TIDMPFP

RNS Number : 5374A

Pathfinder Minerals PLC

30 March 2012

For immediate release: 30 March 2012

Pathfinder Minerals Plc

Letter to Shareholders

Pathfinder Minerals Plc is today posting a letter to all its

shareholders, the full text of which appears below.

Dear Shareholder

General Meeting of Pathfinder Minerals Plc ("Pathfinder" or "the

Company"); and Letter from General Veloso and Mr Cavaco

As you will know, the Company convened and duly held on

Wednesday a general meeting, following a requisition letter from

General Veloso's company, JV Consultores Internacionais Limitada

("JVC"), and Mr Diogo Cavaco (the "Requisitioners"). That meeting

was called to consider and vote on the resolution that there be an

external investigation into the Company's affairs. For the reasons

we set out in the circular, the Board recommended that you should

vote against the resolution, principally because it was an attempt

to distract your Board from dealing with the actions taken by the

Requisitioners themselves. The Requisitioners (of course) voted in

favour of the resolution proposed, but did not attend in person. I

was delighted to receive the overwhelming support of our

shareholders (other than the Requisitioners). Not only was the

resolution defeated unanimously on a show of hands by those of you

who were present, but also the proxy vote was comprehensive: 393 of

you voted against the resolution, with only 7 shareholders

(including the two Requisitioners) voting for it. I and the rest of

the Board are very grateful for your continued support.

The requisition letter from the Requisitioners did not meet the

statutory requirements that would have compelled us to call a

meeting. Nevertheless the Board felt it important to give you the

opportunity, as a part owner of the Company, to vote on their

suggestion that an external investigation be carried out. As I said

at the meeting, if the resolution were to have been passed, the

Board would have included in the scope of any review a report on

the Company's solvency (given the breadth of the investigation

requested). The Board has no concerns in this regard. It is hoped

that the Requisitioners now appreciate how little they are

supported by other shareholders and will not seek to distract the

Board further from the goal of preserving the assets of the

Company: this is and remains my sole focus.

As a fellow shareholder in the Company, I received in the post

on the morning of the general meeting a letter dated 24 March 2012

which I assume was sent to all shareholders. Whilst the Board

welcomes open debate amongst shareholders, the Board is concerned

to note that what has been presented in the letter as "facts" is

only a partial account. The letter contains a number of statements

which are so materially false and seriously defamatory that I have

felt it necessary to write to you in order to dispel a number of

these falsehoods.

Ownership of Companhia Mineira de Naburi SARL ("CMDN")

At the heart of the "concerns" expressed by the Requisitioners

is their denial of the Group's ownership of the shares in CMDN from

which the Requisitioners (and General Veloso) have diverted the

Company's sole assets, namely the mining licences over the Moebase

and Naburi sites ("the Licences"). Having diverted the Licences,

they are now engaged upon a course of conduct designed to enable

them to take control of CMDN so as to prevent the Group from

recovering its diverted assets and/or compensation for its

loss.

As to the ownership of CMDN, the Group's wholly-owned subsidiary

IM Minerals Limited ("IMM") acquired 99.99% of the issued share

capital of CMDN pursuant to valid and binding agreements (the

"Agreements") signed by or on behalf of the Requisitioners. Despite

this, and the fact that, in December 2010, General Veloso and Mr

Cavaco themselves issued and signed a share certificate evidencing

that ownership, the Requisitioners and those representing them now

seek to deny that IMM owns any shares in CMDN. This is wholly

inconsistent with the Agreements and bears no relationship to the

prior conduct of the Requisitioners and General Veloso. This is

evidenced, for example, by:

(i) Express representations made by General Veloso and Mr Cavaco

to the Mozambique Ministry of Mineral Resources in 2009 that IMM

was the owner of 75% (as it then was) of the shares in CMDN. In a

letter dated 1 October 2009 to the National Director of Mines and

signed by General Veloso, General Veloso stated: "Companhia Mineira

de Naburi assigned 75% of its share capital to IM Minerals Ltd"

(translation from Portuguese). On 1 October 2009 in an e-mail to me

Mr Cavaco wrote: "I Informed officially the Mining Ministry and the

Nacional Mining Director that IMMinerals as 75% of Companhia

Mineira de Naburi". In describing the Minister of Mineral

Resources' understanding of the position, Mr Cavaco wrote to me: "I

can repeat, she is complete aware of the situation and she knows

that IM Minerals already as 75% of the capital of Companhia Mineira

de Naburi".

