TIDMHOC

RNS Number : 7056V

Hochschild Mining PLC

20 April 2016

20 April 2016

Production Report for the 3 months ended 31 March 2016

Operational highlights

-- Q1 2016 attributable production exceeding budgeted mine

plans

o 3.7 million ounces of silver

o 51.1 thousand ounces of gold

o 7.4 million silver equivalent ounces, up 79% versus Q1 2015

(4.2 million ounces)

-- Inmaculada mine produced 47.2 thousand gold equivalent

ounces

o 34.0 thousand ounces of gold

o 1.0 million ounces of silver

o 3.5 million silver equivalent ounces

-- 2016 all-in sustaining costs per silver equivalent ounce on

track to meet $12.0-12.5 guidance

Improving financial position

-- Total cash of approximately $105 million as at 15 April

2016

-- Net debt of approximately $345 million as at 15 April

2016

-- Current Net debt/LTM EBITDA ratio of approximately 1.8x (31

December 2015: 2.5x)

-- Argentina macroeconomic & tax reforms significantly

improving San Jose cash flows

-- Cashflow further protected by 2016 precious metal hedges -

45% of production sold forward

Ignacio Bustamante, Chief Executive Officer commented:

"We have once again delivered a strong start to the year at all

our mines in what is budgeted as the lowest quarter of production.

Output is scheduled to increase through the rest of the year and we

are firmly on track to reach our full year production target of 32

million silver equivalent ounces. Our flagship mine, Inmaculada

continues to operate efficiently at a very competitive cost and we

remain excited by the potential in the surrounding district where

we will commence a drilling programme later in the year as part of

our Company-wide 2016 brownfield exploration plan. Our cash balance

has now grown to beyond the $100 million level and with the recent

relative strength in prices, our leverage ratio is currently

running at approximately 1.8x Net Debt to EBITDA for the year."

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Wednesday 20 April 2016 for analysts and investors.

Dial in details as follows:

International Dial in: +44 (0) 20 3139 4830

UK Toll-Free Number: +44(0) 808 237 0030

Pin: 41037930#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 (0) 20 3426 2807

UK Toll Free: +44(0) 808 237 0026

Pin: 669622#

__________________________________________________________________________________

Overview

In Q1 2016, the Company delivered attributable production of 3.7

million ounces of silver and 51.1 thousand ounces of gold.

As per Company guidance, the first quarter of the year is always

the lowest due to the sequencing of the annual mine plans and

scheduled hourly workers' vacation in Argentina. However,

production was slightly ahead of budget due to a better than

expected performance in March across all operations and is also up

79% versus the first quarter of 2015.

The Company can report that its all-in sustaining costs per

silver equivalent ounce are on track to fall to between 12.0 to

$12.5 in 2016.

Production

Inmaculada

Inmaculada delivered a very smooth start to the year with gold

production at 34,000 ounces and silver production of 974,000 ounces

(silver equivalent production of 3.5 million ounces), driven by

better than expected gold grades and silver recoveries.

Arcata

At Arcata, silver production in the first quarter was 1.4

million ounces with gold production of 4,700 ounces which results

in silver equivalent production of 1.7 million ounces, a 12%

improvement on the first quarter of 2015 (Q1 2015: 1.5 million

ounces). This was driven by better than expected mined tonnage

resulting from the success of the Company's 2015 brownfield

exploration programme in addition to higher silver recoveries.

Pallancata

At Pallancata, as expected, tonnage through the plant in the

first quarter was lower than the average 2015 rate with the

operation entering a transitionary period before the introduction

of feed from the new Pablo vein towards the end of the year.

Production was 615,000 ounces of silver and 3,100 ounces of gold

bringing the silver equivalent total to 841,000 ounces (Q1 2015:

1.2 million).

San Jose

In what is a shorter period of operation due to scheduled hourly

workers vacation in February, the San Jose operation delivered

another solid quarter in line with the corresponding period of 2015

with lower than expected tonnage offset by higher grades. Silver

production was 1.4 million ounces and gold production was 18,280

ounces resulting in silver equivalent production of 2.7 million

ounces (Q1 2015: 2.7 million ounces).

Average realisable prices and sales

Average realisable precious metal prices in Q1 2016 (which are

reported before the deduction of commercial discounts and include

the effects of the existing hedging agreements) were $1,266/ounce

for gold and $16.2/ounce for silver (Q1 2015: $1,247/ounce for gold

and $17.6/ounce for silver).

Brownfield exploration

Due to the rainy season in Peru, exploration programmes were not

scheduled to commence until the second quarter.

At Arcata, a 7,000 metre drilling programme is planned to

incorporate additional resources from the Tunel 4, Marion and

Alexia veins with the Q2 programme expected to consist of drilling

at the Paralela 1 zone and to the north of the Tunel 4 vein.

At Pallancata, the main focus has been on mine development to

access the Pablo vein with the Company currently on track to

realise initial production from Pablo towards the end of the year.

The focus of the brownfield exploration programme will be a 5,500

metre drilling programme to add resources in from the Pablo and

Yurica veins as well as a surface drilling campaign at Yanacohita

Norte in Q2. Geological mapping of the Pallancata-Selene area will

also be carried out.

At San Jose, surface drilling is scheduled for the second

quarter at the Aguas Vivas and Cerro Colorado Grande areas.

Financial position

Total cash was approximately $105 million with net debt of

approximately $345 million as at 15 April 2016.

