London Stock Exchange Group PLC Final Results -20-

March 05 2015 - 2:02AM

UK Regulatory

(Unaudited) (Unaudited)

GBPm GBPm

Cost of sales 120.9 71.5

Employee costs 354.4 254.5

Depreciation and non-acquisition

software amortisation 60.1 53.7

IT costs 123.6 105.0

Other costs 164.2 131.8

Total expenses 823.2 616.5

4. Amortisation of purchased intangible assets and non-recurring

items

12 months 12 months

to to

31 December 31 December

2014 2013

(Unaudited) (Unaudited)

Restated

GBPm GBPm

--------------------------------------------- ------------

Amortisation of purchased intangible

assets 122.0 108.9

Transaction costs 56.1 15.9

Transaction credit (2.4) -

Restructuring costs 4.6 16.7

Restructuring credit (3.8) -

Integration costs 13.0 6.1

Impairment of purchased intangibles

and goodwill 22.0 -

---------------------------------------------- ------------

Total affecting operating profit 211.5 147.6

Charge for new transaction related

revolving credit facility 1.8 -

Total affecting profit before tax 213.3 147.6

Tax effect on items affecting profit

before tax

Deferred tax on amortisation and impairment

of purchased intangible assets (35.5) (30.9)

Current tax on amortisation of purchased

intangible assets (3.2) (1.1)

Tax effect on other items affecting

profit before tax (9.5) (7.6)

---------------------------------------------- ------------

Total tax effect on items affecting

profit before tax (48.2) (39.6)

Total charge to income statement 165.1 108.0

---------------------------------------------- ------------

Transaction costs comprise charges incurred for ongoing services

related to potential or completed acquisitions.

The transaction credit relates to a reduction in obligations

arising from the acquisition of LCH.Clearnet Group.

Restructuring and integration costs principally relate to the

acquisition, restructuring and integration of LCH.Clearnet and

Frank Russell Company.

The restructuring credit relates to contributions made by third

parties to cover restructuring costs incurred in previous periods.

Of the impairment recognised during the period GBP21.8m relates

to licenses recognised on the acquisition of the LCH.Clearnet

Group. Following a review it was determined that the cash flows

required to maintain the current valuation are too uncertain.

Consequently it was considered appropriate to impair the asset.

The remaining GBP0.2m relates to the goodwill on EDX London

Limited, following the transfer of the UK derivatives business

to its parent company.

5. Earnings per share

12 months 12 months

to to

31 December 31 December

2014 2013

(Unaudited)

(Unaudited) Restated

Basic earnings per share 56.5p 64.2p

Adjusted basic earnings per share 103.3p 96.5p

GBPm GBPm

------------

Profit for the financial period attributable

to equity holders 179.3 188.1

Adjustments:

Amortisation and non-recurring items:

Amortisation of purchased intangible

assets 122.0 108.9

Transaction costs 56.1 15.9

Transaction credits (2.4) -

Restructuring costs 4.6 16.7

Restructuring credit (3.8) -

Integration costs 13.0 6.1

Charge for new revolving credit facility 1.8 -

Impairment of purchased intangibles

and goodwill 22.0 -

Other adjusting items:

Unrealised net investment loss (included

in other income) 0.5 2.9

Tax effect of amortisation of purchased

intangible assets and non-recurring

items (48.2) (39.6)

Tax effect of other adjusting items (0.2) (1.0)

Adjusted items, amortisation of purchased

intangible assets and taxation attributable

to non-controlling interests (17.1) (15.1)

------------

Adjusted profit for the financial period

attributable to equity holders 327.6 282.9

------------

Weighted average number of shares

- million 317.1 293.1

Earnings per share for the year ended 31 December 2013 have been

restated for the prior year adjustment and the Rights Issue of the

Group issued on 11 September 2014.

6. Analysis of net debt

31 December 31 December

2014 2013

(Unaudited)

GBPm GBPm

Due within one year

Cash and cash equivalents 1,127.2 955.4

Bank borrowings (789.9) (304.1)

Derivative financial assets 0.4 -

Derivative financial liabilities - (17.4)

337.7 633.9

Due after one year

Bonds (796.7) (796.5)

Preferred securities (139.8) (149.6)

Derivative financial assets 22.7 5.3

Derivative financial liabilities - (5.6)

Total net debt (576.1) (312.5)

----------------------------------

12 months 12 months

to to

Reconciliation of net cash flow to 31 December 31 December

movement in net debt 2014 2013

(Unaudited) (Unaudited)

GBPm GBPm

Increase in cash in the period 224.3 568.2

Bank loan repayments less new drawings (495.8) (215.9)

Change in net debt resulting from

cash flows (271.5) 352.3

Foreign exchange movements (33.1) (2.4)

Movement on derivative financial

assets and liabilities 40.8 (27.0)

Bond valuation adjustment 0.2 (0.5)

Acquired debt - (242.3)

Net debt at the start of the period (312.5) (392.6)

Net debt at the end of the period (576.1) (312.5)

----------------------------------------

7. Net cash flow generated from operations

12 Months 12 Months

to to

31 December 31 December

2014 2013

(Unaudited) (Unaudited)

GBPm GBPm

-----------------------------------------------------

Profit before taxation 277.9 262.2

Depreciation and amortisation 181.8 162.6

Loss on disposal of property, plant

and equipment 0.1 0.1

Profit on disposal of shares in subsidiary/associate - (6.9)

Net finance expense 68.1 67.2

Increase in inventories (3.9) (1.0)

(Increase)/decrease in trade and

other receivables (6.7) 53.6

Decrease in trade and other payables (85.6) (49.2)

Impairment of purchased intangibles

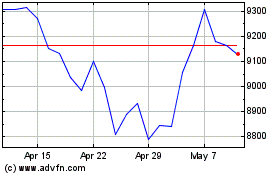

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

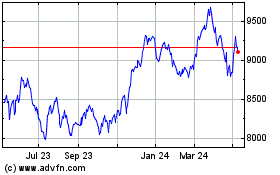

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024