By Annie Gasparro

Hershey Co. Chief Executive J.P. Bilbrey announced plans Friday

to step down, following months of failed negotiations to sell the

company to Mondelez International Inc., making him the third person

to leave the candy maker's top job in the past decade.

Mr. Bilbrey, 60, will retire as chief executive next July to

spend more time with his family but remain as chairman, he said.

Hershey said it is searching for a successor.

The leadership shake-up comes seven weeks after Oreo cookie

maker Mondelez ended its pursuit of the chocolate company. Hershey

rejected two bids from Mondelez over the summer, hoping for a

higher price for iconic brands like Reese's peanut butter cups and

chocolate Kisses.

Two people close to the company's controlling shareholder, the

Hershey Trust Co., said trying to negotiate a deal could have

raised tensions between Mr. Bilbrey and members of the trust's

board who opposed a sale.

The trust said Friday that Mr. Bilbrey "guided the Hershey Co.

with sound judgment and good business sense." A Hershey spokeswoman

said Mr. Bilbrey chose to leave his job and wasn't under pressure

from the trust.

"While there is never a best time for a leadership transition, I

do believe now is the right time to start the process," Mr. Bilbrey

wrote in an email to Hershey employees Friday.

But the timing of his departure comes as the Pennsylvania-based

chocolatier attempts to evolve into a more diversified snack

company and the trust's board looks to avoid extra attention,

months after state regulators concluded an investigation into their

handling of Hershey dividends.

Hershey's disbursements and the trust's other investments

generate billions of dollars in revenue for a boarding school for

poor children in Hershey, Pa., as well as other charitable

endeavors. The Pennsylvania Attorney General this year investigated

whether the trust's board members were receiving excessive

compensation or ignoring conflicts of interest over some of the

trust's beneficiaries.

The Attorney General and the trust reached a settlement in July,

agreeing to make governance changes including the resignation of

several board members. James Nevels, who agreed to step down from

the trust at the end of the year, has sat on the trust board and

the Hershey board since 2007. Hershey said Friday that he won't

stand for re-election on the company's board either.

The trust could install one of its current board members to fill

Mr. Nevels's spot as a company director. Back in 2007, the trust

installed eight of its own picks as Hershey directors, flexing its

muscles in front of an new, incoming CEO.

The Wall Street Journal has reported that disagreements with the

trust contributed to the departure of Hershey's two previous

CEOs.

David J. West stepped down in 2011, in part over a disagreement

with the trust over whether to bid for Cadbury PLC. Mr. West's

predecessor, Richard Lenny, stepped down in 2007 after multiple

clashes with the trust's board. In one instance, the trust blocked

a potential deal that Mr. Lenny pursued with Wm Wrigley Jr. Co. in

2002 after the state attorney general fought against it.

Both Mr. West and Mr. Lenny left their posts within three months

of their announced departure.

Mr. Bilbrey, who joined Hershey from Danone in 2003 and replaced

Mr. West as chief executive in 2011, encouraged the negotiations

with Mondelez that began earlier this year. He said in a letter to

employees that Hershey needs to move "beyond core confection into

broader snacking categories."

Hershey didn't make Mr. Bilbrey available for comment on Friday.

"Luckily for me at least, July is a long way away, and until then I

will remain involved with the business with the support of a great

management team," he wrote in his email to Hershey employees.

Some corporate-governance specialists questioned why he would

announce his exit so far in advance if his family's concerns were

pressing.

Roger Dennis, dean of Drexel University's law school, said he

suspected conflicts within the trust crimped Mr. Bilbrey's

effectiveness in the boardroom.

"A CEO's ability to be a strategic leader of the entity has to

be difficult in this context," Mr. Dennis said.

Edward Jones analyst Jack Russo said the change in leadership

doesn't make a sale of the company more likely. Some people view

Hershey as unsalable because of the trust's strong control and

because any deal would also essentially require approval from

Pennsylvania's attorney general.

Hershey said it would review internal and external candidates

for chief executive. Industry analysts expect Hershey's Chief

Operating Officer and head of North America Michele Buck to be the

leading contender.

Ms. Buck, who joined Hershey in 2005, has more than two decades

of experience in branding and marketing at Frito Lay, Kraft,

Nabisco and Hershey. Hershey promoted Ms. Buck to chief operating

officer in June, adding Hershey's operations in Central and South

America to her responsibilities.

Mr. Bilbrey's departure also reflects challenging times for

candy makers. Chocolate and candy sales in the U.S. are under

pressure from consumers' turn toward healthier foods. Hershey

recently introduced dried meat bars, made from dried meats and a

combination of other ingredients such as mangos, cranberries and

quinoa.

The company on Friday reaffirmed its full year outlook and plans

to report quarterly earnings later this month. Shares of the

company rose 78 cents to $96.43; before Friday, the stock had

gained 1.4% over the past year.

--Joann S. Lublin and Austen Hufford contributed to this

article.

Write to Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

October 15, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

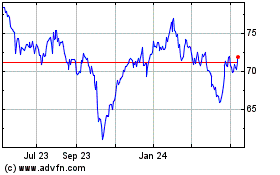

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

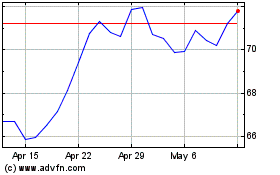

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Apr 2023 to Apr 2024