HSBC Plans Further Buyback After 4th-Quarter Net Loss Widens to $4.23 Billion

February 21 2017 - 12:29AM

Dow Jones News

By Margot Patrick and Joanne Chiu

HSBC Holdings PLC (0005.HK) plans to buy back additional $1.0

billion of shares, bringing the program's total size to $3.5

billion since the second half of 2016.

The Asia-focused bank said Tuesday said that it expected the

latest buyback round to be completed in the first half of 2017.

The measures comes as the lender reported a $4.23 billion net

loss in the fourth quarter after having posted a $1.33 billion net

loss in the year-ago period.

It declared a final dividend of 21 cents a share, in line with

expectations.

Analysts have projected the bank this year or next could raise

its dividend or buy back more shares as excess capital accrues.

HSBC's Hong Kong-listed stock showed signs of profit-taking.

Shares were down 0.3% at midday before the bank released results.

The stock had gained around 49% as of Monday since its recent

trough in mid-June, mainly on expectations that future U.S.

interest-rate rises will lift margins and revenue.

The bank has undergone a major restructuring since 2011, exiting

from most of Latin America and placing more focus on Asia. It faces

potential business and economic effects from the U.K.'s decision to

leave the European Union as well as potential hits to global trade

during the administration of U.S. President Donald Trump. The U.K.

and Hong Kong are the bank's two biggest markets.

Revenue in the fourth quarter was $8.98 billion, down 24% from a

year earlier. Its pretax loss in the fourth quarter was $3.45

billion, widening from $858 million a year ago.

The global banking major's full-year net profit was $1.30

billion, compared with a net profit of $12.6 billion a year ago.

Full-year revenue fell more than 19% to $47.97 billion.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

February 21, 2017 00:14 ET (05:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

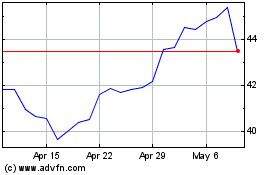

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

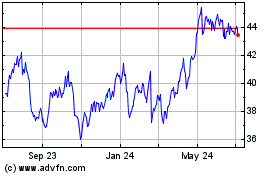

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024