Linde Shares Drop As Company Lowers Guidance -- Update

December 01 2015 - 7:06AM

Dow Jones News

By Monica Houston-Waesch

FRANKFURT--Linde AG shares traded sharply lower Tuesday after

the engineering and gases company cut earnings targets for 2017,

hit by sluggish industrial production and price cuts in the U.S.

healthcare industry.

Linde lowered its operating profit forecast for 2017 to 4.2

billion-4.5 billion euros ($4.44 billion-$4.75 billion), compared

with EUR4.5 billion-EUR4.7 billion forecast previously. Linde now

expects return on capital employed between 9% and 10% in 2017,

below the 11% to 12% forecast previously.

The company said it has also been hurt by low oil prices, which

will clip the engineering division's contribution to earnings. The

division makes processing plants for hydrogen and synthetic gases,

oxygen and olefins, as well as natural gas treatment.

On top of that, Linde said U.S. government health-care price

cuts in 2016 and 2017 would be deeper than assumed in October 2014,

when the previous forecasts were formulated. Linde provides oxygen

therapy and other medical gas equipment to U.S. healthcare

operators.

At 1100 GMT, Linde traded about 13% lower at EUR143.60, off an

intraday low of EUR141.15.

Bernstein Chemicals maintained its preference for rival Air

Liquide SA over Linde. Linde's engineering operations account for a

bigger share of group sales, around 20% at Linde, versus 10% for

Air Liquide, it noted.

"Air Liquide has less emerging market exposure, which has been

impacting Linde, and almost no exposure to U.S. healthcare,"

Bernstein said in a note. Air Liquide last month agreed to pay

$10.3 billion for U.S.-based Airgas Inc.

Other brokerages played down the revision, and said they still

saw strategic value in Linde. Deutsche Bank said in a research note

that 2016 will be "more of a 'dent' in the investment thesis rather

than an indicator that the business model is broken."

The shares have longer-term potential even if they lack an

immediate catalyst, Deutsche Bank said, and management will likely

accelerate restructuring efforts to achieve cost cuts. Deutsche

Bank reiterated its buy rating but cut its target price for the

stock to EUR170 from EUR178.

"Although this is a negative development, we are not entirely

surprised since Linde's nine-month results provided a glimpse of

subdued growth, and we toned down our expectations back then," said

S&P Capital IQ Equity Research analyst Jit Hoong Chan in a

research note. Mr. Chan, who has a sell rating on the share, said

Linde's oil and gas sectors continue to face headwinds from lower

oil prices.

-Write to Monica Houston-Waesch at nikki.houston@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 06:51 ET (11:51 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

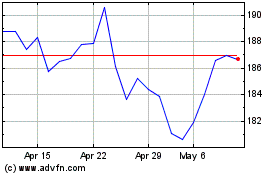

Air Liquide (EU:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Liquide (EU:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024