TIDMKIBO

RNS Number : 5351A

Kibo Mining Plc

30 September 2015

Kibo Mining Plc

(Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

("Kibo" or "the Company")

Condensed Consolidated Interim Financial Statements

for the six months ended 30 June 2015

Dated 30 September 2015

Kibo Mining plc (ÒKiboÓ or the ÒCompanyÓ) (AIM: KIBO; AltX: KBO)

the mineral exploration and development company focused on coal,

gold, nickel, and uranium projects in Tanzania, is pleased to

announce its unaudited half year results for the period ended 30

June 2015.

Highlights from the Chairman, Christian SchaffalitzkyÕs

statement:

-- Signing of a Joint Development Agreement with China based, SEPCOIII on the Mbeya Coal to Power Project (MCPP);

-- Completion of Mining Pre-feasibility Study on MCPP with project fundamentals surpassing those indicated in the

earlier Concept Study report;

-- Signing of joint Venture Agreements on the Morogoro (gold) and Pinewood (uranium) projects with Metal Tiger plc;

-- Haneti geophysical interpretation results indicates nickel sulphide prospective rocks are much more extensive

than previously thought over the project; and

-- Placing funds of GBP526,000, locked down since March due to the appointment of an Administrator to CompanyÕs

former broker (Hume Capital), to be released to Kibo within two months.

Highlights from the interim results for the period ended 30 June

2014:

-- Decrease in basic and dilutive loss per ordinary share of 99% compared to previous interim results; and

-- Decrease in trade and other payables of 311%

Chairman's Statement

Dear Shareholder,

I am pleased to present our accounts for the six month period

ending 30 June 2015. During the period the Company continued to

advance work across our entire project portfolio despite the

persistent challenging economic environment for mining companies.

While prioritising resources to advancing our flagship Mbeya Coal

to Power Project (MCPP), we have also made good progress on our

gold (Lake Victoria & Morogoro), base metals (Haneti) and

uranium (Pinewood) projects during the period. The highlight of the

period was the signing of a Joint Development Agreement (JDA) with

China based, SEPCOIII on the MCPP, which was announced on the 20

April 2015 and became fully unconditional on the 21 July 2015.

Prior to the signing of the JDA, the Company had already commenced

its Mining Prefeasibility Study on the MCPP following the

successful results from the earlier Concept Study (Mining) and

Power Pre-feasibility (Power) reports, the results of which were

announced in late 2014. During the period prior to the JDA becoming

unconditional, Kibo continued to sole fund and successfully

complete the Mining Pre-feasibility Study on the MCPP. The results

of this study, announced in July 2015, underlined the robustness of

the project and demonstrated that the project fundamentals surpass

those indicated from the earlier Concept Study report.

On the gold front, the Company also commenced a Pre-feasibility

Study on its Imweru project in April following the encouraging

results from a Preliminary Economic Study reported during February

2015. As the gold market continues to experience significant

downward price pressure, the Company is proceeding cautiously with

completion of this study, pending improved market sentiment for

gold. Recognising the current volatility in the gold market and the

prudence of sharing risk, particularly on early stage projects, the

Company entered a joint venture with AIM listed Metal Tiger plc in

early 2015 on its Morogoro Project. Under the terms of the JV,

Metal Tiger has been granted a 50% equity interest in the project,

to be maintained by project expenditure of GBP800,000 over 4 years.

Initial work has commenced under the JV. We also completed a JV

under broadly similar terms with Metal Tiger on the CompanyÕs

Pinewood uranium project and work has just commenced on this

project also.

I am also pleased to report that we have built significantly on

the 2013 and 2014 exploration results emerging from the Haneti

project, particularly in relation to its prospectivity for magmatic

nickel sulphide and associated mineralisation. Following the

encouraging results from an independent geochemical interpretation

report announced in January, we proceeded to follow up with an

independent airborne geophysical interpretation study based on

recently released Government of Tanzania survey data. The results

both validated the robustness of the existing drill targets on the

project in addition to demonstrating that the nickel prospective

rock formations were much more extensive than previously

interpreted.

