense and other, net 24 41 Dividends paid to participating

securities 69 37 Discontinued operations, net of tax (2,016 )

(27,079 ) Estimated impact of income taxes (2,041 )

(1,516 )

Adjusted Non-GAAP net income from continuing

operations $ 4,161 $ 2,474

Discontinued operations, net of tax 2,023 27,081 Estimated impact

of income taxes - (9,521 ) Adjusted

Non-GAAP net income including discontinued operations $ 6,184

$ 20,034

Adjusted Non-GAAP EPS from

continuing operations $ 0.10

$ 0.06 Adjusted Non-GAAP EPS including

discontinued operations $ 0.15 $ 0.48

Shares used to calculate diluted net

income (loss) per share applicable to common stockholders

(GAAP)

38,760 41,152 Weighted average stock options and common shares

subject to purchase or cancellation (if applicable) 2,898

366 Diluted shares used to calculate

Adjusted Non-GAAP EPS (1) 41,658 41,518

(1) For the purpose of computing the number of diluted shares

for Adjusted Non-GAAP EPS, Marchex uses the accounting guidance

that would be applicable for computing the number of diluted shares

for GAAP EPS.

Certain reclassifications have been made to prior periods to

conform to current presentation.

MARCHEX, INC. AND SUBSIDIARIES Quarterly Financial

Summary Information (in thousands) (unaudited)

NON-GAAP MEASURES

CONSOLIDATED1 Q214

Q314 Q414 Q115

Q215 GAAP Revenue $ 47,042 $

47,238 $ 31,226 $ 35,915

$ 35,346 Adjusted OIBA $ 3,145

$ 3,214 $ 2,355 $ 2,491

$ 1,319 Adjusted EBITDA $

4,012 $ 4,105 $

3,253 $ 3,353

$ 2,272

CALL-DRIVEN AND

RELATED Q214 Q314

Q414 Q115 Q215 GAAP

Revenue $ 45,856 $ 46,379 $

30,324 $ 35,028 $ 34,458

Adjusted OIBA $ 2,896 $ 3,280

$ 2,511 $ 2,632 $ 1,400

Adjusted EBITDA $ 3,763 $

4,171 $ 3,409

$ 3,494 $ 2,353

ARCHEO EXCLUDING DISCONTINUED

OPERATIONS1 Q214 Q314

Q414 Q115 Q215 GAAP

Revenue $ 1,186 $ 859 $

902 $ 887 $ 888 Adjusted

OIBA $ 249 $ (66 ) $

(156 ) $ (141 ) $

(81 ) Adjusted EBITDA $

249 $ (66 ) $

(156 ) $ (141 )

$ (81 )

CALL-DRIVEN REVENUE

EXCLUDING YP Q214 Q314

Q414 Q115 Q215 GAAP

Revenue $ 45,856 $ 46,379 $

30,324 $ 35,028 $ 34,458

Revenue excluding YP $ 35,634 $

35,162 $ 19,261 $ 24,271

$ 24,096 YP Revenue $

10,222 $ 11,217 $

11,063 $ 10,757

$ 10,362

ARCHEO REVENUE

EXCLUDING YP AND DISCONTINUED OPERATIONS1

Q214 Q314 Q414

Q115 Q215 GAAP Revenue $

1,186 $ 859 $ 902 $

887 $ 888 Revenue excluding YP $

716 $ 608 $ 524 $

525 $ 515 YP Revenue $

470 $ 251 $

378 $ 362 $

373

DISCONTINUED OPERATIONS1

Q214 Q314 Q414

Q115 Q215 Revenue from Discontinued

Operations $ 2,634 $ 1,943 $

2,065 $ 6,659 $ 422 Adjusted

OIBA from Discontinued Operations $ 1,646

$ 1,035 $ 1,113 $ 5,142

$ (56 ) Adjusted EBITDA from Discontinued

Operations $ 1,680 $

1,050 $ 1,127

$ 5,156 $ (53 )

1 In April 2015, Marchex divested certain Archeo domain name and

related assets. The operating results of the divested assets are

included in discontinued operations net of tax in the unaudited

consolidated financial statements. The financial results for the

discontinued operations are preliminary, subject to updates, and

have been derived from the unaudited consolidated financial

statements of Marchex, Inc. for all periods presented.

Due to rounding, the sum of quarterly amounts may not equal

amounts reported for year-to-date periods.

MARCHEX, INC. AND SUBSIDIARIES (in thousands)

(unaudited)

Reconciliation of GAAP Income (Loss) from Operations to

Operating Income before Amortization (OIBA) and Adjusted

Operating Income Before Amortization (Adjusted OIBA)

Three Months Ended

6/30/2014 9/30/2014

12/31/2014

3/31/2015 6/30/2015

Income (loss) from operations $ 69 $ 193 $ (521 ) $ (300 ) $

(1,466 ) Stock-based compensation 3,113 3,021 2,876 2,791 2,667

Amortization of intangible assets from acquisitions 31

- -

- - Operating income before

amortization (OIBA) 3,213 3,214 2,355 2,491 1,201 Acquisition and

disposition related costs (68 ) -

- - 118

Adjusted OIBA - Consolidated $ 3,145

$ 3,214 $ 2,355 $ 2,491

$ 1,319 Less: Archeo Adjusted OIBA1 249

(66 ) (156 ) (141 )

