Indian Rupee Extends Rally Against U.S. Dollar After RBI's Surprise Rate Cut

January 15 2015 - 4:09AM

RTTF2

The Indian rupee extended its early rally against the U.S.

dollar in afternoon deals on Thursday, after the Reserve Bank of

India unexpectedly cut key rates, as weak inflation created scope

for policy manoeuvre.

The central bank lowered the repo rate to 7.75 percent from 8.00

percent, with immediate effect. The reverse repo rate was adjusted

to 6.75 percent from 7.00 percent.

This was the first reduction in nearly two years.

Inflation has been running below the RBI's target in recent

months, enabled by lower global crude oil prices, weaker demand

conditions globally and locally and the government's commitment

towards fiscal consolidation, the bank noted.

Regional stocks are also trading higher, with the benchmark

S&P BSE Sensex rising by 662.64 points or 2.42 percent at

28,009, while the broader CNX Nifty index up by 214.45 points or

2.59 percent at 8,492.

The rupee added 1.08 percent to hit 61.435 against the U.S.

dollar, its highest since November 24, 2014. At yesterday's close,

the pair was worth 62.11. The next possible resistance for the

rupee is seen around the 61.00 mark.

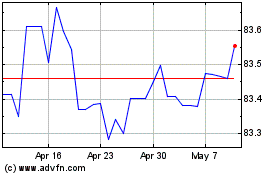

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

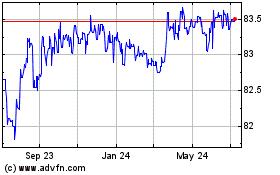

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024