On the corporate front, we implemented two placings during the

period for amounts of GBP950,000 and GBP1,500,000 at prices of 5p

and 6p per share respectively. Funds in the amount of GBP526,000

from the first placing are still pending to the Company due to the

appointment of Administrators to Hume Capital plc Limited (ÒHumeÓ),

the CompanyÕs broker at the time (March 2015). As the

administration process is currently winding up, Kibo expects to

receive these funds within the next two months, less some small

administration expense. In response to the Hume administration,

Kibo appointed a new Company broker, Beaufort Securities Limited

(ÒBeaufortÓ) in March. Beaufort subsequently successfully arranged

the second placing for GBP1,500,000 in April.

Exploration & Development

MCPP

On the 20 April 2015, Kibo announced the signing of a JDA with

SEPCOIII, a large international China based EPC contractor on the

MCPP. The JDA provides for SEPCOIII to contribute up to US$3

million towards completion of the Definitive Feasibility Study

(ÒDFSÓ) on the project on which Kibo had made substantial progress

up to the date of signing. Under the terms of the JDA, Kibo has

reserved the right to introduce third parties to assist with its

share of the financing and or development of the MCPP in exchange

for an interest in the MCPP. The JDA became unconditional on the 21

July 2015 as announced by the Company on this date. During JDA due

diligence period, Kibo, recognising the need to keep momentum

behind the MCPP, continued to sole fund the DFS and completed the

Mining PFS (Phase 2, Stage 1 of the DFS), the results of which the

Company announced on the 12(th) August 2015. The results of this

study showed project fundamentals to be significantly improved from

those previously announced from the earlier stage Concept Study

with an indicative headline all-in-cost margin range improvement of

49% - 62% from 38% - 45% (exact figure will depend on mining option

chosen).

Other Projects

Work is continuing at a steady pace on all KiboÕs non-coal

assets with our strategy reflecting the priority to direct funding

towards the MCPP, which has the greatest potential to create

exponential value in the short term.

At Imweru (Lake Victoria Project), where the Company has

embarked on a Definitive Feasibility Study (DFS), it commenced a

Prefeasibility Study in April following the encouraging results

from a Preliminary Economic Assessment (PEA) report announced in

February. The PEA (Phase1, Stage 1 of the DFS) confirmed the

potential of Imweru to sustain a mine development with a minimum

mine life of 6 to 10 years based on the existing Mineral Resource

of c.550,000 oz. (15 million tonnes at 1.14g/t) of which KiboÕs

attributable interest is 90%. In light of the contagion effects

from the continued weakness in the gold price which has dampened

investor confidence in the sector, Kibo is proceeding cautiously

with the Imweru PFS (Phase 2, Stage 1 of the DFS) and is

principally focussing on further modelling and desktop studies to

test the economic robustness of the project under various gold

price scenarios and other operating and technical variables.

During the first six months of 2015, Kibo successfully

negotiated two joint venture agreements with AIM listed Metal Tiger

plc (ÒMetal TigerÓ) on its Morogoro Gold project and Pinewood

Uranium Project under broadly similar terms. These provide for

Metal Tiger to maintain a 50% interest in the projects by licence

fee and exploration expenditure of up to GBP800,000 on each project

over a period of three years. Preliminary exploration programmes

and budgets for both projects were agreed with Metal Tiger during

the period and exploration has already commenced on both

projects.

At the Haneti nickel project, the Company commissioned an

independent geophysical interpretation report based on recently

available high resolution airborne geophysical survey data

purchased from the Geological Survey of Tanzania during 2015. This

followed the encouraging results from an earlier independent

geochemical interpretation report announced in January which

underlined the prospectivity of Haneti for magmatic nickel sulphide

and associated mineralisation and confirmed, in particular, the

robustness of the Mihanza Hill drill target. The geophysical

interpretation results announced after the period end on the 24(th)

June 2015, established the areal extent of the nickel prospective

Haneti Itiso Ultramafic Complex to be substantially more extensive

than previously thought. Additionally, magnetic modelling on the

Mihanza Hill drill target, revealed significant increasing magnetic

susceptibility with depth and the presence of a substantial volume

of this prospective magnetic rock to a depth of 800 metres which

bodes well for nickel sulphide potential at this site. Plans to

conduct an initial drilling programme at Haneti during 2015 have

now been postponed until next year due to the imperative to focus

resources in the short term on completion of the MCPP.

