TIDMIPO

RNS Number : 0418O

IP Group PLC

22 May 2015

FOR IMMEDIATE RELEASE 22 MAY 2015

IP Group plc - Director / PDMR Shareholding and Issue of

Equity

IP Group plc (LSE: IPO) ("IP Group" or "the Company" or "the

Group"), the developer of intellectual property-based businesses,

announces that it has issued 153,940 new ordinary shares of 2p each

(the "New Shares") following the exercise of nil-cost options

awarded under the Company's Deferred Bonus Share Plan ("DBSP

Options") by certain of the Company's executive directors and other

employees on 21 May 2015.

The DBSP Options were awarded on 15 April 2014 to reflect the

deferral of fifty per cent of each person's bonus under the Group's

Annual Incentive Scheme. Fifty per cent of the awards became

exercisable on the first anniversary of the date of grant and fifty

per cent shall become exercisable on the second anniversary of the

date of grant, generally subject to continued employment. The

remaining awards are exercisable for a maximum of three years from

the date of grant. Further details are set out in the Group's 2014

Directors' Remuneration Report.

As a result, the Company received notification from the

following Directors/Persons Discharging Managerial Responsibilities

in relation to the acquisition of New Shares and subsequent sale

on

21 May 2015, at an aggregate price of 213.8 pence per share, as

set out in the table below.

Resultant

beneficial

interest

------------------

Director/ DBSP Options Outstanding New Shares

PDMR Position exercised DBSP Options sold Shares %

-------------- ------------------ ------------- ------------- ----------- ---------- ------

Chief Executive

Alan Aubrey Officer 33,037 33,037 15,886 2,453,999 0.43%

Chief Investment

Mike Townend Officer 22,024 22,024 10,590 1,074,504 0.19%

Chief Financial

Greg Smith Officer 15,593 15,593 7,498 330,233 0.06%

Angela Company

Leach Secretary 15,593 15,593 7,498 223,918 0.04%

The New Shares sold by the above-named persons discharging

managerial responsibilities ("PDMRs") were done so to meet the

income tax and national insurance liabilities arising on the

exercise of the DBSP Options with the balance of New Shares being

retained by each PDMR.

An application has been made to the Financial Conduct Authority

for admission of the New Shares to the premium listing segment of

the Official List maintained by the UK Listing Authority and to the

London Stock Exchange. It is expected that admission will take

place on 28 May 2015.

Following the issue of New Shares, the Company has 564,619,369

ordinary shares in issue.

Long Term Incentive Plan Awards

In addition, the Group has made conditional awards of 1,320,122

ordinary shares of two pence each ("Shares") to its executive

directors, other persons discharging managerial responsibilities

and certain other employees under its Long Term Incentive Plan (the

"LTIP").

Conditional awards have been made to the executive directors and

PDMRs totalling 491,362 as follows:

Executive Director/PDMR Maximum number Maximum number

of Shares conditionally of conditionally

awarded awarded Shares

outstanding at

the date of this

announcement

Alan Aubrey 124,751 415,032

David Baynes 99,801 663,435*

Mike Townend 99,801 332,027

Greg Smith 89,409 264,846

Angela Leach 77,600 261,587

* includes 446,000 Shares conditionally awarded under the former

Fusion IP plc LTIP scheme

The number of Shares stated is the maximum number that could be

issued to each executive director or PDMR upon full satisfaction of

the performance conditions attaching to the awards.

In addition to the above, awards over a total of 828,760 Shares

were made to certain other of the Group's employees under the

LTIP.

The performance measures attaching to the 2015 LTIP awards are

based on the achievement of targets linked to growth in the

Company's "hard" net assets and total shareholder return as

described in the Directors' Remuneration Report of the 2014 Annual

Report and Accounts.

Assuming satisfaction of the conditions in full, the awards will

ordinarily vest on or after 31 March 2018 and the Shares will be

issued as soon as practicable after these dates. Any such Shares

would be subject to a minimum two-year post-vesting holding

period.

As at the date of this announcement, a total of 3,418,471 Shares

conditionally awarded to executive directors, PDMRs and employees

of IP Group remain outstanding and subject to performance

conditions.

For more information, please contact:

IP Group plc www.ipgroupplc.com

Alan Aubrey, Chief Executive +44 (0) 20 7444

Officer 0050

Greg Smith, Chief Financial +44 (0) 20 7444

Officer 0050

+44 (0) 20 7444

Vicki Bradley, Communications 0062

FTI Consulting

James Melville-Ross/Simon

Conway/

Victoria Foster Mitchell +44 (0)20 3727 1000

Notes for editors

About IP Group

IP Group is a leading UK intellectual property commercialisation

company, developing technology innovations primarily from its

research intensive partner universities. The Group offers more than

traditional venture capital, providing its companies with access to

business building expertise, networks, recruitment and business

support.

IP Group's portfolio comprises holdings in around 90 early-stage

to mature businesses across the Healthcare, Biotech, Cleantech and

Technology sectors. These businesses include Oxford Nanopore

Technologies, the DNA sequencing development company, Revolymer,

best known for its removable chewing gum, and Xeros, which has

received many accolades for its revolutionary clothes washing

techniques with a much reduced requirement for water.

For more information, please visit our website at

www.ipgroupplc.com.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

RDSPGUPUAUPAGUP

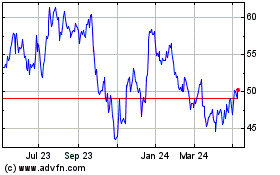

Ip (LSE:IPO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ip (LSE:IPO)

Historical Stock Chart

From Apr 2023 to Apr 2024