TIDMGEMD

RNS Number : 4013Y

Gem Diamonds Limited

17 May 2016

17 May 2016

GEM DIAMONDS LIMITED

Trading update for Q1 2016

Gem Diamonds Limited (LSE: GEMD) ("Gem Diamonds" or the

"Company" or the "Group") is pleased to provide the following

Trading Update detailing the Group's operational performance for

the Period 1 January 2016 to 31 March 2016 ("Q1 2016") or (the

"Period") and sales performance to the date of this report.

Letšeng:

Strong start to the year with production in line with plan.

Prices steady for higher quality goods.

-- Recovered 28 698 carats during the Period (reflecting a 28%

increase on the first quarter of 2015).

-- Ore treated was 1 624 964 tonnes (up 14% on Q1 2015).

-- Recovered grade was 1.77cpht (up 12% on Q1 2015).

-- Average price of US$ 1 938(1) per carat achieved for first

three tenders in 2016 (US$ 2 157(1) for the first three tenders of

2015).

-- Zero Lost Time Injuries (LTIs) for the Period, resulting in

522 consecutive LTI free days to the end of the Period.

[1] (Refer to section 2.2 "Rough Diamond Sales and Diamonds

Extracted for Manufacturing" for further details.)

Ghaghoo:

Production slowdown and cost reduction plan implemented.

-- Downsizing process advanced.

-- Buffer zone successfully created to contain sand ingress.

-- Development of production block 2 on Level 1 is progressing well.

-- 47 diamonds greater than 4.8 carats each were recovered

during the Period, including 3 diamonds larger than 10.8 carats,

with the largest being a 12.99 carat diamond.

-- Recovered 11 029 carats during the Period

-- Achieved US$ 160 per carat for the parcel sold in the Period.

Financial:

Strong Balance Sheet maintained. Ordinary and special dividend

subject to shareholder approval at the Company's AGM in June.

-- The Group had US$ 68.8 million cash on hand at the end of the

Period (excluding the receipts from the third tender), of which US$

60.6 million was attributable to Gem Diamonds.

-- During the Period, the Board recommended a dividend of 5 US

cents per ordinary share (US$ 6.9 million) to shareholders

following the announcement of the 2015 Full Year results on 15

March 2016. The payment is to be made on 14 June 2016 to holders of

ordinary shares on the register at close of business on 13 May

2016.

-- The Board also recommended a once off special dividend of 3.5

US cents per ordinary share (US$ 4.8 million) to shareholders.

-- During the Period, Letšeng paid dividends of US$ 20.8

million, which resulted in a net cash flow of US$ 13.1 million to

Gem Diamonds and a cash outflow from the Group as a result of

withholding taxes of US$ 1.5 million and payment of the Government

of Lesotho's dividend portion of US$ 6.2 million.

Gem Diamonds' CEO, Clifford Elphick commented:

"The prices achieved for Letšeng's top quality and large

diamonds have remained steady and have contributed to an average

price of US$ 1 938 per carat for the first three Letšeng

tenders.

At Ghaghoo the downsizing of the operation is advanced and the

buffer zone around the sand ingress has been successfully created.

Development of the second production block on Level 1 has

progressed well and will be the main source of ore for the

remainder of the year. A parcel of 14 114 carats of Ghaghoo

diamonds was sold during the Period for an average of US$ 160 per

carat, which is some 7 percent above the previous price achieved in

December 2015"

1. Diamond Market Overview

Positive actions taken by the major diamond producers (i.e.

reduced supply, reduction of prices of rough diamonds and concerted

consumer marketing efforts) have led to an overall steady sentiment

in the diamond market in the first quarter of 2016. Although there

have been signs of improvement in the first quarter of 2016, the

diamond market as a whole remained cautious during the Period. The

continued slowdown in Chinese retail demand, a strong US dollar and

reports of continued high levels of polished inventory

(particularly in the manufacturing sector) have contributed to a

cautious approach being adopted in the purchasing of rough and

polished diamonds.

2. Letšeng

Gem Diamonds holds a 70% shareholding in Letšeng Diamonds (Pty)

Ltd ("Letšeng") in partnership with the Government of the Kingdom

of Lesotho which owns the remaining 30%.

2.1 Production

Q1 2016 Q4 2015 QoQ Q1 2015 YoY

% Change % Change

------------------------- ---------- ---------- ---------- ---------- ----------

Waste stripped (tonnes) 7 056 303 6 401 631 10% 5 299 922 33%

------------------------- ---------- ---------- ---------- ---------- ----------

Ore treated (tonnes) 1 624 964 1 810 935 -10% 1 427 656 14%

------------------------- ---------- ---------- ---------- ---------- ----------

Carats recovered 28 698 29 100 -1% 22 472 28%

------------------------- ---------- ---------- ---------- ---------- ----------

Grade recovered (cpht) 1.77 1.61 10% 1.57 12%

------------------------- ---------- ---------- ---------- ---------- ----------

During the Period, 7.1 million tonnes of waste were mined. This

is in line with the revised life of mine plan which allows for

increased levels of higher grade ore from the higher value

Satellite Pipe to be mined annually. Due to seasonal rain impacting

access to ore and treatment rates, there was a reduction to the

tonnage treated when compared to the previous Quarter.

Letšeng's Plants 1 and 2 treated a total of 1.4 million tonnes

of ore during the Period, of which 64% was sourced from the Main

Pipe and 36% from the Satellite Pipe. The balance of the ore (0.2

million tonnes) for the Period was treated through the Alluvial

Ventures Plant which was sourced from the Main pipe and low grade

stockpiles. The increase of the grade recovered is reflective of

the area mined in the Satellite Pipe that has historically produced

higher than reserve grades albeit at a slightly smaller average

stone size, which contributed to a lower average $ per carat for

the Period.