Corporate

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 03:00 ET (07:00 GMT)

The Company undertook two equity capital raisings during the

period, one in March for a gross amount of GBP950,000 at 5p per

share and one in April for a gross amount of GBP1, 500,000 at 6p

per share to fund on-going feasibility work at the MCPP in

particular and for general working capital requirements. Due to the

unforeseen appointment of administrators to the affairs of Hume

Capital plc during the execution of the first placing in March

2015, shares issued to clients of Hume for GBP204,000 of the

GBP950,000 remained unpaid and the shares were subsequently

forfeited and placed in a Company treasury account. Funds with

respect to a further GBP526,000 of the March placing funds were

frozen by the Hume Administrator pending completion of the

administration process. As announced on the 26(th) August 2015,

these funds less a small administration expense will be released to

Kibo on, or within two months from the 2(nd) October 2015. The net

effect of the Hume administration for the Company is that it will

not receive GBP204,000 of the nominal March Placing amount of

GBP950,000. Un-paid shares issued in respect of this shortfall are

now non-trading and locked down in a treasury account (forfeited

share account) for later disposal.

In conclusion, I would like to thank our board and management

for their on-going work under the direction of CEO Louis Coetzee. I

look forward to continued significant progress on the CompanyÕs

projects for the remainder of 2015 and beyond.

_________________________________

Christian Schaffalitzky

Chairman

Unaudited condensed consolidated interim statement of

comprehensive income

For the six months ended 30 June 2015

6 months to 6 months to 12 months to

30 June 30 June 31 December

2015 2014 2014

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Continuing Operations

Administrative expenses (851,620) (665,708) (1,500,757)

Exploration Expenditure (248,203) (389,764) (1,073,022)

Reversal of Impairment/

(Impairment of assets) - - 4,695,356

Bargain purchase on acquisition 185,698 - -

of subsidiary

------------ ------------ -------------

Operating (loss)/ profit (914,125) (1,055,472) 2,121,577

Investment and Other Income 234 - 3, 427

------------ ------------ -------------

(Loss)/ Profit before

tax (913,891) (1,055,472) 2,125,004

Tax - -

------------ ------------ -------------

Loss for the period (913,891) (1,055,472) 2,125,004

Other comprehensive income:

Exchange differences on

translating of foreign

operations, net of taxes 69,704 37,500 193, 550

Total comprehensive (loss)

/ profit for the period (844,187) (1,017,972) 2,318,554

------------ ------------ -------------

(Loss)/ Profit for the

period attributable to (913,891) (1,055,472) 2,125,004

------------ ------------ -------------

Owners of the parent (913,891) (1,055,472) 2,125,004

Non-controlling interest - -

------------ ------------ -------------

Total comprehensive (loss)

income attributable to (844,187) (1,017,972) 2,318,554

------------ ------------ -------------

Owners of the parent (844,187) (1,017,972) 2,318,554

Non-controlling interest - - -

------------ ------------ -------------

Basic (loss)/ earnings

per share (pence) (0.0029) (0.68) 0.01

Diluted (loss)/ earnings

per share (pence) (0.0029) (0.68) 0.01

Headline Loss per share

(pence) (0.0036) (0.68) (0.013)

Unaudited condensed consolidated interim statement of financial

position

As at 30 June 2015

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2015 2014 2014

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Assets

Non-current assets

Property, plant and equipment 27,394 4,401 3,761

Intangible assets 14,413,865 9,718,509 14,413,865

Total non-current assets 14,441,259 9,722,910 14,417,626

------------- ------------- --------------

Current assets

Trade and other receivables 844,143 59,594 11,557

Cash and cash equivalents 835,227 68,783 186,447

------------- ------------- --------------

Total current assets 1,679,370 128,377 198,004

------------- ------------- --------------

Total assets 16,120,629 9,851,287 14,615,630

------------- ------------- --------------

Equity

Called up share capital 13,191,116 11,370,993 12,591,750

Share premium 25,791,441 23,672,092 23,903,307

Translation reserve (331,281) (557,035) (400, 985)