(ii) Mr Cavaco's signature (in his capacity as a director of

CMDN) on 22 October 2010 of the financial statements of CMDN for

the six month period ended 31 December 2009, which showed IMM as

owner of 75% of the shares in CMDN.

(iii) Mr Cavaco's representations to Pathfinder as to IMM's

ownership of all but two of the 400,000 shares (representing

99.99%) in CMDN as part of the due diligence exercise conducted

during 2010 in connection with Pathfinder's proposed reverse

takeover of IMM.

(iv) General Veloso and Mr Cavaco's signatures on a Nominative

Share Certificate in the name of

IMM confirming its holding of 399,998 shares in CMDN.

(v) IMM's ownership of first 300,000 shares in 2009 and then

399,998 shares in 2010 were registered in the Share Registry Book

of CMDN and stamp duty was paid on the transfers to IMM.

(vi) The fact that the transfer to IMM of 300,000 shares in CMDN

representing 75% of its share capital and (in 2010) the transfer to

IMM of all but two of the shares in CMDN not already owned by IMM,

were formally confirmed by CMDN in a general meeting.

(vii) General Veloso's approval of a regulatory announcement

concerning his appointment to the Board which stated that

Pathfinder, through a "wholly owned subsidiary", held licences over

the Naburi and Moebase sites.

The Requisitioners' letter is notable in its omissions. Whilst

numerous references are made to the agreement entered into in 2006

(as subsequently varied and novated) by which IMM ultimately

acquired 70% of the shares in CMDN (the "2006 Agreement"), it is

telling that the Requisitioners have not seen fit to mention the

other agreements by which IMM acquired the remainder of the shares

in CMDN, namely an agreement in 2009 by which Mr Cavaco sold 5% of

the shares in CMDN to IMM (the "2009 Agreement") and an agreement

in 2010 (the "2010 Agreement") by which the Requisitioners sold the

remaining 24.99% of the shares to IMM. In the case of both the 2009

and 2010 Agreements, the consideration for the transfer of CMDN

shares to IMM was the transfer to the Requisitioners of shares in

IMM. The Requisitioners subsequently exchanged those IMM shares

(less some shares which had been previously sold by Mr Cavaco for

GBP50,000) for shares in Pathfinder by an agreement dated 30

December 2010. It is the rights in respect of these Pathfinder

shares which the Requisitioners used in calling the General

Meeting. Their position seems to be that they are entitled to

ownership of 100% of CMDN and of 19% of Pathfinder Minerals Plc and

of the Licences themselves.

Not only did the Requisitioners agree in the Agreements to

transfer ownership in the relevant shares to IMM, but in the 2010

Agreement in which they agreed to sell 24.99% of the shares in

CMDN, they also contractually warranted that IMM was the holder of

the other 75% of the shares in CMDN. Similarly, when they agreed in

December 2010 to exchange their shares in IMM for shares in

Pathfinder they (as well as General Veloso himself) warranted to

Pathfinder that CMDN was the sole legal and beneficial owner of all

but two of the shares in CMDN. Inexplicably, they now seek to deny

this.

Amounts owed to the Requisitioners

As to the amounts still payable in respect of the initial 70% of

the CMDN shares, it has never been denied that IMM is liable to pay

$9.9 million to the Requisitioners (less GBP209,000 already paid to

Mr Cavaco at his request). However, on the express terms of the

2006 Agreement, that amount is not payable until six months after

(and therefore is conditional upon) signature of a construction

agreement in respect of the Naburi site. That liability has been

recorded in IMM's audited accounts in accordance with applicable

accounting rules.

