Italy Approves Rescue Plan for Four Local Banks

November 22 2015 - 8:40PM

Dow Jones News

MILAN—The Italian government has approved a €3.6 billion

privately-funded rescue plan for four troubled small and midsize

local banks, applying newly enacted European rules on the

resolution of troubled lenders.

According to the plan approved on Sunday by Matteo Renzi's

government, four good banks and one single bad bank will be carved

out of lenders Cassa di risparmio di Ferrara SpA, Banca delle

Marche SpA, Banca popolare dell'Etruria e del Lazio SC and Cassa di

risparmio della Provincia di Chieti SpA.

Each of the four good banks will contain the healthy assets of

the different banks, while one single bad bank will contain those

banks' bad loans.

The plan comes at the end of a long period in which Italian

authorities tried to set the four banks on a path to recovery,

having replaced their management and having worked to recapitalize

the institutions and make them more profitable.

The Italian government and the Bank of Italy are now using

recently approved European rules to attempt to resolve the issues

at the banks, which had been severely hit by mounting bad loans and

lack the capital to absorb losses.

The Bank of Italy, who is overseeing the resolution of the four

banks, said that the losses of the four lenders have already been

partially absorbed by their shareholders and some of their

bondholders, as requested by the Bank Recovery and Resolution

Directive—the European law regulating the decision of the Italian

government.

The good banks will be recapitalized by a fund financed by the

country's lenders, the so-called Resolution Fund, to increase the

four banks' capital to a level equal to 9% of their risk-weighted

assets.

UniCredit SpA, Intesa Sanpaolo Spa and UBI Banca SpA will lend

the Fund the initial capital it needs to be immediately

operational, the Bank of Italy said.

These banks will all be chaired by Roberto Nicastro, a veteran

Italian banker who has recently left UniCredit SpA, where he was

general manager, and run by new managers appointed by the Bank of

Italy.

These managers are tasked with selling the good banks to "the

best bidders in a short time," the Bank of Italy said.

The bad bank will contain deteriorated loans of an overall

nominal value of €8.5 billion, which have been written down to €1.5

billion. It will either sell them or work to collect at least part

of them.

The Bank of Italy said the Resolution Fund will pay €1.7 billion

to cover for the original losses of the four banks and that it will

be able to recuperate only a small part of this money.

Then the Fund will hand out another €1.8 billion to recapitalize

the good banks, which it could get back when the banks are sold,

and €140 million to provide the bad bank with the necessary cash to

function.

Giada Zampano contributed to this article

Write to Giovanni Legorano at giovanni.legorano@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 22, 2015 20:25 ET (01:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

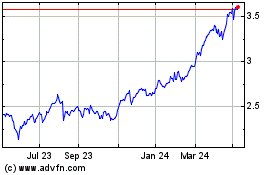

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Mar 2024 to Apr 2024

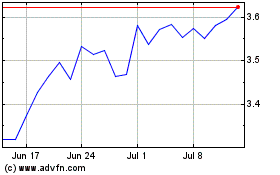

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Apr 2023 to Apr 2024