Share options 510,978 977,543 510, 978

Retained deficit (23,143,417) (25,876,567) (22,229,526)

------------- ------------- --------------

Total equity 16,018,837 9,587,026 14,375,524

------------- ------------- --------------

Liabilities

Current liabilities

Trade and other payables 75,209 233,590 240, 146

Current tax liabilities 26,583 30,671 -

------------- ------------- --------------

Total current liabilities 101,792 264,261 240, 106

------------- ------------- --------------

Total equity and liabilities 16,120,629 9,851,287 14,615,630

------------- ------------- --------------

Condensed Consolidated Statement of Changes in Equity

Share Share Share based Foreign currency Total Retained Total

Capital premium payment translation reserve reserves deficit

reserve

----------------- ---------- ---------- ----------- -------------------------- ----------- ------------- --------------

GBP GBP GBP GBP GBP GBP GBP

---------- ---------- ----------- -------------------------- ----------- ------------- --------------

Balance as at 1

January 2014 10,998,282 23,398,853 977,543 (594,535) 383, 008 (24,821,095) 9,959,048

---------- ---------- ----------- -------------------------- ----------- ------------- --------------

Profit / (loss)

for the year - - - - - (1,055,472) (1,055,472)

Other

comprehensive

income- exchange

differences on

translating

foreign

operations - - - 37, 500 37, 500 - 37, 500

Proceeds of share

issue of share

capital 372,711 273, 239 - - 645, 950 - 645, 950

Share options - - - - - - -

acquired through

business

combinations

Share options - - - - - -

issued

---------- ---------- ----------- -------------------------- ----------- ------------- --------------

372, 711 273, 239 - 37, 500 37, 500 (1, 055, 472) (372, 022)

---------- ---------- ----------- -------------------------- ----------- ------------- --------------

Balance as at 30

June 2014 11,370,993 23,672,092 977,543 (557,035) 420, 508 (25,876,567) 9,587,026

Profit / (loss)

for the year - - - - - 3, 180, 476 3, 180, 476

Other

comprehensive

income (loss) -

exchange

differences - - - 156, 050 156, 050 - 156, 050

Reclassification

of share based

payment reserve

on expired share

options issued - - (466,565) - (466,565) 466,565 -

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 03:00 ET (07:00 GMT)

Proceeds of share

issue of share

capital 1,220, 757 231, 215 - - 1, 451, 972 - 1, 451, 972

1,220, 757 231, 215 (466,565) 156, 050 (310, 515) 2,591,569 4,416,476

---------- ---------- ----------- -------------------------- ----------- ------------- --------------

Balance at 31

December 2014 12,591,750 23,903,307 510,978 (400,985) 109, 993 (22,229,526) 14,375,524

========== ========== =========== ========================== =========== ============= ==============

Condensed Consolidated Statement of Changes in Equity

Share Share Share based Foreign currency Total Retained Total

Capital premium payment translation reserve reserves deficit

reserve

-------------- ---------- ---------- ----------- -------------------------- ---------- ------------ ----------

GBP GBP GBP GBP GBP GBP GBP

---------- ---------- ----------- -------------------------- ---------- ------------ ----------

Balance at 1

January 2015 12,591,750 23,903,307 510,978 (400,985) 109, 993 (22,229,526) 14,375,524

---------- ---------- ----------- -------------------------- ---------- ------------ ----------

Profit /

(loss) for

the year - - - - - (913,891) (913,891)

Other

comprehensive

income-

exchange

differences

on

translating

of foreign

operations - - - 69,704 69,704 - 69,704

Proceeds of

share issue

of share

capital 599,366 1,888,134 - - - - 2,487,500

599,366 1,888,134 - 69,704 69,704 (913,891) 1,643,313

---------- ---------- ----------- -------------------------- ---------- ------------ ----------

Balance as at

30 June 2015 13,191,116 25,791,441 510,978 (331,281) 179,697 (23,143,417) 16,018,837

Unaudited condensed consolidated interim statement of cash

flow

For the six months ended 30 June 2015

6 months to 6 months 12 months

to to

30 June 30 June 31 December

2015 2014 2014

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Profit/ (Loss) for the

period before taxation (913,891) (1,055,472) 2,125,004

Adjusted for:

Property, plant and equipment

non-cash movement 699 1,925 2, 565

Investment income (234) - (3, 427)

Foreign exchange loss/

(gain) 69,704 37,500 193,550

Movement of exploration

activities 248,203 389,764

(Reversal of impairment)/

Impairment of assets - - (4,695,356)

Bargain purchase from (185,698) - -

business combinations

Operating income before

working capital changes (781,217) (626,283) (2,377,664)

(Increase)/ Decrease

in trade and other receivables (832,587) (8,394) 39, 643

(Decrease)/ Increase

in trade and other payables (138,314) 3,511 (20, 644)

Cash flow from business 161,367 - -

combinations

------------ ------------ ------------

Net cash outflows from

operating activities (1,590,751) (631,166) (2,358,665)

Cash flows from investing

activities

Expenditure on exploration

activities (248,203) (389,764) -

Net cash used in investing

activities (248,203) (389,764) -

Cash flows from financing

activities

Proceeds from issue of

share capital 2,487,500 645,950 2, 097, 922

Investment Income 234 - 3, 427

------------ ------------ ------------

Net cash proceeds from

financing activities 2,487,734 645,950 2,101,349

Net increase in cash

and cash equivalents 648,780 (374,980) 257, 316

Cash and cash equivalents

at beginning of period 186,447 443,763 443,763

------------ ------------ ------------

Cash and cash equivalents

at end of period 835,227 68,783 186,447

------------ ------------ ------------

Notes to the unaudited condensed consolidated interim financial

statements

For the six months ended 30 June 2015

1. General information

Kibo Mining Plc ("the Company") is a public limited company

incorporated in Ireland. The Group financial statements consolidate

those of the Company and its subsidiaries (together referred to as

the "Group"). The Company's shares are listed on the AIM of the

London Stock Exchange and from the 30 May 2011 the Alternative

Exchange of the JSE Limited (ALTX). The principal activities of the

Company and its subsidiaries are related to the exploration for and

development of coal and other minerals in Tanzania.

2. Statement of Compliance and basis of preparation

The Financial Statements are for the six months ended 30 June

2015. They do not include all the information required for full

annual financial statements and should be read in conjunction with

the audited consolidated financial statements of the Group for the

period ended 31 December 2014, which were prepared under

International Financial Reporting Standards ("IFRS") as adopted by

the European Union ("EU").

The financial information is prepared under the historical cost

convention and in accordance with the recognition and measurement

principles contained within IFRS as endorsed by the EU.

The comparative amounts in the audited consolidated financial

statements include extracts from the Company's consolidated

financial statements for the period ended 31 December 2014. These

extracts do not constitute statutory accounts in accordance with

the Irish Companies Acts 1963 to 2015.

The fair value of assets acquired and liabilities assumed

relating to the above business combinations is subject to change

should additional information become available within the 12 month

re-measurement period from date of acquisition.

3. Loss per share

Basic, dilutive and Headline loss per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share is as follows:

6 months to 6 months 12 months

to to

30 June 30 June 31 December

2015 2014 2014

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (913,891) (1,055,472) 2,125,004

Weighted average number of

ordinary shares for the purposes

of basic and dilutive loss

per share (revised) 305,438,536 155,134,424 193,400,160

Basic loss per share (pence) (0.0029) (0.68) 0.01

Dilutive loss per share (pence) (0.0029) (0.68) 0.01

6 months 6 months 12 months

to to to

Reconciliation of Headline loss 30 June 30 June 31 December

per share

2015 2014 2014

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (913,891) (1,055,472) 2,125,004

Impairment of Goodwill (185,698) - -

Reversal of Impairment of Intangible

Assets - - (4,695,356)

------------ ------------ ------------

Headline loss per share (1,099,589) (1,055,472) (2,570,352)

------------ ------------ ------------

Weighted average number of ordinary

shares for the purposes of headline

loss per share (revised) 305,438,536 155,134,424 193,400,160

Headline loss per share (pence) (0.0036) (0.68) (0.013)

Headline earnings per share (HEPS) is calculated using the

weighted average number of ordinary shares in issue during the

period and is based on the earnings attributable to ordinary

shareholders, after excluding those items as required by Circular

2/2014 issued by the South African Institute of Chartered

Accountants (SAICA).