Assertion of SFO action

In addition to the key issue of the ownership of the CMDN

shares, the Board is very concerned to note the allegation of

bribery contained in the Requisitioners' letter and the claim that

this allegation is being investigated by the Serious Fraud Office.

The Requisitioners know that this is untrue. As the Requisitioners

well know, the Serious Fraud Office having been alerted by the

Requisitioners themselves, has completed its investigation into the

allegations, found no evidence of bribery and has decided to take

no further action.

Protective Legal Proceedings

Given that IMM has entered into valid and binding agreements to

acquire 399,998 shares in CMDN and that the conduct of the

Requisitioners and General Veloso has, until the diversion of the

Licences, been entirely consistent with IMM's ownership of those

shares, the Directors have quite properly sought declarations from

the English High Court (the forum in which the Requisitioners

agreed that any disputes should be determined) as to the position.

In their letter, the Requisitioners assert that they have

particularised the matters of which they seek to complain in

documents submitted to the English Court. These matters will now be

considered by the English High Court at a trial scheduled to start

on 29 October 2012 and a determination of the position made. Your

Board has nothing to hide. On the contrary, it looks forward to a

resolution of the issues by the English High Court.

The Board is also concerned to note the Requisitioners'

description of the recent hearing in the English Court on 19 March

2012. Whilst the letter states that the injunction was discharged,

as the Requisitioners well know, and as referred to in the

Company's announcement dated 20 March 2012, the injunction was

discharged only on the basis that they (and General Veloso) gave

undertakings to the Court in lieu of (but on substantially similar

terms to) the injunction. For all intents and purposes, those

undertakings have the same effect as an injunction. The

Requisitioners also fail to mention that they had sought to

challenge the jurisdiction of the English Court to determine the

dispute but that, very shortly before the hearing, they conceded

this and agreed to accept the English Court's jurisdiction. Of

course, had the Requisitioners (and General Veloso) offered the

undertakings and accepted the jurisdiction of the English Court in

the first instance, rather than shortly before the hearing was due

to open, the Board would not have had to incur legal costs in

preparing for the hearing on 19 March 2012.

Outlook

I appreciate that the actions taken by the Requisitioners are

unsettling and have impacted on your investment (and suspended

trading in the stock). We, as a Board, continue to pursue the legal

remedies we firmly believe are available to Pathfinder and to

strive for an earlier resolution through pursuit of high level

political avenues in the UK and Mozambique. Our prime objective is

to restore control and resume project development as quickly as

possible.

Yours sincerely

Nick Trew

Chief Executive

Enquiries:

Pathfinder Minerals Plc

Nick Trew, Chief Executive

Tel. +44 (0)20 7399 4371

Daniel Stewart & Company Plc

David Hart or James Thomas

Tel: +44 (0)20 7776 6550

M: Communications

Ben Simons or Maria Souvorov

Tel: +44 (0)20 7920 2340 /2327

Notes to Editors

Companhia Mineira de Naburi S.A.R.L ("CMDN"), a subsidiary of

Pathfinder Minerals, was issued mining concession licences 760C and

4623C on 13 September 2004 and 13 July 2011 respectively, each for

a period of twenty-five years. Taken together, these mining

concessions cover approximately 32,000 hectares of land on the

Indian Ocean coast of the Zambezia province of Mozambique, known to

contain the heavy minerals, ilmenite, rutile and zircon.

Pathfinder Minerals Plc is admitted to trading on the AIM market

of the London Stock Exchange. At the Company's request trading in

its shares was suspended on 11 November 2011 following notification

from General Veloso of his resignation as a director and assertions

by him that CMDN was no longer the licence holder. The Company's

ownership rights over CMDN itself are also in dispute and are the

subject of legal action in Mozambique and in the UK.

This information is provided by RNS

The company news service from the London Stock Exchange

END

CIRURSNRUUAOOAR

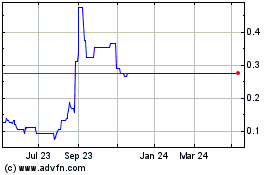

Pathfinder Minerals (LSE:PFP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pathfinder Minerals (LSE:PFP)

Historical Stock Chart

From Apr 2023 to Apr 2024