Kiwi Falls As New Zealand Business Confidence Hits Six-year Low

July 31 2015 - 12:20AM

RTTF2

The New Zealand dollar weakened further against the other major

currencies in the Asian session on Friday after data showed that

business confidence in New Zealand tumbled further to a 6-year low

in July, boosting the possibility of more rate cuts.

Data from the ANZ Bank showed that business confidence in New

Zealand tumbled further in July, with an index score of -15.3.

That's down from -2.3 in June, which had been the first negative

score for the index since March 2011.

In a speech, Reserve Bank governor Graeme Wheeler said earlier

this week further cuts to interest rates were likely this year, due

to weak dairy prices and a deteriorating external trade

position.

Traders also speculate that the RBNZ remains in easing mode as

the U.S. Federal Reserve have inched toward its first rate

hike.

At the same time, the ANZ Activity Outlook survey for July also

showed disappointing results, with the corresponding indicator

coming in at +19, down from 23.6 in the previous month.

Meanwhile, commodity prices fell, especially that of dairy

products, which are the nation's biggest export.

Thursday, the NZ dollar fell 0.94 percent against the U.S.

dollar, 0.77 percent against the yen, 0.12 percent against the euro

and percent 0.64 against the Australian dollar.

In the Asian trading today, the NZ dollar fell to a 1-week low

of 1.1093 against the Australian dollar, from yesterday's closing

value of 1.1039. The kiwi may now test support near the 1.12

region.

Data from the Australian Bureau of Statistics showed that the

final demand producer prices in Australia were up 0.3 percent on

quarter in the second quarter of 2015, following the 0.5 percent

increase in Q1. On a yearly basis, PPI climbed 1.1 percent after

gaining 0.7 percent in the three months prior.

Against the euro and the yen, the kiwi dropped to 3-day lows of

1.6644 and 81.47 from yesterday's closing quotes of 1.6547 and

81.93, respectively. If the kiwi extends its downtrend, it is

likely to find support around 1.68 against the euro, 80.00 against

the yen

The kiwi edged down to 0.6568 against the U.S. dollar, from

yesterday's closing value of 0.6600. On the downside, 0.64 is seen

as the next support level for the kiwi.

Looking ahead, Japan housing starts and construction orders for

June are due to be released at 1:00 am ET. Subsequently, German

retail sales data for June is slated for release at 2:00 am ET.

Eurozone unemployment rate for June and CPI for July are set to

be published later in the day.

In the New York session, Canada GDP for May, U.S. Chicago PMI

for July and University of Michigan's final U.S. consumer sentiment

index for July are due.

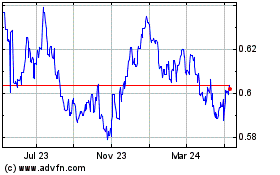

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

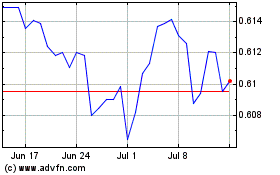

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024