2.2 Rough Diamond Sales and Diamonds Extracted for Manufacturing

First three tenders 2016** Q4 2015 QoQ First three tenders 2015* YoY

(2 tenders)* % Change % Change

--------------------- --------------------------- -------------- ---------- -------------------------- ----------

Carats sold 45 311 30 357 49% 35 940 26%

--------------------- --------------------------- -------------- ---------- -------------------------- ----------

Total value (US$

millions) 87.8 64.3 37% 77.5 13%

--------------------- --------------------------- -------------- ---------- -------------------------- ----------

Achieved US$/ct 1 938 2 117* -8% 2 157 -10%

--------------------- --------------------------- -------------- ---------- -------------------------- ----------

(*Includes carats extracted at rough value for polishing.)

** Includes (a) carats extracted at rough valuation for

polishing and (b) lower-value smaller commercial production carried

over at valuation.

2 This is the actual result achieved which exceeds the estimate

previously reported.

Three Letšeng tenders have been held in 2016, achieving an

average price of US$ 1 938** per carat (first three tenders in 2015

- US$ 2 157*), bringing the 12 month rolling average to US$ 2 198

per carat.

In line with the sales and marketing strategy, the lower-value

smaller commercial production is accumulated and carried over for a

larger volume sale once every quarter. This production from the

third export, valued at US$ 4.8 million, has been carried over to

be sold in the fourth tender to be held in June and has been

included at this value in determining the average US$ per carat for

the first three tenders of 2016.

209 carats were extracted during the first three tenders at a

rough value of US$ 2.9 million.

3. Ghaghoo

Gem Diamonds' wholly-owned subsidiary, Gem Diamonds Botswana

(Pty) Ltd, is currently developing the Ghaghoo Mine ("Ghaghoo") in

Botswana.

Q1 2016 Q4 2015 QoQ YoY

% change Q1 2015 % change

------------------------ -------- -------- ---------- ---------- ----------

Ore treated (tonnes) 50 514 85 046 -41% 48 740 4%

------------------------ -------- -------- ---------- ---------- ----------

Carats recovered 11 029 24 294 -55% 11 559 -5%

------------------------ -------- -------- ---------- ---------- ----------

Grade recovered (cpht) 21.8 28.6 -24% 23.7 -8%

------------------------ -------- -------- ---------- ---------- ----------

During the Period, Ghaghoo treated 50 514 tonnes of ore. This

reduced tonnage is in line with the strategy of downsizing and

reducing the production plan for 2016 to approximately 300 000

tonnes.

The Ghaghoo operation recovered 11 029 carats achieving a

recovered grade of 21.8cpht. The majority of the 50 514 tonnes of

ore treated was sourced from tunnels one to five on Level 1. The

area of the pipe mined was close to the contact and contained more

internal dilution and hence delivered a lower grade when compared

to the previous quarter.

The development of the second production block is progressing

well with over 200 metres of tunnelling completed per month which

will allow access to higher grade ore towards the centre of the

pipe from mid year onwards.

A parcel of 14 114 carats was sold for US$ 2.3 million in the

Period (US$ 160 per carat).

Although Ghaghoo will operate at a reduced production rate

during 2016, prices for the Ghaghoo production will continue to be

monitored and the option of returning to full production regularly

reviewed.

4. Health, Safety, Security and Environment (HSSE):

The Group continues to strive toward its goal of zero harm to

its people and environment and to operate within the Group's

sustainable development framework.

During the Period, one LTI was reported at Ghaghoo bringing to

an end the Group's record of 460 LTI free days and resulting in a

Lost Time Injury Frequency Rate (LTIFR) of 0.14. The Group All

Injury Frequency Rate (AIFR) is 1.71 for the Period. For the same

Period in 2015, the Group AIFR was 3.08.

Gem Diamonds continues to work closely with its project affected

communities to ensure that the social projects implemented continue

to benefit the communities and are sustainable.

No significant community or environmental incidents have

occurred across the Group in 2016.

For further information:

Gem Diamonds Limited

Juliet Kirk, Investor Relations Manager

Tel: +44 (0) 203 043 0280

Bell Pottinger

Daniel Thöle

Tel: +44 (0) 203 772 2500

About Gem Diamonds:

Gem Diamonds is a leading global diamond producer of high value

diamonds. The company owns 70% of the Letšeng mine in Lesotho and

100% of the Ghaghoo mine in Botswana. The Letšeng mine is famous

for the production of large, top colour, exceptional white

diamonds, making it the highest dollar per carat kimberlite diamond

mine in the world.

Gem Diamonds has a growth strategy based on the expansion of the

Letšeng mine and bringing the Ghaghoo mine into production, while

maintaining its strong balance sheet. The Company seeks to maximise

revenue and margin from its rough diamond production by pursuing

cutting, polishing and sales and marketing initiatives further

along the diamond value chain. With favourable supply/demand

dynamics expected to benefit the industry over the medium to long

term, particularly at the high end of the market supplied by Gem

Diamonds, this strategy positions the Company well to generate

attractive returns for shareholders in the coming years.

www.gemdiamonds.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTBIGDUUXBBGLL

(END) Dow Jones Newswires

May 17, 2016 02:00 ET (06:00 GMT)

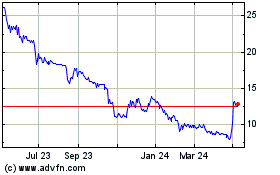

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

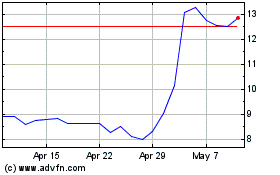

Gem Diamonds (LSE:GEMD)

Historical Stock Chart

From Apr 2023 to Apr 2024