MELA Sciences, Inc. (NASDAQ:MELA), (the “Company”), developer of

MelaFind®, an FDA approved optical diagnostic device that assists

dermatologists in the diagnosis of melanoma, today announced

financial results for the fourth quarter and year ended December

31, 2013.

Conference Call

The Company will host a conference call at 4:30pm ET to review

results. Please dial 877-303-9205 (domestic) or 760-536-5226

(international). A live webcast will be available at:

www.melasciences.com. If you are unable to participate during the

live call and webcast, a replay will be archived and available for

approximately 90 days after call.

Fourth Quarter and Full Year 2013 Financial Results

Net Revenues for the three months ended December 31, 2013 were

$140,000 compared to $122,000 for the same period last year, an

increase of 14.75%. Cost of revenue for the fourth quarter was

$914,000 down 5.87% from $971,000 in the prior year. Total

operating expenses for the fourth quarter were $3.6 million down

30.58% from last year, which was due to management’s cost reduction

and cash conservation policy put in place mid-year.

The Company’s net loss for the three months ended December 31,

2013 was $4.6 million, or $0.09 per diluted share, compared to a

net loss of $6.1 million, or $0.19 per diluted share, for the same

period in 2012.

Net Revenues for the twelve months ended December 31, 2013 were

$536,000 compared to $278,000 reported for the same period in 2012,

an increase of 92.81%. Cost of revenue for the full year was $4.3

million compared to $2.0 million for 2012 and primarily relates to

increased depreciation expense for units placed during the year.

Total operating expenses for 2013 were $20.3 million down 3.02%

from last year and included an impairment charge taken in the third

quarter of approximately $1 million related to our MelaFind®

systems placed in the field.

The net loss for 2013 was $25.9 million or $0.60 per share

compared to $22.7 million or $0.74 per share in 2012. The net loss

for 2013 includes the $1 million non-cash impairment charge

mentioned above, a write-off of unamortized loan costs of

approximately $1 million relating to the pay-off of long term debt,

increased interest expense of $0.6 million also attributed to the

long term debt and a non-cash charge of $0.3 million primarily

related to warrants issued in the October 2013 financing that must

be accounted for as a liability.

Fourth Quarter and Full Year 2013 Highlights

On October 31, 2013 the Company closed on a $6 million

registered direct offering, which resulted in net proceeds to the

Company of approximately $5.5 million. As part of the offering the

Company sold just over 4.2 million shares of common stock and

prefunded warrants to purchase up to 4.3 million shares of common

stock. The Company also issued additional warrants to purchase up

to 6.9 million shares of common stock, which could result in

proceeds of $5.8 million, if exercised.

In November, Rose Crane was appointed President and CEO of the

Company bringing over 30 years of healthcare industry experience in

fields such as pharmaceuticals, medical devices and healthcare

services. As President and CEO of Epocrates, a healthcare

technology firm, she directed the efforts to take the company

public.

In October, Dr. Darrell Rigel, Clinical Professor of Dermatology

at New York University, Langone Medical Center was appointed Chief

Medical Advisor to the Board. Dr. Rigel also serves as a Regional

Chair of the Massachusetts Institute of Technology Education

Council.

In the fourth quarter, MELA Sciences participated in various

clinical conferences and meetings including the following:

- MelaFind® was showcased at the American

Society of Dermatologic Surgery Annual Meeting, the meeting was

held over four days and provided attendees the opportunity to stay

current on innovative devices, news and technology;

- presented four Poster Presentations at

the 32nd Annual Fall Clinical Dermatology Conference in Las Vegas

and held its first Clinical Advisory meeting, which announced the

launch of a new user study, called the MelaFind® Experience

Trial (MET–1);

- participated in the Washington D.C.

Dermatological Society’s Fall Clinical Conference, a hands-on

symposium involving live patient case studies and pathology

analysis; and

- in conjunction with the Mount Sinai

Winter Dermatology Symposium, hosted its second Clinical Advisory

Meeting chaired by Dr. Gary Goldenberg, Medical Director of Mount

Sinai’s Dermatology Faculty Practice.

“Having joined MELA Sciences just before the end of the year, I

can only say thank you to everyone from management to staff for

their diligence and hard work throughout 2013. The market proved to

be a difficult one and ultimately the Company realized that a

refocused strategy was in order. So I am happy to say we have

initiated a new business plan and a new business model that will

serve not only MELA but dermatologists and most importantly the

patients at high risk for melanoma,” said Rose Crane, President and

CEO of MELA Sciences.

The new business plan refocuses the Company’s go-to-market

strategy on medical dermatologists who treat high-risk patients and

on Key Opinion Leaders at leading hospitals and teaching

institutions in the United States as they lead the charge on

melanoma.

The new business model allows dermatologists to purchase the

MelaFind® device rather than rent it. This is typically how

business is conducted for medical devices.

The Company is also working diligently on securing insurance

reimbursement codes for both doctors and insurance companies.

Since the end of 2013, the Company has also taken important

steps in raising awareness of, the Company and its product

MelaFind®, and strengthening its balance sheet. Senior management

presented at a small-cap investor conference in New York and was

well received. MelaFind® has been introduced to several major

institutions in the United States gaining placement in four of the

leading melanoma centers.

In February, the Company completed a private placement offering

with two major healthcare institutional investors and its directors

for net proceeds of approximately $11.54 million prior to

approximately $2.5 million in penalties that have applied and up to

an additional $1.4 million in penalties that may apply. As part of

the offering the Company sold shares of its non-redeemable

preferred stock, which is convertible into approximately 14.6

million shares of its common stock and warrants to purchase up to

13.3 million shares of common stock which, if exercised, could

result in proceeds to the Company of up to $9.8 million. In

addition, the Company sold approximately 200,000 shares of its

common stock to its directors.