4. Called up share capital and share premium

Authorised share capital of the company is 200,000,000 ordinary

shares of 0.015 euro each and 3,000,000,000 deferred shares of

0.009 euro each.

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 03:00 ET (07:00 GMT)

Detail of issued capital is as follows:

Number of

Ordinary Nominal Share

shares Value Premium

GBP GBP

Balance at 1 January 2014 141,116,691 10,998,282 23,398,853

Shares issued in period

(net of expensed for cash) 30, 038, 000 372,711 273,239

Balance at 30 June 2014 171,154,691 11,370,993 23,672,092

Shares issued in period

(net of expensed for cash) 103, 074, 066 1,220, 757 231,215

Balance at 31 December 2014 274,238,757 12,591,750 23,903,307

-------------- ----------- -----------

Shares issued in period

(net of expensed for cash) 54,660,000* 599,366 1,888,134

-------------- ----------- -----------

Balance at 30 June 2015 328,898,757 13,191,116 25,791,441

-------------- ----------- -----------

*The number of additional ordinary shares issued during the

interim reporting period includes 4,090,000 ordinary shares which

were issued by the CompanyÕs broker, Hume Capital Limited, which

was placed under administration during the same period. The

ordinary shares have thus been forfeited in accordance with the

CompanyÕs articles of association, effective from 22 June 2015.

Contacts

+27 (0) 83 2606126 Kibo Mining Chief Executive Officer

Louis Coetzee plc

------------------- ------------------- -------------------- ------------------------

Andreas Lianos +27 (0) 83 4408365 River Group Corporate Adviser

and Designated Adviser

on JSE

------------------- ------------------- -------------------- ------------------------

Jon Belliss +44 (0) 207 382 Beaufort Securities Broker

8300 Limited

------------------- ------------------- -------------------- ------------------------

Oliver Morse +61 8 9480 2500 RFC Ambrian Nominated Adviser

Limited on AIM

------------------- ------------------- -------------------- ------------------------

Daniel Thšle +44 (0) 203 772 Bell Pottinger Investor and Media

2500 Relations

------------------- ------------------- -------------------- ------------------------

Kibo Mining - Notes to editors

Kibo Mining is listed on the AIM market in London and the AltX

in Johannesburg. The Company is focused on exploration and

development of mineral projects in Tanzania, and controls one of

Tanzania's largest mineral right portfolios. Tanzania provides a

secure and stable operating environment for the mineral resource

industry and Kibo Mining therein.

Kibo Mining holds a thermal coal deposit at Rukwa, which has a

significant JORC compliant defined resource (See Table 1 below),

and is developing a 250-350MW mouth-of-mine thermal power station,

the Mbeya Coal to Power Project (ÒMCPPÓ), previously called Rukwa

Coal to Power Project (ÒRCPPÓ), with an established management team

that includes Standard Bank as Financial Advisor. Kibo is

undertaking a Coal Mining Definitive Feasibility Study and a Power

Pre-Feasibility Study for the Mbeya project with an integrated

Coal-Power interim study report to be released in the near term. On

20(th) April 2015, Kibo signed a Joint Development Agreement for

the completion of the Definitive Feasibility Studies and

development of the MCPP with China based EPC contractor SEPCO

III.

The Company also has extensive gold focused interests including

Lake Victoria Goldfields and Morogoro projects. At Lake Victoria,

the Company has projects with a 550,000oz JORC compliant gold

Mineral Resource at Imweru Project (See Table 2 below) and a

168,000oz NI 43-101 compliant gold Mineral Resource at the Lubando

Project (See Table 3 below) in which the Company holds a 90%

attributable interest. The Company is currently undertaking a

Definitive Feasibility Study on its Imweru Project.

Kibo also holds the Haneti Project on which the latest technical

report confirms prospectivity for nickel, PGMs, gold and strategic

metals including lithium.

Kibo Mining further holds the Pinewood (coal & uranium)

project where the company has entered into a 50/50 Exploration

Joint Venture with Metal Tiger plc.

