TIDMLLOY

RNS Number : 9506O

Lloyds Banking Group PLC

12 February 2016

12 February 2016

NOT FOR DISTRIBUTION IN OR INTO OR TO ANY PERSON LOCATED OR

RESIDENT IN THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS

(INCLUDING PUERTO RICO, THE U.S. VIRGIN ISLANDS, GUAM, AMERICAN

SAMOA, WAKE ISLAND AND THE NORTHERN MARIANA ISLANDS), ANY STATE OF

THE UNITED STATES OR THE DISTRICT OF COLUMBIA (THE "UNITED STATES")

OR TO ANY U.S. PERSON.

(SEE "OFFER AND DISTRIBUTION RESTRICTIONS" BELOW)

LBG CAPITAL NO. 1 PLC AND LBG CAPITAL NO. 2 PLC ANNOUNCE RESULTS

OF THEIR CASH TENDER OFFERS ON CERTAIN EURO AND STERLING

SECURITIES

On 29 January 2016:

(i) LBG Capital No. 1 plc ("LBG 1") invited Holders of certain

of its euro denominated Enhanced Capital Notes (the "LBG 1 Existing

Notes") to tender any and all of their LBG 1 Existing Notes for

purchase by LBG 1 for cash (the "LBG 1 Offers"); and

(ii) LBG Capital No. 2 plc ("LBG 2" and, together with LBG 1,

the "Offerors" and each an "Offeror") invited Holders of certain of

its euro and sterling denominated Enhanced Capital Notes (the "LBG

2 Existing Notes" and together with the LBG 1 Existing Notes, the

"Existing Notes") to tender any and all of their LBG 2 Existing

Notes for purchase by LBG 2 for cash (the "LBG 2 Offers" and,

together with the LBG 1 Offers, the "Offers").

The Offers were made upon the terms and subject to the

conditions contained in the tender offer memorandum dated 29

January 2016 as amended by an announcement made on 9 February 2016

(the "Tender Offer Memorandum").

This announcement is made in accordance with the Tender Offer

Memorandum. Capitalised terms not otherwise defined in this

announcement have the same meaning as assigned to them in the

Tender Offer Memorandum.

The Offerors hereby announce that they will accept for purchase

all Notes validly tendered under the relevant Offers (c. 730m

Sterling equivalent). The below table sets out the results of the

Offers.

Accrued

Amount Interest

Outstanding Payment

Following per Make

Series Settlement thousand Whole Make

Title of Acceptance of the Principal Redemption Whole Purchase

Security Issuer ISIN Number Amount Offers Amount Price Premium Price

----------------- -------- --------------- ----------------- ----------------- ----------- ----------- -------- -------------

EUR486,527,000 EUR1,389.33

15.000 per per

cent. Enhanced EUR1,000

Capital in

Notes due aggregate

December LBG 136.933 principal

2019 2 XS0459089412 EUR165,321,000 EUR321,206,000 EUR10.30 % 2 % amount

EUR125,330,000

8.875 per

cent. Enhanced EUR1,020

Capital per EUR1,000

Notes due in aggregate

February LBG principal

2020 2 XS0459087986 EUR31,646,000 EUR93,684,000 EUR1.94 N/A N/A amount

EUR53,040,000

Floating EUR1,020

Rate Enhanced per EUR1,000

Capital in aggregate

Notes due LBG principal

March 2020 1 XS0459090931 EUR46,603,000 EUR6,437,000 EUR5.21 N/A N/A amount

EUR94,737,000

7.375 per EUR1,020

cent. Enhanced per EUR1,000

Capital in aggregate

Notes due LBG principal

March 2020 1 XS0459090774 EUR24,675,000 EUR70,062,000 EUR68.51 N/A N/A amount

EUR661,955,000

6.385 per EUR1,020

cent. Enhanced per EUR1,000

Capital in aggregate

Notes due LBG principal

May 2020 2 XS0459088794 EUR260,202,000 EUR353,911,000 EUR48.67 N/A N/A amount

EUR226,172,000

7.625 per

cent. Enhanced EUR1,020

Capital per EUR1,000

Notes due in aggregate

October LBG principal

2020 1 XS0459091236 EUR133,863,000 EUR92,309,000 EUR25.83 N/A N/A amount

GBP775,158,000

15.000 per

cent. Enhanced GBP1,342.90

Capital per GBP1,000

Notes due in aggregate

December LBG 132.290 principal

2019 2 XS0459089255 GBP185,877,000 GBP517,588,000 GBP10.30 % 2 % amount

GBP67,853,000

15.000 per

cent. Enhanced GBP1,753.38

Capital per GBP1,000

Notes due in aggregate

January LBG 173.338 principal

2029 2 XS0459089685 GBP48,061,000 GBP19,792,000 GBP10.30 % 2 % amount

Settlement Date

Settlement of the relevant Purchase Price and Accrued Interest

Payment in respect of the Existing Notes validly tendered in the

Offers and accepted for purchase is expected to be made on 15

February 2016. Following settlement of the Offers, the Offerors

intend to cancel any Existing Notes purchased pursuant to the

Offers.

Regulatory Call Right

The Offerors further announced on 29 January 2016 that they had

released call notices in respect of certain of their euro, sterling

and U.S. dollar denominated Enhanced Capital Notes exercising their

right to redeem those ECNs (a "Regulatory Call Right") following a

Capital Disqualification Event (as defined in the terms and

conditions of the ECNs) ("CDE"). The redemption of these securities

occurred on 9 February 2016.

