HSBC’s Global Value of Education Report found

that US Parents Spend on average more than $58,000 on their

Children’s Education from Primary School through College

US parents have high aspirations for their children, with more

than 84% parents expressing confidence that their child will have a

bright future. In fact, HSBC’s global Value of Education report

found 87% of parents confirmed that they are ready to make personal

sacrifices so that their children can succeed. To support their

child’s education, nearly a quarter of parents (24%) have forfeited

‘me time’ and 17% have either drastically reduced or completely

stopped leisure activities or holidays.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20170912006279/en/

It’s clear that parents see their children’s education as an

essential investment in their future, but it can be costly. US

parents are spending an average of $58,464 on their child’s

education from primary school through undergraduate university

level. This is much steeper than the overall global average of

$44,221, based on the fifteen countries surveyed as part of this

research. Even with these steep costs American parents do not top

the list. For example, in Hong Kong, parents are spending an

average of $132,161 for their child’s education, roughly 126% more

than US parents are spending.

“Parents are willing to go to great lengths to help their

children get the best possible start in life,” said Pablo Sanchez,

HSBC’s Head of Retail Banking and Wealth Management for the US and

Canada. “They understand that education is paramount in today’s

highly competitive job market, and are willing to make personal,

lifestyle and financial sacrifices to ensure their child receives

the education necessary that will set them up for success in the

future.”

In order to pay for education, many US parents are making or

have made financial sacrifices including reducing their spend on

leisure activities (30%), working longer hours in their existing

job (20%), contributing less to their own long-term savings or

investments (18%) and taking on a job/second job (14%) to help fund

their child’s education.

In the US, most parents are helping to fund their child’s

current stage of education, with 84% contributing towards their

child’s elementary school education, 76% towards high school and

73% towards college or university education. While parents are

willing to support their children many are not planning ahead for

the significant education costs. Three-fifths of US parents (60%)

are using their day-to-day income, while 34% are using general

savings, investments or insurance and even fewer parents (24%) are

funding their child’s education through a specific education

savings or investment plan.

Additionally, in the US two in five parents wish they had

started saving earlier, while 35% wish they had put more money

aside for their child’s education, and 15% wish they had taken

professional financial advice.

“It’s easy to underestimate the full and long-term costs of

educating a child, so it’s important for parents to start planning

early, to be realistic about costs and to prepare for the long

term,” added Michael Boardman, HSBC’s US Head of Wealth Management.

“Doing so will help to reduce the strain that education can have on

family finances. Seeking professional advice can help parents make

more informed choices and develop a longer term financial

plan.”

Additional Findings

Digital Learning: The majority (87%) of US parents are

aware of online degree programs and 67% say they would consider a

university degree for their child that is either completely online

or incorporates some online courses/modules, with a third (33%)

saying they would consider a degree that is completely online. In

contrast, 73% of parents surveyed worldwide are aware of online

degrees, and 60% would consider a degree that is completely or

partly online.

Studying Abroad an Essential Experience: In today’s

globalized world, a university education in a different country is

a real option, with 36% of US parents saying they would consider a

university education abroad for their child. And, of parents who

would consider university education abroad for their child, the UK

is their most popular choice: 37% would consider sending their

child to a UK university, with France and Canada tied as the second

most popular choices at 36%.

The US is a Top Destination: Of parents who would

consider sending their children abroad for a university education,

many have a preferred country in mind where they would like their

child to study. The US is the most popular choice overall for

parents outside of the US. Nearly half (47%) of these parents would

consider sending their child to university in the USA, and it is

the most favored destination for parents in Taiwan (70%), China

(61%) and Canada (61%). Australia (40%) is the second most popular

choice and the UK (39%) is the third most popular choice.

Notes to Editors:

Spending on Education (methodology)

To calculate spending on education, parents who are currently

contributing to funding any aspects (e.g. school/university fees,

educational books, transport, accommodation) of their child’s

primary, secondary and tertiary education (up to undergraduate

level) were asked approximately how much they contribute each

year.

The average yearly amount spent by parents on each stage of

education in each country was multiplied by the typical length of

each educational stage in that country, to derive the total amount

spent on a child’s education.

The exchange rates used are based on the NZForex 2016 average

yearly rate.

About This Report

The Value of Education is an independent consumer research study

into global education trends, commissioned by HSBC. Higher and

higher, the fourth report in the series, was published in June 2017

and represents the views of 8,481 parents in 15 countries and

territories around the world: Australia, Canada, China, Egypt,

France, Hong Kong, India, Indonesia, Malaysia, Mexico, Singapore,

Taiwan, UAE, UK and USA.

The findings are based on a sample of parents with at least

one child aged 23 or younger currently (or soon to be) in

education, drawn from nationally representative online panels in

each country or territory. At least 500 parents (including 150 with

a child at university or college), were surveyed in all countries.

In the UK, 1,001 parents (including 202 with a child at university

or college) were surveyed. In China, 946 parents (including 504

from the Pearl River Delta region) were surveyed.

The research was conducted online by Ipsos MORI in February

2017, with interviews in Egypt conducted face-to-face.

To view the full report, go here.

HSBC Bank USA, National Association (HSBC Bank USA,

N.A.), with total assets of US$191.9bn as of 30 June 2017 (US

GAAP), serves customers through retail banking and wealth

management, commercial banking, private banking, asset management,

and global banking and markets segments. It operates 229 bank

branches throughout the United States. There are 146 in New York as

well as branches in: California; Connecticut; Delaware; Washington,

D.C.; Florida; Maryland; New Jersey; Pennsylvania; Virginia; and

Washington. HSBC Bank USA, N.A. is the principal subsidiary of HSBC

USA Inc., a wholly-owned subsidiary of HSBC North America Holdings

Inc. HSBC Bank USA, N.A. is a Member of the FDIC.

HSBC Holding plc, the parent company of HSBC, is

headquartered in London. HSBC serves customers worldwide from

approximately 4,000 offices in 70 countries and territories in our

geographical regions: Europe, Asia, North America, Latin America,

and Middle East and North Africa. With assets of $2,416bn at 31

March 2017, HSBC is one of the world’s largest banking and

financial services organizations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170912006279/en/

Media:HSBCMatt Klein,

212-525-4644matt.klein@us.hsbc.comorSteve Goewey,

212-525-5677stephen.x.goewey@us.hsbc.com

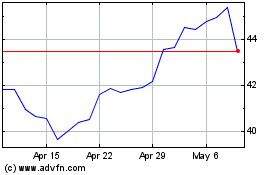

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

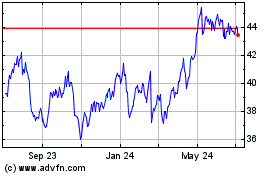

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024