Please follow us:Twitter: @MELASciencesIR or

@MelaFindFacebook: www.facebook.com/MelaFindStockTwits:

@MELASciencesIR

About MELA Sciences, Inc. www.melasciences.com

MELA Sciences is a medical device company developing dermatology

diagnostics utilizing state-of-the-art optical imaging. The

flagship product is MelaFind®, an FDA, PMA and CE Mark approved,

non-invasive diagnostic tool to assist dermatologists in melanoma

evaluation and diagnosis. MelaFind® uses a variety of visible to

near-infrared light waves to analyze atypical pigmented skin

lesions 2.5mm below the skin surface. It provides images and data

on the relative disorganization of a lesion's structure that

provides substantial additional perspective to assist melanoma

diagnosis. MELA is also exploring new potential uses for its core

imaging technology and algorithms.

Safe Harbor

This press release includes "forward-looking statements" within

the meaning of the Securities Litigation Reform Act of 1995. These

statements include but are not limited to our plans, objectives,

expectations and intentions and may contain words such as “seeks,”

“look forward,” and “there seems” that suggest future events or

trends. These statements are based on our current expectations and

are inherently subject to significant uncertainties and changes in

circumstances. Actual results may differ materially from our

expectations due to financial, economic, business, competitive,

market, regulatory and political factors or conditions affecting

the company and the medical device industry in general, as well as

more specific risks and uncertainties set forth in the company’s

SEC reports on Forms 10-Q and 10-K. Given such uncertainties, any

or all of these forward-looking statements may prove to be

incorrect or unreliable. MELA Sciences assumes no duty to update

its forward-looking statements and urges investors to carefully

review its SEC disclosures available at www.sec.gov and

www.melasciences.com.

MELA SCIENCES, INC. BALANCE

SHEETS As of December 31, 2013 and 2012 (in

thousands, except for share and per share data)

2013 2012 ASSETS Current Assets: Cash

and cash equivalents $ 3,783 $ 7,862 Accounts receivable, net 57

180 Inventory, net 5,631 676 Prepaid expenses and other current

assets 880 965

Total Current

Assets 10,351 9,683 Property and equipment, net 3,691 7,350

Patents and trademarks, net 42 47 Deferred financing costs - 106

Other assets 48 84

Total Assets

$ 14,132 $ 17,270

LIABILITIES AND

STOCKHOLDERS' EQUITY Current Liabilities:

Accounts payable $ 1,479 $ 1,850 Accrued expenses 844 956 Deferred

placement revenue 244 172 Warrant liability 3,017 - Other current

liabilities 68 41

Total Current

Liabilities 5,652 3,019

Long Term Liabilities: Deferred placement revenue 64 132

Deferred rent 120 144

Total Long

Term Liabilities 184 276

Total Liabilities 5,836 3,295

COMMITMENTS AND CONTINGENCIES

Stockholders'

Equity Preferred stock - $.10 par value; authorized 10,000,000

shares: issued and outstanding: none Common stock - $.001 par

value; authorized 95,000,000 shares:

Issued and outstanding 47,501,596 and

32,204,720 shares at December 31, 2013 and 2012, respectively.

48 32 Additional paid-in capital 176,396 156,143 Accumulated

deficit (168,148 ) (142,200 )

Stockholders'

Equity 8,296 13,975

Total

Liabilities and Stockholders' Equity $ 14,132 $ 17,270

MELA SCIENCES, INC. STATEMENTS OF

OPERATIONS (in thousands, except for share and per share

data) Three months

ended December 31 Twelve months ended December 31

2013 2012 2013 2012 Net revenues 140

122 536 278 Cost of revenue 914 971

4,341 2,042 Gross profit (774 ) (849 )

(3,805 ) (1,764 ) Operating expenses: Research and

development 540 1,285 3,782 6,792 Selling, general and

administrative 3,096 3,953 15,536 14,169 Impairment of long-lived

assets - - 1,011 -

Total operating expenses 3,636 5,238

20,329 20,961 Operating

loss (4,410 ) (6,087 ) (24,134 ) (22,725 ) Other income

(expenses): Interest income 1 4 8 32 Interest expense (1 ) - (564 )

- Change in fair value of warrant liability (206 ) - (296 ) - Loss

on early extinguishment of debt - - (983 ) - Other income, net

6 5 21 20

(200 ) 9 (1,814 ) 52

Net loss $ (4,610 ) $ (6,078 ) $

(25,948 ) $ (22,673 ) Basic and diluted

net loss per common share $ (0.09 ) $ (0.19 ) $ (0.60 ) $ (0.74 )

Basic and diluted weighted average number

of common shares outstanding

46,058,796 31,727,391 42,894,500

30,762,610

MediaMELA Sciences, Inc.Diana Garcia

Redruello212-518-4226dgarcia@melasciences.comorInvestorsCatalyst

GlobalToni Trigiani, David

Collins212-924-9800mela@catalyst-ir.com

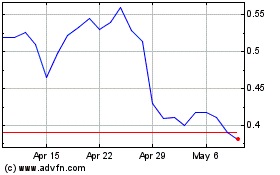

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Mar 2024 to Apr 2024

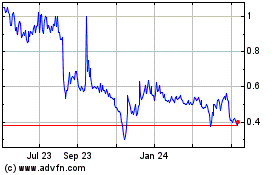

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Apr 2023 to Apr 2024