Live Nation Ticket Sales Improve in Latest Quarter

July 28 2016 - 6:20PM

Dow Jones News

Live Nation Entertainment Inc. on Thursday reported

better-than-expected quarterly profit and sales as the concert

promoter held more events and sold more tickets than the year-ago

period.

In the second quarter, Live Nation said, the number of events

increased 5.3%, to 6,677, with number of tickets sold climbing

9.3%, to 40.2 million.

Revenue in the concerts segment jumped 26%, to $1.6 billion,

while ticketing rose 23%, to $443.3 million. Sponsorship and

advertising posted a 17% climb, to $95.2 million, while the Artist

Nation segment's revenue retreated 1%, to $86.7 million.

Analysts with Albert Fried & Co. said that Live Nation

"benefits from the demand by recording companies and artists to go

on tour as a solution to thwart streaming revenue losses."

They did warn however that international growth has been a boost

to the company's results, and a "global economic slowdown" could

stymie growth.

Shares of the company, down about 1% for the past year, rose

4.9% to $27 in after-hours trading.

Over all, Live Nation Entertainment reported a profit of $37.7

million, or 13 cents a share, compared with $15.1 million, or 6

cents a year earlier.

Revenue rose 23%, to $2.2 billion

Analysts surveyed by Thomson Reuters had projected, on average,

a profit of 8 cents a share on $1.9 billion in revenue.

Live Nation merged with Ticketmaster in 2010 and acquired

promoter and festival operator Hard Events in 2012. In 2014, Live

Nation bought a controlling stake in C3 Presents, the Texas-based

promoter of festivals such as Lollapalooza and Austin City

Limits.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

July 28, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

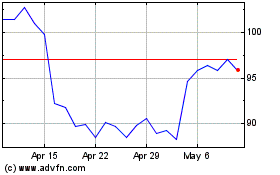

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

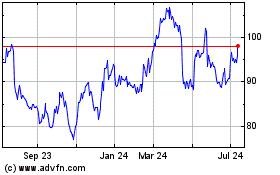

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Apr 2023 to Apr 2024