On 11 February 2016, the Group signed a zero cost collar

contract with JP Morgan Chase Bank over three million ounces of

silver at a call/put price of US$17.60 and US$14.00 per ounce, from

12 February to 30 December 2016. In addition, on 12 February 2016,

the Group signed a commodity swap contract with Citibank to hedge

15,000 ounces of gold at a price of US$1,244.25 per ounce from 12

February to 30 December 2016. These agreements are in addition to

previous agreements for 2016 to hedge the sale of 29,000 ounces of

gold at $1,145 per ounce, 6.0 million ounces of silver at $15.93

per ounce and 71,000 ounces of gold at a price of $1,154 per

ounce.

Outlook

The Company is on track to achieve its full year production

target of 32.0 million attributable silver equivalent ounces with

all-in sustaining cost per silver equivalent ounce expected to be

between $12 to $12.5 in line with guidance.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3714 9040

Head of Investor Relations

Hudson Sandler

Charlie Jack +44 (0)207 796 4133

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

PRODUCTION & SALES INFORMATION*

TOTAL GROUP PRODUCTION

Q1 Q4 Q1 12 mths

2016 2015 2015 2015

----------------------- ------- ------- ------------ --------

Silver production

(koz) 4,329 5,322 3,523 18,037

Gold production

(koz) 60.04 82.87 26.66 213.37

Total silver

equivalent (koz) 8,772 11,454 5,496 33,827

Total gold equivalent

(koz) 118.54 154.78 74.27 457.12

Silver sold

(koz) 4,471 5,866 3,348 17,263

Gold sold (koz) 62.54 96.61 25.64 187.39

----------------------- ------- ------- ------------ --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q1 Q4 Q1 12 mths

2016 2015 2015 2015

------------------- ------- ------- -------- --------

Silver production

(koz) 3,662 4,345 2,879 14,752

Gold production

(koz) 51.08 68.44 17.20 166.02

Silver equivalent

(koz) 7,442 9,410 4,152 27,037

Gold equivalent

(koz) 100.56 127.16 56.11 365.37

------------------- ------- ------- -------- --------

Attributable production includes 100% of all production from

Arcata, Inmaculada, Pallancata and 51% from San Jose.

QUARTERLY PRODUCTION BY MINE

(MORE TO FOLLOW) Dow Jones Newswires

April 20, 2016 02:00 ET (06:00 GMT)

ARCATA

Product Q1 Q4 Q1 12 mths

2016 2015 2015 2015

------------------- -------- ------------ -------- --------

Ore production

(tonnes treated) 161,092 184,994 145,551 648,051

Average grade

silver (g/t) 309 288 330 323

Average grade

gold (g/t) 1.13 1.03 0.97 0.99

Silver produced

(koz) 1,377 1,453 1,287 5,613

Gold produced

(koz) 4.68 4.58 3.47 15.67

Silver equivalent

(koz) 1,724 1,792 1,544 6,772

Silver sold

(koz) 1,349 1,798 1,057 5,653

Gold sold (koz) 4.43 5.30 2.85 15.29

------------------- -------- ------------ -------- --------

INMACULADA

Product Q1 Q4 Q1 12 mths

2016 2015 2015 2015

------------------- ------------------ ------------ -------- ------------------

Ore production

(tonnes treated) 280,530 329,925 - 659,737

Average grade

silver (g/t) 121 118 - 115

Average grade

gold (g/t) 4.05 4.57 - 4.36

Silver produced

(koz) 974 1,084 - 2,055

Gold produced

(koz) 34.02 45.11 - 84.64

Silver equivalent

(koz) 3,492 4,423 - 8,318

Silver sold

(koz) 882 1,546 - 1,638

Gold sold (koz) 31.91 3.64 - 67.51

------------------- ------------------ ------------ -------- ------------------

PALLANCATA

Product Q1 Q4 Q1 12 mths

2016 2015 2015 2015

------------------- ------- ------------- -------- --------

Ore production

(tonnes treated) 69,423 107,320 148,722 522,431

Average grade

silver (g/t) 324 272 229 259

Average grade

gold (g/t) 1.69 1.40 1.08 1.28

Silver produced

(koz) 615 791 922 3,664

Gold produced

(koz) 3.05 3.74 3.89 16.42

Silver equivalent

(koz) 841 1,068 1,210 4,879

Silver sold

(koz) 559 918 851 3,632

Gold sold (koz) 2.74 4.27 3.48 15.80

------------------- ------- ------------- -------- --------

SAN JOSE

Product Q1 Q4 Q1 12 mths

2016 2015 2015 2015

------------------- -------- ------------ -------- --------

Ore production

(tonnes treated) 101,937 154,642 108,771 532,488

Average grade

silver (g/t) 470 453 428 448

Average grade

gold (g/t) 6.27 6.63 6.20 6.36

Silver produced

(koz) 1,362 1,994 1,315 6,706

Gold produced

(koz) 18.28 29.44 19.29 96.64

Silver equivalent

(koz) 2,715 4,172 2,742 13,857

Silver sold

(koz) 1,681 1,604 1,439 6,340

Gold sold (koz) 23.46 23.17 19.31 88.79

------------------- -------- ------------ -------- --------

The Company has a 51% interest in San Jose.

*Silver equivalent production assumes the average gold/silver

ratio for 2015 of 74:1 unless otherwise stated.

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

- ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRFEAKLNFSXKEFF

(END) Dow Jones Newswires

April 20, 2016 02:00 ET (06:00 GMT)

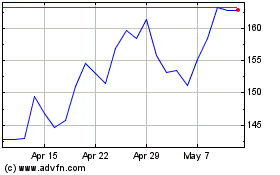

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024