(81 ) Call-Driven1 and related Adjusted OIBA $ 2,896

$ 3,280 $ 2,511 $ 2,632

$ 1,400

Reconciliation from

Net Cash provided by Operating Activities to Adjusted EBITDA

Three Months Ended

6/30/2014 9/30/2014

12/31/2014

3/31/2015 6/30/2015

Net cash provided by (used in) operating activities $ 3,289

$ 6,750 $ 4,302 $ 6,251 $ (1,814 ) Changes in assets and

liabilities 1,672 (24,736 ) 58 2,228 3,883 Income tax expense

(benefit) 149 22,980 - 5 (185 ) Disposition related costs - - - -

118 Discontinued operations (1,120 ) (1,050 ) (1,127 ) (5,156 ) 91

Tax effect of gain on sale of discontinued operations - 143 - - 163

Interest expense and other, net 22 18

20 25

16

Adjusted EBITDA - Consolidated $

4,012 $ 4,105

$ 3,253 $ 3,353

$ 2,272 Less: Archeo Adjusted EBITDA1

249 (66 ) (156 )

(141 ) (81 ) Call-Driven1 and related Adjusted

EBITDA $ 3,763 $ 4,171 $ 3,409

$ 3,494 $ 2,353

Summary of Revenue by Segment

Three Months Ended

6/30/2014 9/30/2014

12/31/2014

3/31/2015 6/30/2015

Call-Driven1 and related Revenue $ 45,856 $ 46,379 $ 30,324 $

35,028 $ 34,458 Archeo Revenue1 1,186

859 902 887

888

Revenue - Consolidated $

47,042 $ 47,238

$ 31,226 $ 35,915

$ 35,346

1 The financial results for Call-Driven and Archeo have been

derived from the unaudited condensed consolidated financial

statements. The Call-Driven financial results include certain

direct operating expenses and general corporate overhead expenses.

The Archeo financial results include direct operating expenses.

Due to rounding, the sum of quarterly amounts may not equal

amounts reported for year-to-date periods.

MARCHEX, INC. AND SUBSIDIARIES Consolidated Continuing

and Discontinued Operations (in thousands)

(unaudited)

Three months ended

Six months ended 6/30/2014

9/30/2014 12/31/2014

3/31/2015

6/30/2015 6/30/2014

6/30/2015 Consolidated Continuing Operations

Revenue $ 47,042 $ 47,238 $ 31,226 $ 35,915 $ 35,346 $ 95,137 $

71,261 Adjusted OIBA $ 3,145 $ 3,214 $ 2,355 $ 2,491 $ 1,319 $

6,462 $ 3,810 Adjusted EBITDA $ 4,012 $ 4,105 $ 3,253 $ 3,353 $

2,272 $ 8,230 $ 5,625

Archeo Continuing

Operations1 Revenue $ 1,186 $ 859 $ 902 $ 887 $ 888 $

3,788 $ 1,775 Adjusted OIBA $ 249 $ (66 ) $ (156 ) $ (141 ) $ (81 )

$ 1,155 $ (222 ) Adjusted EBITDA $ 249 $ (66 ) $ (156 ) $ (141 ) $

(81 ) $ 1,206 $ (222 )

Discontinued

Operations2 Revenue $ 2,634 $ 1,943 $ 2,065 $ 6,659 $

422 $ 5,035 $ 7,081 Adjusted OIBA $ 1,646 $ 1,035 $ 1,113 $ 5,142 $

(56 ) $ 3,038 $ 5,086 Adjusted EBITDA $ 1,680 $ 1,050 $ 1,127 $

5,156 $ (53 ) $ 3,124 $ 5,103

Reconciliation of

GAAP Income (Loss) from Discontinued Operations, Net of Tax to

Adjusted Operating Income Before Amortization (Adjusted OIBA)

and Adjusted EBITDA

Three months ended

Six months ended

6/30/2014 9/30/2014

12/31/2014

3/31/2015 6/30/2015

6/30/2014 6/30/2015

Discontinued Operations2 Income (loss) from

discontinued operations, net of tax $ 1,082 $ 1,031 $ 1,109 $ 5,139

$ (92 ) $ 2,016 $ 5,047 Income tax expense 560

- - -

37 1,014 37 Income (loss)

from discontinued operations before provision for income taxes

1,642 1,031 1,109 5,139 (55 ) 3,030 5,084 Stock-based compensation

4 4 4

3 (1 ) 8 2

Adjusted Operating income before amortization (OIBA)

1,646 1,035 1,113 5,142 (56

) 3,038 5,086 Domain Amortization 34

15 14 14

3 86 17

Adjusted EBITDA 1,680

1,050 1,127

5,156 (53 )

3,124 5,103

1 The financial results of Archeo are preliminary and have been

derived from the unaudited consolidated financial statements of

Marchex, Inc. for all periods presented. The unaudited Archeo

financial results include direct operating expenses for all periods

presented.

2 Operating results of discontinued operations relate to certain

pay-per-click assets sold in July 2013 and certain Archeo domain

names and related assets sold in April 2015 are included in

discontinued operations net of tax in the unaudited consolidated

financial statements.

Due to rounding, the sum of quarterly amounts may not equal

amounts reported for year-to-date periods.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150805006547/en/

Marchex Investor RelationsTrevor Caldwell,

206-331-3600ir(at)marchex.comOrMEDIA INQUIRIESMarchex

Corporate Communications206-331-3434pr(at)marchex.com

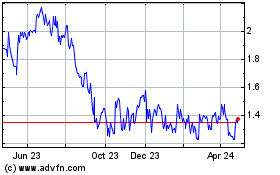

Marchex (NASDAQ:MCHX)

Historical Stock Chart

From Mar 2024 to Apr 2024

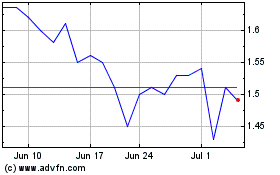

Marchex (NASDAQ:MCHX)

Historical Stock Chart

From Apr 2023 to Apr 2024