Finally the Company also holds the Morogoro (gold) project where

the company has also entered into a 50/50 Exploration Joint Venture

with Metal Tiger plc.

The Company's projects are located in the established and gold

prolific Lake Victoria Goldfields, the emerging goldfields of

eastern Tanzania and the Mtwara Corridor in southern Tanzania where

the Government has prioritised infrastructural development

attracting significant recent investment in coal and uranium. The

Company has a positive working relationship with the Tanzanian

government at local, regional and national levels and works hard to

maintain positive relationships with all communities where company

interests are held. The Company recognises the potential to enhance

the quality of life and opportunity for Tanzanian citizens through

careful development of its projects.

Updates on the Company's activities are regularly posted on its

website www.kibomining.com

Technical data

Rukwa Mineral Resource

Table 1 below presents a table showing the Mineral Resource

estimate for the Rukwa Coal Project. The table is taken from an NI

43 101-Compliant Report by GEMECS (Pty) Ltd dated April 2012.

Table 1

RUKWA COAL RESOURCE SUMMARY- GEMECS (Pty) Ltd

--------------------------------------------------------

SEAM NI 43-101 IN SITU

---------- ----------------- ---------- -------------

SEAM THICKNESS CLASS MILLION TONS

---------- ----------------- ---------- -------------

S4 1.14 Indicated 2.17

---------- ----------------- ---------- -------------

S3U 2.04 Indicated 6.92

---------- ----------------- ---------- -------------

S3L 2.3 Indicated 12.63

---------- ----------------- ---------- -------------

S2 3.45 Indicated 23.43

---------- ----------------- ---------- -------------

S1U 2.48 Indicated 7.34

---------- ----------------- ---------- -------------

S1L 2.92 Indicated 17.4

---------- ----------------- ---------- -------------

S0 1.08 Indicated 1.44

---------- ----------------- ---------- -------------

Total Indicated Resources 71.34

----------------------------- ---------- -------------

S4 1.31 Inferred 1.38

---------- ----------------- ---------- -------------

S3U 2.24 Inferred 2.94

---------- ----------------- ---------- -------------

S3L 2.27 Inferred 3.86

---------- ----------------- ---------- -------------

S2 3.42 Inferred 7.94

---------- ----------------- ---------- -------------

S1U 2.05 Inferred 6.5

---------- ----------------- ---------- -------------

S1L 3.15 Inferred 12.83

---------- ----------------- ---------- -------------

S0 1.06 Inferred 2.6

---------- ----------------- ---------- -------------

Total Inferred Resources 38.05

----------------------------- ---------- -------------

TOTAL RESOURCES *109.39

----------------------------- ---------- -------------

*Kibo holds 100% of the Rukwa Mineral Resource

Imweru Mineral Resource

Table 2 below presents a table showing the Mineral Resource

estimate for the Imweru Project at a base case economic cut-off

grade for the reporting of the resource of 0.4 g/t. The table is

taken from a JORC-Compliant Report by Tetra Tech EBA dated February

2014.

Table 2

Material Cut- Specific Metric Gold Contained

Area Type Classification off Gravity Tonnes Short Grade Gold Ounces

(g/t) (t) Tons (g/t) (troy)

========= ============= ================== ======== ============ ============ ============ ======== ===============

Laterite Indicated 0.40 2.50 131,000 144,000 1.785 8,000

============= ============================ ======== ============ ============ ============ ======== ===============

Saprolite Indicated 0.40 2.50 706,000 778,000 1.387 32,000

============= ============================ ======== ============ ============ ============ ======== ===============

Bedrock Indicated 0.40 2.89 1,895,000 2,089,000 1.043 64,000

============= ============================ ======== ============ ============ ============ ======== ===============

Central Total Indicated 0.40 2.77 2,732,000 3,012,000 1.168 103,000

========= ============= ================== ======== ============ ============ ============ ======== ===============

(MORE TO FOLLOW) Dow Jones Newswires

September 30, 2015 03:00 ET (07:00 GMT)

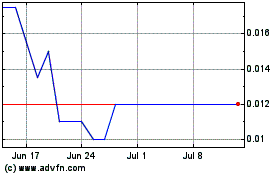

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024