London Stock Exchange Group PLC Trading Statement (1140A)

December 18 2014 - 2:00AM

UK Regulatory

TIDMLSE

RNS Number : 1140A

London Stock Exchange Group PLC

18 December 2014

18 December 2014

LONDON STOCK EXCHANGE GROUP plc

PRE-CLOSE TRADING UPDATE

Unless otherwise stated, the following commentary refers to

non-financial KPIs for the eleven months ended 30 November 2014

and, where appropriate, to the corresponding period last year.

-- Good year-on-year increases in activity across all main LSEG businesses

-- GBP41.0 billion equity capital raised on the Group's markets

for the period (2013: GBP26.7 billion): 193 new issues (2013: 140);

new issue pipeline remains encouraging

-- Average daily UK equity value traded up 12 per cent; Italian

average daily volumes up 16 per cent

-- Fixed income cash markets value traded increased 35 per cent

and MTS money markets (repo) value traded increased 1 per cent

-- Italian clearing volumes increased 14 per cent; initial

margin held decreased 15 per cent, averaging EUR9.9 billion

-- SwapClear interest rate swap clearing showed strong growth in

notional cleared of $606 trillion, up 29 per cent, with $271

trillion compressed contributing to a year-to-date net reduction in

notional outstanding of $22 trillion; Global client swap clearing

was up 126 per cent at $117 trillion; over $186 trillion cleared

since launch of service

-- LCH.Clearnet's fixed income clearing increased 1 per cent to

EUR67.7 trillion; listed derivatives clearing also rose 2 per cent;

and, equities clearing increased 29 per cent on the same period

last year

-- ETF assets benchmarked to FTSE up 20 per cent; demand for

other information products, including UnaVista and SEDOL, remained

strong. Professional users of UK market real time information

decreased 5 per cent and users of Italian data increased 1 per cent

year on year

-- LSEG announced completion of acquisition of Frank Russell

Company on 3 December 2014; the comprehensive review of Russell's

investment management business is making good progress and is on

track to be completed early in 2015

Commenting on performance for the period, Xavier Rolet, Group

Chief Executive, said:

"The Group has made good progress this year, with strong

performances across all our main business areas. We are also

pleased to have recently completed the acquisition of Frank Russell

Company and work is already well underway to integrate the Russell

and FTSE indices operations to deliver significant cost and revenue

benefits.

"The Group continues to develop, diversify and evolve. We now

have strong market positions in a wide range of businesses and

geographies, including North America."

The Group expects to announce its Preliminary results for the

period ending 31 December 2014 on 5 March 2015.

Further information is available from:

London Stock Exchange Victoria Brough - Media +44 (0) 20 7797 1222

Group plc Paul Froud - Investor Relations +44 (0) 20 7797 3322

RLM Finsbury Guy Lamming / David Henderson +44 (0) 20 7251 3801

Additional information on London Stock Exchange Group can be

found at www.lseg.com

Key Performance Indicators

Capital Markets - Primary Markets

Eleven months ended

30 November Variance

--------------

2014 2013 %

New Issues

UK Main Market, PSM & SFM 68 43 58%

UK AIM 101 86 17%

Borsa Italiana 24 11 118%

Total 193 140 38%

----------------------------- ------ ------ ---------

Company Numbers (as at

period end)

UK Main Market, PSM & SFM 1,349 1,359 (1%)

UK AIM 1,099 1,094 0%

Borsa Italiana 305 285 7%

Total 2,753 2,738 1%

----------------------------- ------ ------ ---------

Market Capitalisation (as

at period end)

UK Main Market (GBPbn) 2,265 2,224 2%

UK AIM (GBPbn) 72 73 (1%)

Borsa Italiana (EURbn) 485 443 9%

Borsa Italiana (GBPbn) 386 370 4%

Total (GBPbn) 2,723 2,667 2%

----------------------------- ------ ------ ---------

Money Raised (GBPbn)

UK New 14.8 11.2 32%

UK Further 15.9 14.4 10%

Borsa Italiana new and

further 10.3 1.1 836%

Total (GBPbn) 41.0 26.7 54%

----------------------------- ------ ------ ---------

Capital Markets - Secondary

Markets

Eleven months ended

30 November Variance

----------------

Equity 2014 2013 %

Totals for period

UK value traded (GBPbn) 1,069 952 12%

Borsa Italiana (no of

trades m) 61.7 53.4 16%

Turquoise value traded

(EURbn) 863.5 606.4 42%

SETS Yield (basis points) 0.63 0.66 (5%)

Average daily

UK value traded (GBPbn) 4.6 4.1 12%

Borsa Italiana (no of

trades '000) 265 228 16%

Turquoise value traded

(EURbn) 3.67 2.57 43%

Derivatives (contracts

m)

LSE Derivatives 10.8 15.6 (31%)

IDEM 35.8 30.3 18%

Total 46.6 45.9 2%

--------------------------- ------- ------- ---------

Fixed Income

MTS cash and BondVision

(EURbn) 3,933 2,921 35%

MTS money markets (EURbn

term adjusted) 68,066 67,591 1%

Post Trade Services - CC&G and Monte

Titoli

Eleven months ended

30 November Variance

--------------

2014 2013 %

CC&G Clearing (m)

Equity clearing (no of

trades) 64.5 56.1 15%

Derivative clearing (no

of contracts) 35.8 31.7 13%

Total 100.3 87.8 14%

------------------------------ ------- ----- ---------

Open interest (contracts

as at period end) 6.0 6.4 (6%)

Initial margin held (average

EURbn) 9.9 11.6 (15%)

Monte Titoli

Settlement instructions

(trades m) 60.1 52.7 22%

Custody assets under

management (average EURtn) 3.30 3.34 (1%)

Post Trade Services - LCH.Clearnet

Eleven months ended

30 November Variance

--------------

2014 2013 %

OTC derivatives

SwapClear

IRS notional outstanding

($trn) 404 452 (11%)

IRS notional cleared

($trn) 606 469 29%

SwapClear members 113 103 10%

CDSClear

Open interest (EURbn) 37.4 23.6 58%

Notional cleared (EURbn) 58.4 166.8 (65%)

CDSClear members 10 11 (9%)

ForexClear

Notional value cleared

($bn) 817 830 (2%)

ForexClear members 21 19 11%

------------------------------- ------ ------ ---------

Non-OTC

Fixed income - Nominal

value (EURtrn) 67.7 67.2 1%

Commodities (lots m) 123.6 112.9 9%

Listed derivatives (contracts

m) 163.0 159.4 2%

Cash equities trades

(m) 414.1 321.0 29%

------------------------------- ------ ------ ---------

Average cash collateral

(EURbn) 47.1 39.5 19%

Information Services

As at

30 November Variance

------------------

2014 2013 %

Terminals

UK 76,000 80,000 (5%)

Borsa Italiana Professional

Terminals 130,000 129,000 1%

FTSE ETFs assets under

management benchmarked

($bn) 222 185 20%

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTVDLFFZLFEFBD

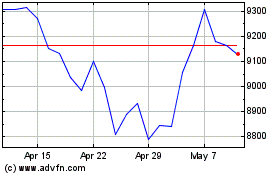

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

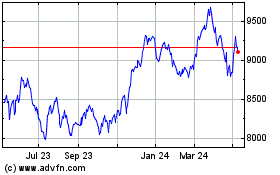

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024