The Offerors hereby confirm that, following settlement of the

Offers, they will redeem all the Existing Notes which remain

outstanding, as set out in the table above in the column entitled

"Amount Outstanding Following Settlement of the Offers". The

redemption of such Existing Notes is expected to occur on 29

February 2016 or, in the case of the EUR53,040,000 Floating Rate

Enhanced Capital Notes due March 2020 (ISIN: XS0459090931), on the

next scheduled interest payment date, being 14 March 2016.

February 12, 2016 07:29 ET (12:29 GMT)

Lloyds Banking Group plc has been notified that the Supreme

Court has granted the ECN trustee leave to appeal the unanimous

judgement of the Court of Appeal of 10 December 2015 that a CDE had

occurred. The Group continues to seek to balance the interests of

all stakeholders in this matter and has previously confirmed that,

if the Supreme Court were to determine that a CDE had not occurred

in relation to the ECNs, it would compensate fairly the holders of

the ECNs whose securities are redeemed by LBG Capital No. 1 plc and

LBG Capital No. 2 plc by reason of a CDE for losses suffered as a

result of such early redemption.

FURTHER INFORMATION

Lucid Issuer Services Limited has been appointed by the Offerors

as tender agent (the "Tender Agent") in connection with the

Offers.

BNP Paribas, Deutsche Bank AG, London Branch, Goldman Sachs

International, Lloyds Bank plc, Merrill Lynch International and UBS

Limited were appointed by the Offerors as Dealer Managers (the

"Dealer Managers") for the purposes of the Offers.

For further information please contact:

Investor Relations

Douglas Radcliffe +44 (0) 20 7356 1571

Group Investor Relations Director

Email: douglas.radcliffe@finance.lloydsbanking.com

Corporate Affairs

Matt Smith +44 (0) 20 7356 3522

Head of Corporate Media

Email: matt.smith@lloydsbanking.com

Requests for information in relation to the Offers should be

directed to:

DEALER MANAGERS

BNP Paribas Deutsche Bank AG, London Goldman Sachs International

10 Harewood Avenue Branch Peterborough Court

London NW1 6AA Winchester House 133 Fleet Street

United Kingdom 1 Great Winchester Street London EC4A 2BB

London EC2N 2DB United Kingdom

United Kingdom

Telephone: +44 20 7595 Telephone: +44 20 7774

8668 Telephone: +44 20 7545 9862

Attention: Liability Management 8011 Attention: Liability

Group Attention: Liability Management Group

email: liability.management@bnpparibas.com Management Group email:

email: liabilitymanagement.eu@gs.com

liability.management@db.com

Lloyds Bank plc Merrill Lynch International UBS Limited

10 Gresham Street 2 King Edward Street 1 Finsbury Avenue

London EC2V 7AE London EC1A 1HQ London EC2M 2PP

United Kingdom United Kingdom United Kingdom

Telephone: +44 20 7158 Telephone: +44 20 7996 Telephone: +44 20 7568

2720 5698 2133

Attention: Liability Management Attention: Liability Attention: Liability

Group Management Group Management Group

email: liability.management@lloydsbanking.com email: email:

DG.LM_EMEA@baml.com ol-liabilitymanagement-eu@ubs.com

Requests for information in relation to, and for any documents

or materials relating to, the Tender Offer should be directed

to:

TENDER AGENT

Lucid Issuer Services Limited

Tankerton Works

12 Argyle Walk

London WC1H 8HA

United Kingdom

Tel: +44 20 7704 0880

Attention: Sunjeeve Patel / Paul Kamminga

Email: lbg@lucid-is.com

DISCLAIMER

This announcement must be read in conjunction with the Tender

Offer Memorandum. This announcement and the Tender Offer Memorandum

contain important information which must be read carefully. If any

Holder is in any doubt as to the action it should take, it is

recommended to seek its own legal, tax, accounting and financial

advice, including as to any tax consequences, from its stockbroker,

bank manager, solicitor, accountant or other independent financial

adviser. None of the Offerors, the Dealer Managers, the Tender

Agent and any person who controls, or is a director, officer,

employee or agent of such persons, or any affiliate of such

persons, has made any recommendation in connection with the

Offers.

This announcement and the Tender Offer Memorandum do not

constitute an offer or an invitation to participate in the Offers

in the United States or in any other jurisdiction in which, or to

any person to or from whom, it is unlawful to make such offer or

invitation or for there to be such participation under applicable

laws. The distribution of this announcement and the Tender Offer

Memorandum in certain jurisdictions may be restricted by law.

Persons into whose possession this announcement and/or the Tender

Offer Memorandum comes are required by each of the Offerors, the

Dealer Managers and the Tender Agent to inform themselves about and

to observe any such restrictions.

The Dealer Managers and the Tender Agent (and their respective

directors, employees or affiliates (other than the Offerors in

their capacity as such)) make no representations or recommendations

whatsoever regarding this announcement, the Tender Offer Memorandum

or the Offers. The Tender Agent is the agent of the Offerors and

owes no duty to any Holder.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSFEFEEFMSEEE

(END) Dow Jones Newswires

February 12, 2016 07:29 ET (12:29 GMT)

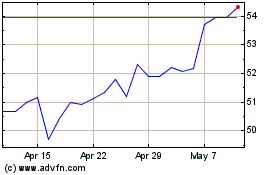

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Apr 2023 to Apr 2024